Broadcom: Connecting Everything

"In a gold rush, don’t invest in the gold miners, invest in shovels!"

– André Kostolany

99%.

This is the percentage of all internet traffic that passes through at least one of their chips.

The company's products connect people, households, production processes and companies. They enable service providers, data centers and the cloud to quickly move and store huge amounts of data needed for everyday applications such as email, social media, eCommerce, cloud storage, banking, video-on-demand and gaming services.

What is more?

Even Apple loves the company.

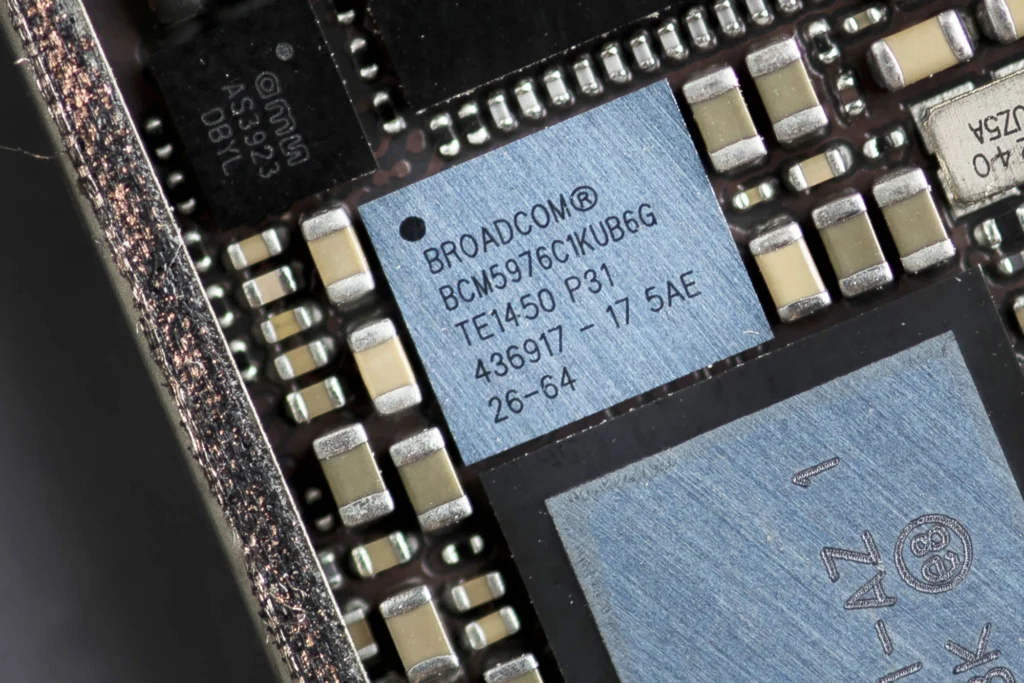

It is the sole provider of chips (chart 1) that enable wireless charging, Wi-Fi, Bluetooth and GPS in the new iPhones. With every new iPhone, the company earns $10.

In short, the company literally connects everything.

Ladies and gentlemen, may I introduce.

Broadcom.

Chart 1: A Broadcom chip in an Apple iPhone

Source: Getty Images, CNBC

Serial Acquirer & Shovel Supplier

Over the years, Broadcom has made several ingenious strategic acquisitions.

Serial acquisitions are a difficult task and require a lot of discipline, knowledge, and well-thought-out execution.

A favorite word in this endeavor is "synergy". It is something that haunts my dreams. In fact, it is the main reason why I do not look for inorganic growth in my investments, especially large acquisitions. Management boasts about a big milestone but loses focus and gets bogged down in paperwork, hidden problems, and clashing cultures.

Exceptions prove the rule, and every now and then a management and a company capable of exemplary capital allocation grows its trees from the crown of the forest.

Thanks to extraordinary investments and strategic acquisitions, Broadcom is now the market leader in virtually all end markets (chart 2). This means that the company is present in enterprise networking, wireless chips for smartphones, broadband access and storage applications.

Or in plain English, it is a shovel supplier and beneficiary of all the trends you read about, such as artificial intelligence, electric vehicles, automation, the cloud and cybersecurity.

As part of the gold rush, this has led to impressive profitability.

Chart 2: Broadcom’s broad product offering

Source: Broadcom

On the way to becoming a dividend aristocrat

Broadcom is an excellent aggregator of large and small companies. Its ability to acquire and rationalize businesses leads to high profits and cash flows and contributes to a solid dividend.

This is reflected in an astonishingly high gross margin of 75% and a net profit margin of 39%. This means that the company produces something for CHF 2.50 and sells it for CHF 10.00, while netting CHF 3.90 in profit. The rest in between are operational costs.

Pretty impressive, isn’t it?

Strangely, Broadcom has never been expensively valued. This is partly due to the underlying cyclicality of the semiconductor business (chips) or the fact that Apple accounts for 20% of revenues.

Being loved by Apple seems to be both a gift and a curse.

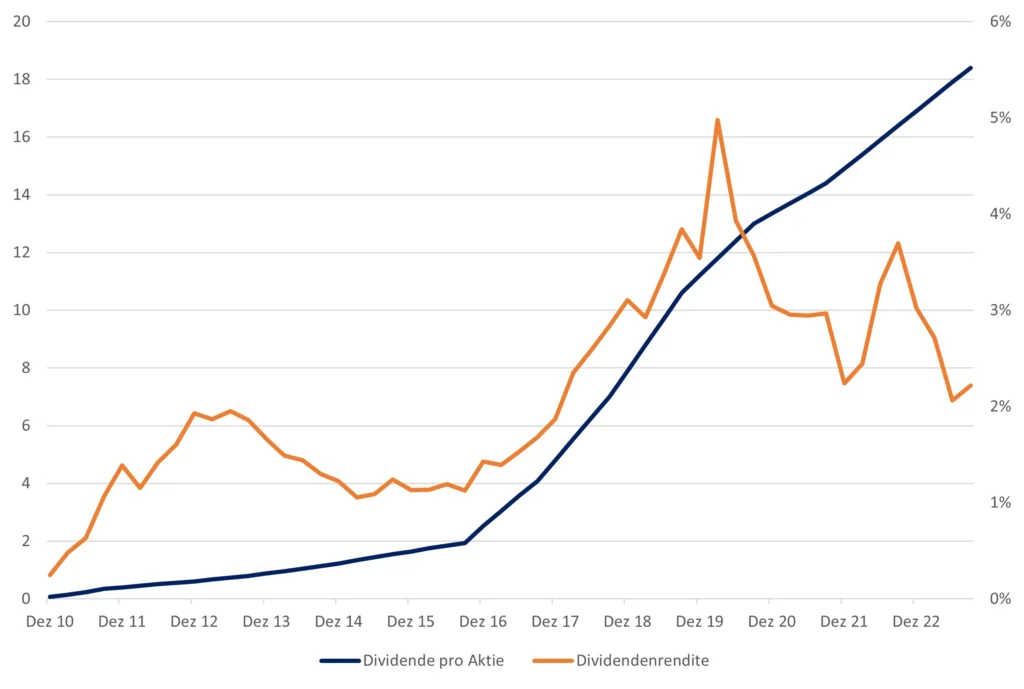

Due to substantial growth over the years, dividends per share have been aggressively increased (chart 3), making the company a dividend aristocrat halfway through - rewarded after 25 years of continuous annual dividend increases. This makes it an attractive dividend paying technology stock. Thanks to the company's high liquidity, there was enough left to make further strategic investments.

The Broadcom tree grew faster, broader and stronger than all the others.

Chart 3: Broadcom’s dividend history and dividend yield, in $

Source: Koyfin, arvy

High trees catch a lot of wind

There is a Dutch saying: "Hoge bomen vangen veel wind". Literally: "High trees catch a lot of wind." This means that successful companies or people in a high position must take a lot of criticism.

This is also the case with Broadcom, which has grown a lot in the past and tends to make large strategic acquisitions to keep up with the pace. The most recent is VMware to strengthen its software business segment.

An acquisition for $69 billion. Or 1/5 of the size of Broadcom.

Although the amount is much higher than usual, it is a prime example of Broadcom's ability to acquire strong companies, increase their profitability and create a whole that is more valuable than the sum of its parts. This will be a big acid test for them, but we have every reason to believe that they will succeed.

Why?

Because they have mastered the art of serial acquisitions.

Chart 4: Broadcom over five years

Source: TradingView

arvy's takeaway: Broadcom, the linchpin of connectivity, handles 99% of internet traffic through its chips. The company, which is making a series of strategic acquisitions, covers markets from smartphones to cybersecurity. Despite its cyclical chip dynamics and dependence on Apple, Broadcom is thriving. Approaching dividend aristocracy, the company's tree of success has weathered storms and stands tall. But as tall trees get a lot of wind, Broadcom's recent $69 billion acquisition of VMware is putting its historic knack for creating value through strategic integration to the test.