Casey’s General Stores: Newly Crowned Dividend Aristocrat

"Be a shameless copycat"

– Monish Pabrai, The Warren Buffett of India

arvy's teaser: Casey's General Stores, America's hidden pizza giant. With a winning combination of gas stations and delicious pizza, Casey's is an example of steady growth, brand loyalty and market dominance and has earned its place as a newly crowned dividend aristocrat.

Pizza.

A dish that is at the top of many people's list of favorite foods.

For me too, there is nothing better than a great pizza evening. I usually prepare it myself or have it delivered from time to time. One thing is certain: as a Swiss person, you do not immediately think of convenience stores when you think of good pizza. Or would you prefer a pizza from the gas station to your beloved Italian restaurant next door? As you might imagine, things are a little different in the US - especially in more rural areas.

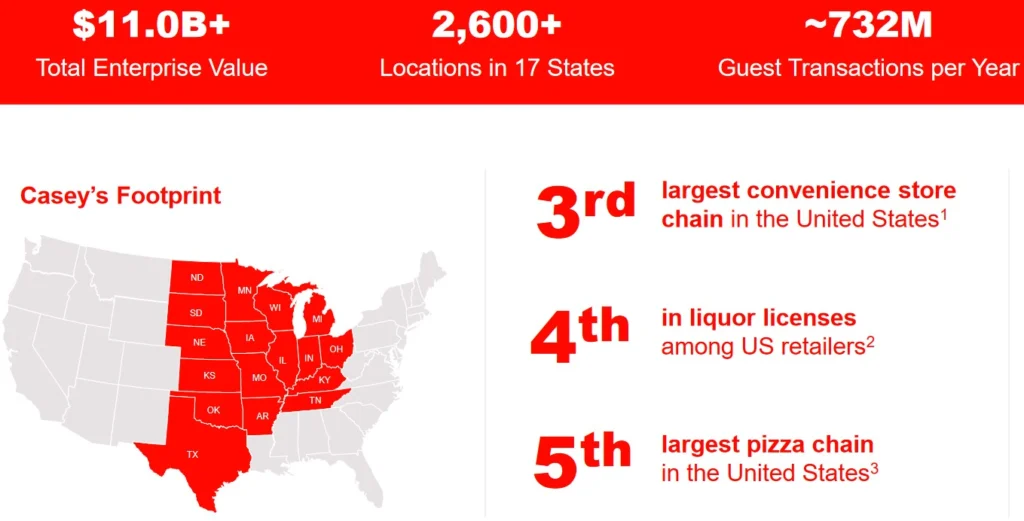

Consumers in the US Midwest have become so loyal to this store's pizzas that they have made it the fifth largest pizza chain in the country (chart 1).

America’s hidden pizza giant?

Casey's General Stores.

Chart 1: Casey’s is a staple for millions of Americans

Source: Casey’s General Stores, Annual Report 2023

Be a Shamless Copycat

Gas stations, can it really be a good business? Yes, we have seen it at Alimentation Couche-Tard, one of the largest convenience store operators (including franchising) in the world compounding at a rate of 21% annually over the last 20 years.

An investment of $1,000 has grown to $45,000.

Pizza restaurants, can it really be a good business? Yes, we have seen it at Domino's Pizza, the largest pizza restaurant operator (franchising) in the world compounding at a rate of 25% annually over the last 20 years.

An investment of $1,000 has grown to $87,000.

Amazing, isn't it?

Take the business, the concept and all the other characteristics of both together and look for a smaller market capitalization where it is easier to grow and get big and you will find Casey's. Basically, the idea is a copy of something that already exists and has a proven concept. A similar story is Coca Cola with the energy drink company Monster and Pepsi copying the success story with a collaboration with the energy drink company Celsius.

You see, you do not always have to reinvent the wheel. You can also be a shameless copycat.

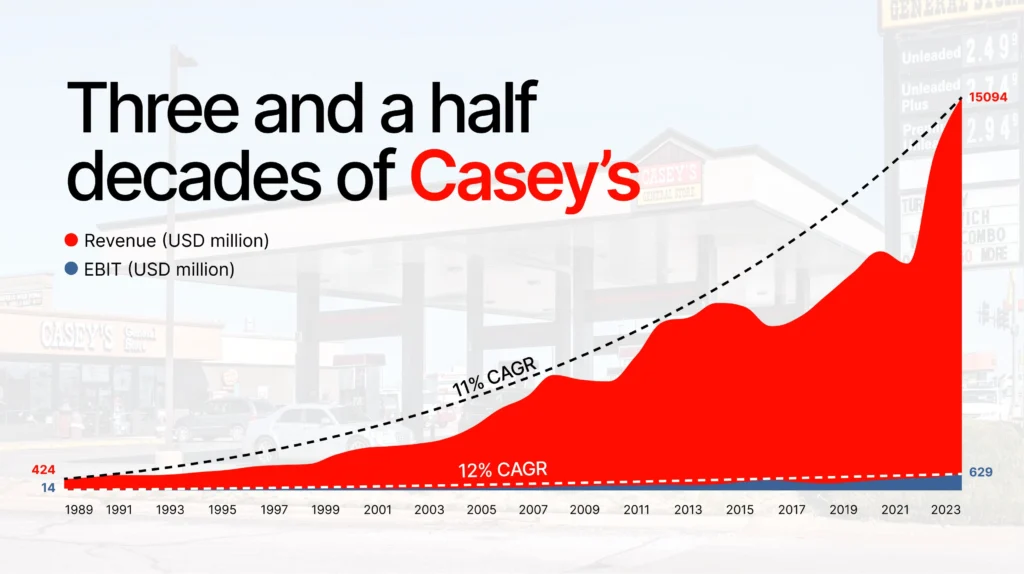

Casey's is now the third largest convenience store in the USA with around 2,600 locations in 17 states. The rather boring business has been growing both strongly and steadily (chart 2).

We know it is already based on the combination of two major success stories.

But what is their secret sauce?

Chart 2: Casey’s revenue and EBIT (operating profit) growth over three and a half decades

Source: Quartr

A Value Proposition Hard to Beat

Casey's business model is based on several pillars that make the company one of the best convenience store retailers:

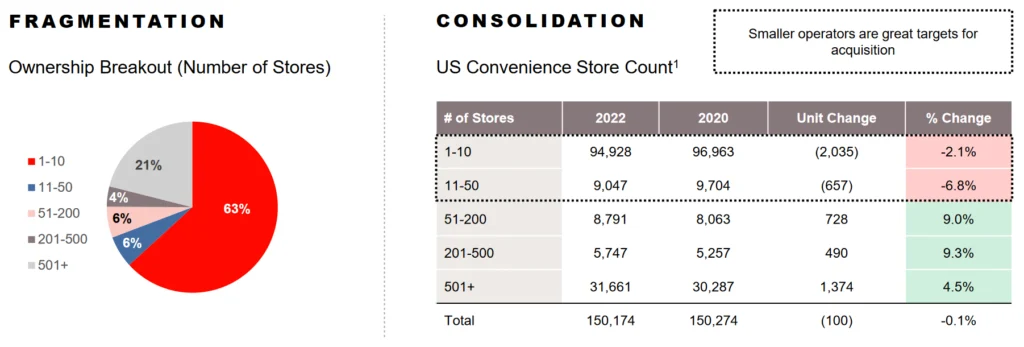

You see, Casey's is growing its business by having loyal customers, owning private label products with higher profit margins, and acquiring more and more stores by simply copying and reproducing the business model.

Speaking of loyalty, Casey's is known for providing a family with a pizza dinner at a good price.

A value proposition that is hard to beat.

And that is not all.

Chart 3: The convenience industry is fragmented, but consolidating

Source: Casey’s General Stores, Annual Report 2023

Newly Crowned Dividend Aristocrat

The resilience of the convenience sector is remarkable.

But when you think about it, it all makes sense. Casey's is more in the realm of the everyday things you need and where you are not so price sensitive. After all, you always need something to eat and would rather go without a juicy, expensive steak than an affordable pizza.

Given its very interesting business characteristics - steady growth, high stability and visibility - Casey's received a rare seal of approval just last week. It is now a newly crowned dividend aristocrat, having raised its dividends for 25 consecutive years. A characteristic that we love to see in our latest addition in the 1st quarter.

A "Good Story" that looks as appetizing as what I am probably craving today.

A pizza.

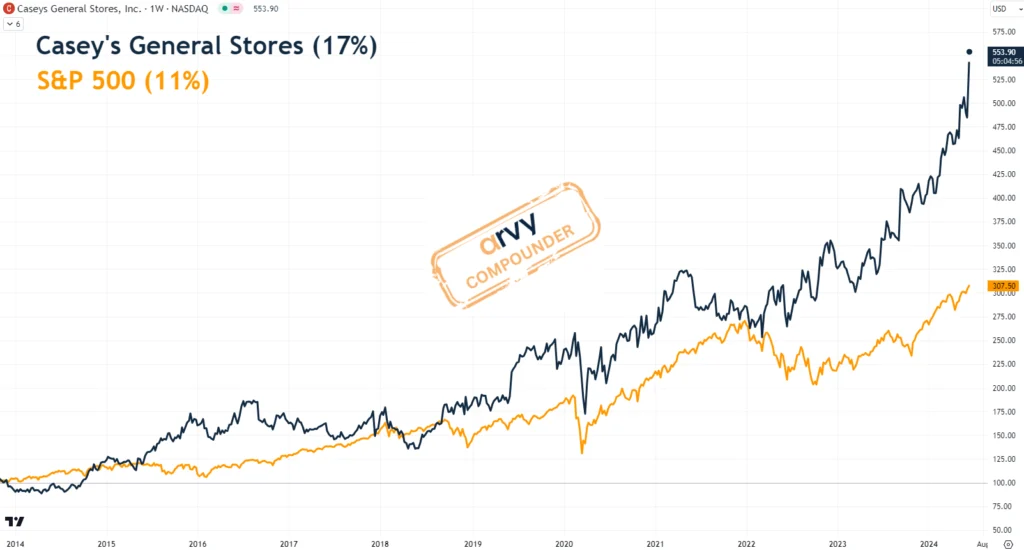

Chart 4: Casey’s General Store over 10 years

Source: TradingView