Duopolies: The Unfair Growth Machines

„Gentlemen, you had my curiosity… but now you have my attention”

– Leonardo DiCaprio's character Calvin Candie in Django Unchained

arvy's teaser: When two giants dominate, they wield pricing power, crush weaker rivals, and leverage compound interest to outpace markets. By forming a duopoly, they build their business model like a flywheel leading to perpetual growth machines.

Duopoly.

A market where two firms dominate or control exclusively.

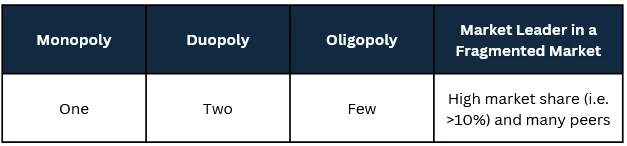

The other key market structures (chart 1) are monopoly (one firm in control), oligopoly (a few firms sharing control), and market leader in a fragmented market (one firm leading among many peers). These structures have my curiosity, and they should have yours, too. Why? Because for them to exist, specific criteria must be met. And history has shown that companies in these areas have been winners in the past and will most likely continue to be winners in the future. But I have not yet told you about their most attractive attribute.

They can play an unfair advantage.

Especially duopolies.

Chart 1: Type of Market Structures and How Many Sellers

Source: arvy

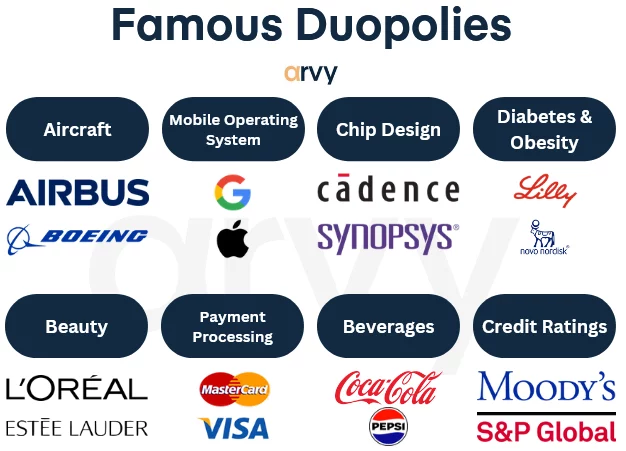

World's Best-Known Duopolies

First things first, let's look at the world's best-known duopolies:

You have met many of them in your life. But how is it that these companies dominate a certain market so much?

Let's look at how they engage in an unfair fight.

Chart 2: World's Best-Known Duopolies

Source: arvy

Flywheel Effect Leading to Perpetual Growth Machines

How can those duopolies exploit their dominance? And why are they such attractive businesses to own (excerpt from our NZZ The Market article)?

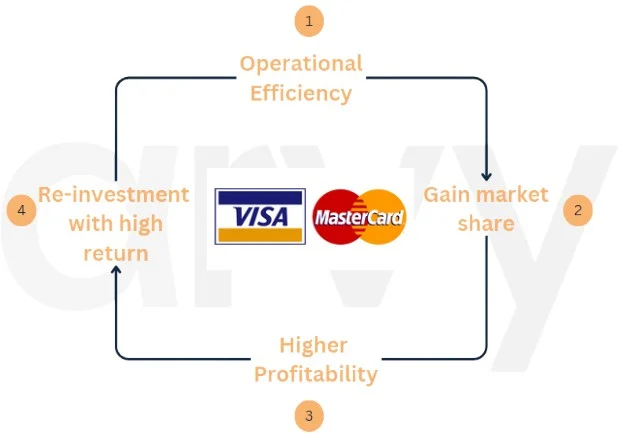

They build their business model in these types of markets like flywheels. In theory, once a flywheel starts moving from a standstill, it gradually builds momentum. Over time, the wheel can spin on its own, creating even more momentum in a self-reinforcing loop. In practice, market leading companies can use their dominance in their industry to leverage the following three points to turn their flywheel.

Let’s take the duopoly of Mastercard & Visa, two businesses we own, as an example:

In short, companies such as Mastercard & Visa can use their dominance, based on a moat and best-in-class operational efficiency, to push weaker competitors out of the market and gain further market share. The improved profitability from market share gains leads to more capital that can be reinvested at high returns, which in turn further extends their dominance through operational efficiency and enables further market share gains. All of this happens in repeat mode (chart 3). These market leaders can use the flywheel effect to build a business model that turns them into perpetual growth machines.

The cherry on the cake is when companies are supported by structural growth trends in their sectors. Like payment processors Mastercard & Visa in the cashless payment trend.

This boosts growth rates and ultimately also the compound interest effect.

But of course, there is a catch.

Chart 3: Illustration of the Visa and Mastercard flywheel effect

Source: arvy

Time-Horizon Arbitrage

You must engage in time-horizon arbitrage.

In what?

The concept is simple, but not easy. It is about focusing on the long term, years if not decades, while most investors are fixated on short-term performance.

By extending your investment horizon, you reduce competition, as many are distracted by quarterly results, clickbait headlines, and market noise. The true advantage comes from buying undervalued assets with long-term potential and holding them for a long period of time - like businesses in duopolies, such as Mastercard & Visa (chart 4).

These companies leverage structural dominance, pricing power, and compounding growth to outperform over decades. The key is patience: hold through market fluctuations, temporary underperformance and let time work its magic. Over the long run.

I know it is easier said than done, but for now, one thing remains clear.

Duopolies first piqued your curiosity.

Now they have your attention.

Chart 4: Mastercard and Visa since going public

Source: TradingView