Mercadolibre: Amazon of Latin America

„Be a shameless copycat”

– Monish Pabrai, The Warren Buffett of India

arvy's teaser: MercadoLibre, the Amazon of Latin America, blends the best of e-commerce, payments, and logistics into a one-stop solution for 500 million people. With relentless growth and strong fundamentals, this story is just beginning. But expect volatility along the way.

Latin America.

It is not just a nice place to spend your well-deserved vacation.

Here you will find many great businesses that you could consider owning. With 500 million inhabitants, they tend to have a huge total addressable market and therefore great opportunities for growth. With most countries there lagging developed markets like Europe or the US, there is a lot of catch-up potential that can be exploited. Of course, great potential is equally met with great risk - much higher geo and political risks and uncertainty that come with it. This is reflected above all in the higher volatility of share prices in these markets.

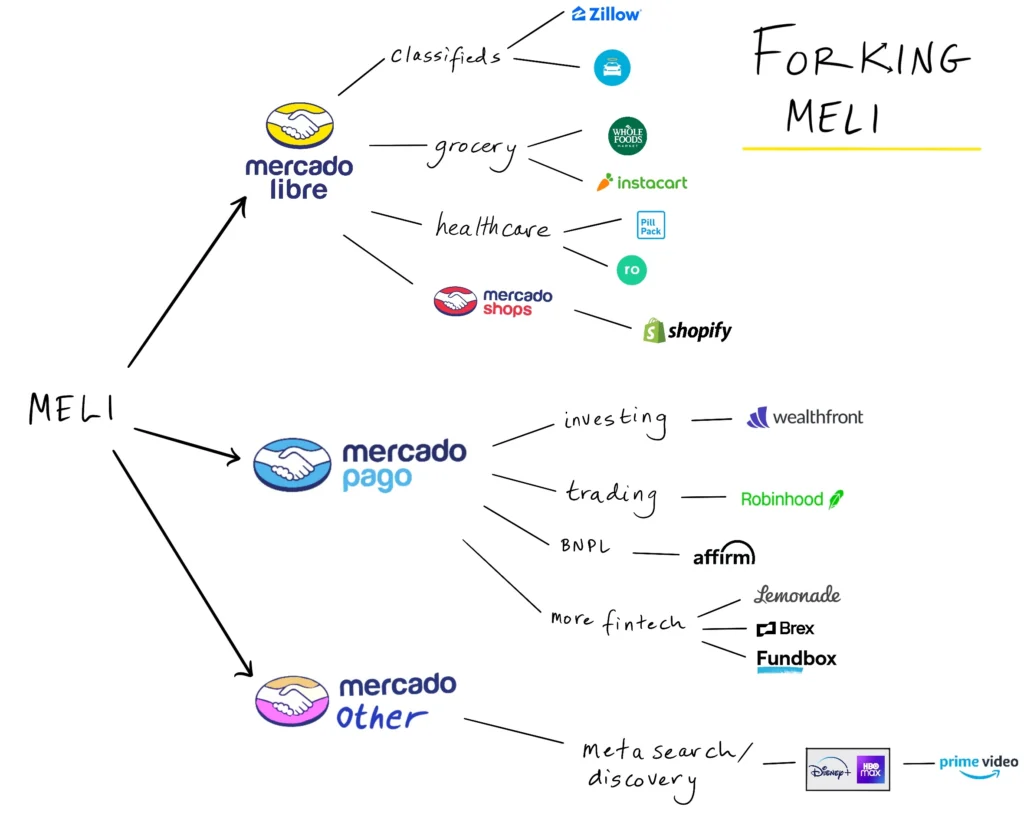

In terms of catch-up potential, there is one company that shamelessly copies what works in the Western world and implements it with a Latino twist (chart 1).

It has positioned itself as a one-stop shop solution for Latin American commerce.

For this reason, it is nicknamed the “Amazon of Latin America”.

May I introduce.

MercadoLibre.

Chart 1: MercadoLibre’s business models and a corresponding peer group

Source: Generalist

Multi-Bagger Characteristics

MercadoLibre fulfills many of the criteria for a company that can achieve 100-bagger status – i.e. a company that increases 100x in value. In fact, the company has already been a 93-bagger since its IPO in August 2007.

This means that an investment of USD 10,000 on the day of the IPO would be worth USD 930,000 today.

Yeah, nice investment, buddy, couldn't you have told me that years earlier?

Hindsight is always twenty-twenty.

But let's look at the company. What are the typical characteristics of businesses like MercadoLibre and multi-baggers?

What sounds very interesting, however, meets the other half of the coin - volatility. To achieve such multi-bagger returns, one had to endure: several 50%+ declines, COVID, short-seller reports, bad earnings reports and public relations fiascos.

This is the main problem that we at arvy also face when we analyze such high-growth stocks. Enduring the volatility and not losing faith in the business and the investment case.

To continue to underpin the “Good Story” with the volatile “Good Chart”.

Easier said than done.

Chart 2: MercadoLibre has grown its revenue by 36x over the last 10 years

Source: Quartr

One-Stop Shop Solution

Let's take a closer look at the Amazon of Latin America.

And find out why, when in doubt, I favor the business case - the “Good Story” - over the volatility of the share price - the “Good Chart”.

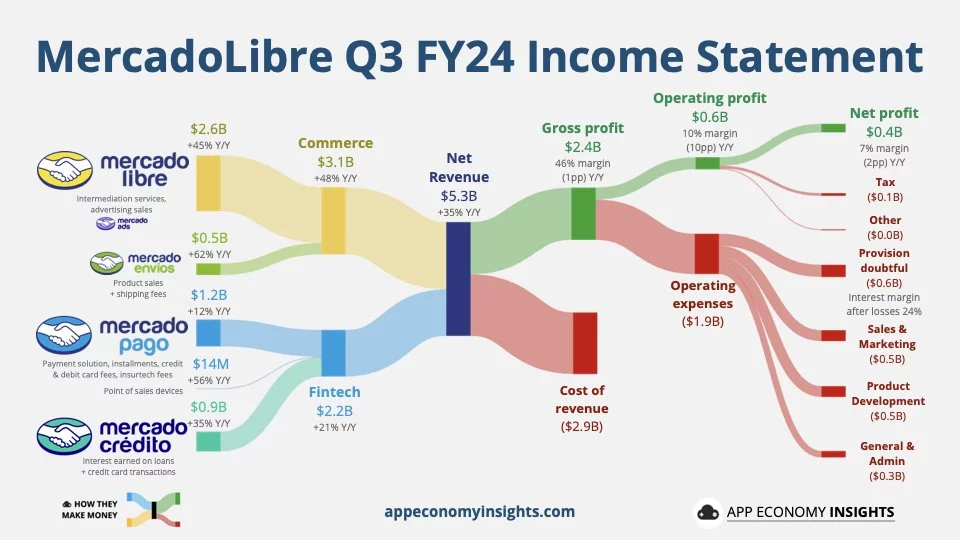

MercadoLibre has developed a comprehensive ecosystem of mutually reinforcing services (Chart 3), with a core marketplace (MercadoLibre) supported by a payments and credit division (Mercado Pago and Mercado Credito), a world-class shipping solution (Mercado Envios) and an increasingly robust advertising platform (Mercado Ads).

The clou?

With virtually all the gross merchandise volume on the company's platform being processed through proprietary payment systems and shipped via Envios, the marketplace operator has effectively tackled two of the biggest problems in e-commerce.

Payment processing and logistics & shipping.

It makes it easier for both buyers and sellers to engage on the platform and improve the overall e-commerce experience in Latin America. The result?

A one-stop shop solution for Latinos.

Chart 3: MercadoLibre Q3 FY 2024 Income Statement

Source: App Economy Insights

Stock Price Follows Fundamentals

As avid readers of arvy know, we think boring as good. But MercadoLibre does not exactly qualify as “boring”.

But the exception proves the rule, and at MercadoLibre we see several business areas that are too good to be ignored. This is reflected in annual sales growth of 43% over the last 10 years and several business areas where they are acting as shameless copycats of what is already working - only this time are they building it as a regional top dog in Latin America, operating in 18 countries.

In our opinion, you can keep it simple. You do not always have to reinvent the wheel, you just need a company that implements what works and that can grow faster because it is smaller. This is how we found Casey's, for example - a mixture of very successful business models over decades: one of the largest gas stations Alimentation Couche-Tard and the pizza chain Domino's Pizza.

In the case of MercadoLibre?

This can be seen everywhere: Pago, which copies PayPal/Square, Credito, which copies Klarna/Affirm, Envios, which copies Amazon Logistics/FedEx, Ads, which copies Amazon/Facebook Ads, Meli+, which copies Amazon Prime, Marketplace, which copies Ebay, Shops, which copies Shopify and Financial Services, which copies the trading platform Robinhood.

While the company is firing on all cylinders in terms of revenue, the top line, the bottom line is also improving dramatically. Whereas the focus is on the significant growth opportunities, MercadoLibre is becoming much more operationally efficient, which is reflected in its most favorable free cash flow valuation, a yield of 5.4%, in ten years. This is despite the stock trading near its all-time highs.

And yet MercadoLibre's market capitalization of $100 billion is still small compared to Amazon's $2,000 billion.

Remember chart 2 and how steadily sales have grown over the last ten years. Compare this with chart 4, the share price over the same period.

This illustrates a key concept for long-term investing.

The share price follows fundamentals.

Chart 4: MercadoLibre over the last ten years

Source: TradingView