Ares: Alternative in Financials

"A warrior is not defined by the battles he wins, but by the battles he chooses to fight"

– Ares, Greek god

"Sticky".

That is an adequate word to describe this industry.

I would add "largely institutional", "yearlong locked up assets assets under management" and both high "management fees" and "performance fees", respectively.

This is the alternative investment management or private capital industry. A segment that has grown strongly in recent decades, including a Swiss gem called Partners Group, which is part of the game. This is not a financial sub-sector fought over by UBS, JP Morgan, Morgan Stanley and the like, but specialized players focusing on private equity, credit, real estate and infrastructure businesses.

In short, they invest in and manage so-called illiquid assets.

Within the sector, there is a sector standout.

Ares Management.

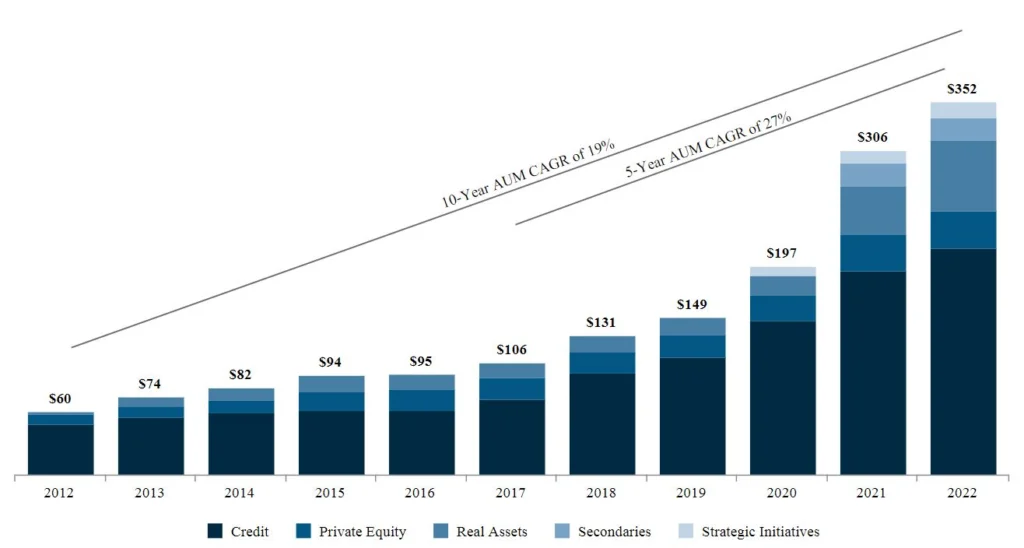

Chart 1: Ares Management, Assets under Management (AuM) growth, in bn $

Source: Ares Management

TINA

Ares has become a global powerhouse in alternative asset management (Chart 1). The key drivers of growth and the appetite for private investments were the low interest rate environment and high equity market valuations.

This strong tailwind was given the infamous name TINA - There Is No Alternative.

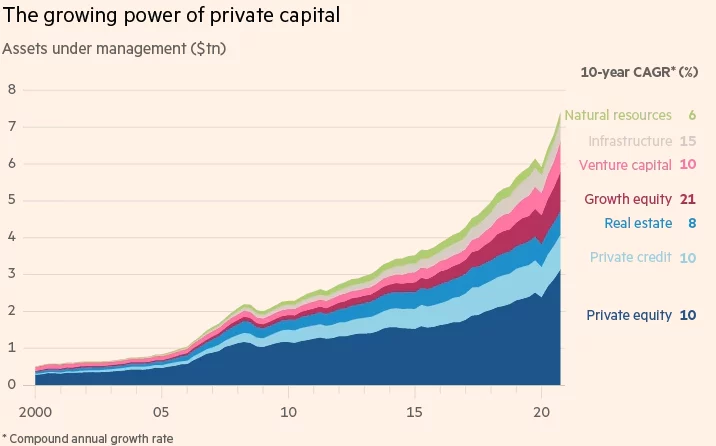

Now, private capital and in particular private equity, which has seen tremendous growth (Chart 2), is quite accessible and in my opinion is currently past its prime. For the time being.

But not Ares, which stands out from the industry, as last week's quarterly results show.

For two reasons.

Chart 2: The Growing Power of Private Capital

Source: Financial Times

Credit Specialist and Inflation Hedge

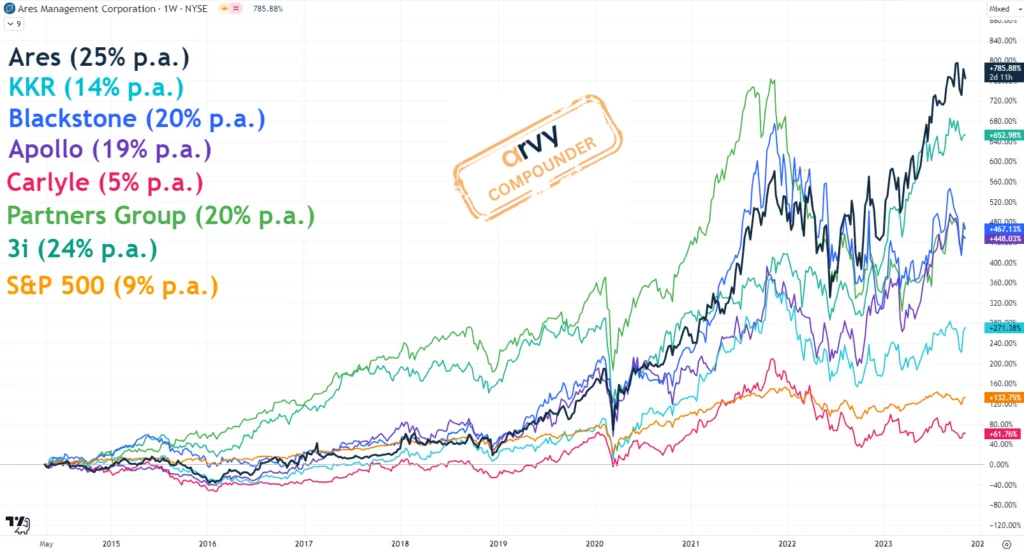

Ares is defined by the fact that it is defensively positioned in terms of its income streams and target markets (Chart 3) compared to other well-known players in the private capital market.

The asset manager chooses to fight two battles:

This is a business from which banks mostly have withdrawn due to stricter regulatory requirements and a lower risk appetite. In this segment, however, it is precisely rising interest rates that are not a problem. The investments are structured as a floating base rate (e.g. LIBOR + x% risk premium). Hence, higher interest rates result in higher returns for both Ares and the end-investor.

A hedge against inflation.

That is a very attractive combination of the two as it increases visibility and stability. Remember, the market loves certainty and hates uncertainty and is willing to pay a premium for it.

Always.

Chart 3: Private Capital Companies and Their Business Split

Source: arvy, Koyfin, Company Reports

A Major Risk Remains

A major risk remains a collapse of the global economy and thus credit events, i.e. defaults or significant stress in the system.

As mentioned in the previous section, to challenge myself, higher interest rates are of course not that simple to digest for the company taking the loan – the borrower. This would affect Ares disproportionately, which would be reflected in stronger setbacks in times of recession fears such as in 2022 (chart 4). It is therefore important for them to use their deep expertise and extensive relationships to select only solid borrowers.

If problems nevertheless arise, two further technical terms come into play, which are painful in the short term but beneficial in the long term.

"Distressed debt" and "dry powder".

But that is a topic for another day.

Chart 4: Ares since IPO and selected peers

Source: TradingView

arvy's takeaway: Ares Management shines in the alternative investment sector due to its credit-focused approach and stable fee structure, offering resilience in uncertain markets. The world of private capital beckons with high returns, and Ares, with its expertise, is well-poised. However, global economic turmoil remains a risk, unleashing possibilities like distressed debt and untapped resources. In these volatile times, Ares' strategic positioning sets it apart as a stronghold in the private capital landscape.