McCormick; A dividend king in the making

„Do you know the only thing that gives me pleasure? It is to see my dividends coming in“

– John D. Rockefeller

Spices.

Have you ever thought that they are a good investment when you shop at Migros or Coop?

Me neither. Ok, maybe once I thought about a saffron plantation. After all, at up to 20,000 CHF/kg, it is the most expensive herb.

The world market for spices and seasonings is worth $11 billion and growing steadily at 5% per year. A sleepy business, too. With a 20% share, four times that of the next largest operator, one company has dominated this industry for decades. It counts 9 of the 10 largest food and beverage manufacturers among its customers, as well as 9 of the 10 largest food and restaurant chains.

In more than 170 countries, people know its brands at first sight - and taste.

It is a valuable partner for anyone who works with food.

McCormick.

Chart 1: McCormick spices, chili powder spice blend

Dividend Aristocrat

Given its very interesting business characteristics of steady growth, high stability and visibility, McCormick has shown a rare commitment to market participants.

The company is an attractive choice, in particular, for income investors.

It is a "dividend aristocrat."

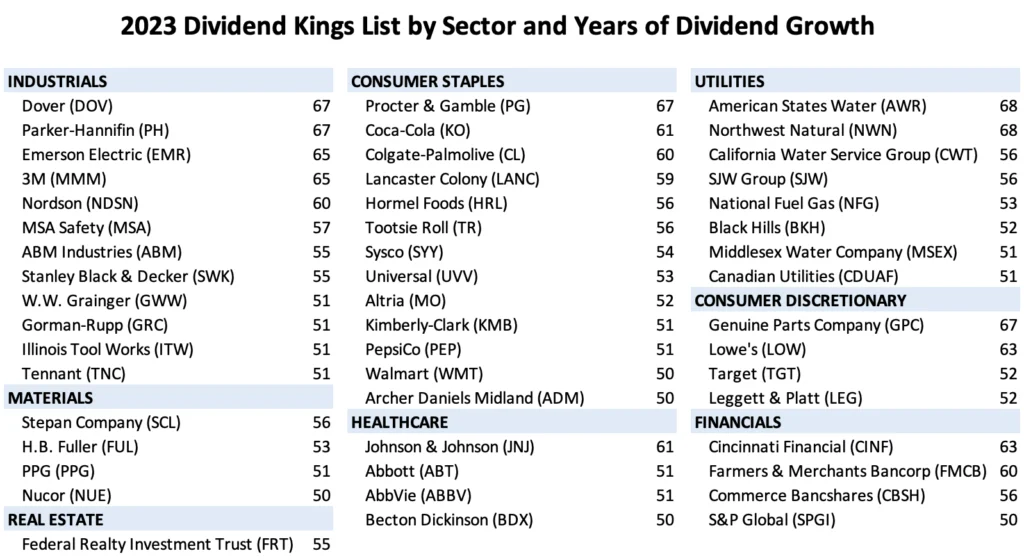

In the investing world, a dividend aristocrat is a company that has a long history of paying dividends and consistently increasing them - at least 25 years in a row. In the S&P 500, there are 67 members in this club.

The leader in spices has increased its dividends for 38 consecutive years. The company is on its way to the last major milestone - dividend king status. This is obtained by raising dividends every year for 50 years.

There are only 51 US companies, and perhaps a few more in the rest of the world, that have this status.

Quite impressive when you look at history.

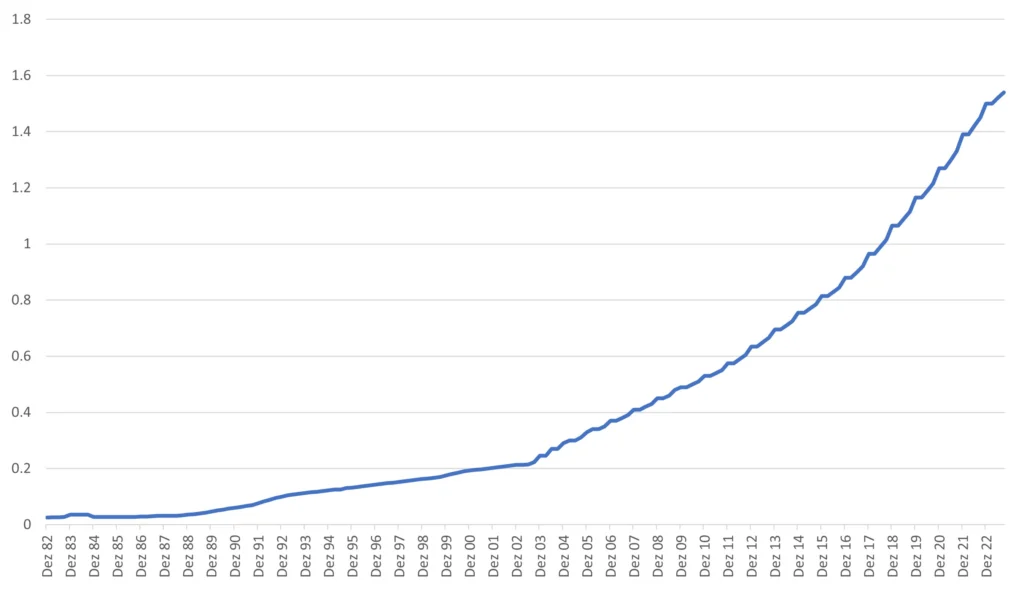

Chart 2: McCormick quarterly dividend payout

Come rain or shine

At arvy, we prefer reinvesting in one's own business than paying dividends. Nevertheless, being able to reward shareholders with a dividend increase for over half a century is no small feat.

Over the past 50 years, some catastrophes experienced include:

This shows two things.

First, you do not have to chase the "next big thing" to make money in the stock market. Second, so-called boring and old companies that survived major events like two world wars, the Great Depression (1929) and the Great Inflation (1965-1982) can be excellent compounders. They are likely to survive whatever comes next.

If you are still wondering where to get the list of names, I will save you the trouble.

My pleasure!

Chart 3: Dividend Kings by Sector and Years of Dividend Growth

Heated costs

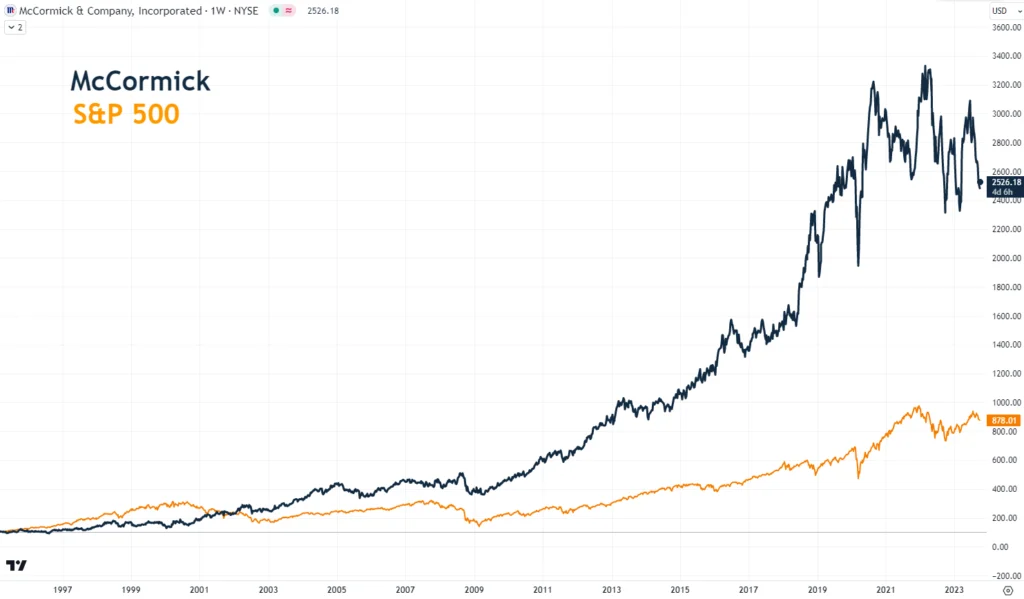

Back to the spice giant. It is a defensive compounder with a stellar stock price performance.

There is an ever-expanding middle class in developed markets that is driving spice consumption. On top, population and wealth growth in emerging markets is an additional supporting factor for McCormick.

But as this week's results have shown, not everything is always as exciting and consistent as their dividend.

For one, McCormick continues to face high costs (in raw materials, packaging, freight and labor, which management says are the highest in the last decade or two). In addition, low-income consumers cutting spending due to rising food prices and interest rates may impact the company as they reduce or exit the category.

Nevertheless, McCormick has shown that it is well positioned to weather all kinds of storms and deliver sustainable growth and market share gains in the years ahead.

After all, you do not want your food to be bland, do you?

Chart 4: McCormick since 1995

arvy's takeaway: McCormick, the spice giant, has seasoned its investors with steady dividends for over 38 years, showcasing resilience through economic storms. In a world chasing 'The Next Big Thing,' it is a reminder that timeless companies can be excellent investments. Even in uncertain times, spices remain an essential ingredient in life's recipe for success and investing.