Energy Stocks: Black Gold

"The longer the base, the higher in space"

– Wall Street adage

arvy's teaser: The resurgence of the oil price has yet to capture the market's attention. It may steal the spotlight from tech stocks. But what is the reason for this sudden surge? Both the micro and macro factors align, and energy companies are poised for growth: the "Good Story" meets the "Good Chart" in the oil industry comeback.

Oil.

Or black gold.

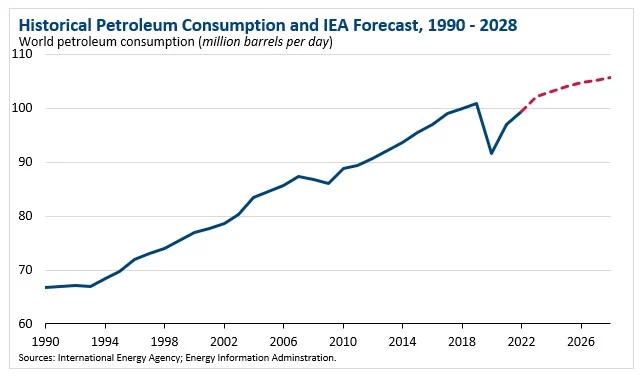

The end of it is likely to occur, but not anytime soon (chart 1).

This is how we began our "Big Oil is Back in Business" arvy's Weekly in October last year on ExxonMobil. The "Good Story" was emerging, accompanied by a long consolidation in the "Good Chart". While many investors have understandably focused on technology stocks in recent weeks, it has been energy stocks (and materials) that have caused a stir.

As the sector has always had our curiosity, it now has our attention. There is an intriguing combination of rare events that have occurred simultaneously in recent years and have intensified in recent quarters.

The energy sector is supported by both macro and micro-economic factors. Like a ninja, this underrepresented sector has moved quickly and silently upwards in recent weeks.

This development is important for all of us.

Why?

Chart 1: Historical Petroleum Consumption and IEA Forecast, 1990 – 2028, mn barrels per day

Source: International Energy Agency (IEA)

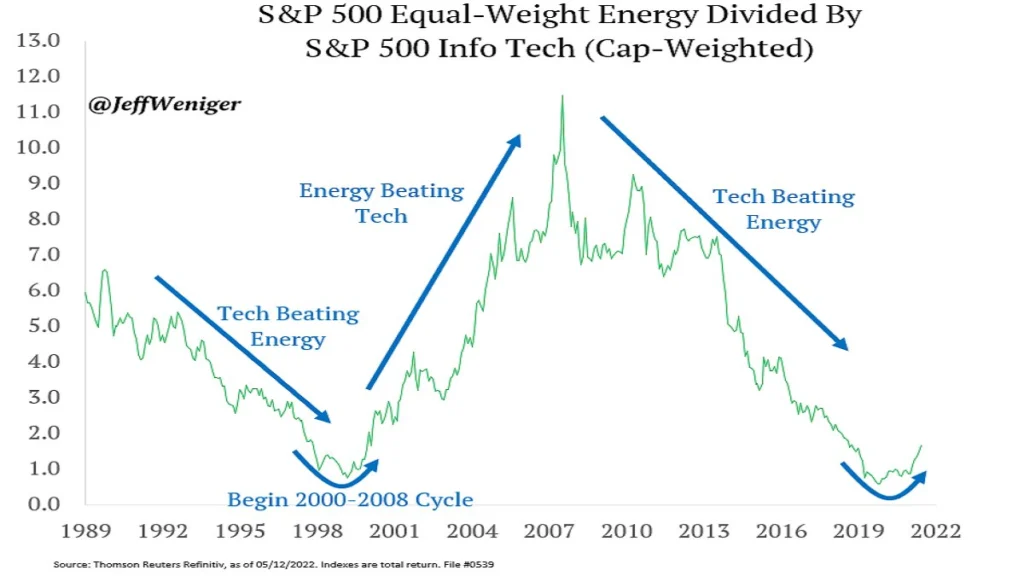

Energy vs Technology

In short: It is because energy and technology stocks cannot move in lockstep. They are inversely correlated. Every time the former does well, the latter suffers. And vice versa.

Why?

Because their drivers are also opposites.

Technology stocks, mostly growth companies, are strongly driven by growth expectations and are therefore heavily dependent on interest rates, as these play a major role in equity valuation models. This means that the valuation is largely determined by the terminal value, which receives a tailwind from lower interest rates. This is also one of the reasons why the share prices of these companies can rise and fall in mind-boggling proportions (stock price maturity cycle). They usually correct due to disappointing growth prospects or excessively high valuations.

Energy stocks are the exact opposite.

Their underlying business is much more cyclical and short term, and a commodity (oil) is an important part of the equation. Oil is also an inflationary force, as higher oil prices lead to higher expenses for the average consumer (e.g. heating costs or fuel for the car). This leads to higher prices in the baskets of goods that are used to measure inflation. All of which in turn leads to central banks raising interest rates to combat and reduce rising inflation. Energy stocks usually correct sharply due to recessions or exogenous shocks. They are usually cheaply valued.

The result of all this is an inverse correlation (chart 2).

The past weeks, energy started to move higher.

Let's recap the investment case.

Chart 2: Energy and Technology cannot move in lockstep, relative chart

Source: Thomson Reuters Refinitiv, Jeff Weniger

Micro-Boot Camp Meets Macro-time to Shine

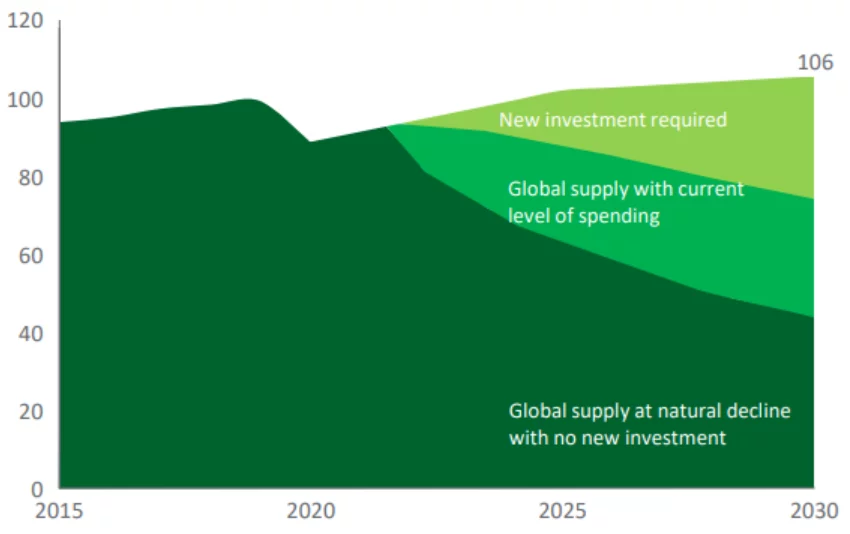

Two factors speak in favor of the energy companies.

In Covid, only the fittest energy companies have survived because they have been hit tremendously hard. Remember negative oil prices? This has made energy stocks that are still alive much more attractive in every respect. Now they are exceptionally profitable companies with historically favorable free cash flow valuations.

Micro:

Macro:

If we add 1 + 1 together, we have fundamentally strong energy companies that are much more investor friendly and are still meeting solidly growing demand, but that demand will meet inadequate supply in the future.

The result?

Oil prices should continue to remain elevated while energy companies reap the rewards of their hard work over the coming years. The "Good Story" is set in stone.

What about the "Good Chart"?

Chart 3: Global Oil Supply Outlook to 2030

Source: Saudi Aramco

The Longer the Base, the Higher the Space

The energy sector is at a potentially powerful turning point, having just reached a new multi-year high - new highs are outright bullish.

What is even more bullish?

New multi-year highs after very long consolidations. Let's remember the good old stock market adage: the longer the base, the higher the space.

We do not bother in forecasting and are not intending to do so with oil. Yet, despite unpredictable macro factors, we cannot ignore the fact that a strong fundamental "Good Story" is now meeting a powerful breakout that is reflected in a "Good Chart."

Black Gold is back in business!

Chart 4: Energy sector over 20 years, price graph

Source: TradingView