Ulta Beauty: Cannibal Conquers the Beauty Market

„Pay close attention to the cannibals – the businesses that are eating themselves by buying back their stock”

– Charlie Munger

arvy's teaser: Ulta Beauty, the powerhouse behind a quarter of American women's beauty routines, leverages a massive loyalty program and savvy stock buybacks to dominate the market.

The beauty market.

This is one of my favorite sectors to invest in.

It has a huge total addressable market because almost everyone in the world can be your customer. It satisfies a need that exists every day, and it involves consumer goods that need to be replenished on a regular basis. People love to try new offerings, and demand is very inelastic – meaning consumers tend to buy your products regardless of economic conditions (chart 1).

The $360 billion market is growing at 5% annually and is divided into the mass and high-margin premium segments.

This is where the largest US retailer of beauty products comes in.

Ulta Beauty.

Chart 1: Beauty market growth since 1999

Source: L’Oréal

Loyalty Program

Ulta Beauty is a leading beauty products retailer in the US with a market share of 40%, known for its wide range of beauty products and services. It operates both brick-and-mortar stores and an e-commerce platform, offering cosmetics, skin and hair care products, salon services with stylists, and fragrances from both high-end and drugstore brands.

Ulta Beauty's main competitor, which you have probably heard of, is Sephora with a market share of 28% in the US, owned by LVMH.

Sephora focuses on higher-end beauty products and has a global presence (2,700 stores in 35 countries) and typically offers 13,300 products from 200 selected brands in one store. On the other hand, Ulta offers 25,000 products from more than 600 beauty brands in 1,300 stores in the US only.

The biggest advantage of Ulta Beauty?

The customer loyalty program "Ultamate" with more than 43 million active members. Since most of them are women, this means that 25% or literally one in four women in the US is a member of Ulta Beauty. This success has made Ulta a sought-after partner for prestige, mass and emerging beauty brands.

One example?

Kylie Jenner, the youngest of the Kardashian clan, launched her own brand Kylie Cosmetics exclusively at Ulta Beauty in 2018 (Chart 2). As she enjoys one of the largest social media followings in the world, especially among young people, this gave Ulta Beauty a significant boost - to the business and the stock, which subsequently rose by more than 30 %.

And the management knows exactly what to do with all the profits flowing in.

It is eating itself.

Chart 2: Kylie Cosmetics came to Ulta Beauty before the Christmas season in 2018

Source: Kylie Jenner, Ulta Beauty

The Cannibal

Scorpions are not the only ones known for cannibalism.

It is also a notorious act in the stock market world. It is a word popularized by Charlie Munger, Warren Buffett’s best friend and the architect of Berkshire Hathaway, decades ago. In short, it involves companies buying back their own stock.

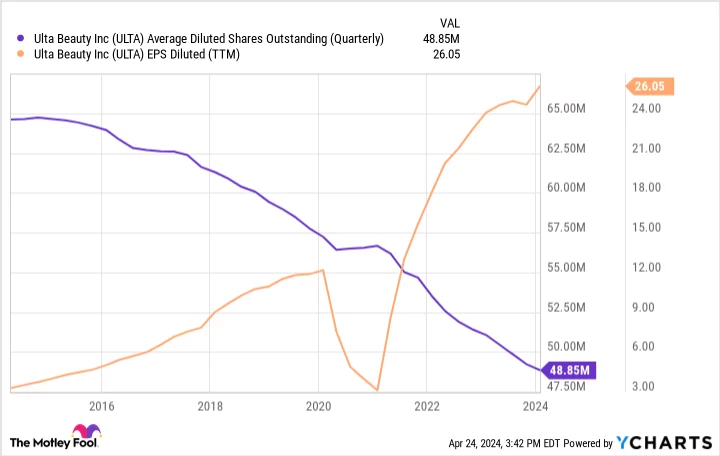

A prime example of a cannibal is Ulta Beauty. The company uses almost all its free cash flow to buy back its own shares on a large scale over a very long period of time (chart 3).

Extremely successful.

Think of a company’s shares as slices of a pie. When the company decides to buy back its own shares, it is like they are taking a slice of that pie away, but the pie remains the same overall size. Now, with fewer slices (or shares) available, each remaining slice represents a larger portion of the pie. So, if you are an investor holding onto a slice, your piece of the pie just got bigger in terms of ownership percentage. As a result, the value of your slice (or share) in the company increases. In Switzerland, this process is tax-free compared to dividends.

While the business is doing well, Ulta Beauty is simultaneously buying back shares, and without doing anything, your share in the company continues to grow.

Sounds too good to be true, doesn't it?

Chart 3: Ulta Beauty’s shares outstanding and earnings per share (EPS)

Source: The Motley Fool, Y Charts

At the End of the Value Chain

Ulta Beauty always must fight for revenue compared to product suppliers like L'Oréal or Estée Lauder (these two account for 54% of Ulta's sales) and for customers to come into its stores and spend money there. The two product suppliers on the other hand also supply to Sephora, Amazon and hundreds of other stores - they do not have this problem and care little about where you buy their products. As long as you buy them.

This means that Ulta Beauty is at the end of the value chain before the customer buys the product. And must therefore accept all the disadvantages that this entails.

The company must always be at the forefront of customers' minds, constantly be on top of the latest trends and work with influencers like Kylie, because 65% of consumers bought cosmetics after an influencer promoted them on social media.

The market for beauty retailers is highly competitive, making the business less stable, which is reflected in the high volatility of Ulta Beauty shares.

But while you may experience a rollercoaster ride with the stock from time to time, Ulta consistently buys back its shares when setbacks occur.

And you get more of the pie for enduring the volatility.

Day after day.

Chart 4: Ulta Beauty over ten years

Source: TradingView