Swiss Equities

"I think that we are seeing the best Swiss national team that has ever existed"

– Murat Yakin, Head Coach of the Swiss Nati

arvy's teaser: Swiss values of modesty, quality, and reliability drive both our national team and our equities to unparalleled success. From dominating the pitch to outperforming global markets, Switzerland exemplifies excellence and resilience.

Switzerland.

We clearly dominated the defending champions Italy and are the best we have ever been.

To say this is not a typical Swiss trait and one of our main characteristics: Modesty. But I think we can agree that even "Trompeten Sigi" has lost his breath by now. The other attributes we strongly identify with are reliability, quality, intelligence, diversity and simplicity. These Swiss values are deeply rooted in our DNA, and the Swatch Group even emphasized them in 2012 by publishing its entire annual report in Swiss German to mark its 30th anniversary (chart 1). We not only saw all these values in the Swiss Nati in the last game.

We have also been able to find them on the stock market for decades.

In Swiss equities.

Chart 1: Swatch Annual Report 2012, in Swiss German (note the cantonal coat of arms 😉)

Source: Swatch Group, Annual Report 2012

Swiss Values

The six values demonstrate that Swatch did not choose them just like that and that there is a lot running through Swiss equities.

I will show you how:

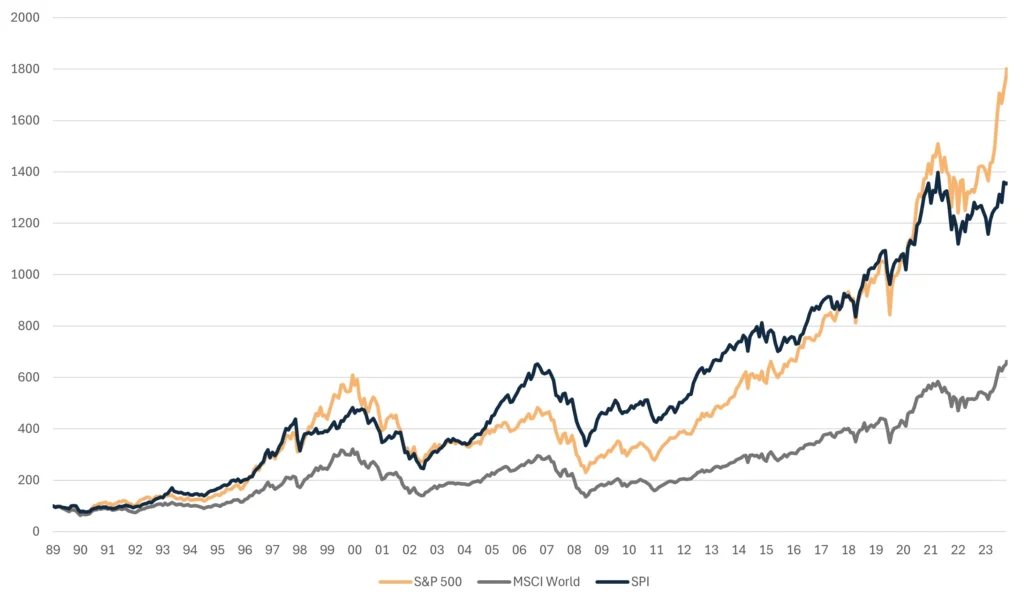

If we look at the last point, reliability, we see that Swiss equities have not only achieved a convincing long-term performance on their own, but also in comparison (chart 2) with global equities (MSCI World) and even the technology-heavy S&P 500 (with stocks such as Nvidia, Meta, Microsoft, Alphabet, Apple, Amazon, Tesla, Netflix and Co).

This is reflected in an annual return of 8% since 1925!

Meaning you doubled your capital every 9 years.

Chart 2: Swiss Performance Index vs MSCI World & S&P 500 since 1989, in CHF, Total Return

Source: Bloomberg

Small and medium-sized market leaders

Switzerland is not just made up of the big elephants Nestlé, Roche and Novartis, which account for 39% of the Swiss market (Swiss Performance Index - SPI). The next seven stocks (UBS, ABB, Richemont, Zurich Insurance, Holcim, Sika, Alcon), which fill out the top 10 and together make up 66% of the Swiss market, are not representative either.

It is more about the other almost 200 small and medium-sized companies that make up the remaining third. Many of them are Hidden Champions - remember them?

Market leaders. Switzerland has the most in the world after Germany, the USA and Japan.

The essential ingredients for their success are innovation, specialization and corporate culture. Many of them are family/founder-owned and have a long history that is reflected in their thinking.

The result?

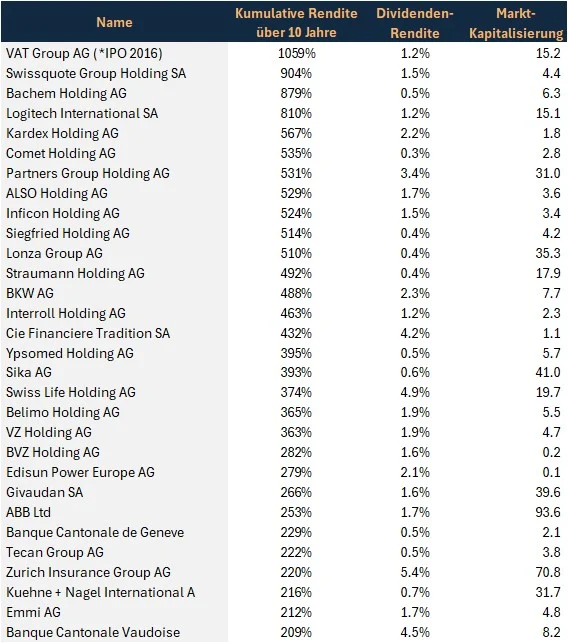

A sea of strong compounders.

Great companies with structural growth markets that can grow strongly year after year. Another metric worth highlighting about the best long-term performing stocks (chart 3) is the fact that they do not pay the highest dividends (average 1.7% vs. 3% Swiss average) as they are able to reinvest their capital in their business at high returns.

At arvy, we focus little on high dividend paying businesses (pros and cons), as this is a less efficient way to profit from the most important thing.

Compound interest.

Chart 3: The 30 Swiss stocks with the best performance over ten years

Source: arvy, Bloomberg

Compound Interest

Play iterated games. All the returns in life, whether in wealth, relationships, or knowledge, come down to one thing.

Example?

It happened with the Swiss Nati. 15 years ago, winning the U-17 World Cup in Nigeria in 2009 laid the foundations for today's golden generation (chart 4). Remember? Xhaka and Rodriguez were part of it.

Many players are now at an age where they are close to their sporting zenith, be it in terms of their performance or their experience. No more childish actions like blond hair or hand gestures. They have worked on themselves repeatedly and have grown together as a team over the years. They have used the compound interest effect to become the best team Switzerland has ever had.

But you see, it takes time to unleash the power of compound interest and reap the rewards.

With this in mind, if not now, then when!

Go for gold and glory!

Hopp Schwiiz!

Chart 4: Switzerland's historic victory at the U17 World Championship 2009

Source: Getty Images