Watsco: The Coolest Green Company

„Show me the incentive and I’ll show you the outcome.”

– Charlie Munger, the architect of Berkshire Hathaway

arvy's teaser: Watsco, the HVAC/R giant, powers North America’s cooling needs with a resilient ownership culture and 30 years of 20% annual returns. In a warming world, this “coolest green company” proves that “boring” businesses can deliver extraordinary outcomes.

Air conditioning.

In Switzerland, we do not think too much about it. After all, summer only lasts three weeks here.

But if you live in countries or regions where the average temperatures are much higher all year round, it is one of the first purchases you consider as soon as you have enough money. In fact, in certain areas it is almost one of the basic needs in Maslow's pyramid. So, it is not far-fetched that due to 1) rising disposable income worldwide and 2) higher average temperatures, the air conditioning business or the entire industry, HVAC/R (heating, ventilation, air conditioning and refrigeration), has boomed and seen continuous growth in recent decades.

The US, particularly the Sun Belt states (chart 1), which have experienced considerable growth and prosperity alongside a housing and infrastructure boom, led the way.

There we find a market leader with an estimated market share of 15-18%.

North America's largest distributor of HVAC/R parts.

Nicknamed “the coolest green company”.

Watsco.

Chart 1: The 18 Sun Belt States in the US

Source: Moody’s Analytics, Q1 2024

Boring is Good

First things first: Watsco operates in the HVAC/R industry primarily as a distributor, not a manufacturer.

Watsco is North America's largest distributor of HVAC/R equipment, parts, and supplies, partnering with major manufacturers to deliver products and solutions for residential and commercial markets. The company focuses on distribution and customer service rather than manufacturing its own HVAC/R systems.

Their business model is boring (chart 2):

That is it.

Watsco sells an extensive range of more than 1,500 items and maintains a diverse product line to meet the needs of its customers. The company estimates that more than 350,000 contractors visit or call one of its 673 locations each year. The Texas and Florida markets are a strategic focus for Watsco because of their size and the dependence of homeowners and businesses on HVAC/R products to maintain a comfortable indoor environment.

I remember my last summer vacation in Florida when I had to queue for hours for the roller coasters at the Disney World theme parks and how the air conditioners made the suffering bearable.

Watsco probably played a decisive role in keeping the business going😉.

And that is exactly their reputation.

Chart 2: What is Watsco’s Business Model?

Source: Watsco, annual report 2023

Ownership Culture

Watsco has developed a culture that we admire at arvy. As recently as 2022, the company was named one of FORTUNE's Most Admired Companies in the world.

But what is it about?

Ownership culture.

Watsco has developed a culture that offers employees the opportunity to own shares in Watsco through various stock-based participation plans. The plan is designed to promote both long-term performance and employee retention, continuity of leadership and an ownership culture where management and employees think and act as owners of Watsco. The CEO, 84-year-old Albert H. Nahmad, leads by example and owns 11% of the company.

More than 40% of employees are now shareholders and have a clear incentive to do their best for the company and their shared future.

Step by step. Day by day.

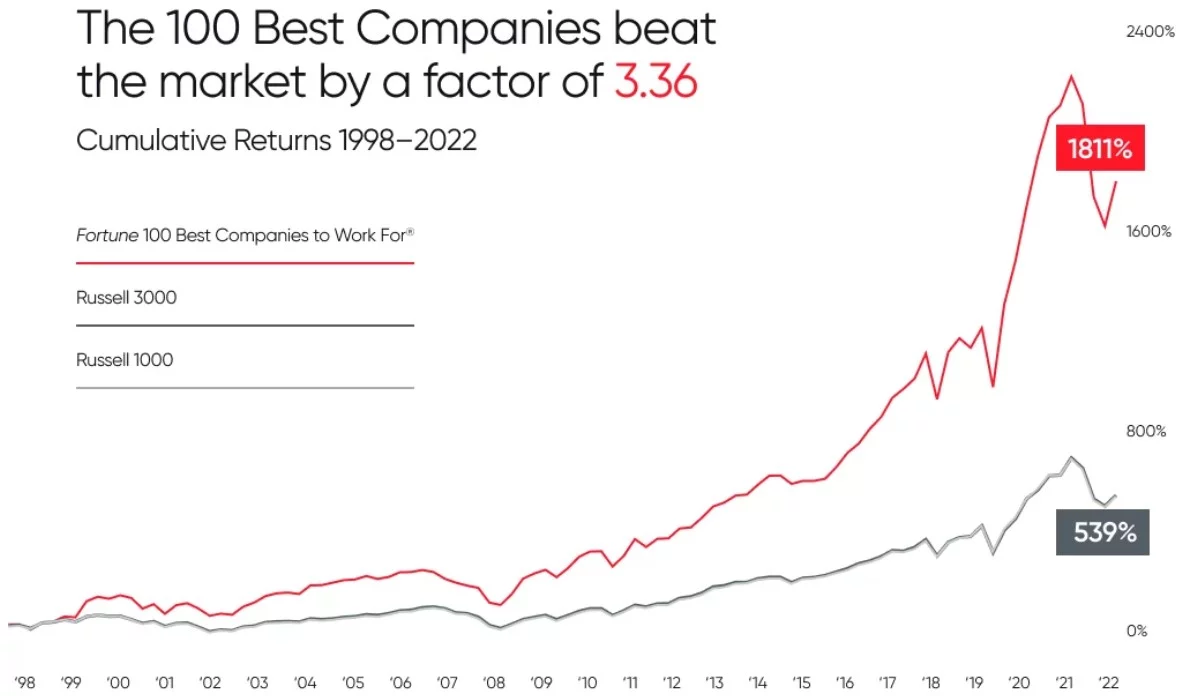

When analyzing a “Good Story”, this is an important checkmark criterion. Because all good business models, all promising ideas and plans will encounter challenges, obstacles, and difficult phases sooner rather than later. But history has shown that companies with a strong ownership culture, reflected in a strong corporate culture, weather such times well and perform better in the long term (chart 3).

As one of our favorite Naval Ravikant quotes points out, “When you find the right thing to do and the right people to work with, invest deeply. Sticking with it for decades is really how you make the big returns in your relationships and your finances. So, compound interest is very important.”

As you can see, it is simple. How can the probability of a good outcome be increased?

By aligning the incentives.

Chart 3: Companies that are a great place to work outperform

Source: Great Place To Work

Long-Term Growth Drivers

Watsco is one of the most successful stocks in the US.

With an annual return of 20%, Watsco ranks 16th out of 1,600 US stocks over the last 30 years. As compound interest is difficult to grasp, here are the numbers: A $10,000 investment turned into $380,000 for Watsco and $67,000 for the S&P 500 over the same period.

A hell of a “Good Chart”.

Despite its remarkable success, Watsco still has attractive long-term growth drivers, which are likely to be in the region of 4-6%:

As the points above illustrate, the company stands to benefit immensely from long-term market trends that favor its business model. Underscored by its market leadership, ownership culture and the company's growth-focused, long-term vision.

Watsco embodies the essence of a “Good Story”.

And shows, boring is good.

So, what is the catch?

Quality has its price.

Chart 4: Watsco over the last ten years

Source: TradingView