arvy Strategies – Quarterly Report Q3 2025

arvy's teaser: Quality out of fashion – opportunity for the long-term. In the third quarter of 2025, global markets kept climbing despite growing concerns — driven by AI enthusiasm and a narrow group of tech giants. While hype dominates headlines, quality companies have rarely been this attractively valued.

Dear arvy client,

In our latest arvy Strategies Quarterly Report, we share insights on:

Stay invested. Stay long-term. Let compounding work for you.

Read or watch the full Q3 2025 Report

arvy Equity Strategy Update Q3 2025 | Update Wolters, Constellation | Performance, Buys & Sells

The arvy strategies have delivered the following net returns in CHF this year and over previous periods.

arvy Savings Plan (net):

| Strategie | Q3 | YTD 2025 | 1 year | 3 years p.a. | 5 years p.a. | 10 years p.a. |

| Defensive | -0.4% | 2.7% | 0.4% | 6.0% | 2.2% | 4.3% |

| Balanced | -1.8% | 3.5% | 1.0% | 8.8% | 4.8% | 5.8% |

| Growth | -3.7% | 4.3% | 1.7% | 12.4% | 8.1% | 7.7% |

arvy Pillar 3a (net)

| Strategie | Q3 | YTD 2025 | 1 year | 3 years p.a. | 5 years p.a. | 10 years p.a. |

| Strolling | 0.0% | 2.5% | 0.2% | 5.3% | 1.5% | 3.8% |

| Walking | -0.7% | 2.9% | 0.5% | 6.6% | 2.8% | 4.6% |

| Hiking | -1.8% | 3.2% | 1.0% | 8.2% | 4.6% | 5.4% |

| Mountaineering | -2.6% | 3.8% | 1.3% | 10.3% | 6.2% | 6.6% |

| Climbing | -3.7% | 4.3% | 1.7% | 12.4% | 8.1% | 7.7% |

arvy Equity Strategy (net):

| Strategie | Q3 | YTD 2025 | 1 year | 3 years p.a. | 5 years p.a. |

| arvy Equity Strategy in $ | -2.6% | 8.1% | 6.4% | 17.7% | 8.6% |

| arvy Equity Strategy EUR | |||||

| arvy Equity Strategy in CHF |

In this review, we examine the current market environment, developments in the AI sector, winners and losers in the portfolio, our adjustments, and our outlook for the coming quarters.

Global equities showed impressive strength in Q3. U.S. markets in particular continued to climb the “wall of worry”, supported by optimism that the Federal Reserve will manage a soft landing, inflation will ease, and recession can be avoided.

Selected returns of different asset classes:

| Index | Q3 | YTD 2025 |

| MSCI AC World in CHF | 7.2% | 3.1% |

| Swiss Equities (SPI) | 1.3% | 8.2% |

| S&P 500 | 13.1% | 13.3% |

| Bonds in CHF | 0.0% | 0.7% |

| Gold | 17.3% | 46.7% |

| Bitcoin | 9.6% | 21.9% |

| Cash | 0.0% | 0.0% |

Source: Tradingview

Q3 2025 was characterised by high market concentration, ongoing AI euphoria and growing valuation gaps between hype and quality. While large tech giants posted new highs, the environment for quality companies — the kinds of businesses we invest in — was one of the most challenging since the dotcom era more than 20 years ago.

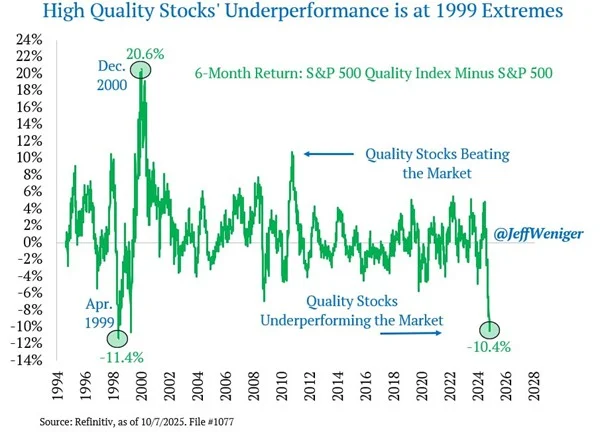

Chart 1: Quality stocks vs S&P 500, relative

Source: Jeff Weniger, Refinitiv

Historical note: The underperformance of quality stocks versus the broader market reached levels last seen in 1999. Historically, such phases have often proven to be excellent entry points for long-term investors.

While the market currently prefers the AI hype and channels capital into highly speculative names (mainly unprofitable tech stocks), we remain true to our philosophy: we invest in profitable, robust, and structurally growing companies — not in fashion trends.

A clear sign of our conviction: all three arvy founders — Patrick, Florian and Thierry — invested an additional six-figure amount directly into the arvy Equity Fund in September, on top of their regular monthly savings plans.

Why?

The companies we own together are as attractive as they have been in years.

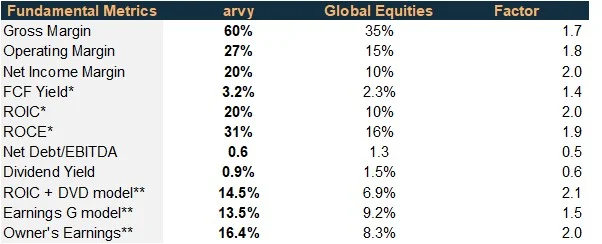

Chart 2: arvy Portfolio: Fundamental data

Source: arvy, Fiscal AI

This underlines our confidence: quality pays off — especially when it’s out of fashion.

Let’s now look at what worked and what didn’t.

Chart 3: arvy Portfolio — Top and bottom performers

Source: arvy

These short-term setbacks do not change the structural strength of these companies.

Let’s move on to the main theme: Artificial Intelligence.

What does arvy think?

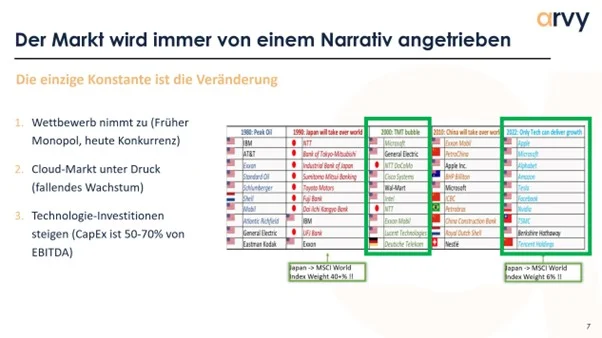

The current market dynamic resembles historical phases of excess. In the 1970s (the “Nifty Fifty”), during the dotcom era, or in Japan in the 1990s we saw the same pattern: extreme concentration and very high valuations rarely end well over the long term.

Chart 4: Excerpt from the arvy Q3 quarterly update video

Source: arvy

Many of today’s Big Tech firms are no longer “asset-light”; they are investing billions in data centres and infrastructure. Historically, high capital intensity often correlates with falling returns on capital — a warning sign for future profitability. In practice, profits are currently missing for many of these companies, and even market leaders like OpenAI (parent of ChatGPT) generate only comparatively modest revenues relative to their massive investments.

The question remains: who ultimately pays for all of this?

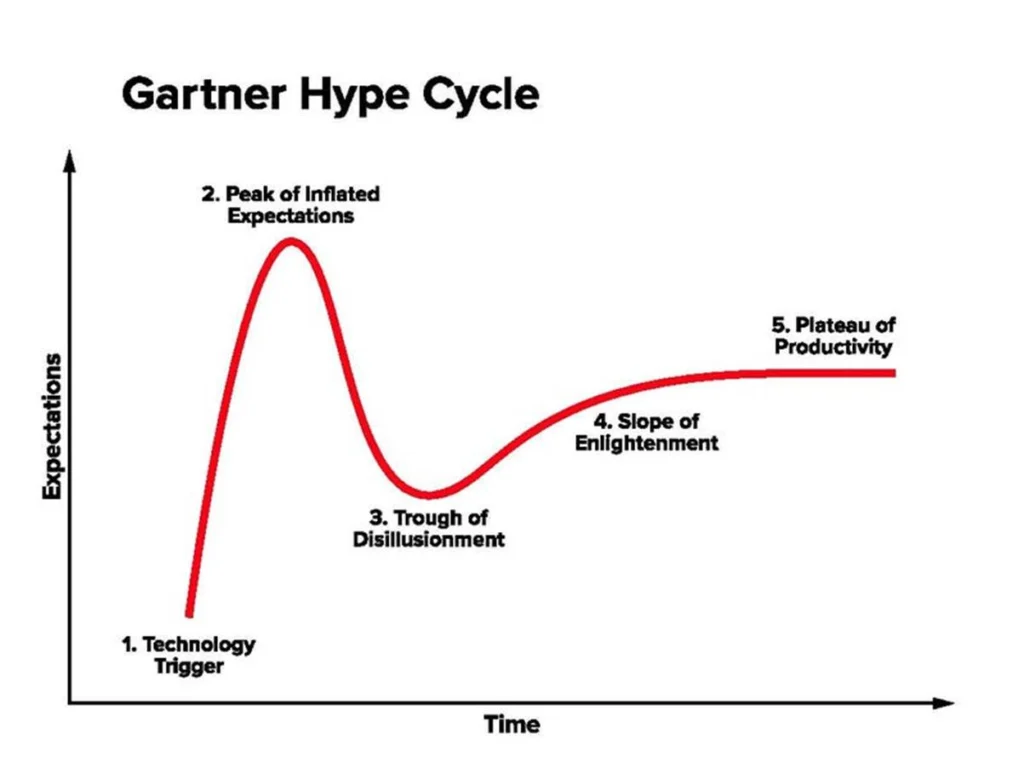

This development resembles the Gartner Hype Cycle: new technologies and narratives can strongly influence markets and valuations, but they typically go through a cycle of over-expectation, correction, and eventual consolidation into sustainable growth.

Chart 5: Gartner Hype Cycle

Source: Gartner

Even former monopolies like Meta Platforms (which we hold) and Google face growing pressure:

Nevertheless, we remain invested in the AI beneficiaries Broadcom, Microsoft and Meta Platforms for now. We let trends run because nobody can predict exactly when they will end. At the same time, we monitor momentum closely to limit risks and lock in gains when appropriate.

As usual, we’ll keep you updated on developments via the arvy app.

Let’s move on to portfolio adjustments and new investments.

Our focus remains unchanged: quality, capital discipline and sustainable earnings power.

New positions

Reductions and sales

We sold smaller, low-conviction positions such as Ares Management, Novo Nordisk, Copart and Watsco to make room for higher-conviction ideas. We also reduced larger software positions in Wolters Kluwer and Constellation Software in a risk-aware manner.

In addition, we are building two new family-owned oligopoly positions that deliver above-average returns on capital and stable cash flows. These positions are already visible in the app.

In the bond book we remain balanced: 36% of the portfolio is invested in attractively yielding government bonds with high credit quality — including the USA, Germany, New Zealand and Spain. A further 50% is invested in corporate bonds from top issuers such as Johnson & Johnson, Booking Holdings and Siemens.

The average yield to maturity of our bond allocation currently stands at 3.63%.

This keeps the fixed-income portion a stabilising element in the portfolio for the Defensive and Balanced savings plan strategies as well as the Strolling, Walking, Hiking and Mountaineering strategies in Pillar 3a — offering attractive running yields and high credit quality.

Markets are seldom calm — the coming months will almost certainly bring more “market noise.” Inflation, central-bank policy, geopolitical risks or AI-related headlines will continue to make the news.

No matter how the market moves in the short term: stay invested. Use price swings to your advantage, not as a reason to exit. Periods of uncertainty often offer the opportunity to buy high-quality companies at attractive prices.

Regular contributions — for example via your savings plan — are your best friend. Over long periods it’s disciplined, consistent participation — not perfect timing — that grows your wealth sustainably.

“Far more money has been lost by investors trying to anticipate corrections than in the corrections themselves.”

— Peter Lynch

Stay invested, stay long-term — and let compound interest work for you.

Best regards,

Your arvy team