Fair Isaac: Deeply Entrenched Monopoly

"I want sharks in the moat to keep away those who would encroach on the castle."

– Warren Buffett

Credit scores.

Even if you don’t live in the US, you’ve almost certainly heard of them.

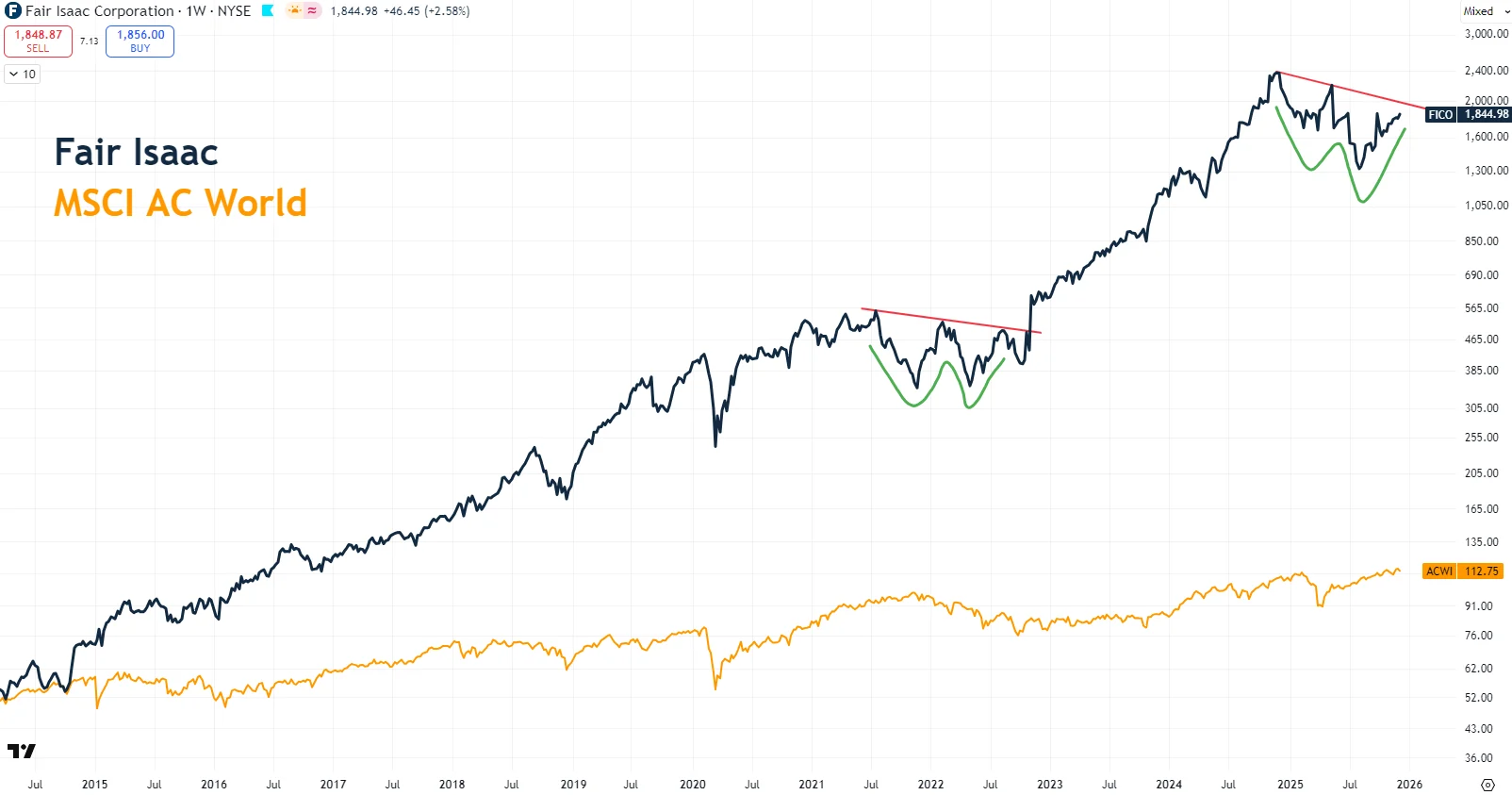

This single number has an enormous influence on what you can do in the United States — and at what price. A credit score is a three-digit number (ranging from 300 to 850) that lenders and businesses use to assess your creditworthiness: how likely you are to repay borrowed money based on your credit history (chart 1, left).

A higher score signals lower risk. That means easier access to loans, lower interest rates, and approvals for things like rentals or insurance. A lower score, on the other hand, implies higher risk — and usually higher costs not to mention limited access to borrowing.

The score is calculated using your financial history: payment behavior, amounts owed, types of credit, and the length of your credit history (again, chart 1, right).

Got a bad one?

No worries. Your score is dynamic. It changes as your financial habits change and improves with consistent, on-time payments and responsible borrowing.

And no — there is no magic number that guarantees approval for everything. That said, the goal is obvious. The higher the score, the easier life becomes.

This number is so important that it affects almost every American citizen in some way.

And there is essentially one company behind it.

A quasi-monopoly, you could say.

Fair Isaac Corporation.

In short: FICO.

Chart 1: What Is a Good FICO® Score & how does FICO Score Factors work

Why a quasi-monopoly?

Because there is another provider: VantageScore.

VantageScore is a consumer credit rating product developed by the three major credit bureaus — Equifax, Experian, and TransUnion — as an alternative to FICO.

Here’s the key difference.

FICO creates a bureau-specific score for each of the three credit bureaus, using only the data from that bureau. In reality, that means FICO isn’t one score — it’s three. And yes, they can differ slightly.

VantageScore, by contrast, is a single tri-bureau score, combining information from all three credit bureaus and used uniformly by each.

But FICO — founded in 1956 by Bill Fair and Earl Isaac — remains the most widely used, the most available, and the most trusted. And we’ll soon see why.

How does FICO make money?

When you apply for a mortgage, your lender doesn’t just “check your credit.” They buy a score — often several. These are purchased from the three major bureaus (Experian, TransUnion, and Equifax), which then remit a royalty back to FICO for having synthesized raw credit data into a single, decision-ready rating.

What does it cost?

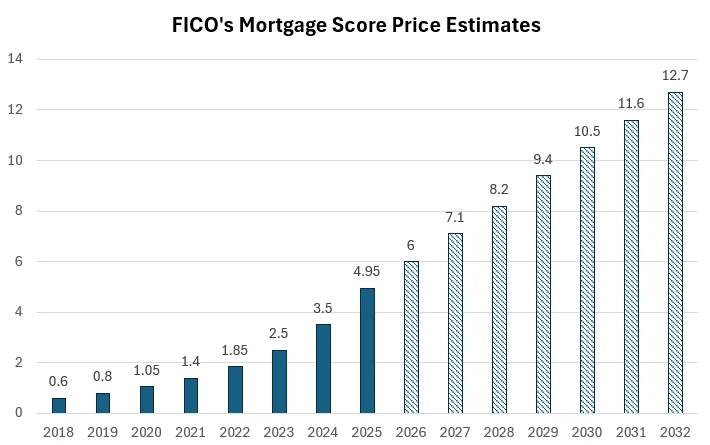

When buying a home, amid the eye-watering closing costs for taxes, title insurance, and commissions — often totaling thousands of dollars — the FICO score itself costs just $4.95 now (chart 2).

A rounding error. Yet absolutely essential.

A Visa analogy fits perfectly. Merchants may grumble about Visa’s tolls, but the network’s utility is so overwhelming that the fee persists — and grows.

For nearly 30 years, the price of a FICO score stayed flat at $0.60. Only in 2018 did FICO begin to raise prices.

And once it started… it didn’t stop.

Over decades, FICO cemented its role as the lingua franca of credit risk. Its score is simply the best tool for predicting who is more — and less — likely to default over time. That prediction directly drives whether a loan is made and at what interest rate.

In fact, over 95% of US mortgage and credit card securitizations reference FICO scores somewhere in the process.

As a deeply entrenched monopoly — embedded across banks, insurers, lenders, and financial workflows — FICO has leveraged its brand, trust, and accuracy to demonstrate extraordinary pricing power.

One of the strongest we’ve ever seen at arvy.

Sounds too good to be true?

In a way, yes — and do not forget, every great story needs a villain.

And we’re still not done.

Fasten your seatbelt.

Chart 2: The cost charged by FICO for a FICO credit score

FICO’s moat is built on network effects — very similar to Visa, as mentioned earlier.

The more the score is used, the stronger the economic moat becomes. Exactly the kind Warren Buffett loves.

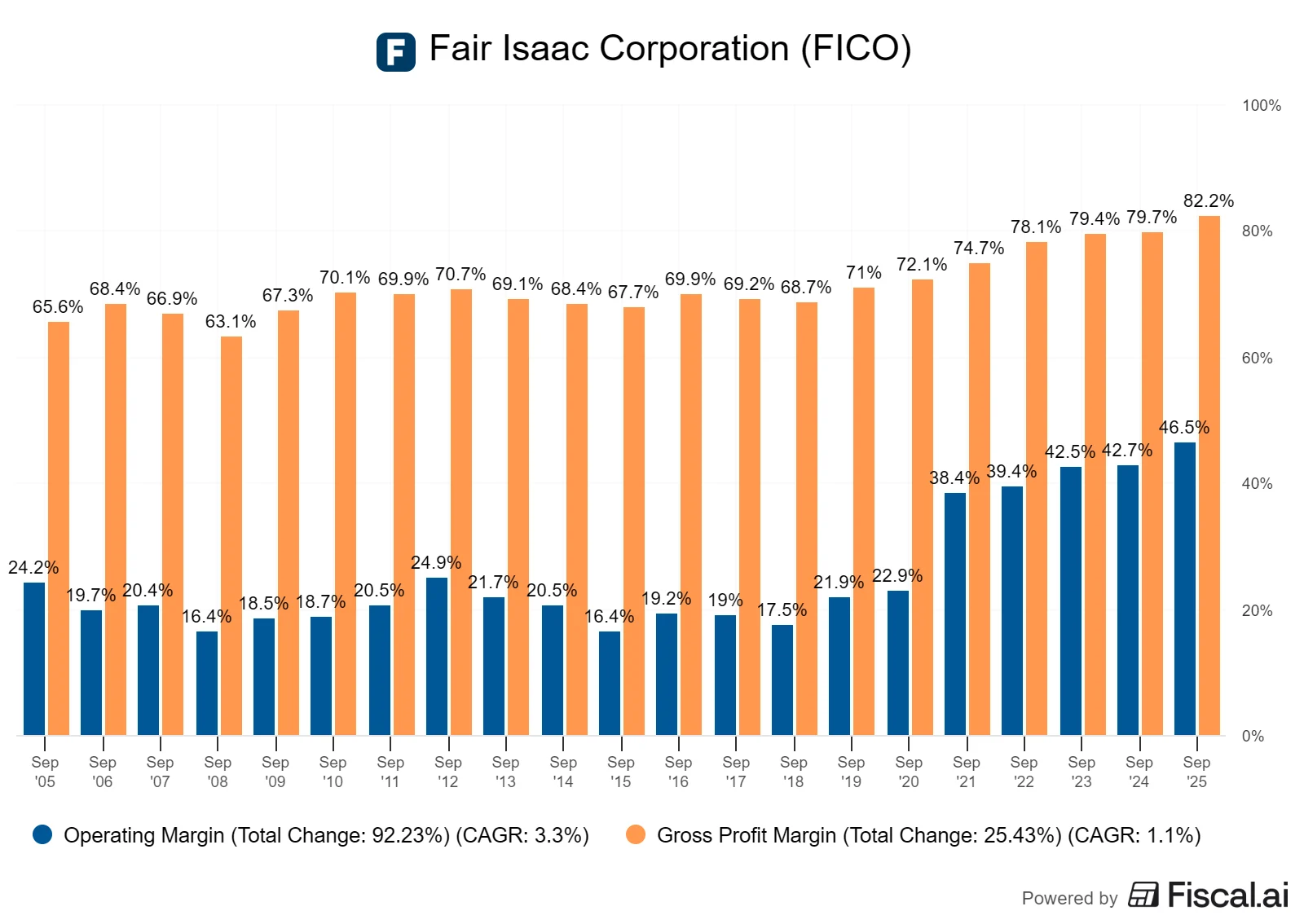

And as I keep repeating: if you have pricing power, you will have high margins — the purest expression of business quality.

In FICO’s case?

Extraordinary.

Gross margins of 82%, operating margins of 47%, and net profit margins of 33% (chart 3).

And they keep expanding — driven by price increases.

How is that possible?

Picture an algorithm that already works — and every year more mortgages are written, more credit is issued, and more consumption flows through it. That’s where FICO’s operating leverage shines.

Once the platform is built, every additional score sold drops into the business at an almost zero marginal cost.

Again — very similar to Visa.

On top of that, FICO has built another moat: switching costs. Beyond the score itself, the company offers software across fraud detection, loan origination workflows, collections, and customer communications — embedding itself even deeper into client operations.

The result of this deeply entrenched position?

A hell of a “Good Story.”

And, inevitably…

Envy.

Maybe that’s a bit dramatic — but history is a clear guide. When profitability reaches these levels, competitors show up wanting a slice of the pie. And sometimes, regulators do too — just look at the Magnificent 7 (Fun Fact: The EU has collected more money from fines imposed on Mag 7 than from taxes paid by all European technology companies combined – no joke).

In FICO’s case, we’ve seen both.

Competition through the gradual rollout of VantageScore, and regulatory pressure from bodies like the Federal Housing Finance Agency (FHFA) attempting to weaken FICO’s moat by encouraging the use of alternatives in certain areas.

That naturally creates uncertainty.

And uncertainty — the kryptonite of markets — leads to volatility.

Add to that a premium valuation of 45x forward earnings (vs. a 5-year average of 41x) and a free cash flow yield of 1.8% (vs. 2.3% historically), and the stage was set for choppy price action.

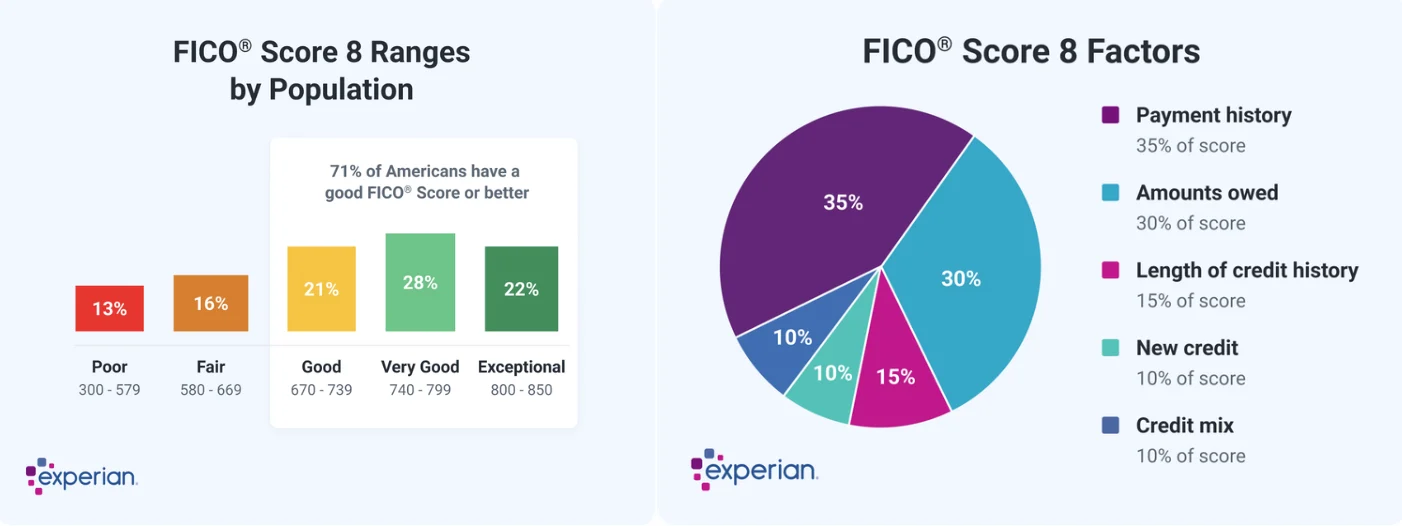

Choppy price action — and history as our guide?

Time to check the “Good Chart.”

Chart 3: FICO’s operating and gross profit margin since 2005

According to the work of our friends at Investor’s Business Daily and its founder William O’Neil, more than 140 years of stock market history show that three recurring chart patterns tend to appear just before major price run-ups.

The first is the famous — and most widely known — cup-with-handle pattern.

The second is the no-less-famous base / box consolidation, summed up by the old market wisdom: The longer the base, the higher the space.

But in FICO’s case?

We’re seeing the third powerful pattern: the double bottom, also known as the W-formation.

W-formation?

Yes. The double bottom resembles the letter “W” — with the second leg typically dipping slightly below the first.

Just look at FICO’s price action (chart 4). We saw a clear double bottom in 2022, and today it looks like another one may be forming — right in the middle of turbulence and regulatory worries.

For the ending, I’ll pull out one last classic stock market saying.

FICO looks set to do what markets always do.

Climb the wall of worry.

Chart 4: Fair Isaac over the last ten years, log scale