Rollins: Constant dropping wears the stone

"Boring is good because it means stability and reliability"

– Unknown

arvy's teaser: In business, sometimes the most unassuming ventures hold the greatest potential. Rollins, the market leader in pest control, is a low-profile compounder that quietly dominates its industry. Its reliable and stable revenue streams, strategic acquisitions and a family-run ethos drive Rollins to outperform, making it a hidden gem in the market.

Pest control.

Have you ever thought that this could be a profitable business?

Controlling termites, ants, rodents, spiders, bed bugs and other insects? Or removing large and small animals such as raccoons, squirrels, bats and birds in a humane and ethical way?

Unlike in Switzerland, homes and businesses in many parts of the world need frequent visits from pest control professionals to keep them comfortable and in some cases even habitable. And I bet the ranch that you do not care what it costs to get rid of the above once they are in your home - or, even more unpleasantly, in your bed.

This is where the market leader in pest control comes in, providing exceptional pest control services in 71 countries around the globe.

Rollins.

Chart 1: Rollins, Clark Pest Control, Residential & Commercial Services

Source: Rollins

Market leader plays its dominant hand

Rollins holds a 13% market share and is the market leader for pest control in the US. The underlying business is in no way "the next big thing", but it is something that meets all the criteria for a "Good Story".

The company benefits from long-term tailwinds for the industry, such as rising global temperatures, climate change, government regulations and long-term global shifts from rural to urban areas.

This makes for attractive long-term growth trends.

Because their 2 million residential and commercial customers need regular pest control, Rollins offers a subscription model. Think of the large timber housing market in the US and potential termite damage. This results in highly recurring and reliable revenue (80% is recurring) as many customers pay monthly for services.

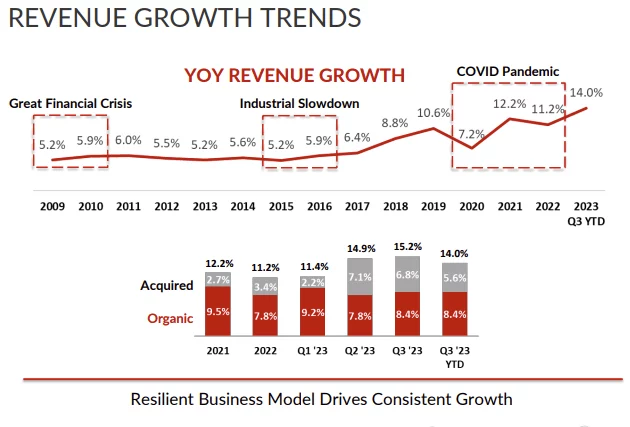

This ensures revenue visibility and stability, especially in times of upheaval (chart 2, top half).

Rollins is a dominant player that controls the market to a significant extent and can therefore benefit from greater pricing power, economies of scale and high barriers to entry.

These factors often contribute to sustained profitability and a strong competitive advantage.

Lastly, since Rollins has 20,000 competitors in the US alone, it cannot always beat them all, which leads it to target weaker competitors and avoid stronger ones.

The result? They keep taking market share from weaker competitors.

A lot of things to like, right?

And that is not all.

Chart 2: Revenue growth trends

Source: Rollins, Quarterly report Q3 2023

Serial acquirer

Over the years, they not only pushed weaker competitors out of the market, but also took them over in several small and ingenious strategic acquisitions, which led to additional acquired growth (see again chart 2, lower half).

In other words, Rollins is a serial acquirer.

They acquire many small competitors, integrate them into their ecosystem and improve operational efficiency. Their success rate is reflected in their operating margin, which has increased from 10% in 2005 to 18% today.

Impressive!

Serial acquisitions are a difficult task and require a lot of discipline, knowledge and well-thought-out execution. However, the Rollins family has mastered the art of capital allocation through several acquisitions over the past decades, most of which have led to great success with a high return on invested capital. This has resulted in a prestigious and well-diversified brand portfolio in the pest control market in all major segments and strong sales growth in recent years.

As you can read in the paragraph above, the Rollins family is pulling the strings.

That is music to my ears.

Why?

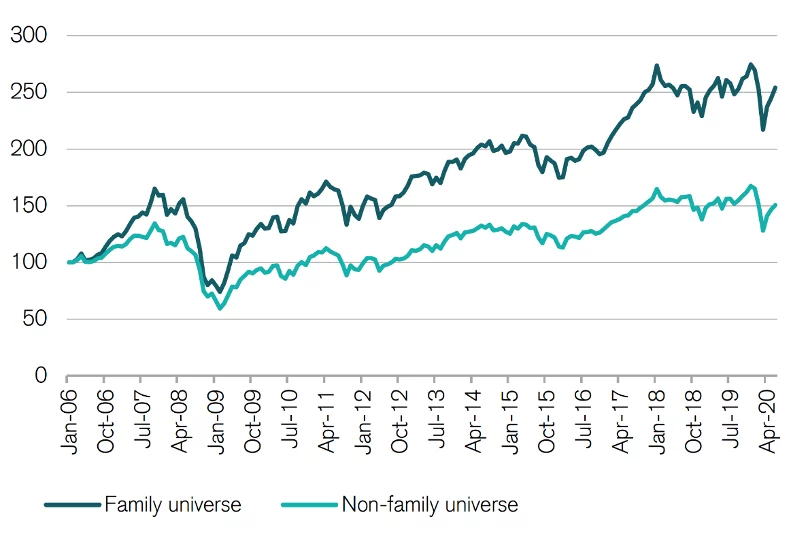

Chart 3: Family-owned companies outperform

Source: Credit Suisse Research, Thomson Reuters Datastream

Family-run

40%.

This is the percentage of Rollins owned by the Rollins family, one of the richest families in the US. A net worth of $14 billion.

Rollins is the epitome of a family-run business and a prime example of why these companies outperform over the long term (chart 3). Ownership structures, attractive incentives and long-term thinking are a key feature of these companies. Details that we focus on when analyzing a "Good Story".

I think you will agree with me that Rollins fulfills many of the criteria of a high-quality company. Like a constant drop, Rollins grows quietly year after year. The characteristics of such businesses sometimes sound a little too good to be true.

Thus, there is usually a catch.

In the case of Rollins?

Quality has its price.

Chart 4: Rollins over 10 years

Source: TradingView