Old Dominion Freight Line: The Dow Theory’s warning

“An investor who will study values and market conditions, and then exercise enough patience for six men will likely make money in stocks.”

– Charles Dow, Founder of The Wall Street Journal & Co-founder of the Dow Jones Index

arvy's teaser: The market’s dancing on the rooftop — but the Dow Theory says the floor below is cracking. When the best trucking operator in America breaks down, it’s not just a stock story. It’s a classic signal. A serious one.

Trucking.

It sits alongside railways, shipping, and airfreight as a core part of the transportation index.

Which means — it’s part of the real economy. Whether it's the daily flood of packages from your Zalando shopping spree, your occasional flight for business or holidays, or goods quietly flowing across borders, transportation reflects the heartbeat of global trade. It tells us how supply meets demand.

And ultimately, it reveals how much money is circulating through the world economy. So, it's no surprise that economists and market-watchers keep a close eye on this sector. Because when the real economy is thriving and markets are rising in tandem, we get a perfect alignment — a confirmation. But when markets push higher while the transportation sector lags? That’s when people start whispering about storm clouds — a divergence.

A concept embedded in the classic Dow Theory. A 100+ years old market phenomenon.

And now, one of the sector’s best performers — a longtime star — is starting to flicker. A subtle warning signal. It tends to act as a leading indicator of broader trouble ahead.

The name? Old Dominion Freight Line (chart 1).

In short: ODFL.

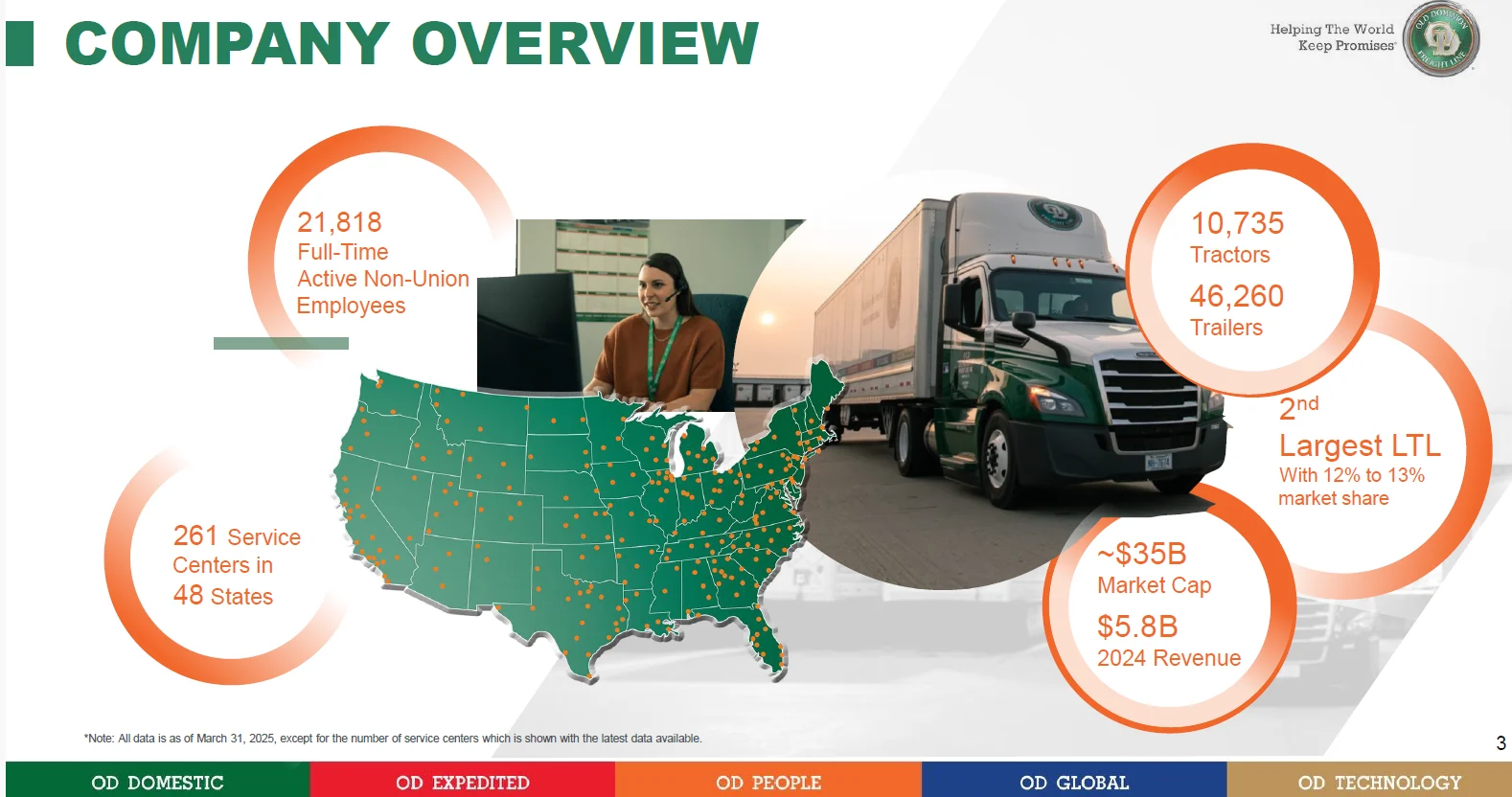

Chart 1: Old Dominion Freight Line – Company Overview

Source: Old Dominion Freight Line, Company Presentation 2025

Best-in Class Trucking Operator

Let’s first talk about Old Dominion Freight Line — ODFL — to understand the business and why it’s such a strong reflection of the real economy.

Then we’ll get to the Dow Theory and tie it all together with a 100+ year-old framework.

Spoiler: it doesn’t look great.

ODFL has been a family-run business for decades, operating in the Less-Than-Truckload (LTL) space. That simply means customers don’t book a full truck — just part of it.

Lower cost for them. Higher margin for ODFL.

Why? Because it gives them pricing power.

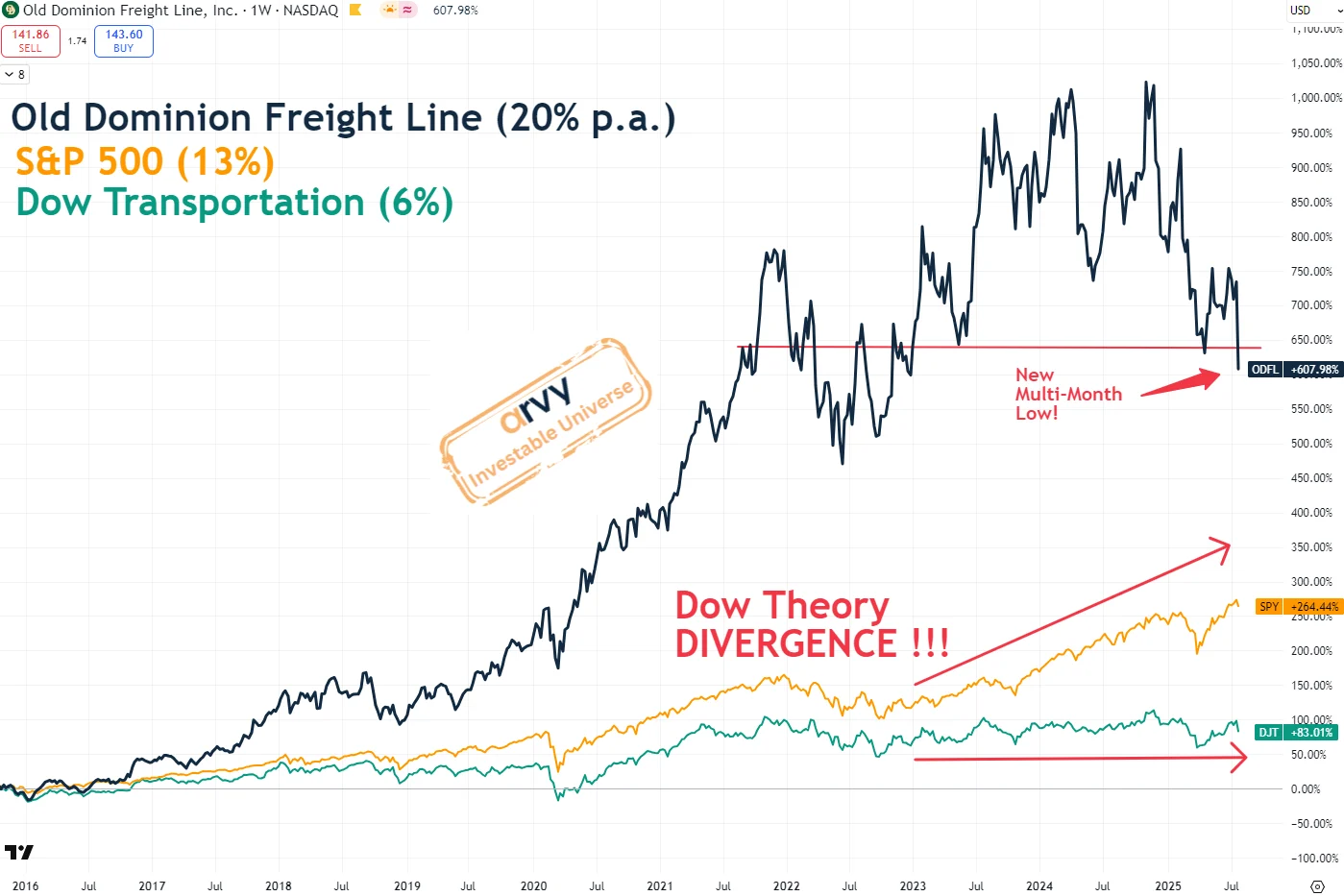

And the success of that model is written all over their stock price — one of the top performers in the entire S&P 500 over decades (chart 2).

How come?

Because the Congdon family, who still own 18% of the company, obsess over one thing: Customer experience.

In trucking, you can measure that. There are two Key Performance Indicators (KPI) that say it all:

And that’s across 47,288 shipments a day!

Now think about it.

With that many shipments, ODFL sits on a goldmine of real-time economic data. Who is booking LTL? How much? How often? How fast? They see what’s really happening in the real economy before anyone else does.

ODFL is the pulse of the economy — in real time.

And the result of those strong KPI’s?

ODFL has been named the #1 national LTL carrier for 15 years in a row — beating every major competitor.

It’s simply the best-in-class trucking operator. And no, they’re not getting comfortable.

Because the opportunity set is still gigantic!

Chart 2: Best performing Stocks in the S&P 500 over last 5, 10, 15 & 20 years (Total Return)

Source: Charlie Bilello, Creative Planning

If You Pay for Quality, You Just Have to Cry Once

The long-term mindset of the Congdon family and their relentless focus on customer experience and quality has built nothing short of an operational efficiency masterclass.

On one hand, their approach allowed ODFL to push through premium pricing — and that, in turn, is reflected in industry-leading profitability.

The key metric here is the Operating Ratio (OR), which stands at 75.4% for ODFL compared to 80%+ for peers - think of FedEx, Saia, XPO Logistics & ArcBest Operations.

The OR measures how efficiently a company operates — it shows operating expenses as a percentage of revenue.

The lower the better.

It means the company is spending less to generate every dollar of sales. And ODFL?

They absolutely crush it.

Now let’s flip it to the customer side. There’s a saying that fits ODFL to perfection: “If you pay for quality, you only have to cry once.”

And you know exactly what that means.

You pay up — but then you don’t have to worry about missed deliveries, damaged goods, or chasing refunds. You just ship. ODFL just delivers.

Reliable. Predictable. Trusted. In this business, that’s everything.

That reputation made it almost effortless for ODFL to eat market share for breakfast — especially from less efficient competitors, many of which are unionized and burdened with legacy cost structures.

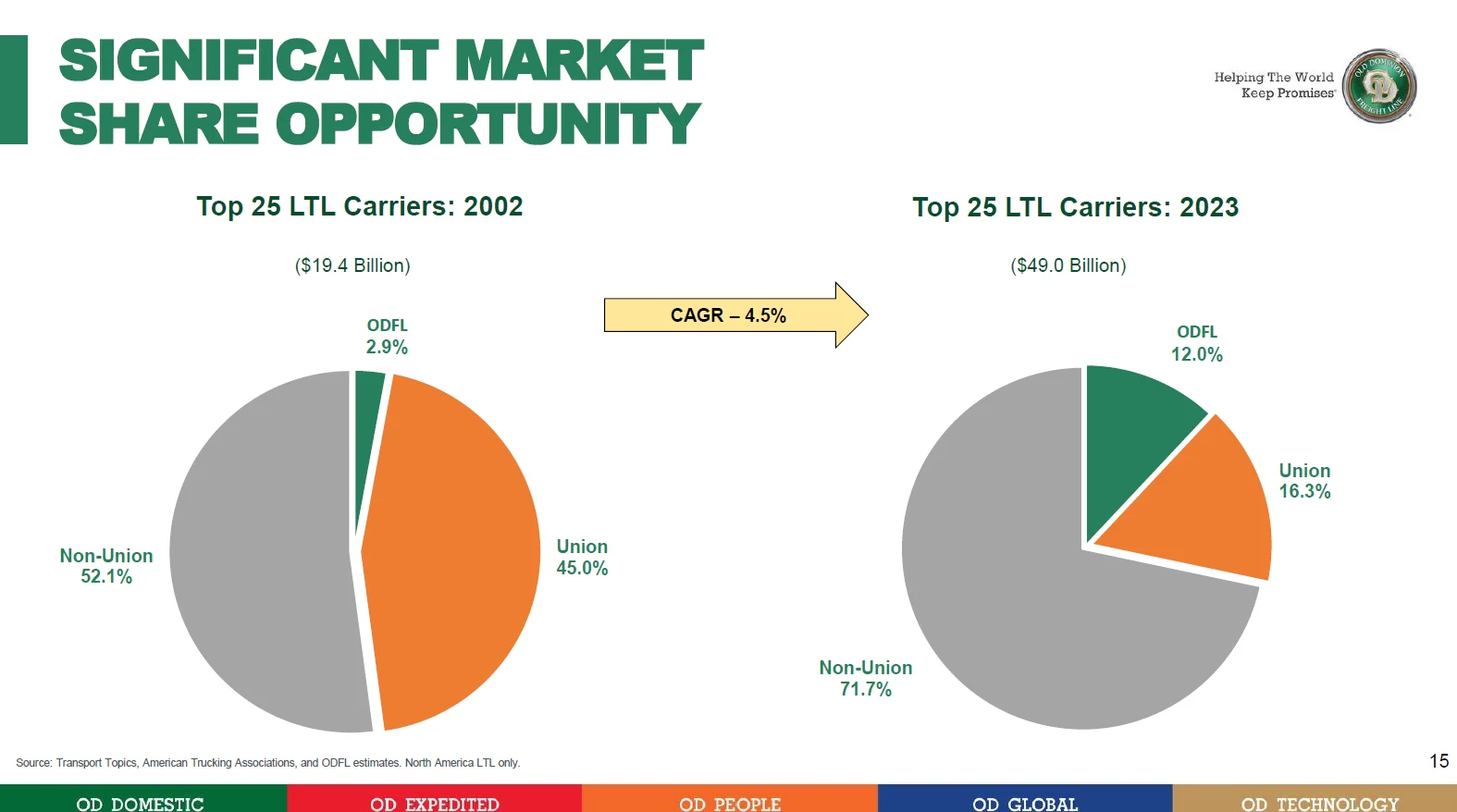

ODFL went from 2.9% to 12% market share over the last 20 years (chart 3).

Business execution at its finest.

Lastly, ODFL is a pure-play beneficiary of the structural growth of e-commerce. Just think about your own street. Zalando boxes? Amazon deliveries? Daily. Non-stop. Me too, I am guilty as charged.

Taking all into consideration, ODFL is a hell of a “Good Story.”

And the stock price reflected that — one of the most impressive long-term charts we’ve ever seen at arvy.

But that “Good Chart” now?

It’s cracking.

Hard.

And when that happens, the market’s trying to tell us something.

Which means it’s time to bring in the Dow Theory.

Chart 3: Significant Market Share Opportunity for Old Dominion Freight Line

Source: Old Dominion Freight Line, Company Presentation 2025

Dow Theory Divergence: A Classic Warning Sign

Let’s now talk about the elephant in the room.

The Dow Theory.

A 100+ year-old framework used by market veterans to spot major trend shifts before they hit the headlines.

At its core, Dow Theory says: For a market rally to be sustainable, both the broader market (Dow Jones Industrial Average or S&P 500) and the Dow Jones Transportation Index need to move in the same direction.

And now we know why transportation. Because it reflects the movement of goods — a proxy for real economic activity.

No goods being shipped = no business being done = red flags.

Now, look at the chart (chart 4):

This is textbook divergence — and Dow Theory is flashing bright red. When the leaders of the real economy falter while the market keeps climbing?

That’s not momentum.

That’s a disconnect.

In short: The market is celebrating at the top floor. But the guys working the freight elevators — they’ve left the building. And that should make any long-term investor pause.

Don't panic just yet. A divergence does not mean that the market will collapse tomorrow.

But it has often meant reality catches up.

So yes — ODFL still tells a “Good Story.” But the “Good Chart”? It's starting to stir up trouble.

And the Dow Theory is listening.

arvy and I are on guard!

Chart 4: Old Dominion Freight Line & Dow Theory (S&P 500, Dow Transportation), last 10 years

Source: TradingView