Medpace: Sweet Spot of the Biotech Industry

“The rewards for biotechnology are tremendous – to solve disease, eliminate poverty, age gracefully”

– George M. Church, pioneer in chemistry and biomedicine

arvy's teaser: Medpace isn’t chasing the next biotech blockbuster—it’s getting paid whether drugs win or fail. Founder-led, asset-light, and deeply entrenched in the drug development cycle, it’s perfectly positioned for the next funding rebound.

CRO.

Contract Research Organizations.

Wow, what the hell is this, Patrick? Let’s keep it simple.

Before a new drug can hit the market, it must go through years of pre-clinical and clinical testing, plus regulatory reviews to prove it’s both safe and effective. These steps aren’t just time-consuming, they’re insanely expensive. The average drug development process takes 10 to 15 years from initial discovery to FDA (US Food and Drug Administration) approval. Clinical testing alone eats up around 7.5 of those years. A 2020 study found that the median cost of bringing a new drug to market is roughly $985 million. And here’s the thing: most small- and mid-sized biopharma companies don’t have the in-house resources, expertise, or infrastructure to pull this off. That’s where Contract Research Organizations, or CROs, come in.

They do the heavy lifting. They plan, manage, and execute clinical trials. They handle regulatory submissions. They collect and analyze data. They make sure the science is solid and the paperwork is perfect.

Enter one of the world’s leading clinical CROs.

Medpace.

Chart 1: The Critical Role of Pre-Clinical Contract Research Organizations

Source: Lide Biotech

Owner Operator

Medpace was founded in 1992 by August Troendle. Over three decades later, he’s still at the helm as CEO.

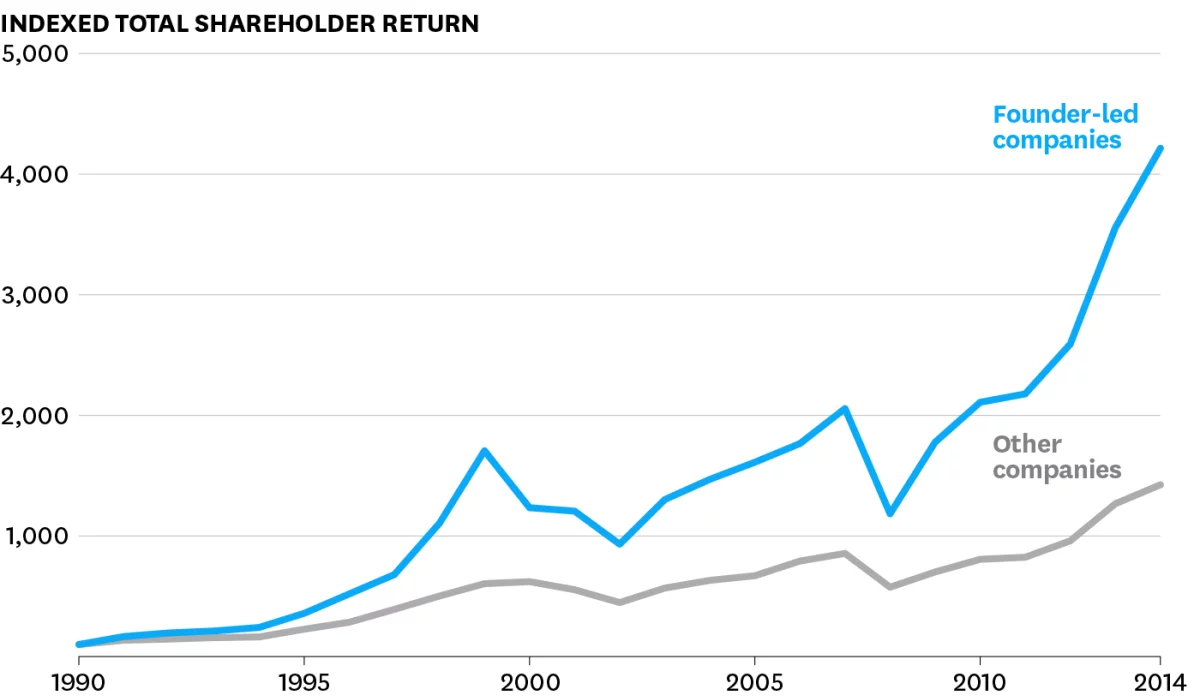

But he’s not just running the show — he owns 20% of the company, which now has a market cap of $9 billion. That’s what we call an owner-operator. A founder-led business with real skin in the game (chart 2).

At arvy, when we talk about a “Good Story,” this is one of the traits we love to see.

Why?

Because in a perfect world, a company’s moat should be protected by leadership with integrity — and aligned incentives. As a co-investor in my own strategy, I don’t just want numbers on a spreadsheet. I want people who bleed for the product, the company, and the vision.

“Skin in the game” means management thinks like shareholders. It’s about more than equity. It’s how they communicate, own their mistakes, and lead by example.

And August Troendle? He walks the talk.

His salary? Just $700k.

That’s two things:

That alone tells you where his priorities are.

But here’s something else that stands out. Many of Medpace’s key people have been with the company for 15 to 20+ years. In this industry, that’s rare. It signals a strong culture, real loyalty, and a mission people want to stay part of.

And that’s not all.

Chart 2: Founder-Led Companies Outperform the Rest (based on S&P 500)

Source: Bain & Company, Harvard Business Review

Full-Service & Asset-Light Model

Medpace focuses almost exclusively on small- to mid-sized biotech companies — they make up 90% of clients and roughly 96% of revenue.

Why that matters?

Because these companies typically must outsource their clinical trials. They don’t have the internal infrastructure or experience that Big Pharma has.

And here’s the clou: Medpace — like many CROs — is about 30% faster than large pharma in running trials. That’s not just nice to have. It’s critical.

Why?

Because once you file for a drug, the patent clock starts ticking — in the US, 20 years from the filing date. Every month of delay eats into potential revenue. So, if Medpace can shave time off the development timeline, the cost savings and commercial upside are massive.

Time is money — especially in drug development.

This is exactly where Medpace’s full-service model shines.

They bring everything in-house: clinical trial management, regulatory affairs, lab services. That tight integration reduces handoffs, increases speed, and enhances precision.

Medpace doesn’t just offer execution. It offers expertise — including deep regulatory know-how and cultural fluency across multinational trials. That’s a strong competitive edge.

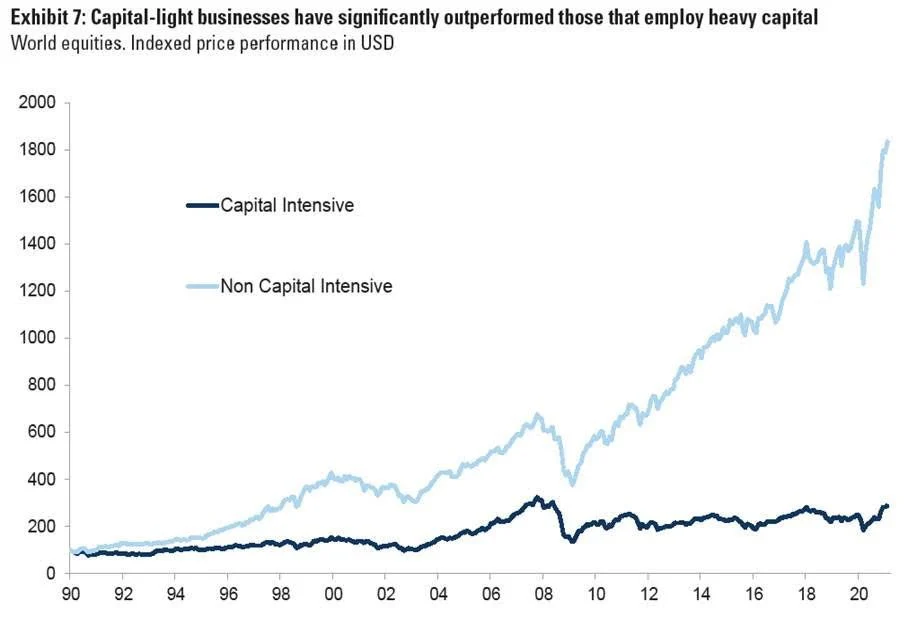

But here’s another key point: Medpace is asset-light (chart 3). Unlike many players in the healthcare space, it doesn’t own manufacturing plants or big infrastructure. It’s focused on coordination and execution — not production. That’s why margins are so healthy.

How does that show up in the “Good Story”?

Medpace currently boasts a 19% net income margin and generates strong free cash flow. Its free cash flow yield and PE ratio sit at 6.2% and 25x, respectively — compared to its 5-year average of 4.4% and 28x. So even while the broader market (like the S&P 500) trades at stretched valuations, Medpace appears relatively undervalued by its own standards.

But that brings us to the next point: If Medpace ticks so many “Good Story” boxes — founder-led, asset-light, highly profitable, deeply entrenched in a mission-critical part of biotech — why is it trading below historical valuation levels?

What’s holding it back?

Is there something in the “Good Chart” we should keep an eye on?

Let’s dig in.

Chart 3: Asset-light businesses have significantly outperformed those that employ heavy capital

Source: Goldman Sachs, World equities in USD

No Direct Drug Failure Risk – But Indirect Exposure

Here’s one thing I haven’t touched on yet.

In biotech, one of the biggest risks is drug failure. A company can spend years — and hundreds of millions — chasing FDA approval. If a trial fails or results disappoint (Novo Nordisk rings a bell?), the stock can fall off a cliff. Brutal.

But not for Medpace. That’s the beauty of its model.

Medpace doesn’t own the drug IP. It’s the executor, not the inventor. Whether a drug succeeds or fails, Medpace still gets paid for managing the clinical trial.

No direct drug failure risk. Thus, it sits in the sweet spot of the biotech industry.

However — and this is important — it is indirectly exposed.

How? Through the biotech funding cycle.

Here’s the chain reaction: If biotech firms can’t raise capital — or suffer major drug failures — they’ll cut back on R&D. And when R&D spending slows, so do CRO order books. Medpace depends on a healthy, well-funded biotech ecosystem. So even if its business model is robust, it can’t escape gravity entirely.

And that’s exactly what’s been playing out recently.

Over the past few quarters, biotech funding has been sluggish. That’s translated into weaker order intake for Medpace — and yes, this showed up in the “Good Chart” as a stock price consolidation.

So, while the business fundamentals remain strong, the market priced in this soft patch. Lower orders = lower near-term visibility = cheaper valuation. So, what changes that? What’s the spark?

Simple: a rebound in biotech funding.

Once capital flows back into the sector and R&D budgets expand again, CROs like Medpace will be early beneficiaries. Order books will strengthen, sentiment will shift, and the “Good Chart” might start looking a whole lot more exciting again.

Until then, Medpace sits in a bit of a holding pattern.

Still high-quality. Still founder-led. Still printing cash.

But waiting for the cycle to turn.

Chart 4: Medpace since IPO 2016

Source: TradingView