Schneider Electric: Europe’s Industrial Future

"This is Europe’s man on the moon moment"

– Ursula von der Leyen, President of the European Commission

arvy's teaser: Schneider Electric is shining amid the industrial revolution in Europe, riding the wave of the European Green Deal and technological progress. As a market leader in automation, big data and electrification, the company is an example of investing in industry leaders. With a proven track record, Schneider Electric is at the forefront of innovation in a cyclical sector.

Industrials.

A cyclical and capital-intensive sector.

It moves dynamically, then treads water and then develops dynamically again - often in 3.5-year cycles.

That is why it is not my first choice when looking for compounders. But exceptions prove the rule. We are facing seismic shifts in this area. From a top-down and bottom-up perspective. Or to put it in the words of Mrs von der Leyen: we are experiencing "Europe's man on the moon moment" (chart 1).

Europe? Yes, you read that right. Can you imagine that? Probably not.

Let's dive in and I think you will agree that these are too big exceptions to ignore. What's more, there are European market leaders who benefit from every single emerging trend.

The best positioned in this segment is a 188-year-old French company.

Schneider Electric.

Chart 1: That is one small step for a woman, one giant leap for Europe

Source: Investigate Europe

Top-Down – The European Green Deal & Structural Trends

At arvy, we are always on the lookout for structural tailwinds.

Just ask yourself. Why invest in struggling companies and fight the trend when we can pick the ones with favorable winds? Is that not more fun?

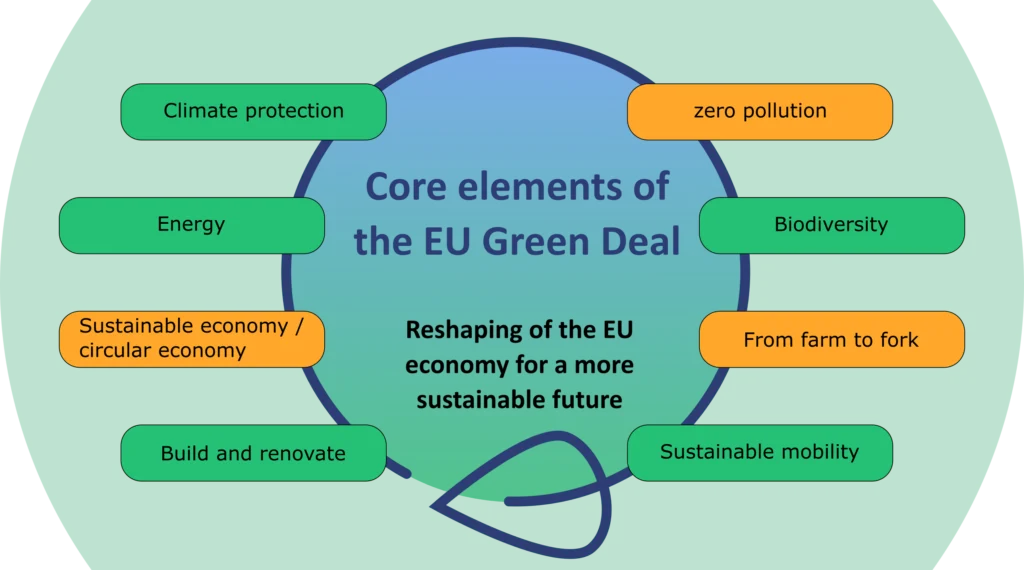

In this sense, in the industrial sector, especially in Europe, we are receiving structural tailwinds from government incentives with projects such as the European Green Deal (chart 2) and industrialization trends such as automation, big data and electrification.

As part of the Green Deal, €1 trillion is to be invested with the overarching goal of making the EU the world's first "climate-neutral bloc" by 2050. The plan envisages reviewing every existing law for its climate relevance and introducing new laws on circular economy, building renovation, biodiversity, agriculture and innovation.

Schneider Electric benefits from all these trends.

Now, I have your curiosity.

Chart 2: European Green Deal, core elements

Source: VdMi

Bottom-up – Automation, Big Data and Electrification

First and foremost, you should always remember the quote from André Kostolany when it comes to investments: “In a gold rush, do not invest in the gold miners, invest in shovels”.

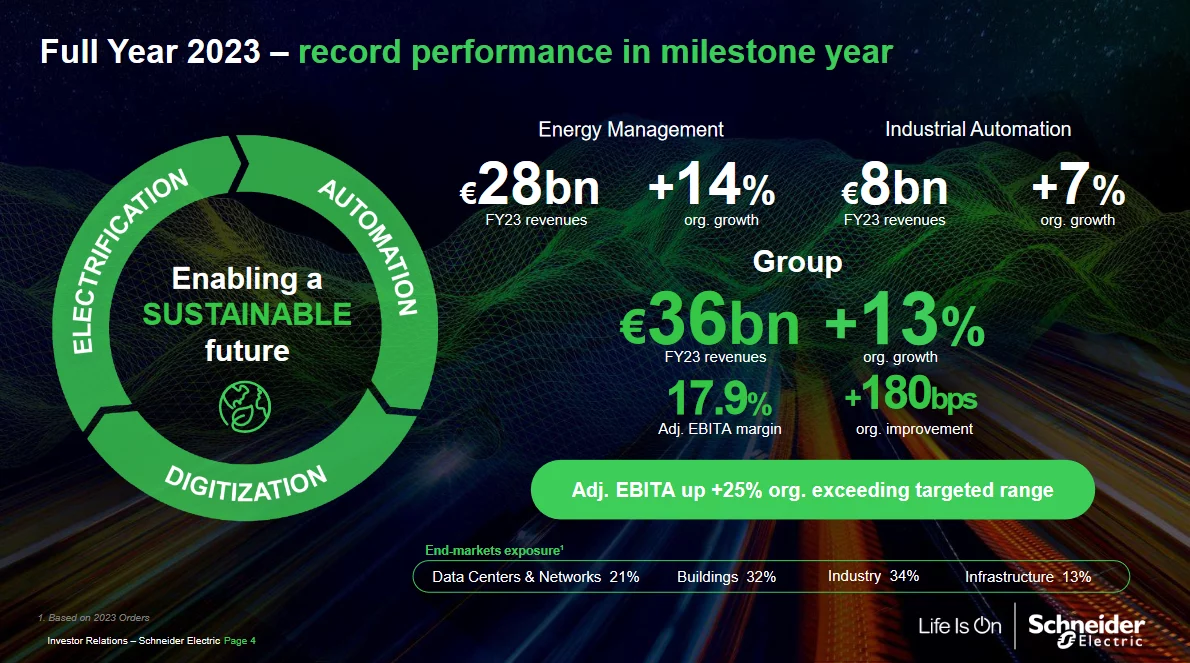

The shovel supplier "par excellence" for the tailwind? Schneider Electric, the manufacturer of electrical and automation products. Leading in automation and electrification, it has, like many of its competitors (ABB and Siemens), pushed into software (big data) to boost sales growth and increase profit margins.

This means that the company has three divisions (chart 3):

Combining all these divisions improves earnings visibility and stability.

Making a cyclical industry less cyclical.

I know, at first, I had your curiosity.

Now, I have your attention.

Chart 3: Schneider’s 2023 performance in their two synergetic businesses + software (big data)

Source: Schneider Electric, annual report, 15.02.2024

Invest in the best, neglect the rest

Schneider is capitalizing on this structural tailwind with technological progress that will make the company significantly more profitable in the coming years.

All this is reflected in strong organic growth and continuous margin improvements, as shown by the results published yesterday.

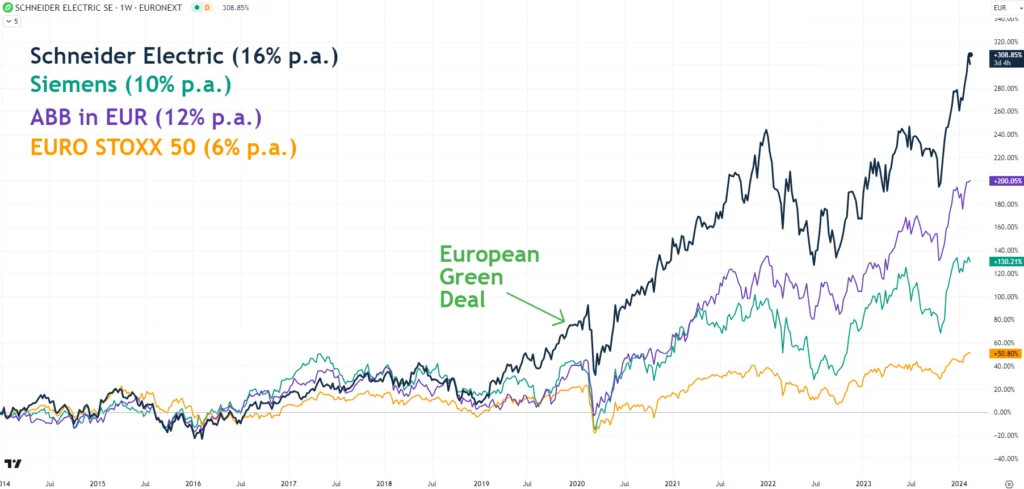

I think we can agree on a "Good Story". But not so fast. What about competitors (chart 4)? After all, they enjoy the same tailwind.

Aside from the realization that three out of four stocks move in lockstep with the broader market, studies show that well over 50% of a stock's performance is attributable to its sector. So, another step towards outperformance is to avoid a sector that is underperforming. I therefore consider the strength of the main sector and sub-sectors of each company I own.

This means I consider the "Good Chart". Schneider has outperformed its competitors since the introduction of the EU Green Deal.

We want to invest in the best and neglect the rest.

Finding these gems is our dedication at arvy.

Schneider Electric is one of them.

Chart 4: Schneider Electric, Siemens & ABB over 10 years, in EUR

Source: TradingView