Buy the Dip vs. Dollar Cost Averaging. What is better?

I recently came across a statistic that I wanted to share with you.

The statistic compares the Dollar Cost Averaging (DCA) strategy to the Buy the Dip (BTD) strategy. The catch is that with the Buy the Dip strategy, you know everything. So you always hit the bottom with your buys.

The hypothesis is clear, right? An all-knowing BTD strategy must be better than DCA.

Well, the results are pretty astounding. The stat I saw was from Nick Maggiulli (@dollarsanddata) and his book "Just Keep Buying", so kudos to him. After asking him on Twitter, I may use his content (original blog post here: https://ofdollarsanddata.com/even-god-couldnt-beat-dollar-cost-averaging/), which I have summarized here, for our blog.

Enjoy reading it!

This article might be the last you'll ever need to read about market timing. It's a bold claim, but let's dig in and see why even a perfect "Buy the Dip" strategy often falls short compared to Dollar-Cost Averaging (DCA).

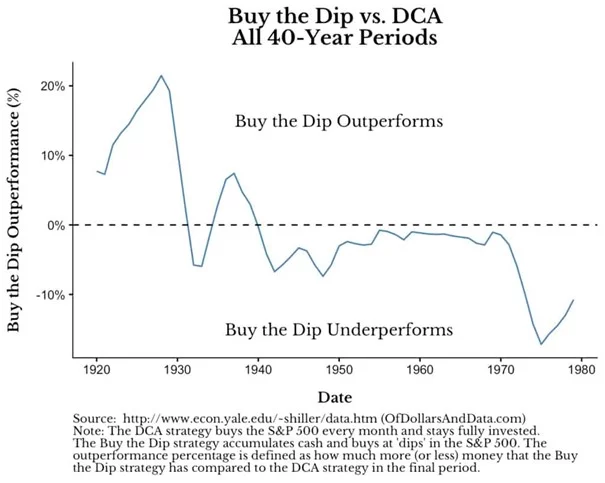

Let's start with a thought experiment. Imagine you're transported back in time, somewhere between 1920 and 1979. You have two investment strategies to choose from for the next 40 years:

It might seem obvious that "Buy the Dip" would outperform DCA, given the ability to buy at the lowest possible prices. However, data shows that even with perfect market timing, "Buy the Dip" underperforms DCA over 70% of the time.

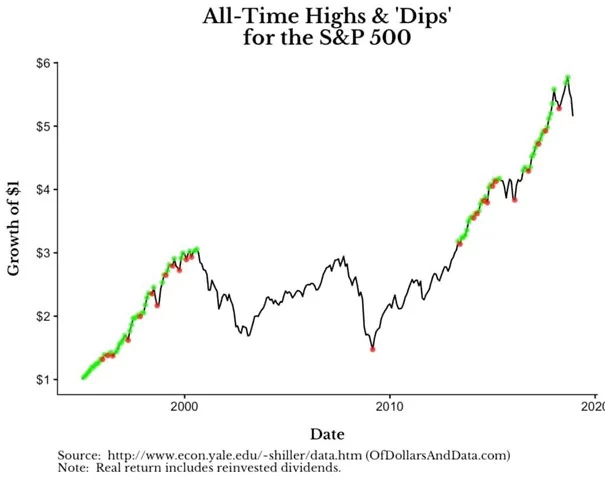

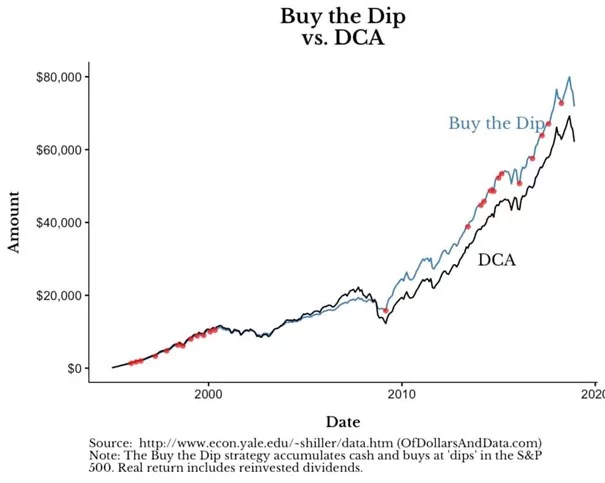

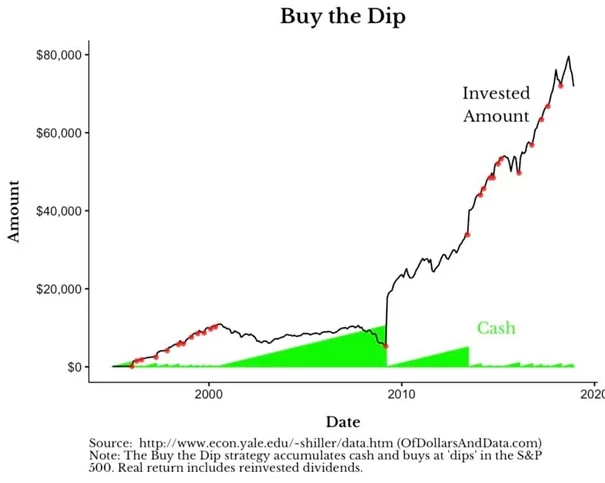

To illustrate, let's examine the U.S. stock market from January 1995 to December 2018. The S&P 500 (including dividends and adjusted for inflation) saw several all-time highs (marked by green dots) and subsequent dips (marked by red dots). The most significant dip occurred in March 2009, where the market bottomed out after the 2000 high. A "Buy the Dip" strategy would have invested heavily at this low point.

Despite this, the "Buy the Dip" strategy only starts to outperform DCA around the 2009 purchase. The $100 invested monthly via DCA since 1995 would have grown steadily, leveraging the market's rise and compounding effect. In contrast, "Buy the Dip" strategies often had cash sitting on the sidelines, waiting for the right moment to invest.

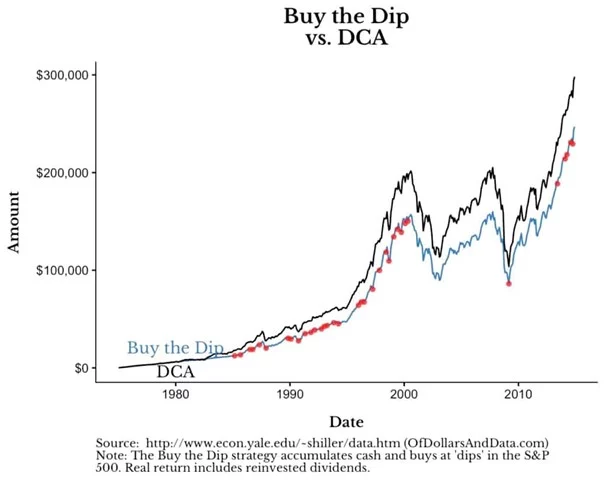

A key takeaway here is the importance of early and continuous investment. In the period from 1928-1957, the "Buy the Dip" strategy performed well primarily because of the severe 1932 market crash, where stocks were bought at rock-bottom prices. However, such opportunities are rare, difficult if not impossible to predict.

Compounding and time in the market are critical factors in long-term investing success. The DCA strategy, by ensuring consistent investment regardless of market conditions, captures the steady rise in market value over time. In contrast, "Buy the Dip" often involves waiting, which means missing out on periods of growth that contribute significantly to overall returns.

For example, from 1995 to 2018, DCA benefited from consistent market growth, while "Buy the Dip" relied heavily on a few significant downturns to catch up. Even during the 1975-2014 period, where the market saw fewer major dips, DCA outperformed because "Buy the Dip" couldn't capitalize on missed opportunities for growth during bull markets.

The data is clear: even an all-knowing "Buy the Dip" strategy cannot consistently outperform Dollar-Cost Averaging. This is due to the unpredictable nature of market dips and the importance of compounding and consistent time in the market. While the idea of buying at the lowest possible prices is appealing, the reality is that timing the market perfectly is nearly impossible.

For most investors, the best approach is to invest regularly and consistently, taking advantage of the market's long-term upward trend. This method reduces the risks associated with trying to time the market and ensures that your investments grow steadily over time. So, if you've been holding out for the perfect dip, consider that even "God" couldn't beat DCA. Investing consistently might just be your best bet for financial success.