Lehman Brothers Collapse: arvy’s 5 Lessons for Investors

“Either the world ends or it doesn't. If it ends, nothing matters. If it doesn't and we don't buy, we failed our job.“

– Memo of Howard Marks to clients, 15th of September 2008

arvy's teaser: Lehman Brothers collapsed 17 years ago this week, markets panicked, and the world watched. Years later, the echoes remain. In this edition, we distill the chaos into 5 essential lessons every investor should carry forward.

2008.

15th of September.

The old hares still remember.

It was the day the most prestigious investment bank in the world fell: Lehman Brothers. When the news broke 17 years ago this week that Lehman was bankrupt - with no buyers in sight and no government bailout - everything changed.

I still recall that day vividly, though I was only 16 years old, in my very first apprenticeship year. I had just stepped into banking, dreaming of conquering the world at the peak of its heydays. Instead, I was confronted with the harsh reality of one of the greatest financial crises in modern history. Within months, the sector that defined Zürich and Switzerland seemed to spit me back out.

The crisis of 2008 still casts a long shadow over investing today. That’s not surprising. At the time, it felt like an epochal shift — and in many ways, it was (see today’s quote).

Let’s revisit the biggest shockwave in modern stock market history.

The collapse of Lehman Brothers.

And our five lessons.

Chart 1: Lehman Brothers Cap in front of arvy’s book club in our offices

Source: arvy

Leverage, Liquidity & Moral Hazard

For the ones who don’t know the prestige of Lehman Brothers, let me explain it with a Champions League analogy.

If Goldman Sachs, JP Morgan or UBS are AC Milan (7 titles), Liverpool (6) or Bayern Munich (6) — Lehman Brothers was Real Madrid (15).

Everyone wanted to work there. If you didn’t make it, you went to the “second best.”

This culture created highflyers, risk-takers — and plenty of moral hazard.

What caused the collapse then?

Lehman Brothers had huge exposure to mortgage-backed securities and complex, risky financial products like collateralized debt obligations (CDOs). When the US housing bubble burst, values collapsed, and losses piled up. Do not worry about how ABS, MBS or CDOs work, unfortunately, no one really does…

On top came high leverage. The firm relied heavily on borrowed money, making it extremely vulnerable when markets turned.

This is where moral hazard kicked in.

It describes when individuals or firms take outsized risks because they don’t expect to bear the full consequences — someone else will pick up the bill.

As we know today, this was not the case with Lehman Brothers. The company was allowed to fall.

Let’s draw our first three lessons:

Let’s move on.

Chart 2: Lehman Brothers collapse sends shockwave around the world

Source: Wall Street Journal, Cover on Monday, September 15th 2008

The Aftermath and Reappraisal

People and markets love stories.

And if there’s one chapter in modern finance that has been told, retold, and dramatized more than any other — it’s the collapse of Lehman Brothers.

I can highly recommend diving into the cultural reappraisal. In particular, the movies and documentary are must-watches — gripping, accessible, and easy to follow even without a finance degree. For those who want to go deeper down the rabbit hole, the two books are worth it: detailed, insider-rich, but more complex.

Think of it as Wall Street’s own cinematic universe (chart 3):

These weren’t just stories — they became the lens through which the world understands leverage, greed, and systemic risk.

Let’s move on to the last two investor lessons.

Chart 3: Selection of movies, documentaries and books covering the collapse of Lehman Brothers

Source: Wikipedia, Imdb, Micheal Lewis, Andrew Ross Sorkin

The Long Compounding View: Patience, Transparency, and Perspective

Lehman Brothers shook the world — but it didn’t stop it.

Markets recover, crises pass, and time reveals resilience. For anyone entering finance or investing, the 2008 collapse is both a warning and a lesson: bad news is inevitable, but it’s rarely permanent.

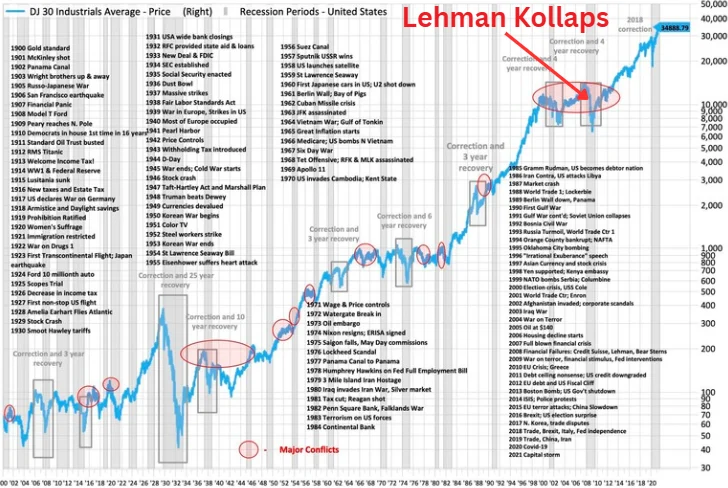

Over the long run, markets have weathered shock after shock — from world wars to pandemics — and continued compounding for those who stayed the course. Just look at the Dow Jones: barely above 50 in the early 1900s, it has now climbed to over 46,000 — nearly a 1’000-fold increase over a century (chart 4).

Crises come and go, but the market marches forward. It climbs the wall of worry — our Lesson Four.

This principle — that “this too shall pass” — is central to how we built arvy. With full transparency, we share wisdom and knowledge so everyone can improve, work on themselves, and make better decisions.

There are no surprises, only informed action.

Lehman reminds us that crises are human, economic, and inevitable — but also temporary. With discipline, patience, and clarity, investors can navigate them, protect their wealth, and benefit from the long-term power of compounding.

And compounding isn’t just for wealth. Knowledge, habits, relationships — everything in life compounds.

And that, dear 9’921 arvy’s Weekly readers, is Lesson Five.

Chart 4: Dow Jones Industrial Average over 120+ years and (mostly) bad news

Source: Brouwer & Janachowski