Big Spirits Stocks: Diageo, Campari & Co – Quo Vadis?

“Gefressen und gesoffen wird immer.”

– Proverb and stock market wisdom alike

arvy's teaser: Spirits were once the ultimate compounding machines — high margins, timeless brands, steady dividends. But consumer habits have shifted. The 200-day trend is broken, nostalgia is worthless, and the new cocktail tastes nothing like the old.

Pilates.

Iced Matcha.

No hangover and no lost brain cells.

That’s the newly sought-after narrative of today’s youth. And honestly — I kind of find myself in this consumer behavior too. Sure, I hit the gym rather than a hot Pilates class, but the point stands: lifestyle has shifted.

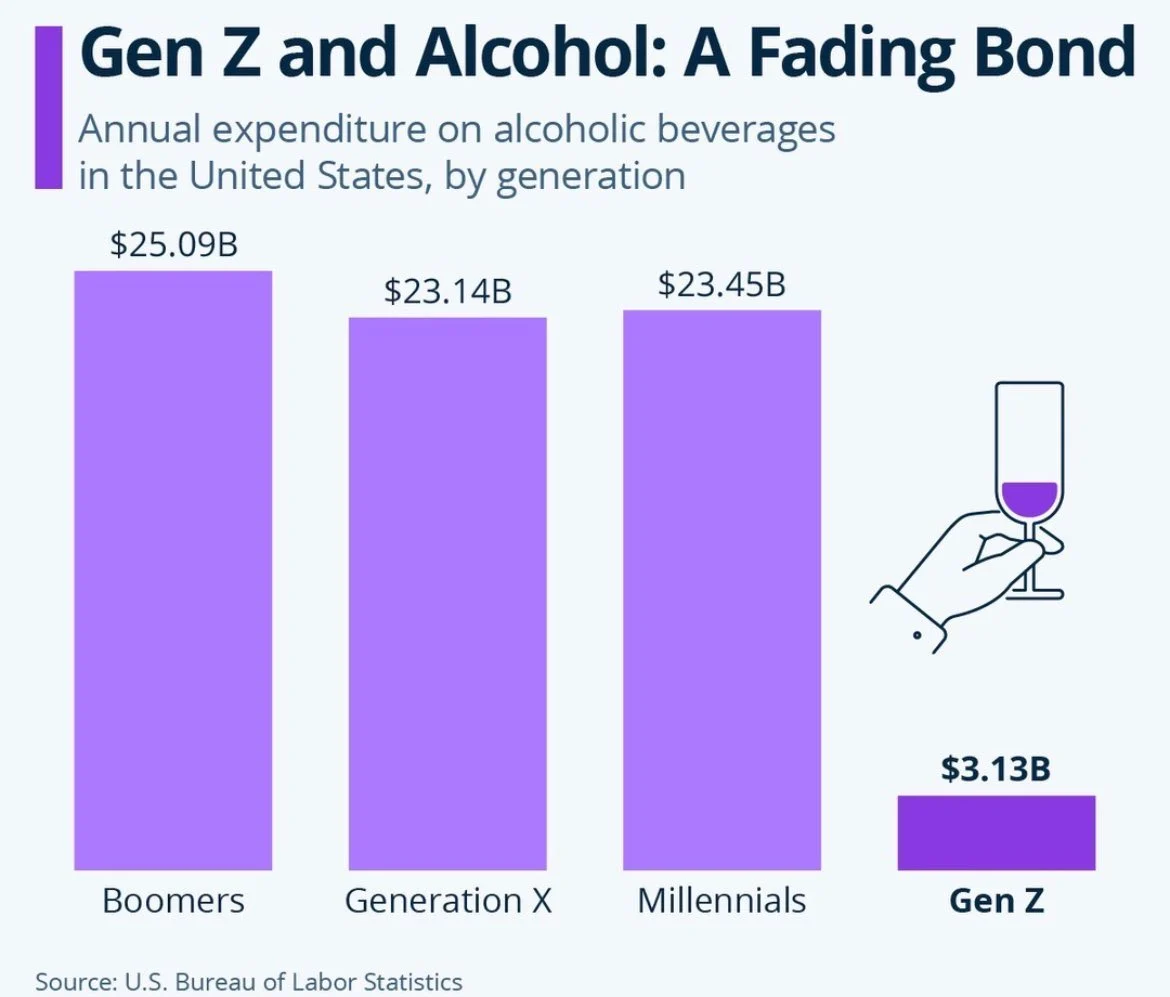

The focus is now on healthy eating, wellbeing, and staying in some sort of self-curated Zen state. And that shift is leaving scars on businesses that once thrived on the old ways. Take Zürich, for example. Many bars and restaurants report up to 40% lost revenues as people swap outlawish dinners and a good bottle of wine (chart 1) for poke bowls, acai bowls, chia seeds, goji berries, spirulina — and of course, the obligatory Brazil nut to reduce “bad cholesterol.”

Walk the streets on a Sunday morning and you’ll see the difference. Instead of hungover faces hiding under blankets in dark rooms, Zürich is full of run clubs, groups in yoga pants (Lululemon rings a bell?), and sportish outfits crowding cafés — happily sipping their healthy drinks.

What you see on those streets is more than anecdote — it’s a real consumer shift. And yes, it’s showing up in the stock market too.

Or rather, in the businesses that sell liquor, spirits, and fine wines. Once evergreen darlings — built on the idea that “gefressen und gesoffen wird immer” — are now stuck in relentless downtrends. The supposedly unshakable thesis is suddenly being tested.

So, we must ask the usual suspects Diageo, Campari Group & Co.

Quo vadis?

Chart 1: Gen Z and Alcohol: a fading bond

Source: US Bureau of Labor Statistics

Big Spirits

Let’s first look at the key players.

You’ll quickly realize that many of the iconic brands — the ones Boomers actually use 😉 and the ones Gen Z might have just spotted shining through the shelves of a Coop — all belong to a handful of global giants.

And while there are plenty of companies worldwide, the biggest by far are Asian. Think Kweichow Moutai in China (market cap $250bn, famous for Moutai, a type of baijiu) or Asahi Group in Japan ($20bn, known for its beer Asahi).

But for the sake of familiarity, let’s zoom in on Western names.

- European Companies

o Diageo Plc ($61bn) - Global leader focused on premium spirits. Top brands: Johnnie Walker, Smirnoff, Tanqueray (chart 2).

o Pernod Ricard SA ($29bn) - French company specializing in a diverse spirits portfolio. Top brands: Absolut Vodka, Jameson, Chivas Regal.

o Davide Campari-Milano N.V. ($9bn) - Italian company known for its spirits and aperitifs. Top brands: Campari, Aperol, Skyy Vodka.

o Rémy Cointreau SA ($3bn) - French company focused on high-end, luxury spirits. Top brands: Rémy Martin, Louis XIII Cognac.

- U.S. Companies

o Constellation Brands, Inc. ($30bn) - Diversified U.S. beverage company with beer, wine, and spirits. Top brands: Corona, Modelo, Robert Mondavi.

o Brown-Forman Corporation ($14bn) - Spirits company, primarily known for whiskey. Top brands: Jack Daniel's, Woodford Reserve.

And of course, there’s LVMH — yes, the Louis Vuitton Moët Hennessy empire. It brings the sparkle: Moët & Chandon, Dom Pérignon, Veuve Clicquot, Belvedere, and Hennessy, the world’s largest cognac house. But for clarity, we’ll focus here on the pure plays.

And to round out the full picture, you’d have to mention the beer titans: Anheuser-Busch InBev, Heineken, China Resources Beer, Carlsberg, Molson Coors, Asahi, or Boston Beer Company.

As you can see, just like in Big Tobacco or Big Food, there is a highly concentrated, oligopolistic “Big Spirits” universe.

So now that we know who’s who and where their strengths lie, it’s time to dig into the fundamentals — the “Good Story.”

Spoiler: Gen Z, what have you done to all those Boomers sitting happily on spirits stocks?

Chart 2: Diageo’s premium brands and net sales by category

Source: Quartr

The Good Old Days vs. Today

Now that we know the players, let’s check the scoreboard.

Spirits stocks used to be darlings. Think of them as the old “set-and-forget” compounding machines:

But then… Gen Z entered the scene.

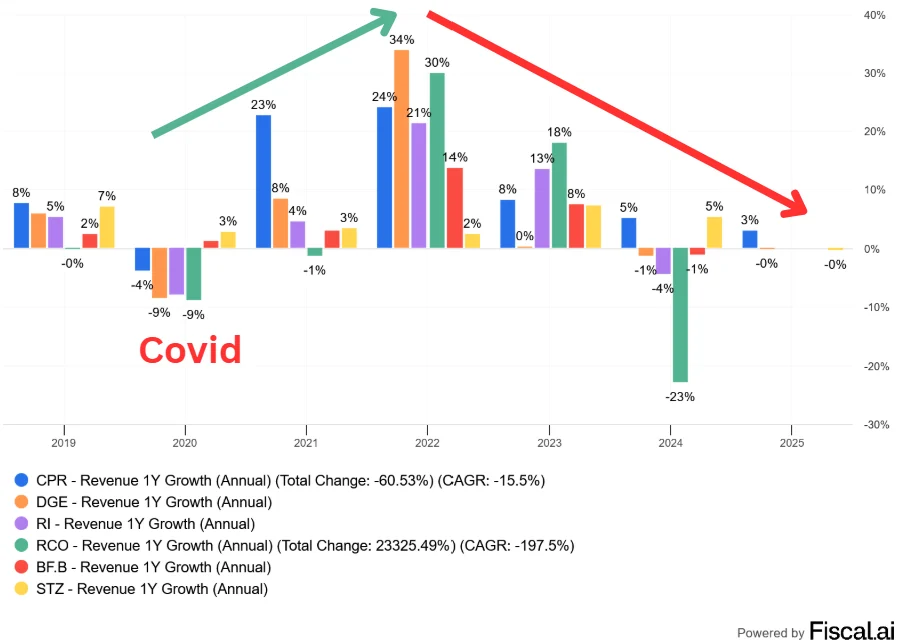

Growth that once ran comfortably in the high single digits has cooled (chart 3). Even Diageo, the industry heavyweight, flagged slowing sales. Aperol and Campari may still ride the “Instagram cocktail” wave, but whiskey, cognac, and vodka are wobbling.

Premiumization — charging more for fancy labels — used to be the golden ticket. Now, with inflation biting and younger consumers swapping to mocktails, kombucha, or matcha lattes in yoga pants, those brands aren’t bulletproof anymore.

Margins have slipped, and investors notice.

The era of cheap money is also gone. Big Spirits financed buybacks and M&A with low rates, but today’s higher debt costs make 25–30x earnings look a lot less “defensive.”

And then there’s China.

Once the turbocharger for Cognac demand at Rémy Cointreau and Hennessy, it’s now slowed under gifting restrictions and shifting lifestyles. That leaves a saturated Western market where consumption leans more toward Pilates and matcha than whiskey and cigars.

So, while these companies still print cash and pay dividends, the “easy compounding” phase looks over.

The cocktail has changed.

And it will likely last.

Why?

Because of what Will and Ann Durant in their masterpiece “The Lessons of History”, and once our Christmas book gift, have noticed in their research of 5’000 years of history.

What was their finding?

That humanity experiences seismic shifts in consumer behavior that tend to last due to three instances.

And guess what…

3. Pandemics

Covid might not be the only reason, but it clearly nudged the dominoes — accelerating healthy lifestyle and wellbeing trends.

And what does Mr. Market say?

The fundamentals reflect this reality. Spirits stocks are not broken businesses — but they are no longer bulletproof compounding machines either.

And that explains why the “Good Story” of Diageo, Pernod, or Rémy today looks more like a sad karaoke version of their former selves.

It’s time to check the “Good Chart.”

Does it show any hope?

Chart 3: Big Spirits 1 year revenue growth with Covid Boom & Bust

Source: Fiscal.AI

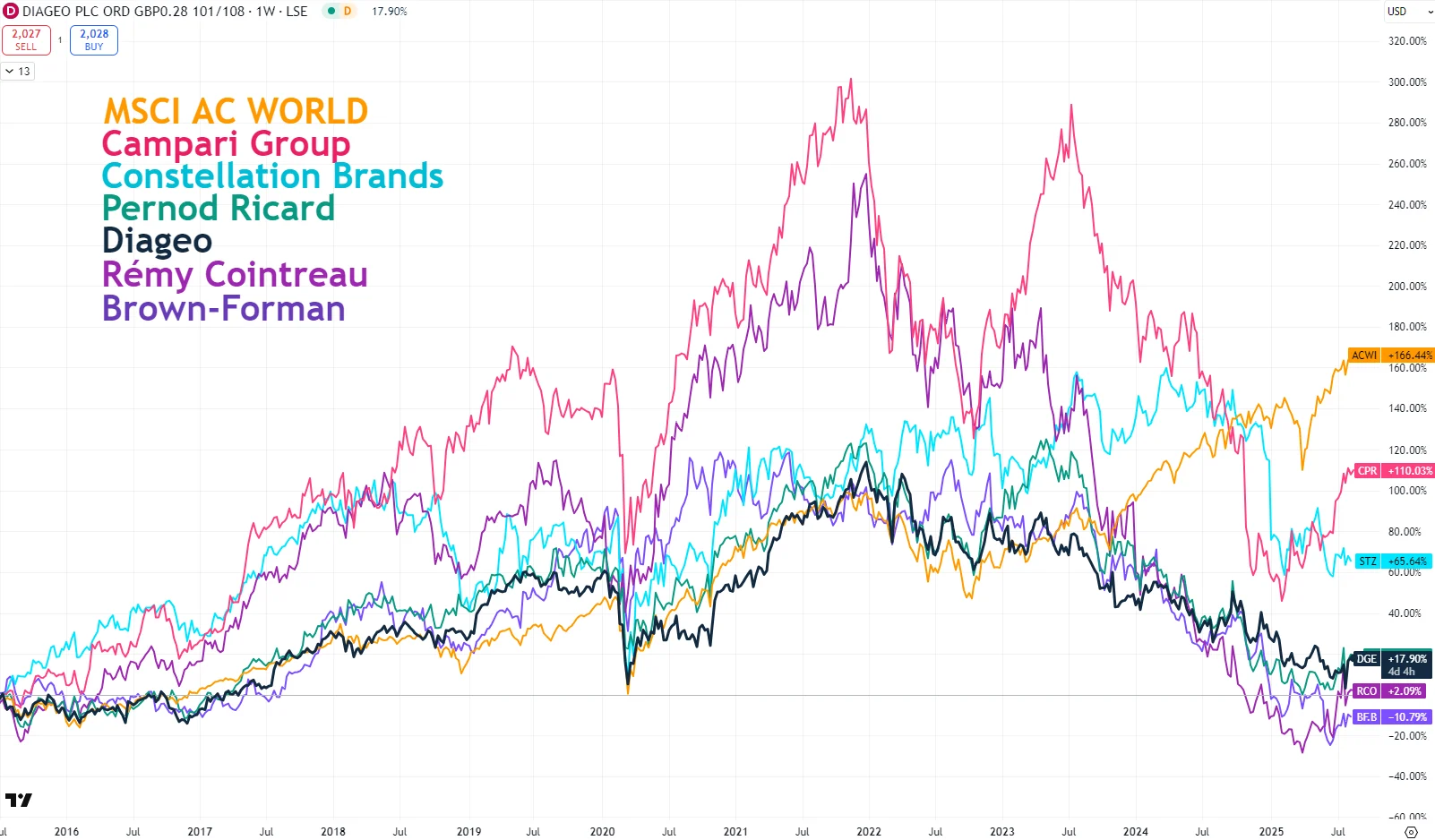

Focus on One Rule: Never Buy a Falling 200-Day Moving Average

Let’s recall the stock market mechanism. Stocks discount the next 6–18 months and therefore price in a good chunk of the future.

So — does the future show any hope yet?

Well… not really.

Yes, valuations are starting to look attractive and even sit below historic norms. But we must stick to one of the most important buy & sell rules at arvy — a rule that has saved us from a lot of trouble.

Never buy or increase a position that has a falling 200-day moving average.

Once we experience a trend reversal, there will be enough time to build into the position. And then the risk/reward will be much more attractive. Until then, anything else is just bottom fishing — a hopeful bet on a turnaround that might never come.

And the cost of being wrong? Sitting on dead capital and massive opportunity costs.

And the 200-day of our Big Spirits? It’s not just falling.

It’s basically cliff-diving.

It looks so bad my heart hurts watching those old darlings. For now, we must acknowledge a simple truth: markets don’t pay for nostalgia. They pay for growth.

And the “Good Chart” is telling us loud and clear.

The trend is down, and growth is gone.

At least for now…

Chart 4: Big Spirits over the last ten years, in $

Source: TradingView