100-Baggers

"The biggest hurdle to making 100 times your money in a stock may be the ability to stomach the ups and downs and hold on"

– Chris Mayer, Author of 100-Baggers

arvy's teaser: The stock market is the greatest wealth creation machine in the world. Among them are the 100-Baggers: stocks that return 100-to-1. What are their characteristics and how do you find them?

100-bagger.

An investment that multiplies 100-fold.

An initial amount of CHF 10,000 in your portfolio grows to CHF 1,000,000. It is every investor's dream. Who would not want to have such an investment?

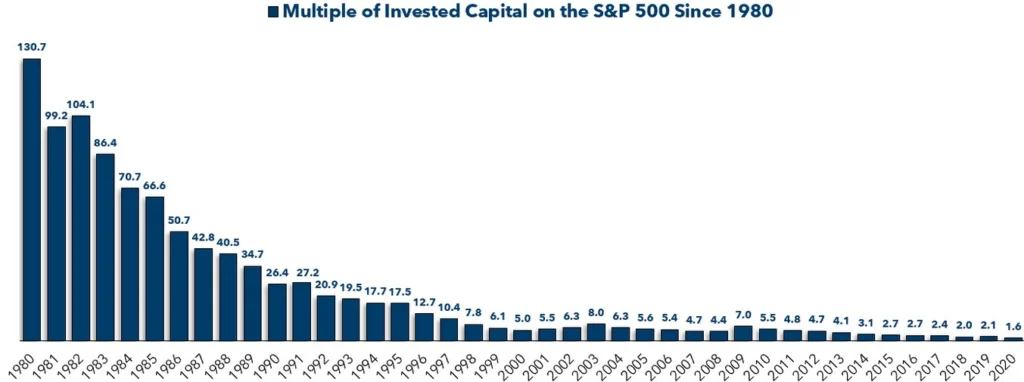

Curious about such super performers, Chris Mayer went in search of their characteristics and wrote a highly recommended book about them: "100-Baggers". But before we look at the attributes and key concepts, I would like to emphasize the main factor: time. Starting to invest early and having a plan to stick to is essential. How powerful is time? An investment in the S&P 500 (an index of 500 stocks, not just one (!) stock) in 1982 would have turned into a 100-bagger today (chart 1). That was only 42 years ago.

The stock market is the greatest wealth creation machine in the world.

In the early 1980s, you only had to do one thing.

Being invested in the first place.

Chart 1: How much would your money multiply in the S&P 500?

Source: Ritholtz Wealth Management

The Ethos

Analyzing past winners, a clear ethos emerges (chart 2).

There are almost 400 stocks that have achieved 100-bagger status in the US. On average, it took them 26 years to multiply a hundredfold. Their initial market capitalization was 500 million dollars - small caps, which make sense. It is easier to become big.

The key ingredients are:

In summary, a good investment would be a business that generates a lot of cash flow with significant growth potential, achieves a high return on invested capital and can consistently reinvest profits for further returns, maintains strong balance sheets and has insider ownership.

What should we not be looking for?

Chart 2: 24 companies that have returned 100x or more over the last 15 years

Source: Quartr

What Kills an Idea?

The focus is on the long-term orientation that is necessary to catch the 100-bagger. We need companies that survive for decades so that the compound interest effect can fully unfold (chart 3).

What would most likely not last for decades?

Now, we know what to look out for and what not to look out for.

We can move on to the last part.

The hardest one.

Chart 3: Years that it takes to grow 100-fold

Source: 100-Baggers

It is supposed to be hard

The hardest hurdle on the way to the 100-bagger is the ability to endure the ups and downs. Remember, on average, it takes 26 years to multiply a hundredfold. That is a long time to hold a stock.

Regarding the ups, if you have invested in a great business that is performing well, you will inevitably see your stock reach new highs that can make you wonder.

But that is exactly what you want to see, also according to Chris Mayer (chart 4). It makes sense. A stock that performs very well over a long period of time - exactly the kind of stock you want to own - is a stock that regularly makes new highs: a nice long-term chart pointing up and to the right. How else could a stock be a great performer? We just wrote an article in The Market NZZ about how hard, but also important, it is to play this game.

The search for 100-baggers always reminds me of the Tom Hanks quote from the 1992 movie "A League of Their Own".

“It is supposed to be hard. If it were easy, everyone would do it.”

“The hard is what makes it great.”

Chart 4: arvy’s book club: Chris Mayer’s 100-Baggers

Source: arvy