Adobe: Value Trap or The Big Opportunity?

"Markets are never wrong, opinions often are."

– Jesse Livermore, trading legend

AI eats Software

It’s the current market narrative — and make no mistake, the market always follows a narrative.

Sometimes cyclical, driven by commodities and demand-supply imbalances. Sometimes structural, powered by trends like digitization, cashless payments, or the cloud. Every narrative has its defining moment — a point in time where the story begins.

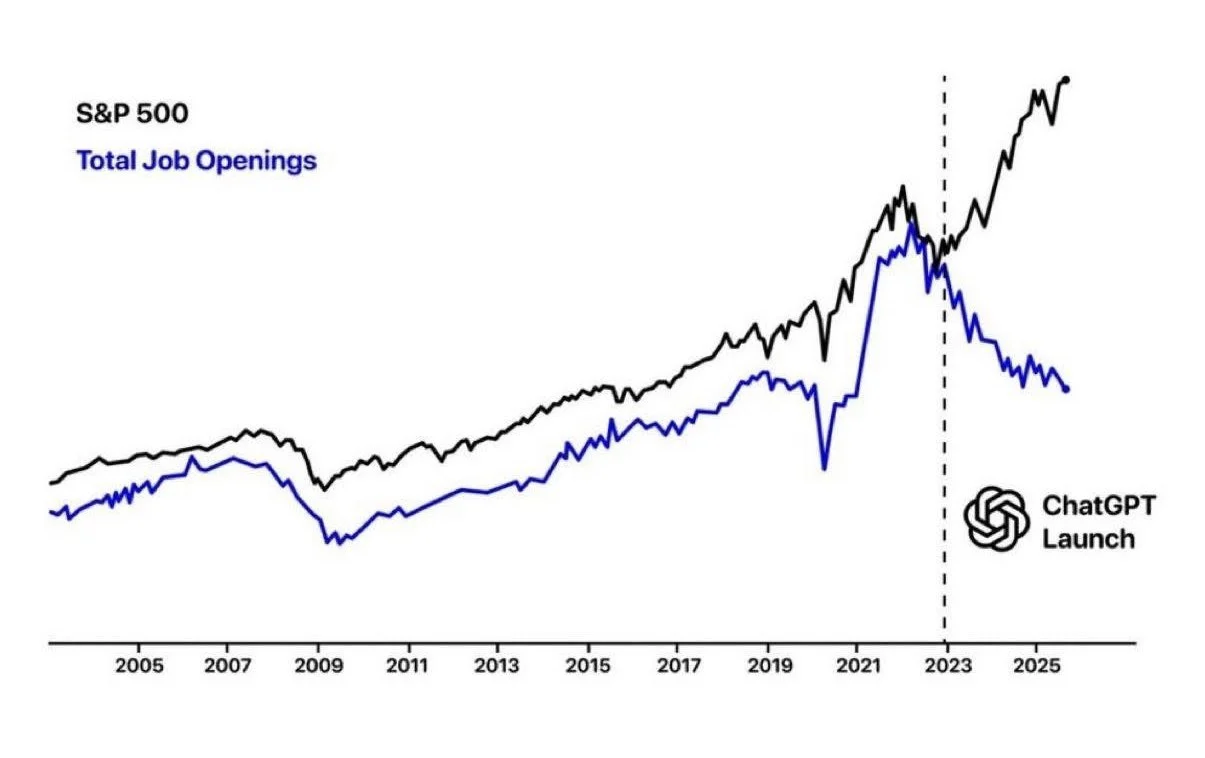

The “AI eats software” narrative started on November 30th, 2022 — the day a large language model called ChatGPT was launched. It took a few months for Mr. Market to grasp the full impact — the realization that such models could code, write, translate, summarize, and even create images or videos.

Suddenly, parts of the software world began to tremble. A new force had arrived — capable of doing certain tasks faster and cheaper. And with that, the market began to reprice the future. We will leave open the question of whether this already means fewer jobs (chart 1).

One company, in particular, unwillingly became the poster child of this narrative — a stock market darling that had delivered for decades.

The owner of PDF and Photoshop.

Adobe.

Chart 1: Total job openings vs S&P 500 since ChatGPT launch

You might recall our arvy Weekly on Adobe, written almost two years ago.

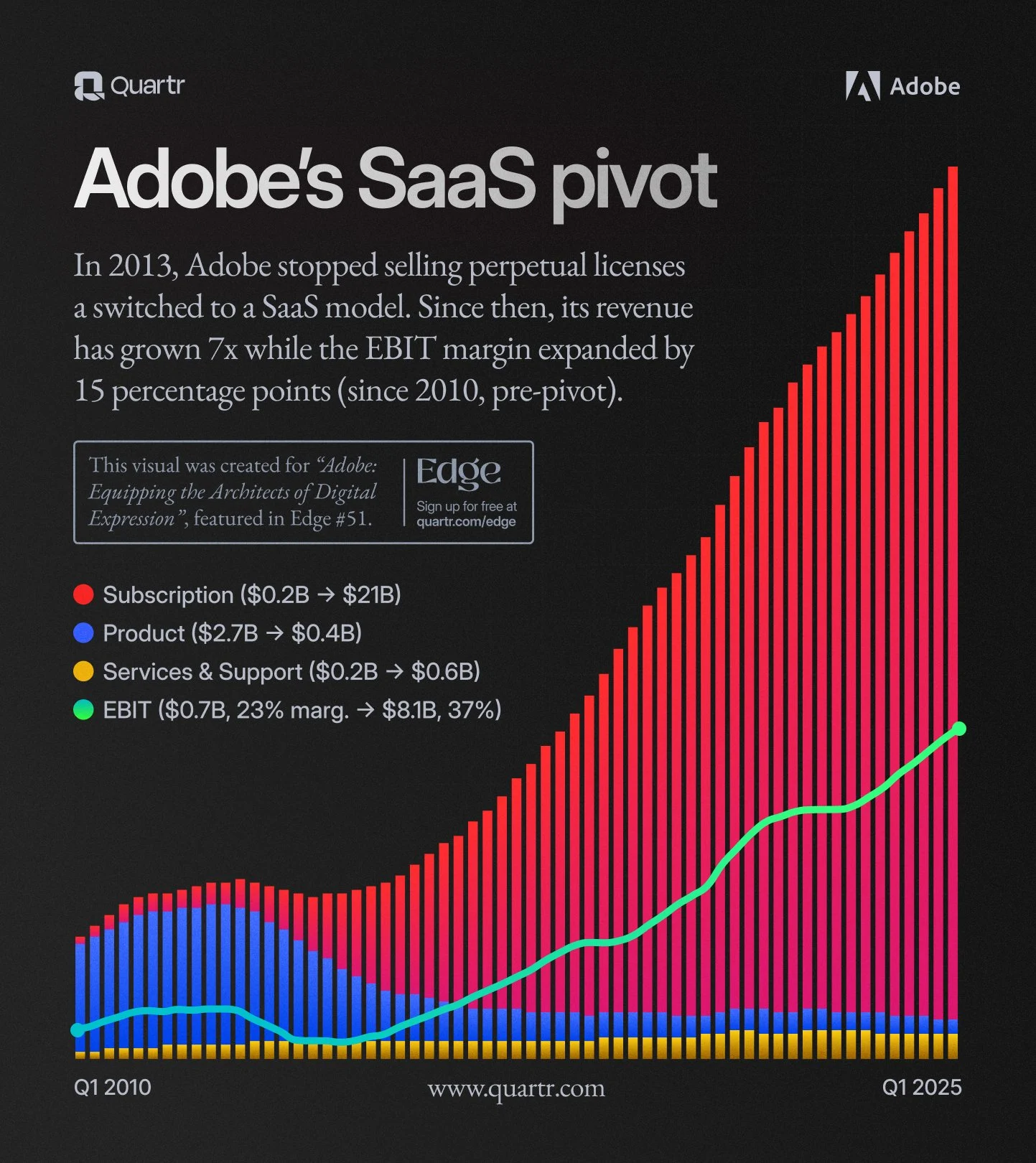

Back then, we highlighted the company as a pioneer — the one that reshaped software forever through its Subscription-as-a-Service model.

That shift, launched in 2013, was radical at the time. No more one-time purchases. No more boxed software.

You’d now subscribe — pay monthly or annually.

What feels perfectly normal today was, back then, a revolution. Customers weren’t thrilled either. Yet, it turned out to be one of the most successful business transformations in tech history.

Fast forward to today: since its IPO in 1986, Adobe has delivered a staggering 170,000% total return, or 22% compound annual growth, while remaining profitable every single year.

Quite a record.

We also emphasized back then that Adobe’s strength lies in its customer focus and its ability to stay ahead of the curve — now again, in another transformative wave: Generative Artificial Intelligence (GAI).

And while the business itself keeps growing steadily — delivering quarter after quarter (chart 2) — we couldn’t be more wrong on Mr. Market’s attention and reaction.

New players like Canva (which we at arvy use daily) and tens of other LLMs next to ChatGPT have entered the scene, showing that for Adobe, AI might be a double-edged sword.

The same technology that empowers its users also enables new competitors.

With breakthroughs in AI happening almost daily — models that generate videos, images, or even full creative workflows — Adobe’s dominance suddenly looks less untouchable.

After all, their flagship products — Photoshop, Illustrator, InDesign, and Acrobat — have long been industry standards. But even the strongest castles face new sieges.

To counter this, Adobe has been embedding AI deep into its ecosystem for years.

From its creative suite to Acrobat, AI quietly enhances productivity, design, and automation. The company’s Firefly platform, a family of generative AI models, is its boldest move yet — allowing users to generate and edit visuals directly inside Adobe apps.

Unlike most AI image generators trained on scraped internet data, Firefly was trained on Adobe Stock, public domain content, and licensed materials — giving it a strong legal and ethical edge.

In short: Adobe’s products, execution, and positioning remain top-notch.

But once again, Mr. Market sees things differently.

He believes there is a major threat.

Price tag of this threat?

-50%.

Chart 2: Adobe’s Subscription-as-a-Service (SaaS) pivot – the pioneer!

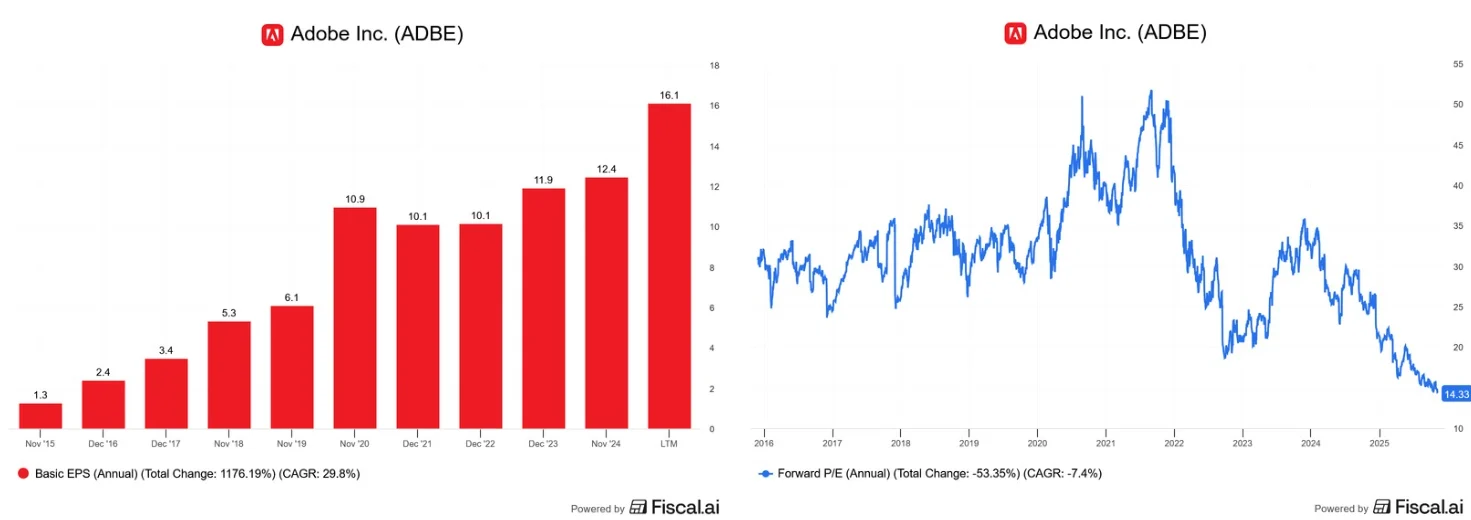

A business that has tripled its revenue and profits, yet whose stock has gone nowhere for the past seven years?

Yes — that’s Adobe.

And when a company keeps firing on all cylinders, but its share price just treads water, you already know what’s happening beneath the surface: The business is getting cheaper valued.

In Adobe’s case, while Earnings per Share continue to accelerate — showing no signs of slowing — its valuation has collapsed (chart 3 – left EPS, right PE).

That’s largely due to one thing: Mr. Market’s fear of disruption.

Specifically, the fear that AI will erode Adobe’s once invincible software dominance.

Let’s restate the facts.

Adobe is executing just fine — still delivering mid-teens growth (14,4% long-term EPS growth estimate), backed by a high-margin (gross margins of 89% and net income margins of 30%), subscription-based model that provides predictability, scale, and stability.

And yet, the stock trades at multi-year valuation lows.

In other words, Mr. Market believes that software’s “sticky” dynamics — the hallmark of businesses like Adobe — are fading. We know from history that the erosion of an economic moat is one of the most destructive forces for a stock price. And, unfortunately for Adobe, it has become the poster child of how quickly a market narrative can turn.

After all, the stock price is down 50% from its most recent highs.

But what does Adobe’s management think?

They couldn’t disagree more.

The company is buying back its own shares at record pace — nearly 10% of outstanding shares this year alone — signalling confidence that the market is dead wrong about its long-term prospects.

They believe the AI “threat” is overstated. That their moat — their ecosystem, customer base, and creative suite, or in arvy’s talk “Good Story” — remains as strong as ever.

Because, if you listen to Mr. Market right now, you’d think it treats Adobe like it will be extinct within 5–10 years.

So, what are we looking at here?

Either the biggest value trap in tech — or the biggest buying opportunity in a generation.

How do we at arvy approach such a dilemma?

Chart 3: Adobe EPS growth and PE Valuation over the last ten years

If you recall one of our 12 Sell Rules, one stands out: Never buy something with a falling 200-day moving average.

Why?

Because when that golden line turns south, the trend is clearly against you (chart 4).

Example?

Just a few weeks ago, our arvy Weekly on Estée Lauder — one of those rare turnarounds that worked — delivered nearly 100% within months.

But the key word here is rare.

At arvy, we don’t pretend to catch turning points. We don’t bottom-fish. We don’t buy turnaround stories. Instead, we wait patiently for what we call a “Good Chart.”

And that means waiting for the 200-day moving average to turn up. When it does, the trend has shifted — and that’s where we prefer to engage.

We’re happy to leave the first 20–30% upside to the bottom-fishers and turnaround traders. Because our focus is not on being first — it’s on being right over the long run. Once the trend reverses, we’ll still have a cheaply valued “Good Story” aligned with a rising “Good Chart.”

That’s when we act. Until then, we stay patient.

I know this might not be the message you were hoping for. But in markets, it’s often precisely this uncertainty that demands discipline — and, in the end, rewards it.

We won’t take sides in the debate between Mr. Market and Adobe’s management. Because, in the end, price action always tells the truth long before opinions do. This means that the benefit of the doubt lies with Mr. Market.

As the legendary trader Jesse Livermore already knew over a century ago.

“Markets are never wrong.

Opinions often are.”

Chart 4: Adobe over the last five years with its 200-day moving average falling