Good Story & Good Chart

"I've always said if you spend 13 minutes a year on economics, you've wasted 10 minutes"

– Peter Lynch

arvy's Teaser: How can one increase the odds of being right and making money in the stock market? In a perfect world, things are kept simple: Buy great businesses. Do not overpay. Hold them for a long time by keeping the trend work in your favor.

Happy New Year 2024!

In the investment world, the return clock is being reset. Everyone starts from zero again.

A psychological thing if you ask me.

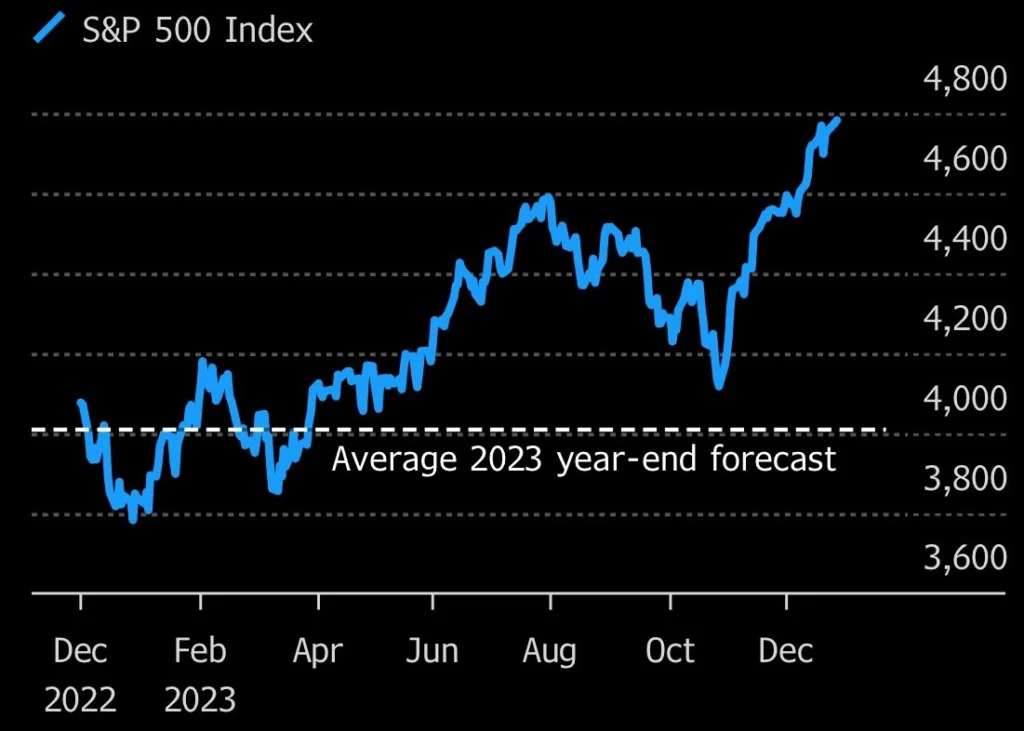

A year has no foundation in the business or investment cycle. Rather, it is the time it takes the earth to orbit the sun and is therefore more suited to the study of astronomy than investing. In addition, stock market commentators always focus on their forecasts around the turn of the year. As interesting as they may be, they are unfortunately of little value (chart 1).

Here is our reassuring part: our investment approach does not hinge on predicting inflation or other macroeconomic elements. Our focus is solely on companies, not countries, indices, or macro forecasts.

Let's dive in. Basics first.

Chart 1: S&P 500 rallies past bearish forecasts for 2023, by 800 points…

Source: Bloomberg

A “Good Story” has already won

As an investor, I am not looking for the “Next Big Thing”. I want to invest in companies that have already won.

The philosophy is simple: winners possess a remarkable ability to sustain their winning streak, often surpassing even the most optimistic expectations.

What are fundamental attributes of winners that kept winning? I recognized five of them that I follow when screening my universe:

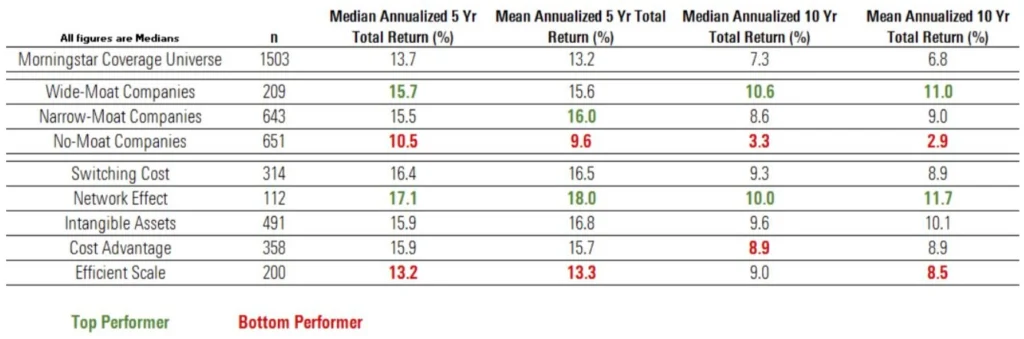

A broad economic moat (chart 2), management with integrity, low capital intensity, good capital allocation, high profitability, attractive historical growth and a strong secular tailwind. If you can acquire these companies at a fair valuation, you will see great results over time.

I have written about these five points in much more detail here: Winner keep winning.

Yet, I can easily fall in love with a "Good Story" because it has a larger subjective component.

Consequently, I take an objective solution at hand.

Chart 2: Market Performance by Moat Rating and Moat Source

Source: Morningstar, 2017

Never trust the story unless confirmed by price action

I believe that the market is the best-informed analyst in the long run and helps me discover investment opportunities that are validated by my analysis. I follow an important key rule by never trusting the story nor just the numbers unless confirmed by price action.

Recognizing a clear regularity in market action, I focus on five factors that we have seen time and again in the best-performing stocks over the past 140 years:

I have written about these five points in much more detail here: History Does Not Repeat Itself, But It Often Rhymes

But no worry, we will touch on all points mentioned over and over again.

Constant dripping wears away the stone.

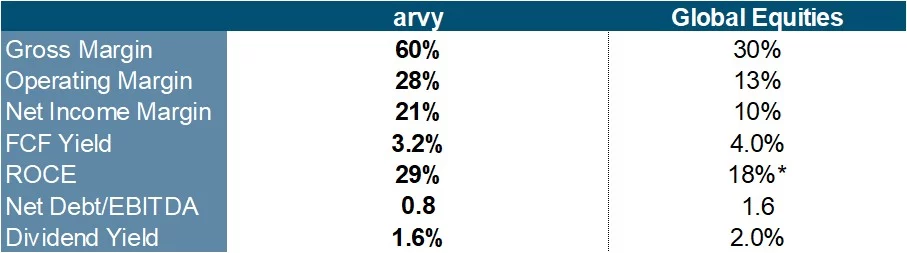

Chart 3: arvy’s portfolio characteristics

Source: Koyfin, arvy, *for S&P 500

Putting it all together

arvy’s strategy closed 2023 with a strong increase of 22.8% and new highs. A pleasing development after a turbulent previous year.

Let's look at the portfolio in terms of the "Good Story & Good Chart" attributes we are looking for (chart 3).

At the time of writing, we hold 29 stocks. 25 or 86% of them have a wide moat, 3 have a narrow moat (Medpace, UnitedHealth and AutoZone) and one has no moat (ExxonMobil).

The strong business models are reflected in the gross and net profit margins of our holdings, which average 60% and 21% respectively, compared to 30% and 10% for a typical company. The companies we own produce something for 4 dollars and sell it for 10 dollars. And make a net profit of 2.10 dollars.

Debt levels are low, a fact we want to keep a close eye on in the coming quarters when a lot of debt is coming up for renewal.

Not only are we cash rich and low leveraged, but we also tend to own companies that are experiencing growth that allows reinvestment of their cash flows at high returns. The current return on capital employed is 29%, compared to 18% for an average company in the S&P 500.

This is reflected in the numerous structural tailwinds such as animal health (Zoetis), demographics (Eli Lilly, Novo Nordisk), subscription economy (ADP, Intuit, RELX, Wolters Kluwer), semiconductors (ASML, Cadence) or a greener world (Schneider Electric, Waste Management).

As quality has its price, our portfolio is valued somewhat higher than the average company. However, it should be noted that they are fundamentally much better than average.

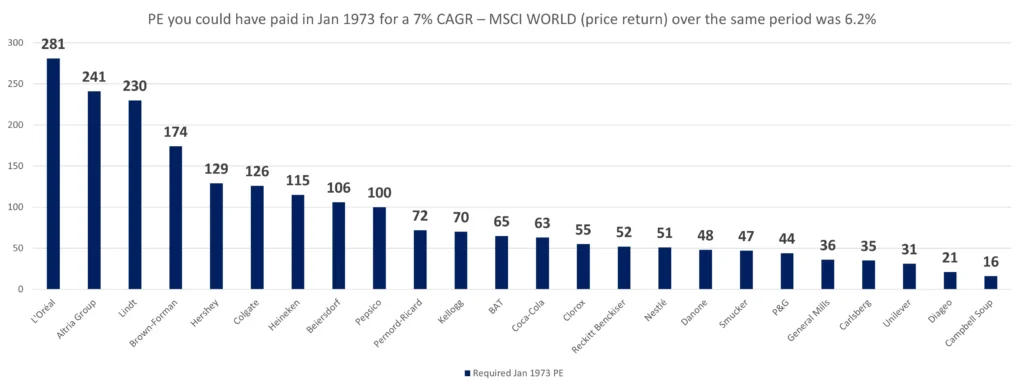

In our opinion, the quality of the company is more important than the valuation, but of course you should avoid paying too much for good companies.

It is okay to pay more for quality.

As we did in the last 5 years.

Chart 4: It is okay to pay more for quality

Source: Ash Park Capital and Refinitiv Datastream, excludes dividends, in USD, 1973 – 2019