Walmart, Costco, Target: It is the economy, stupid

„It is the economy, stupid”

– The winning campaign slogan of Bill Clinton in the 1992 US presidential election

arvy's teaser: Consumer spending drives 70% of the US economy, making retailers like Costco, Target and Walmart economic barometers. This Thanksgiving, their sales reveal critical insights into the health of American wallets - and the economy.

70%.

This is the share of consumer spending in US GDP.

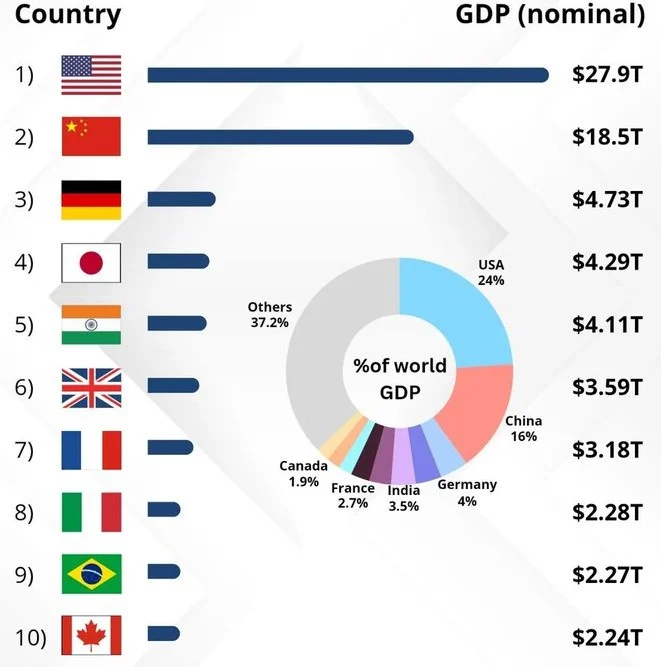

This makes the US one of the most consumer-oriented economies in the world. By comparison, the percentage in Switzerland or Germany is around 55%. Or in contrast to China, where the share of consumer spending is only 40%. The remaining missing percentages are filled by investments, government spending and net exports. Lastly, the US, with a population of 334.9 million and the largest GDP in the world, has a significant impact on the global economy (chart 1). Whether it is economic well-being, growth, innovation, politics or the stock market. The US plays a key role.

That is why it is important to assess the health of the US consumer.

And how on earth do we do that?

Well, we monitor US retailers.

Chart 1: Top 10 Largest Economies in the World

Source: IMF data, country_info7

US Retail - Mass Merchandise

The US retail market is dominated by three big players.

Namely Costco Wholesale, Target and Walmart. They belong to the mass merchandise segment (chart 2). The supermarkets for everyday needs.

Let's look at them:

Although they all focus on the general consumer, the mass market, they all follow a different business model.

Costco operates a membership-based wholesale model, emphasizing bulk purchases and quality – like TopCC. Target blends affordability with trendy, design-focused products, appealing to style-conscious consumers – like the City stores of Coop. Walmart focuses on low prices and wide variety for budget-conscious shoppers - our Migros and Coop. Each retailer differentiates through pricing, product offerings, and customer experience.

Having frequently visited Costco, Target or Walmart over the years, I can tell you one thing.

You can feel the pulse of the economy in consumers' purchases.

And that is reflected in the data.

Chart 2: US retailers and their respective segments

Source: Loyal.Guru

Feeling the shift among Consumers

It is no coincidence that we are writing about the US retail industry and the US consumer today.

It is Thanksgiving week, a harbinger of the Christmas shopping season and the busiest period for stores and shoppers alike. During this time, we receive a wealth of data from Adobe on how much was spent on goods and services. We pay particular attention to Costco, Target and Walmart (Chart 3) for brick-and-mortar retail and Amazon for e-commerce, as they are in the best position to take the pulse of the American consumer.

However, we must roll up our sleeves and make a little effort to look at the health of consumers.

We pay attention to people's financial concerns, such as jobs, wages and cost of living, by focusing on what they buy. Their behavior reflects the strength of the economy. Ultimately, “it's all about the economy, stupid.” As Bill Clinton put it in his victorious 1992 presidential campaign.

As a rule, we see purchasing behavior and the strength of the economy reflected in two things:

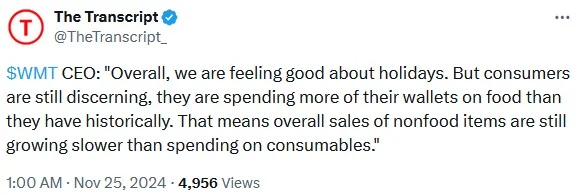

Let's look at the first point: When people spend more on non-food items, they have more disposable income that they can and want to spend on non-food goods. Accordingly, the economy is most likely strong. Conversely, a higher proportion of spending on food is a sign of a weaker consumer.

Second, Walmart and Costco focus much more on low prices or cheap bulk sizes. Target focuses on affordable but stylish and design-oriented products that are like the higher-end offerings of the urban stores of Coop City stores. Target is therefore more focused on middle to higher income consumers and has a stronger presence in cities and suburbs.

This means that Walmart and Costco feel the shift among consumers from non-food to food in times of weaker economic activity, while Target loses customers looking for cheaper alternatives. They are migrating to Costco and Walmart.

Whew - this is a lot of things to focus on. Is there no easier way?

Of course, the stock price!

Chart 3: Consumers spend more on food than on non-food items

Source: The Transcript, November 2024

Every Company tells a Story

In the short term, there is a lot of noise on the stock market.

In the long term, however, a company's share price follows its sales and earnings growth - its fundamentals.

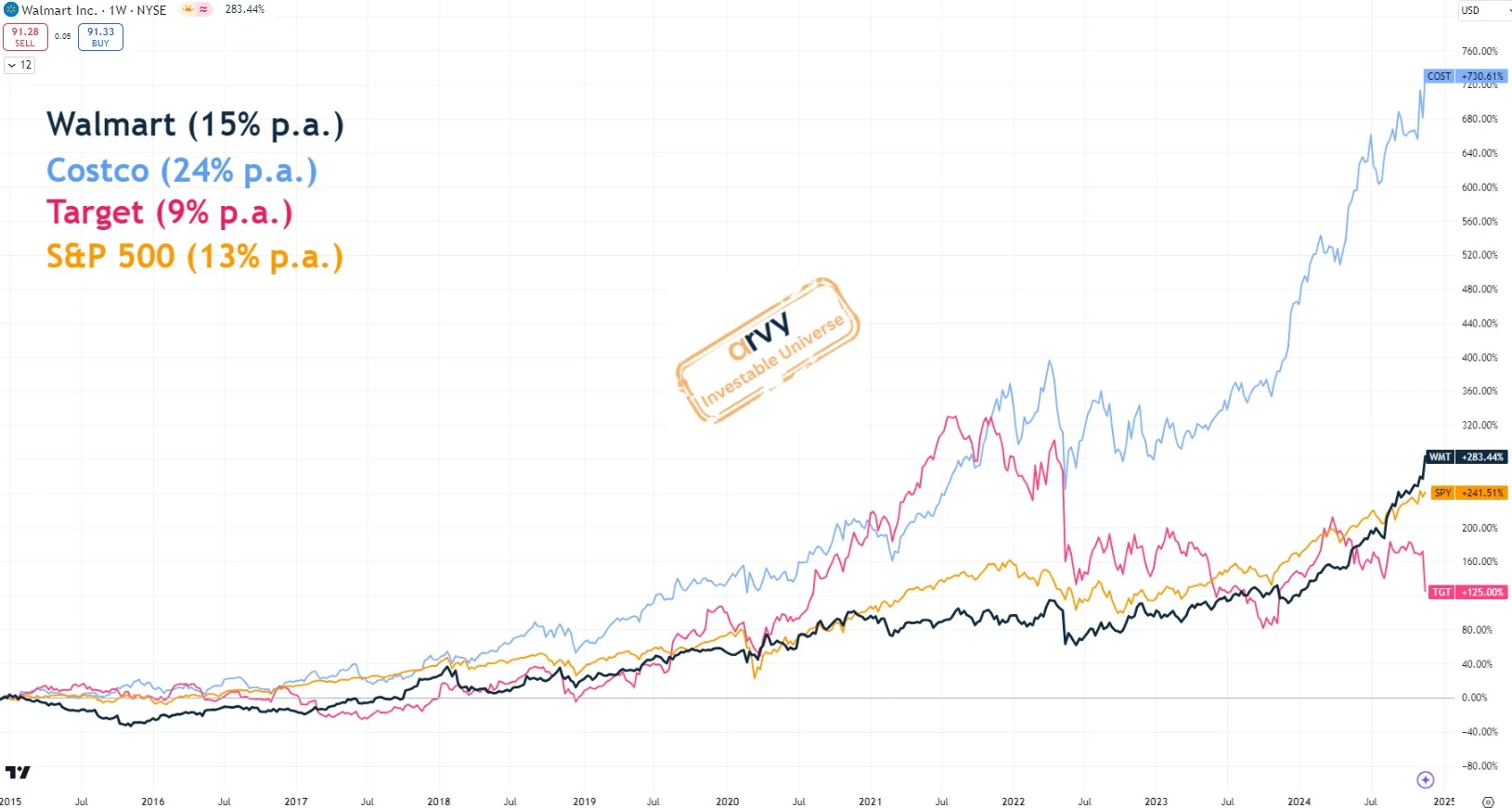

Now let's apply what we've learned about the different value propositions - the “Good Story” - of the three giants of US retail and incorporate their share prices - the “Good Chart”.

What are they telling us?

While consumers benefited from government support during the COVID period and spent a lot of money, they are now struggling with inflation. Target's underperformance since mid-2021 underlines this change.

So, what does this mean for us as investors? We have no crystal ball to predict where the market is heading. Rather, our goal is to decipher the signals that Mr. Market and the individual companies that tell us a story are sending out.

The message is clear: it is not yet time to act according to the motto “Go Big or Go Home”. The consumer is weakening.

We have already received the same signal in the luxury sector, where giants like LVMH are feeling the pressure and only the highest class of luxury is successful - Hermès.

Well, the consumer is keeping its head above water so far. And we will keep you up to date on our investment journey.

Because with arvy, you are part of the ship.

Part of the crew.

Chart 4: Costco, Target and Walmart over ten years

Source: TradingView