Intuit: Solving Annoying Problems

"Nothing is certain except death and taxes"

– Benjamin Franklin

Taxes and accounting.

Something you cannot escape.

What is more, it is certainly not the kind of thing you are comfortable with. It does not come with ease. Or have I just met the first person who eagerly fills out their taxes or expenses?

Probably not.

In short, it is annoying. Reminds me that you do not need to have great ideas when building a startup or business. Just focus on problems that others have, or even simpler, think of a problem you have or something that annoys you - and come up with a solution.

At arvy, we intend to do just that.

We want to solve the problem of barriers to investing, make it simple and accessible. And create the most modern investment experience we wish we had enjoyed years ago – all while giving you updates along the way and, most importantly, with a decent return.

The company we are talking about today has recognized the uncertainty of clients in tackling the challenging tasks of tax filing/accounting. Especially for small businesses and people who fill it out on their own.

They have killed two birds with one stone.

A terrific combination.

Intuit.

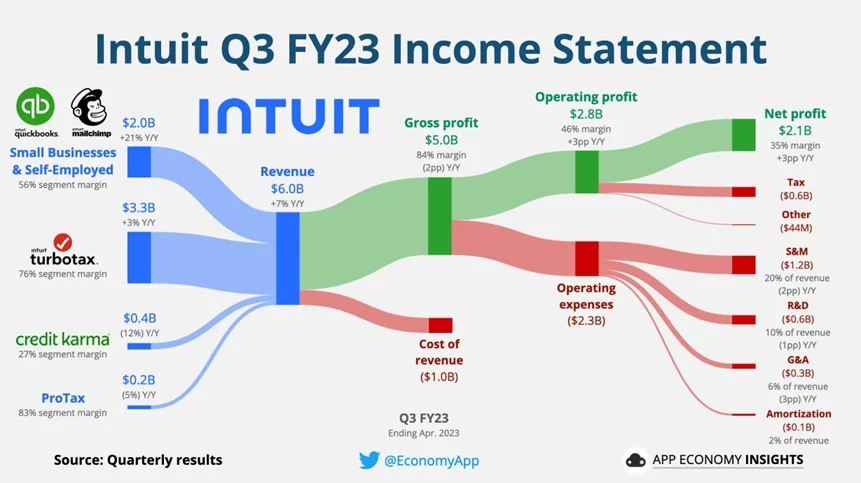

Chart 1: Intuit Q4 FY 2023 Income Statement

Source: App Economy Insights, quarterly results

Nightmare meets Deadline

Intuit is the giant behind the US small business accounting software QuickBooks and the US do-it-yourself tax software TurboTax (chart 1). They also own Credit Karma and Mailchimp - you just received an email from us through the latter.

Along the way, the company has been very innovative. They had to be.

Why?

There are two problems with taxes in the US. First, you have a deadline of mid-April. Second, filing taxes is an absolute nightmare (Chart 2).

Believe you me, it is.

The IRS, or Internal Revenue Service, the federal government's tax agency, says that 25% of Americans put off filing their taxes until the last two weeks before the deadline.

In addition, the IRS introduced a free tax filing software program in 2002. That was 21 years ago. Under some pressure, Intuit then offered its 43 million customers a free filing option with some minimum features as well.

Place your bets. What % of US taxpayers use this free product?

3%.

The rest are persuaded by Intuit's wonderful features and are happy to pay for not having to fret about one of the only two certainties in life, to quote Benjamin Franklin.

And let's not forget it is the certainty that comes every year.

Chart 2: Sylvester Stallone Rambo US Tax Season Meme

Source: memegenerator

Too Good to be True

While TurboTax accounts for about half of Intuit's revenue, the company has built a very strong second pillar with QuickBooks - accounting software for small businesses and the self-employed, as well as their accountants.

Now, buckle up.

QuickBooks online has 4.5 million users. It is estimated to have about an 80% share of the US small business market using financial software.

The only drop of bitterness?

Its customer retention rate is only 79%, which is low compared to business software solutions overall.

Why?

Simply because of the lack of survivability of small businesses. In other words, QuickBooks customers generally do not switch to another software provider but give up their business altogether.

Yes, I know, otherwise, it would have been too good to be true…

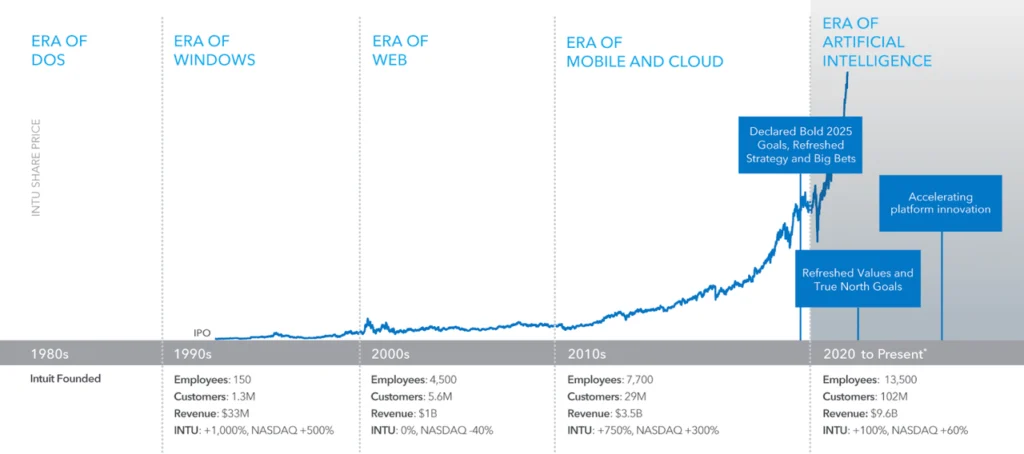

Chart 3: Intuit’s incredibly successful history

Source: Intuit investor report

Smart decisions strengthen the ecosystem

Intuit has never stopped innovating. They are known for super-smart decisions (Chart 3), which in turn allowed them to escape the other certainty cited by Benjamin Franklin:

The three most recent:

It goes without saying that their innovative advances have led to very high scalability and profitability. This is underscored by the two strong moats of network effects and switching costs leading to a very high market share in the US.

Simply put, once you are in their ecosystem, you stay there (switching costs), and there are a lot of upselling features and products (network effects).

The release of this week's quarterly results confirms the "Good Story".

So, what is the catch?

Quality has its price.

Chart 4: Intuit over ten years

Source: TradingView

arvy's takeaway: Intuit, the tech giant behind TurboTax and QuickBooks, is capitalizing on the certainty of taxes and accounting problems. The company dominates the US market and benefits from innovations such as matchmaking services and strategic acquisitions that ensure scalability and high profitability. However, the company's success is also a cautionary tale: quality often comes at a high price. Particularly if you want certainty.