Domino’s Pizza & Marriott: Beauty of Franchising

"Focus on companies that can scale rapidly without being burdened by heavy infrastructure costs"

– Peter Thiel, Founder PayPal and early Facebook investor

arvy's teaser: Asset-light business models through the lens of successful franchises such as Marriott and Domino's Pizza. Their strategies, from leveraging brand reputation to fostering entrepreneurship, are driving their sustainable growth through simplicity, scalability and resilience.

Asset-light.

Owning a minimum of tangible assets in relation to one's own activities.

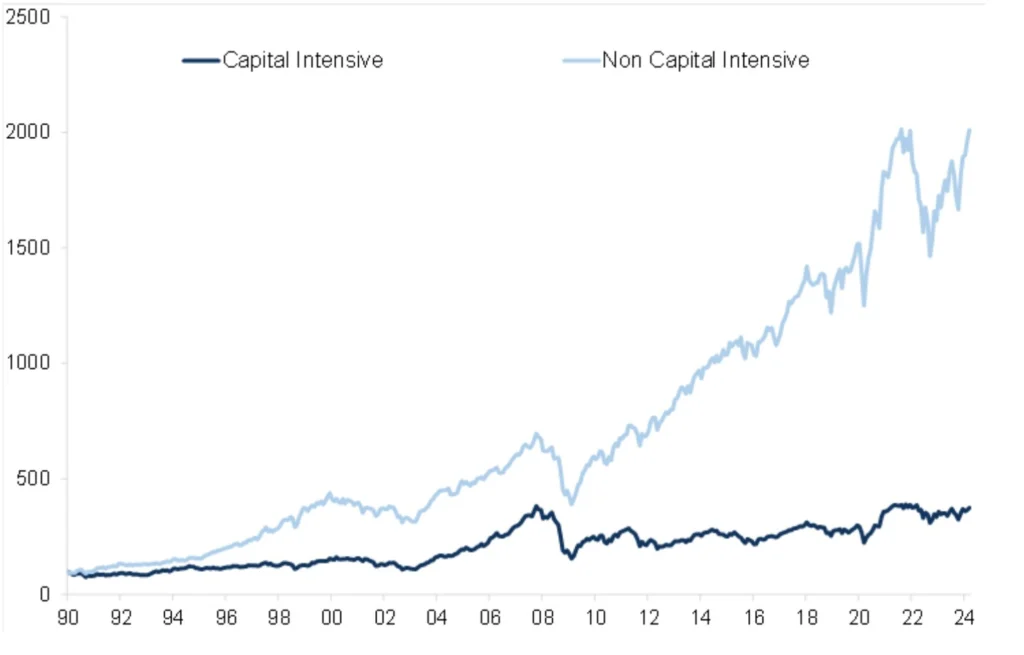

This has been the name of the game in recent decades, given the ever-increasing pace of innovation all around us. The idea behind it is simple. Instead of investing heavily in physical assets such as real estate, factories or equipment, the focus lies on leveraging intangible assets such as intellectual property, brands and networks (chart 1).

This approach offers several advantages such as scalability, flexibility, capital efficiency and - as if all that were not enough - lower risk. Asset-light industries are attractive because they require little capital to grow revenue and you quickly achieve high profit margins.

There is a particularly powerful asset-light business model that is reflected in many success stories.

The secret sauce?

Franchising.

Chart 1: Asset-light business models have far outperformed asset-heavy industries

Source: Goldman Sachs

Franchise Model

Franchising is an underrated strategy for building amazing cash-generating businesses and looking for a "Good Story".

Why?

Because you can build on something that already works. You do not have to:

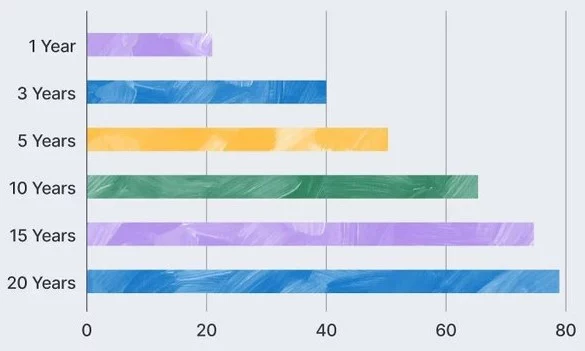

Your starting point is much less risky than turning your own idea into reality (chart 2).

A franchise is a business arrangement in which one party (the franchisor) grants another party (the franchisee) the right to use its brand, trademarks and business model in exchange for licensing fees. Franchising is a popular strategy for expanding businesses as it allows for rapid growth without the franchisor having to make significant capital investments.

The advantages:

In summary, asset-light business models and franchising offer companies efficient ways to grow, scale and maintain their long-term competitiveness, making them attractive investments for quality-oriented investors.

Now let's move from theory to practice.

Chart 2: Business Failure Rates by Year

Source: BLS

American Dream

Examples of successful franchises include McDonald's, Marriott, Domino's Pizza, Subway and Starbucks, which have expanded worldwide through their franchise networks.

In Switzerland? You can have your own migrolino.

Let's look at hotels and pizzerias to get a feel for the business:

The franchise model of Domino’s in the US is remarkable. The initial investment you must make is USD 400,000. This contrasts with the average profit before taxes of a branch of USD 160,000. Simple math: 400,000/160,000 = 2.5 years to break even.

Hardly any other concept makes it possible to pay back investment costs so quickly. The incredible thing about it?

The 7,000 locations in the US are operated by around 730 franchisees, almost all of whom started out as pizza delivery drivers and then worked their way up (chart 3).

That is what I call the American dream.

Chart 3: Domino’s Pizza Franchisees

Source: Domino’s Pizza, Q3 2023 report

Eat, sleep, franchise, repeat

Both Domino's Pizza and Marriott International have mastered the art of franchising. Their lead is reinforced by their continued geographic expansion and constant optimization of their own business (chart 4).

Although one business model sells pizzas and the other offers overnight stays, both place a strong focus on best-in-class operational efficiency in their respective sectors. This is reflected on the profitability side as well as in their technological efforts. Domino's has perfected its route density (fast delivery for hungry customers) and operates the famous pizza tracking app (customer satisfaction through clear knowledge of when the food will arrive), while Marriott has the industry's largest loyalty membership (200 million people), which accounts for 60% of direct bookings (highest profit margin) through their low-cost app.

Both operate with a high proportion of recurring franchise fees, growth funded by third parties – franchisees – and theoretically infinite returns on capital.

Their business model is simple.

Eat, sleep, franchise.

Repeat.

Chart 4: Domino’s Pizza & Marriott International over 10 years

Source: TradingView