Intuitive Surgical: David vs. Goliath

"A good business is like a strong castle with a deep moat around it. I want sharks in the moat. I want it intouchable"

– Warren Buffett

arvy's teaser: In a world where science fiction becomes reality, Intuitive Surgical dominates the robotic surgery landscape with near-monopoly status and a formidable fortress of patents. But wherever high profitability is to be found, competition is waiting around the corner.

Robotic surgery.

Sounds a bit like science fiction.

Hollywood films have brought us all into contact with this topic. I always have the scenes from my beloved Star Wars films floating around in my head. Episode V - The Empire Strikes Back (1980), when a surgical robot successfully attaches a robotic arm to the hero Luke Skywalker.

Back in the 80s, when "The Empire Strikes Back" was released, these medical droids were pure science fiction. Today? Medical robots like the "da Vinci Surgical Robot" are a reality, and some of them are remarkably like those shown in the movies (chart 1).

The innovator that turned science fiction into reality?

Intuitive Surgical.

Chart 1: Intuitive Surgical’s “da Vinci system” and a Star Wars FX-series medical droid

Source: Healthcare IT Today

Monopoly Attracts Competition

8'000.

That is how many "da Vinci" systems are installed worldwide. A market share of 80%.

The da Vinci Surgical System is a robotic surgical system that uses a minimally invasive surgical approach – a technique that limit the size of incisions needed, thereby reducing wound healing time, associated pain, and risk of infection. It is named after Leonardo da Vinci, who studied human anatomy. The system is used for prostatectomies, increasingly for cardiac valve repair and for renal and gynecologic surgical procedures.

This is accompanied by a profitability that is reflected in gross margins of 67 % and net profit margins of 25 %. It is rare for a market as attractive and fast-growing as robotic surgery to remain unaffected by competition for as long as it has.

But why has Intuitive Surgical succeeded in doing so?

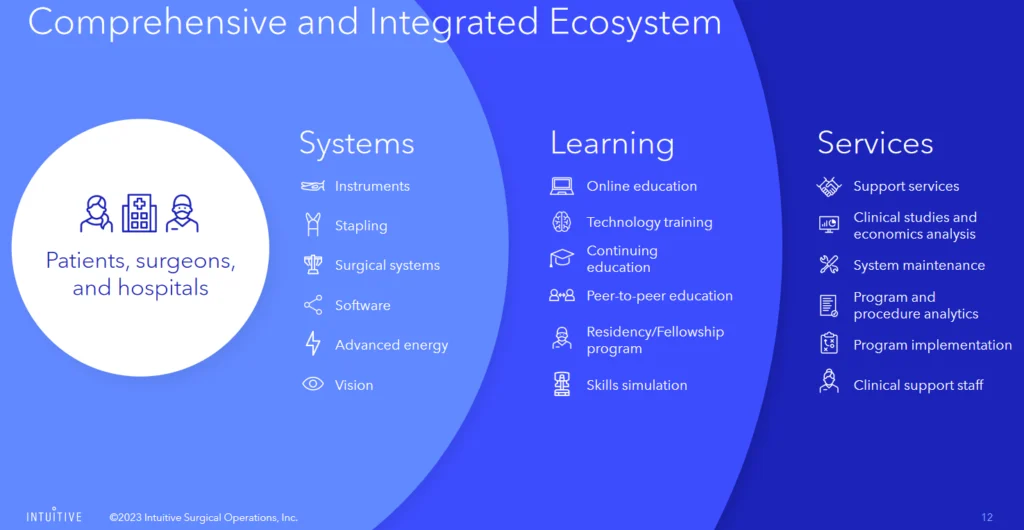

It is their monopoly position in their niche. The company operates in a market that it has dominated for decades owing to its patents and first-mover advantage. Thanks to its comprehensive and integrated ecosystem, it has been able to fend off the competition for years. Moreover, the company is not resting on its laurels, but is ready to invest in its three business areas (chart 2, selling a system, providing learning functions and then services such as maintenance, data or analytics) and to look in other areas where there is a need for robotic support.

But now its monopoly position is over.

Chart 2: Comprehensive and Integrated Ecosystem

Source: Intuitive Surgical, Annual Report 2023

Unfair fight

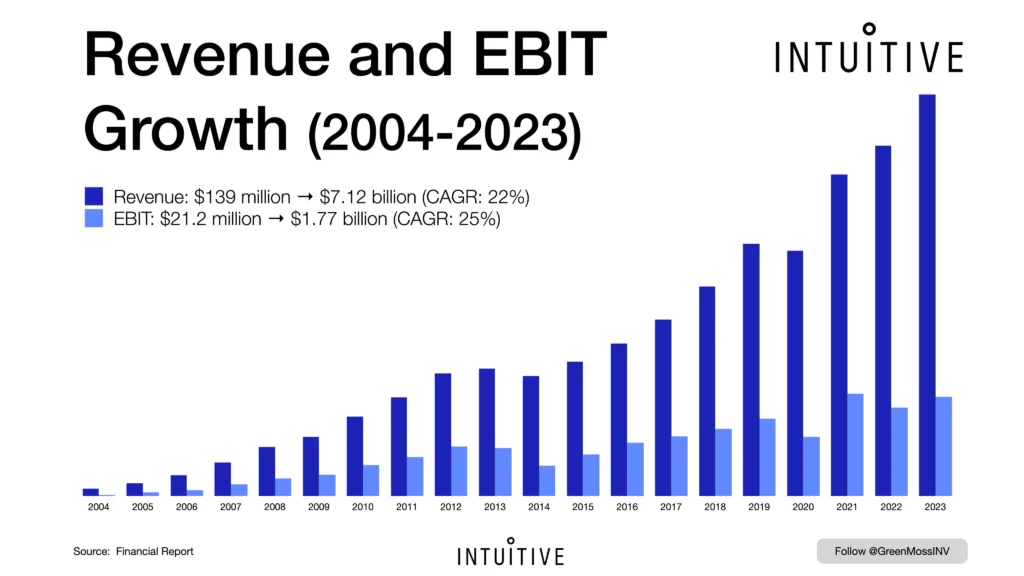

Remember that whenever you have high growth and high profitability in a segment (chart 3), the competition comes around the corner and wants a piece of the pie. Now Medtronic and Johnson & Johnson (still in the late development stage) have entered the market.

However, none of them can change the industry landscape, significantly disrupt the company's operations or erode their return on investment.

Why?

They are struggling to bring their competing platforms to market. And let's not forget that for them it is only a small part of the overall business, whereas Intuitive is a pure play. For them it is an unfair fight - it is like David (Medtronic, J&J) versus Goliath (Intuitive Surgical).

I wrote about unfair fights with more examples in The Market NZZ article this week.

In addition, Intuitive's intellectual property on its system and its growing instrument base is a significant barrier to entry. It is a strong castle with a deep moat with sharks! It is reinforced by the ever-growing clinical database, which is the biggest challenge for a new entrant. To reach Intuitive's database, new competitors will need to convince enough hospitals to buy or test their instruments over an extended period, train surgeons who do not yet own robots or da Vinci, and recruit willing patients. Customers would need a very compelling technology or price difference to switch before their equipment naturally wears out.

Imagine every 17 seconds a da Vinci system performs a surgery and delivers data to Intuitive Surgical.

And that is not all.

Chart 3: Revenue and EBIT growth over two decades

Source: GreenMoss Capital

Adopt, operationalize, standardize

Intuitive Surgical is using its significant market position to invest heavily in its own business.

The result?

Although the company already has by far the most advanced robotic surgical system (da Vinci 4), it has applied to launch its next-generation platform (da Vinci 5) in 2024. This will allow it to participate in the upgrade cycle of around five to eight years that attracts old and new customers to install their systems. The company's innovation and pure focus have led to more and more hospitals working with "da Vinci" and recurring revenues increasing from 70 to 79% due to its services. They are helping to adopt the systems, operationalize them and ultimately standardize the systems in their daily routines. This in turn leads to more data, analytics and high-margin maintenance services that help strengthen the ecosystem.

At the end of the day, real life is not a Hollywood movie.

And David rarely wins as a weak competitor.

Chart 4: Intuitive Surgical over 10 years

Source: TradingView