Mips: The Hermès of Helmet Safety

“History does not repeat but it often rhymes.”

– Mark Twain

arvy's teaser: Mips turned helmets from image accessories into brain insurance. With Hermès-level margins, a yellow sticker became shorthand for safety. But even the best protection can’t shield a stock from the boom-bust cycle of markets.

Look cool and be unprotected.

Or look uncool and be protected.

That was the question 20 years ago whenever I hopped on my bike to school. Same during “Skilager” in February, when we kids raced downhill pretending to be the next Didier Cuche. Back then, a helmet wasn’t about safety — it was about image. Protecting my head (and more importantly, my brain) wasn’t exactly the priority (chart 1). Well, at least it looked iconic.

Fast forward, and everything has flipped.

Today, skiing without a helmet doesn’t make you cool — it makes you reckless. The social judgment is instant: How dare you? Aren’t you worried about brain injuries and concussions?

And that shift opened the door for a market leader that asked a simple but radical question in a Swedish surgery room: “Why don’t helmets do more to prevent severe brain injuries?”

That question sparked years of research. What began as an academic project turned into a breakthrough technology.

A brand you might unknowingly own or know already.

Check your helmet for a yellow sticker.

It shall say.

Mips.

From Academia to Real Life: Saving Our Brains

A brand I might unknowingly own or know already?

Yes.

Check chart 2 (the helmet) and you’ll likely recognize the yellow dot logo on your bike commute, or while waiting in line at the ski lift. And if you don’t notice it yet — I promise you will after reading this.

So, what is Mips all about?

As a Swiss, I can’t help but compare it to the story of On Shoes: there, an ETH engineer reinvented running. Here, it was a neurosurgeon at the Karolinska Institute in Stockholm who reinvented helmet safety.

Mips provides a critical ingredient to helmet makers through a strategic licensing model. At its core, the company designs the Brain Protection System (BPS), works with subcontractors for production, and delivers it to helmet manufacturers. For this, it charges both a fee for implementation and, importantly, a licensing fee for the right to use its IP, technology, and marketing — the iconic yellow dot logo included.

Thus, it is an asset-light business model.

The brilliance here?

The yellow dot, mandatory on every Mips-equipped helmet is a visible seal of safety that builds consumer trust and awareness. In effect, Mips markets itself through its customers’ products, while getting paid for it.

The story begins in the 1990s with Professor Dr. Hans von Holst, who studied brain trauma and noticed something unthinkable.

Many patients with severe brain injuries had been wearing helmets. The skull was intact, but the brain was damaged.

Why?

Traditional helmets protected against linear impact — but not against rotational forces that twist the brain inside the skull.

Von Holst and his team cracked the code.

Their solution became the BPS: a thin, low-friction layer — often yellow — placed inside helmets (chart 2). This layer allows the helmet to slide slightly during angled impacts, reducing rotational motion and lowering the risk of brain injury.

Oh, and before I forget: Mips stands for Multi-directional Impact Protection System.

Phew. Enough academia and abbreviations for a Friday morning.

Let’s turn to the fundamentals of this “Good Story.”

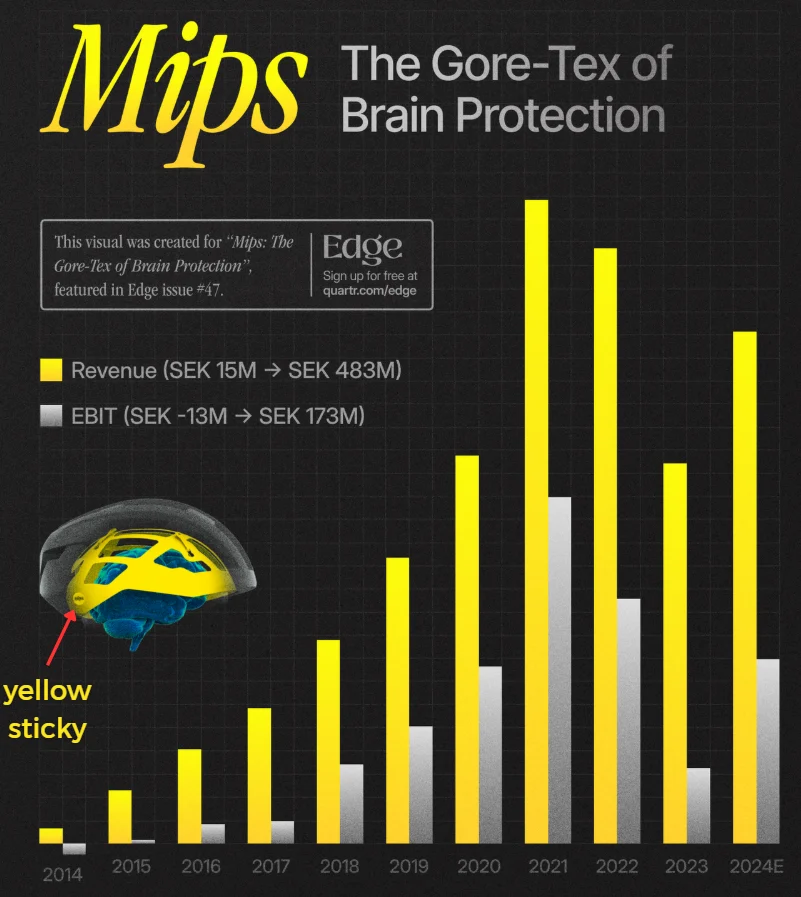

Chart 2: Mips revenue and EBIT growth since its initial public offering

Source: Quartr

Bold Vision Turned Into Genius Marketing

Mips started with a bold vision.

Back in 2009, they declared: “Our vision is for Mips technology to achieve the same impact as the airbag in the automotive industry – to be seen as an obvious and non-negotiable safety feature for helmet users.”

Fast forward, and the Swedish company is now a $1 billion market cap business, growing revenue and EBIT per annum at 21% and 35% respectively since its 2017 IPO (chart 2).

But Mips is not resting on its laurels.

In 2021, it launched a virtual test lab that has since run more than 100,000 virtual helmet tests — accelerating development and simplifying safety validation. On one side, Mips keeps grinding out patents (over 400 to date) – their first moat, intellectual property. On the other, knowing patents eventually expire, it is building something even harder to copy.

Brand awareness.

That’s the second moat.

The yellow sticky is becoming shorthand for: “My head and brain are safe.”

And let’s be honest — this weekend, when you walk through a sports shop as you just noticed your helmet doesn’t carry the yellow dot, you’ll think twice.

Without it?

You’ll feel like the guy who just admitted to 10,000 arvy’s Weekly readers: “Yep, I don’t have the best protection for my head.”

No yellow sticky. No full safety.

That’s genius marketing.

For now, Mips is defending its turf with both breakthrough technology and a consumer-facing brand moat. The numbers show it. 73% gross margins and 27% net income margins.

That’s not just strong. That’s Hermès-level profitability.

But, as every “Good Story” teaches us — there’s always a villain.

For Mips, it was the Covid Boom-Bust cycle.

As lockdowns hit, everyone rediscovered nature, picked up new hobbies, and went outdoors — camping, hiking, and of course, cycling. Helmet demand surged, and Mips rode the wave. Manufacturers scaled up production to meet what looked like a lasting shift. But it wasn’t. Demand normalized, supply flooded, and the momentum broke.

The result?

A “Good Chart” pattern you’ll recognize occasionally.

The Stock Price Maturation Cycle (chart 3).

Let’s check how it goes.

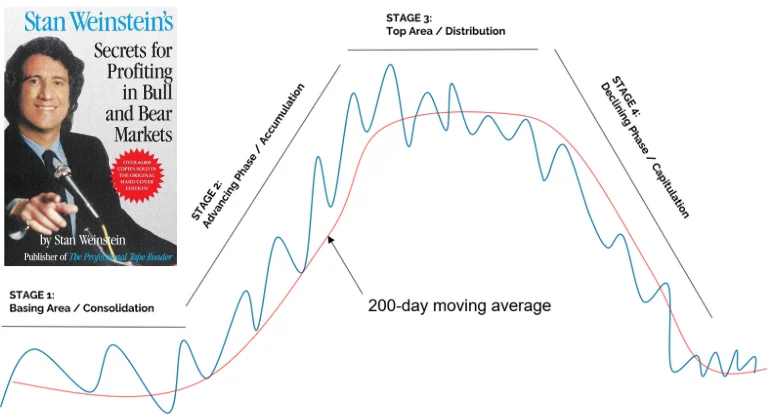

Chart 3: Stock Price Maturation Cycle by Stan Weinstein

Source: arvy, Stan Weinstein’s – Secrets for Profiting in Bull and Bear Markets

Stock Price Maturation Cycle

140 years of stock market history — with the best data coming from the U.S. — shows that stock market leaders and high-growth companies tend to follow a familiar rhythm.

This has been analyzed in depth by Stan Weinstein, who studied thousands of charts and documented the pattern in his classic “Secrets for Profiting in Bull and Bear Markets”.

He called it the “Stock Price Maturation Cycle" (see again chart 3). Oh yeah, I know, we're all getting jealous of his hair.

In short, a growth stock or market leader typically passes through four stages:

And here’s the painful part: once a stock enters Stage 4, the Declining Phase, history shows it on average corrects by 72% and takes about five years to recover.

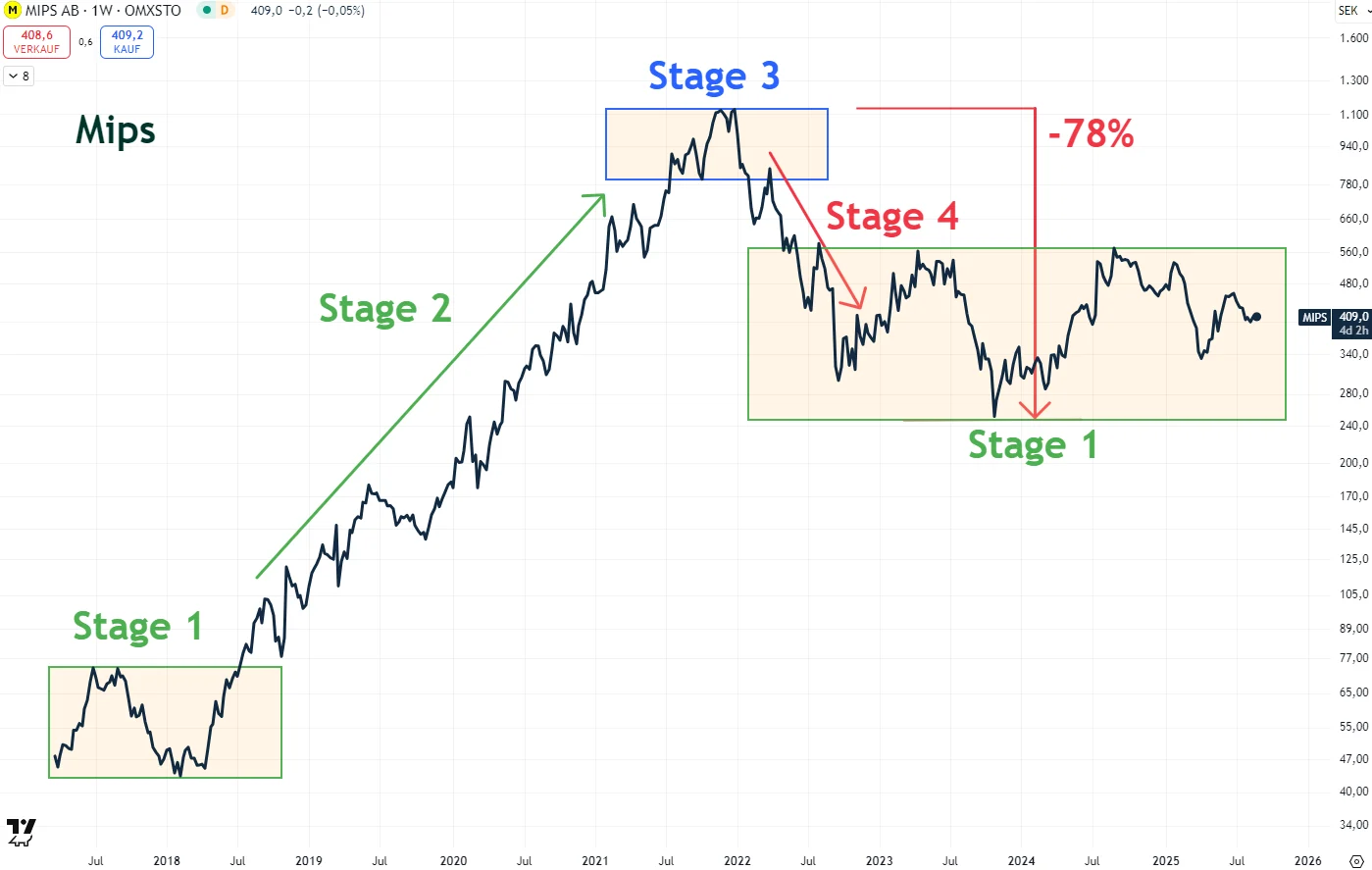

As Mark Twain famously put it: “History does not repeat, but it often rhymes.” And looking at chart 4, it’s clear: our beloved Mips has rhymed almost perfectly with this cycle (down -78%).

The company has spent the last three years stuck back in Stage 1 — consolidation. Investors are now waiting (and hoping) for a breakout into Stage 2, the next accumulation and advancing phase.

Incidentally, Novo Nordisk, PayPal, Ark Innovation and Alibaba have similar patterns if you want to train your eyes.

Anyway, for now, the only recipe is patience.

At least, beyond the chart, this story might have introduced you to a technology you didn’t know — and perhaps inspired you to invest in something more tangible: your own safety.

Because here at arvy, we already have.

And you’ll find us cycling or skiing all with a helmet that proudly carries…

… the yellow sticky.

Chart 4: Mips since its initial public offering in 2017, logarithmic

Source: TradingView