A gift, Now a Curse

"The biggest risk is not taking any risk"

– Mark Zuckerberg

Christmas.

It is a seemingly quiet time when we visit our loved ones and reflect on the past year and the bigger picture.

At this point, I would like to ask you a favor.

After 25 weeks and over 3,337 new readers, we want to thank you for being part of our journey. If you find our content valuable, we would be grateful if you would share it with a friend who you think might like it too. And wants to be part of the “voyage” as in arvy.

We have set the course for 2024.

arvy’s mission: we want to solve the problem of barriers to investing, make it simple and accessible. And create the most modern investment experience we wish we had enjoyed years ago – all while giving you updates along the way and, most importantly, with a decent return.

Think of arvy's weekly as a little gift, every Friday, in five minutes.

Speaking of reflecting on the big picture and gifts.

One of the latter is now becoming a curse.

Chart 1: The «Magnificent 7» vs. everyone else, year-to-date 2023

Source: TradingView

What Keeps Me Awake at Night

We wrote about today's topic in depth in NZZ The Market in mid-December. It can be found here and was entitled: “What Keeps Me Awake at Night”.

What did we refer to?

The performance of equities this year shows that the mega-cap stocks (Chart 1, Magnificent 7 compromising of Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia and Tesla) can hold up the entire index.

But what is the problem with it?

It can be summarized as the following. We now face:

I worry about these points - they keep me awake at night. They should be taken as a warning.

The result is a lost decade for passive investors.

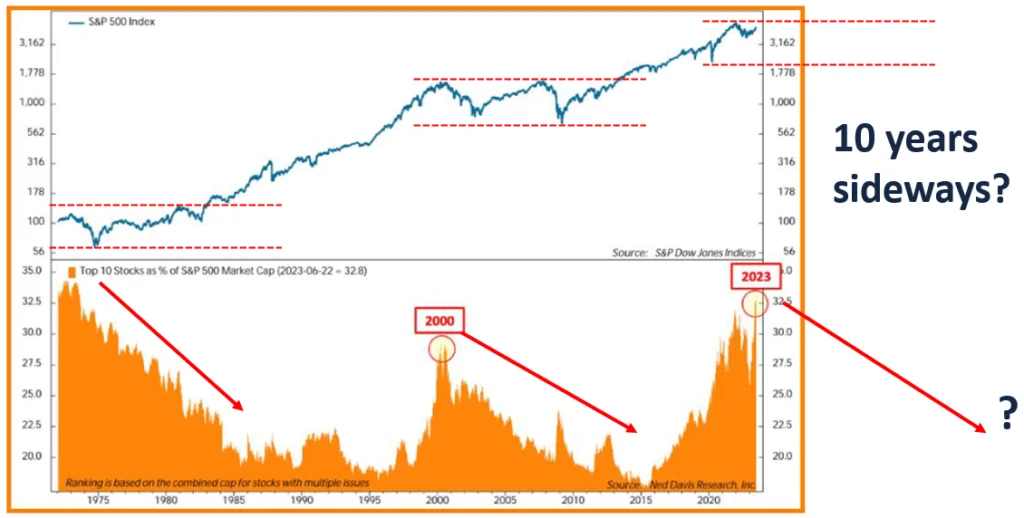

Chart 2: Top 10 market concentration and the S&P 500

Source: NDR, arvy

A 15-Year-Old Idea

Historically, peaks in market concentration have coincided with peaks in stock prices (again, chart 2). Does this mean ten years of sideways movement in the index?

Who am I to judge.

Historically, however, the idea that «stocks always go up» will come under pressure in the longer term. This is a different investment environment to that which has prevailed over the last 15 years, and it will require investors to adjust their thinking.

Yet, most investors have only recently adapted to this «15-year-old idea» by moving to passive investing and indexing.

Not realizing the risks involved.

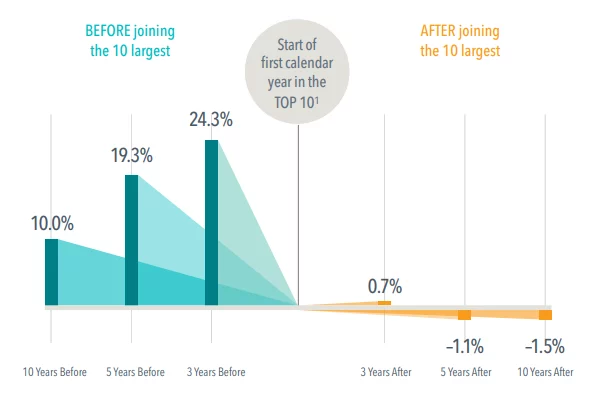

Now, passive investors will be making a bet with a very unattractive risk/reward ratio in the coming years. History has shown that the outperformance of market leaders usually occurs before they reach the top of the market. Once there, subsequent returns tend to lag the market (chart 3).

But now you automatically buy 1/3 of your portfolio consisting of these stocks because of the concentration.

Is this really that attractive?

Chart 3: Annualized returns in excess of the US market before and after joining the top 10 largest US stocks, January 1927 – 2022

Source: Dimensional Fund Advisors

The paradox

“This time it is different”.

This is the typical response when we put forward our thesis.

Unfortunately, this is not the case. It is usually not different. Below are the world's ten largest stocks by market capitalization at the start of each decade (chart 4). The market always tells a story or follows a narrative.

What stands out? Only one in ten stocks remain in the top 10 in the next secular trend.

Anything else?

Significant changes. Japan – once a top performer with a weight of 40% of the MSCI World at the start of 1990; now almost not worth mentioning at 6%.

Ultimately, this means that the large weightings in the indices (or the ETFs that track the index) need to be reduced. They either gain less than the broad market on the upside or lose more than the broad market on the downside.

Both end worse for today’s indexed investor.

The paradox, however, is that currently most market participants - consulted by advisors - mainly buy the core concentration, whether they are aware of valuations and correlations to bonds or not, because they are afraid of doing something different from the masses.

This is ironic, because the only way to succeed in investing is to break out from the crowd.

Therefore, it makes sense to diversify passive engagement with active engagement.

Today, the biggest risk is not taking any risk.

Chart 4: Top 10 stocks by market cap seldom make it to the end of the next decade

Source: Gavekal, arvy

arvy's takeaway: Investors face the daunting task of channeling new funds into an increasingly concentrated market. I believe the time has come when, for the first time in years, the largest stocks have at least as much downside risk as upside risk. At arvy, we advocate for proactive responses from investors to counter the elevated risks posed by both concentrated and correlated portfolios, respectively.