ASML: AI chip gold rush? Sell shovels!

„In a gold rush, don't invest in the gold miners, invest in shovels!“

– André Kostolany

Chips are the world's most sold good.

Not the kind you want to eat every day. Remember, a moment on your lips, a lifetime on your hips.

But the ones you use every day.

Whether it is your phone, computer, car, or even your refrigerator, almost everything runs on chips or so-called semiconductors/semis. The terms are used interchangeably.

Today, your smartphone with the latest chips has more computing power than Nasa needed for its moon landing in 1969. There are 3’500 or more chips in a Tesla, and 1’000 in a combustible engine.

Chips are like the oil of the 21st century. The battle for control of this industry will determine our future.

It is so important that the Financial Times labelled my choice for summer reading, Chip War by Chris Miller, the "business book of 2022".

Chart 1: Chip War by Chris Miller, The Fight for the World’s most Critical Technology

The current AI hype surrounding the already booming digitization trend is now the last straw that breaks the camel's back. A key factor in staying ahead in the AI race is, guess what?

Chips.

Be an ant

In highly complex and specialized fields, the situation is always the same. There are market leaders.

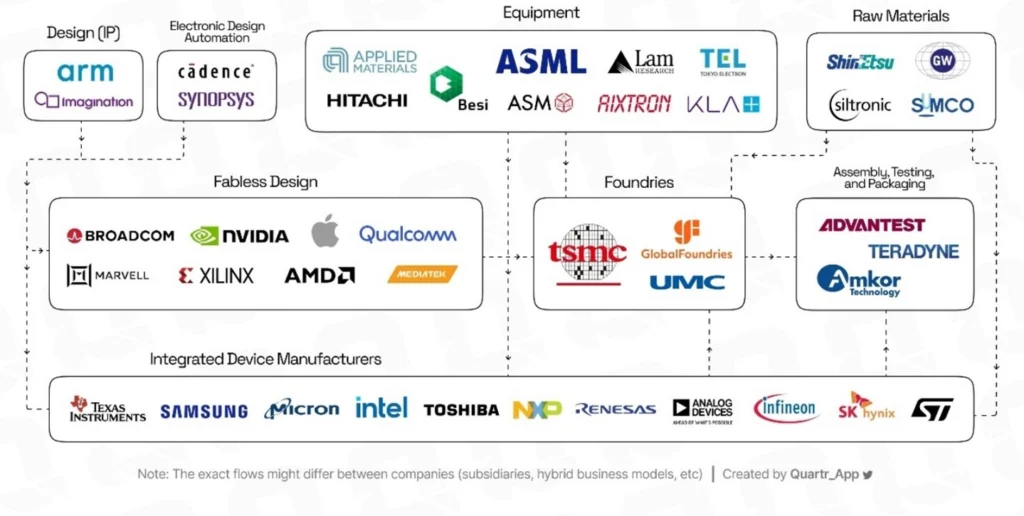

The semiconductor world is a vast, complex, and fiercely competitive landscape. To survive, you must be an ant - specialized in one part of the whole process. It is impossible to be in the top league in every part of the value chain.

This industry operates on a global scale, with key players dispersed across the USA, Europe, and Asia, mainly in China, Taiwan, South Korea, and Japan. We even have a Swiss darling: VAT Group. They produce mission-critical valves. But that is a topic for another day.

Chart 2: The Key Players in the Semiconductor Value Chain

A particularly strong ant published its excellent quarterly results this Wednesday, July 19. The business is firing on all cylinders, it just had to raise its full-year guidance.

It is among the best positioned companies in the entire value chain. The Dutch company ASML - Advanced Semiconductor Materials Lithography.

Precision and Dominance

Imagine if you could invest in a company that is the most technologically advanced in its field and therefore has a monopoly position. And finally, it is the shovel supplier in a gold rush industry that produces the most sold product in the world?

Sounds interesting, doesn't it?

I just described ASML.

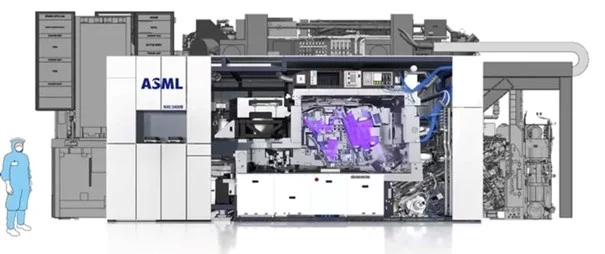

ASML is the predominant supplier of so-called photolithography equipment for semiconductor manufacturers. Simply put, they provide the machines that make the most powerful chips.

They are the only ones who have mastered extreme ultraviolet (EUV) lithography, the most advanced technology in semiconductor device manufacturing. It is like using an incredibly focused laser beam to draw the tiniest patterns on a surface.

Their instruments are so precise that it is the equivalent of a laser from the moon hitting a coin on earth – that is a distance of 384,400 km.

Precision at its finest. ASML's most advanced EUV lithography machine costs at least $160 million. It weighs 180 tons and requires 40 cargo containers, 20 trucks and 3 Boeing 747 Jumbos to transport. The machines take years to build and are about the size of a school bus.

That is why they sell only around 50 units a year.

Chart 3: ASML’s Extreme Ultraviolet (EUV) Lithography System

Kingmaker in the chip sector

Its supremacy in this area has made the company the most valuable and important European technology company in recent decades. It amassed a market capitalization of $300 billion - making it one of the 30 largest companies in the world.

That is, they only manufacture the equipment for production, but not the chips themselves. The question naturally arises as to why ASML does not then simply manufacture the chips itself?

Well, ASML has no idea how to make chips. This machine is just one of several ultra-complex machines and steps needed to make chips.

Another question: why isn't there competition?

There is. Nikon and Canon. But they are years behind.

The technology is so complex that it deserves a Nobel Prize. ASML secures its position by applying for patents and concluding exclusive agreements with, in turn, specialized suppliers. This enables them to gain control over the industry's products.

After all, an ant rarely comes alone... Specialized ants in this industry.

Everywhere.

Chart 4: ASML ($ASML) vs EURO STOXX 50 ($SX5E)

arvy's takeaway: ASML is a critical chip company. Yet, it does not even make them. In the words of legendary investor Kostolany, they are selling the shovels in a chip gold rush. In the technological race for the most powerful computer chips, fueled by AI hype, there is no way around ASML's EUV machines. No other company in the world can produce such equipment. ASML is not just shaping the Dutch economy - it is shaping the entire global economy. As the book Chip War reveals, they are of paramount importance to the world.