Exxon Mobil: Big Oil is Back in Business

"If you are going through hell, keep going"

– Winston Churchill

Oil.

The end of it is likely to occur, but not anytime soon.

While many companies are redirecting their investments into renewables to meet their long-term carbon intensity reduction targets, the largest player by far continues to rely on oil and gas. While this strategy is unlikely to be popular with environmentally minded investors, I believe it is more successful and less risky. If you are going to do oil, then do it properly.

On top of that, there is a dazzling combination of rare events that have occurred simultaneously over the past few years and have intensified in recent quarters.

This means that the energy sector is now being supported by both macro and micro factors, respectively. The main beneficiary is none other than the rock of the sector since time immemorial.

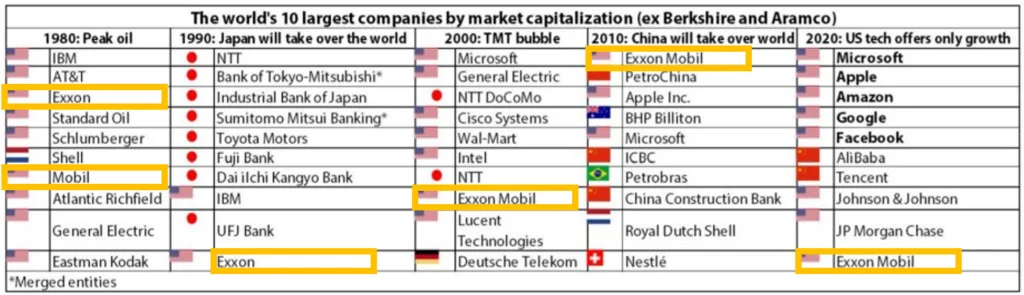

Whatever was trending or happening. Against all odds. It was part.

ExxonMobil.

Chart 1: ExxonMobil is among the top 10 by market capitalization in each cycle or trend

Micro - What Does not Kill you Makes you Stronger

Energy companies kept going through hell over the past two decades, ending with Covid's final blow. The pandemic has bankrupted every energy company that was on the verge of survival.

The only corporations left in this sector are those that are fit as a fiddle.

This is reflected in the micro data of them. Their fundamentals reflect both very solid balance sheets and business efficiency, underpinned by very high profitability once oil prices rise a bit.

Example?

Exxon last year posted the biggest profit in its 153-year history, thanks to rising commodity prices. A net profit of $59 billion.

To put that in perspective. Their profit was the market cap of our largest bank: UBS.

In one year.

What is more, energy companies have learned the hard way that they need to put more emphasis on a sustainable future and responsible operations to win over their shareholders.

As a result, they have begun to take a disciplined approach to new projects, paying investors high dividends or buy back shares, and listening to investor pressure about their future sustainability goals.

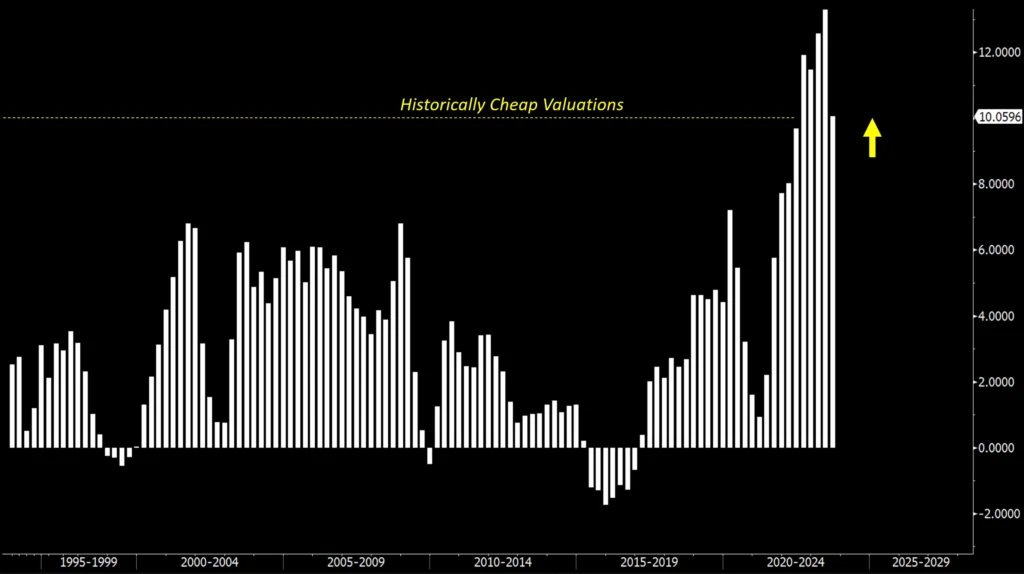

This has made energy stocks much more attractive by any measure. Now, they are exceptionally profitable companies with historically cheap free cash flow valuations.

Energy companies are synonymous with "what does not kill you makes you stronger."

And that is not all.

Chart 2: Energy Stocks: Free Cash Flow Yield (%) of the S&P 500 Energy Sector

Macro - A Mix that Supports Oil Prices

At arvy, we generally dislike cyclical sectors because timing and the macro environment are very important drivers – and macro is unpredictable. Their characteristics, such as boom and bust cycles, do not fit our goal of buying a stock and holding it forever. Moreover, these sectors are often based on a commodity that is influenced by a variety of factors in a given period.

In plain English: Beyond our company assessment, there are dozens of other exogenous forces that influence the business.

However, based on the factors discussed in the "Micro" section, we have reason to believe that we are dealing with an exception that proves our rule.

Two factors come into play:

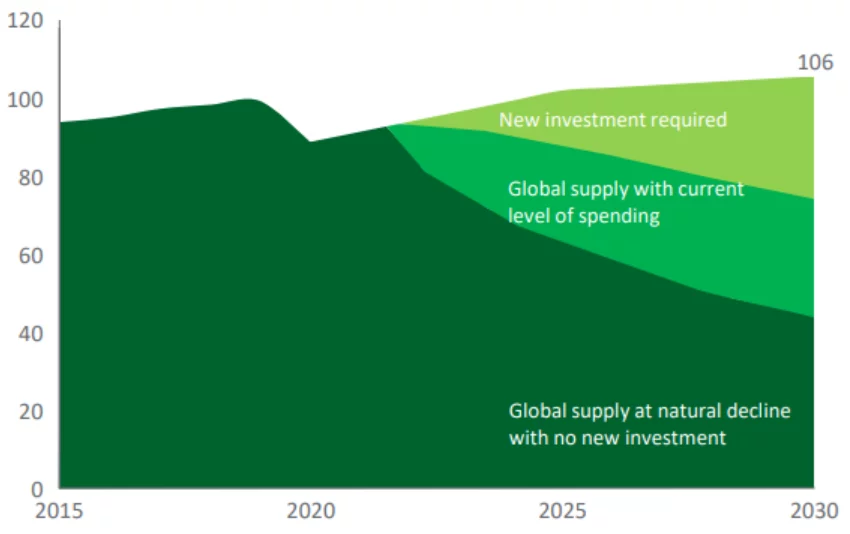

Therefore, solid growing demand is meeting insufficient supply.

A mix that is supporting oil prices.

Chart 3: Global Oil Supply Outlook to 2030

Micro-Boot Camp Meets Macro-time to Shine

We are now dealing with corporate fundamentals (micro) and a changing world and economy (macro), indicating that the stars are favorable for energy stocks.

Of course, risks remain and are naturally higher. One of them being the increasing penetration of electric vehicles that could threaten the long-term profitability of Exxon's business.

Mindful of this trend, we will continue to face increasing demand for oil while supply will decrease. This means that a well-positioned company like Exxon, with much less competition and having gone through a years-long boot camp, is now encountering a macro environment that offers it an opportune time to shine.

Despite unpredictable macro factors, we cannot ignore the fact that a strong fundamental "Good Story" is now meeting a powerful breakout that is reflected in a "Good Chart."

Big Oil is back in business!

Chart 4: ExxonMobil since 1997

arvy's takeaway: ExxonMobil, the enduring titan of the energy sector, defies the odds. Its remarkable resilience and record-breaking profits signify a renaissance for the industry. As the world shifts towards renewables, the demand for oil remains surprisingly robust. The fusion of resilient corporate fundamentals with a transforming macroeconomy creates a unique opportunity. Big Oil is back in business, a testament to the age-old adage, "what does not kill you makes you stronger”.