Alibaba: Boom & Bust: China’s Bazooka Playbook

„Markets are never wrong – opinions often are”

– Jesse Livermore, Trading Legend

arvy's teaser: Boom and bust cycles have plagued Chinese equities, but Alibaba's fundamentals tell a different story. With stimulus in play, strong fundamentals, and rock-bottom valuations, are we nearing an inflection point?

China.

This investment theme is on everyone's lips.

The spark came from an enormous stimulation of the battered economy by the People's Bank of China, the Chinese SNB/Fed, which primarily supported the over-leveraged real estate market. A last-ditch attempt to save the economy from sliding further into the abyss. This comes at an interesting time as Chinese stocks have been on a downward trend since 2021.

Let's look at the market leader in e-commerce and cloud with our “Good Story & Good Chart” lens in this new context.

It is the other Chinese giant besides Tencent.

An almost forgotten darling.

Alibaba.

Chart 1: Alibaba Ecosystem

Source: Alibaba Fiscal Year 2024 annual report

Boom & Bust Cycles meets “uninvestable” Label

First things first: the Chinese stimulus program.

What is all the fuss about? If China's economy is in trouble, does it matter to the rest of the world?

Just think of the commodity producers of copper or iron ore, China is the biggest consumer/importer. It is the simple reason why Australia, the largest iron ore producer, has not experienced a recession for 34 years (ex-Covid). Think of luxury stocks: 2/3 of growth and 1/3 of sales come from China. Swiss gems like elevator manufacturer Schindler? 15% of sales come from China.

Long story short. Of course it plays a role, a big one.

By hook or by crook, China wants to achieve growth of around 5% - and it has somehow managed to do so with pinpoint accuracy over the last decade.

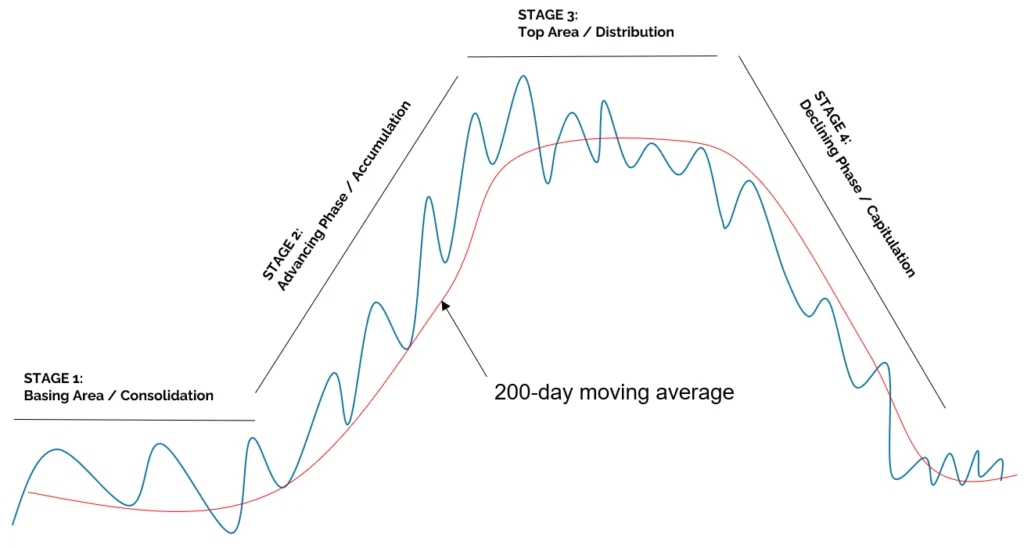

This is partly because China is trying to stimulate the economy with many bazooka-like measures, such as in 2007, 2015 and 2020, which often leads to boom-and-bust cycles (chart 2) in the stock market. What sets China apart from the West is its long-term strategy for the greater good. Instead of thinking in typical 4-year election cycles, it plans for decades. The Silk Road initiative (book club: China’s Asian Dream) is just one example of this. To the disappointment of some investors, this is not always in the interests of company owners or shareholders.

An example?

In 2021, China literally expropriated two company founders. The tutoring school TAL Education and the language and exam preparation course New Oriental Education.

The reason?

New regulations. Education should be free and for everyone. A greater good.

The result?

Both stocks plummeted 90% and are now just treading water. The owners, multi-billionaires at the time, lost both their hard-built businesses and their fortunes in the blink of an eye.

This kind of thinking made China an “uninvestable” country for many. Stubborn investors were often lured by economic growth and the looming turnaround, only to be proven wrong by another unexpected policy decision or the sharp downturn in the stock market.

Is this time different?

Chart 2: 20-years sideways: A history of boom & bust with Chinese equities

Source: Tradingview

Four Stages of Market Leaders

Now we come to the world's largest online and mobile commerce company in terms of gross merchandise volume - Alibaba.

It operates China's online marketplaces, including Taobao (consumer-to-consumer) and Tmall (business-to-consumer), AliExpress, where we Swiss mainly order, and Alibaba Cloud, as well as other segments (chart 1). Since its IPO in September 2014, the company has increased its revenue 13-fold from $10 billion in annual sales to $130 billion.

The company is firing on all cylinders.

The stock price?

Thanks to a history of boom & bust and the “uninvestable” label, it has only moved sideways. Yeah, you earned nothing.

Let‘s look at the stock from a “Good Story & Good Chart” viewpoint:

What happens when you have completed these four stages?

Of course, you return to Stage 1 - the consolidation phase.

What happens when you break out of this phase?

Including sound fundamentals?

A price firework.

Chart 3: Stan Weinstein's stock price maturation cycle

Source: Stan Weinstein, Secrets for Profiting in Bull and Bear Markets

Markets are Never Wrong

In sober terms, the story remains the same and investors in China will continue to burn their hands as the economy is dominated by a political agenda.

Monetary expansion (stimulus) and stock market support are not as important, and instead fiscal measures will be needed to lift the economy out of what is widely seen as a Japan-style deflationary slump. Only this will bring about lasting change.

The intention of the Communist Party to give a jolt was necessary. This led to a strong recovery in Chinese equities, which needed some relief.

Alibaba is part of our investable China universe alongside a handful of other names that we believe can make a difference, but it takes a particularly strong conviction to be included in the portfolio in the first place.

We leave the quick profits to the speculators. Investing is a probabilistic game, and we want to be right in the long run. The fundamentals in our “Good Story” must endure an “uninvestable” overhang and are prone to subjectivity and many opinions, the “Good Chart” will inevitably lead the way. The price is what counts.

After all, the market has taught us one thing.

Markets are never wrong.

Opinions often are.

Chart 4: Alibaba since the initial public offering, September 2014

Source: TradingView