UnitedHealth: Demographics – An Undeniable Factor

„Whatever the future holds... it will be nothing like the past“

– Charles Goodhart, Author of the Great Demographic Reversal

Health insurance.

Oh lord, it is soon that time of year again. And prices are going up. As they always do.

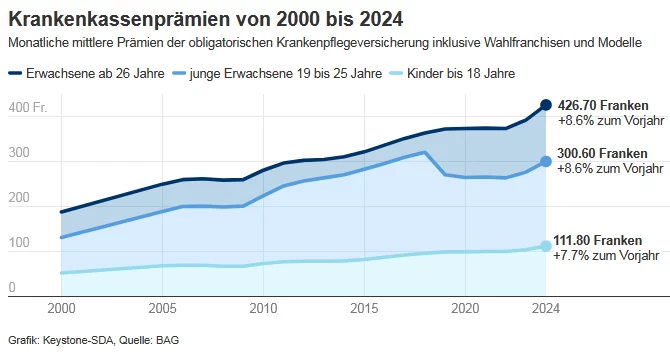

In Switzerland, the average increase over 2023 will be 8.7%. The main reason for the high increase in premiums is the sharp rise in healthcare costs. This is due to the aging of the population as well as new medications and treatments.

A fact that is hard to believe. Swiss health insurers are currently posting losses in basic insurance.

In a global comparison, Switzerland is the front-runner in terms of its healthcare system and the trend is very much in favor of health insurance companies. However, you cannot invest in them in Switzerland. In the US, on the other hand, you can.

This is where the giant of healthcare comes into play.

It has 51 million customers.

UnitedHealth Group.

Chart 1: Swiss Health Care Insurance premium from 2000 – 2024, monthly

Under One Roof

UnitedHealth Group is the largest healthcare company in the US with 400’000 employees. It is unique because it brings together all critical parts of the healthcare system under one roof.

This business model makes health insurers in the US very profitable. We talk about the so-called "medical-care ratio". It is calculated by dividing expenses by premiums. For UnitedHealth, it is at 83%.

That means the insurer earns 17 cents for every $1 in premiums.

And that is not all.

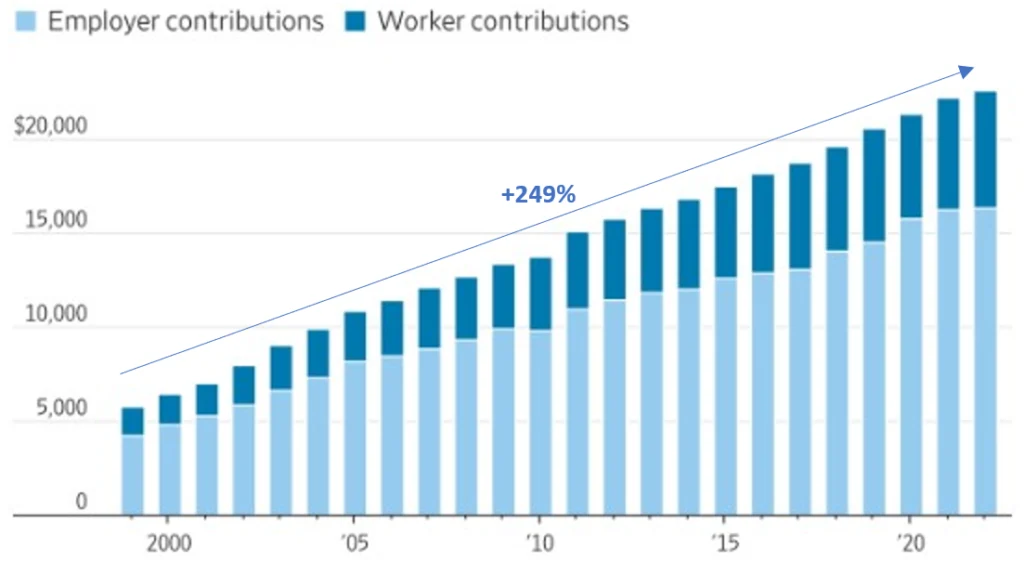

Chart 2: Average annual premiums for employer family health coverage in the US

The Great Demographic Reversal

It is impossible to compare the Swiss and US healthcare systems, but the message is clear: In the US, costs are much higher in absolute and relative terms (compared to your salary), with much lower benefits. On top of that, the average US health insurance premium has increased by 249% over the last two decades, while in Switzerland it has increased by 99%.

So, the Swiss health insurance system is suddenly the lesser of two evils, right?

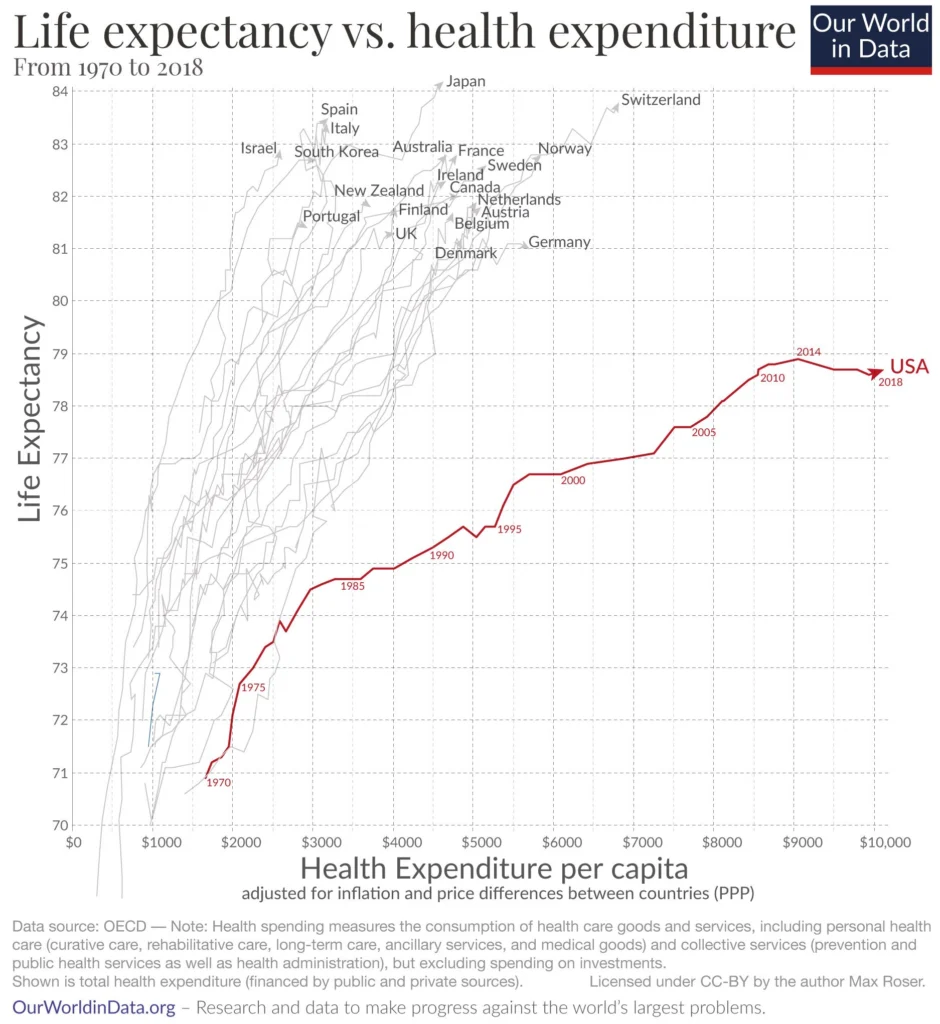

One major reason for the strikingly inflated costs in the US is certainly their health factor, which translates into astonishingly low life expectancy compared to the rest of the world.

Add to this the Great Demographic Reversal (a very recommendable book) in which the baby boomer generation stops working and passes the age of 65. Worldwide, there are one billion people over the age of 65 - that is 12.5%. In 2050, there will be two billion people - that will be 22.2%.

This future is nothing like the past, because >65-year-olds:

All this plays into the hands of UnitedHealth.

Chart 3: Life expectancy vs. health expenditure, from 1970 to 2018

Compounder par Excellence

UnitedHealth is one of the best-positioned healthcare services companies in the world.

An aging population in the US creates a growing market for healthcare services, insurance, data analytics and related products. UnitedHealth's diverse offerings, market dominance and size position it well to capitalize on this demographic trend.

It is shooting for 13%-16% annual earnings growth in the long run. This is expected to be confirmed in today's earnings announcement.

With the structural tailwind of demographics and Big Data as a new growth market, the company has always been well equipped for all kinds of macroeconomic conditions.

This is reflected in an excellent share price performance of a staggering 22% p.a. since inception in 1985.

A hell of a compounder.

Chart 4: UnitedHealth since 1985

arvy's takeaway: In the ever-evolving world of healthcare, UnitedHealth Group's all-encompassing approach stands as a hallmark of innovation, resilience and profitability. While healthcare costs are rising worldwide and demographics are an undeniable factor, UnitedHealth's position as a healthcare giant is more important than ever.