PayPal Mafia: Rebels, Visionaries, Tech Pioneers

“My proceeds from the PayPal acquisition were $180 million. I put $100 million in SpaceX, $70m in Tesla, and $10m in Solar City. I had to borrow money for rent“

– Elon Musk

arvy's teaser: The PayPal Mafia didn’t just build a company — they launched a generation of industry-defining empires. Vision, risk, and founder DNA turned a scrappy startup into a blueprint for Silicon Valley dominance.

Founders.

We look up to them.

They are admired, envied, and endlessly talked about. Surrounded by groupies, gossip, and gloating.

And here comes a group that defined 21st-century innovation. Names that stir passion. Admired and hated in equal measure.

Before they launched rockets into space or rewired global social networks, they were just scrappy outsiders. Building an online payments start-up. PayPal.

It was a knife fight: brutal competition, internal battles, waves of online fraud, and the dotcom bust crashing down. Success was far from guaranteed.

But they made it. And what they built became one of the world’s most important companies.

The alumni? You know them all. The name?

The PayPal Mafia.

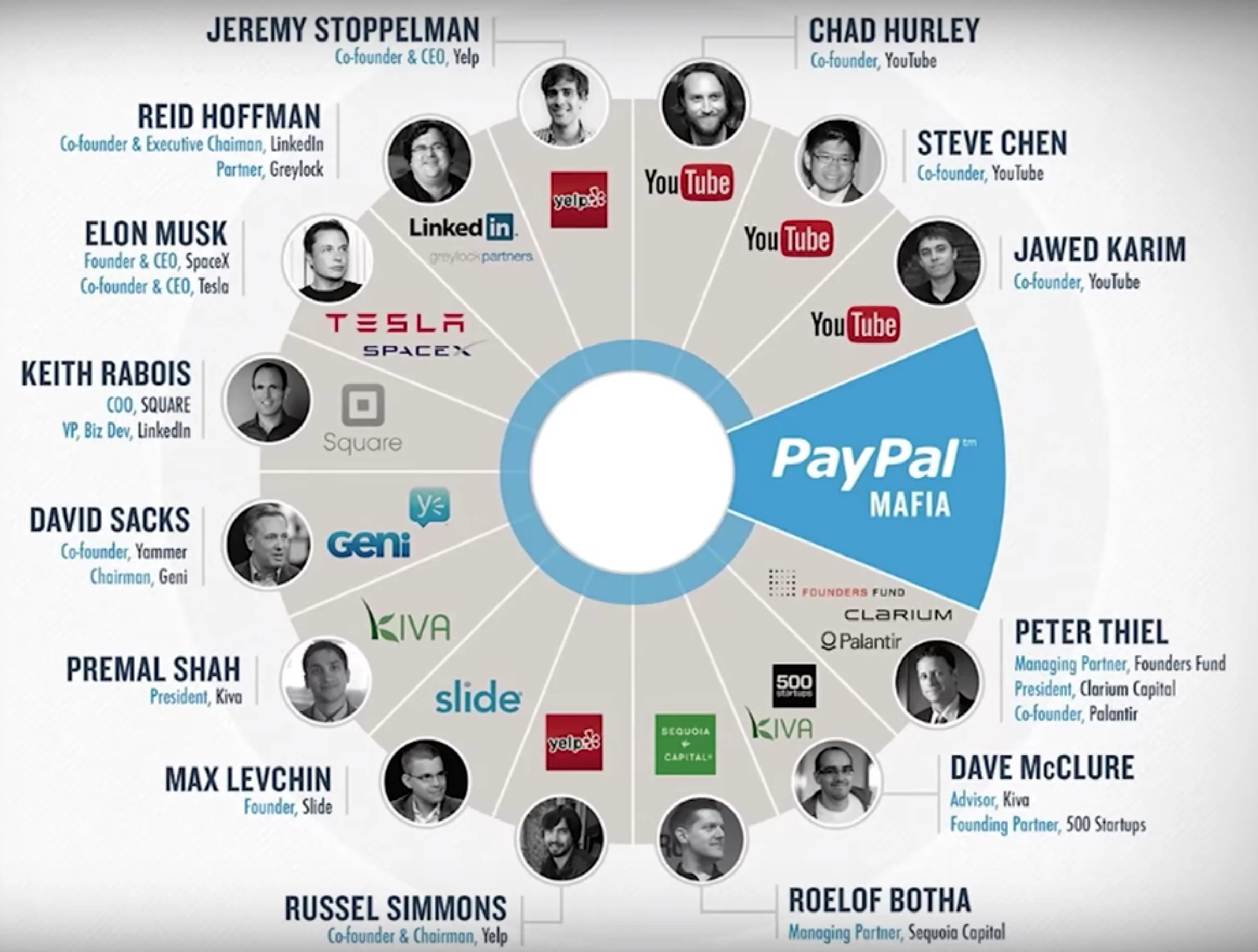

Chart 1: Members of the PayPal mafia and companies that have emerged from it

Source: Medium, Ross Simmonds

The PayPal Mafia – Members and Companies

First things first. Who are they?

The PayPal Mafia is a group of former PayPal employees and founders who went on to build (or back) some of the most iconic tech companies of the 21st century (chart 1).

Originally, PayPal was a money-transfer service offered by a company called Confinity. In 1999, it merged with Elon Musk’s online bank X.com. Later, X.com was renamed PayPal and in 2002, eBay bought it for $1.5 billion.

Fun fact: Musk kept the X.com domain — and yes, that’s the “X” he later slapped on Twitter.

But here’s the twist. The original PayPal crew couldn’t stand eBay’s corporate culture. Within four years, all but 12 of the first 50 employees were gone.

Gone, but not forgotten.

They stayed connected. And what followed was nothing short of Silicon Valley history.

The most famous spin-offs? Tesla. LinkedIn. Palantir. SpaceX. YouTube. Yelp. Yammer. Affirm. (chart 1 again).

That’s why the term PayPal Mafia was born.

The most famous members?

You could spend hours falling down this rabbit hole. At arvy, we'll be happy to give you the full blast.

The book: The Founders by Jimmy Soni (chart 2).

It’s a thriller-like history of PayPal and the entrepreneurs who shaped Silicon Valley. And it’s also been an important part of our evolved thinking around founder- or family-led businesses.

When founders stay at the wheel, the “Good Story” often stays intact.

Because here’s the thing.

There’s a pattern.

Chart 2: The Founders – The Story of PayPal and the Entrepreneurs who shaped Silicon Valley

Source: arvy’s Book Club

Founder Led Businesses Outperform

Markets love numbers. Investors pore over margins, multiples, and models. But behind every line item sits something harder to quantify: the people steering the company. And that matters — a lot.

As a co-investor in my own strategy, I want to back companies where leadership has fire in their eyes — for their product, their mission, their future. That’s why I look for founder-led or family-run businesses.

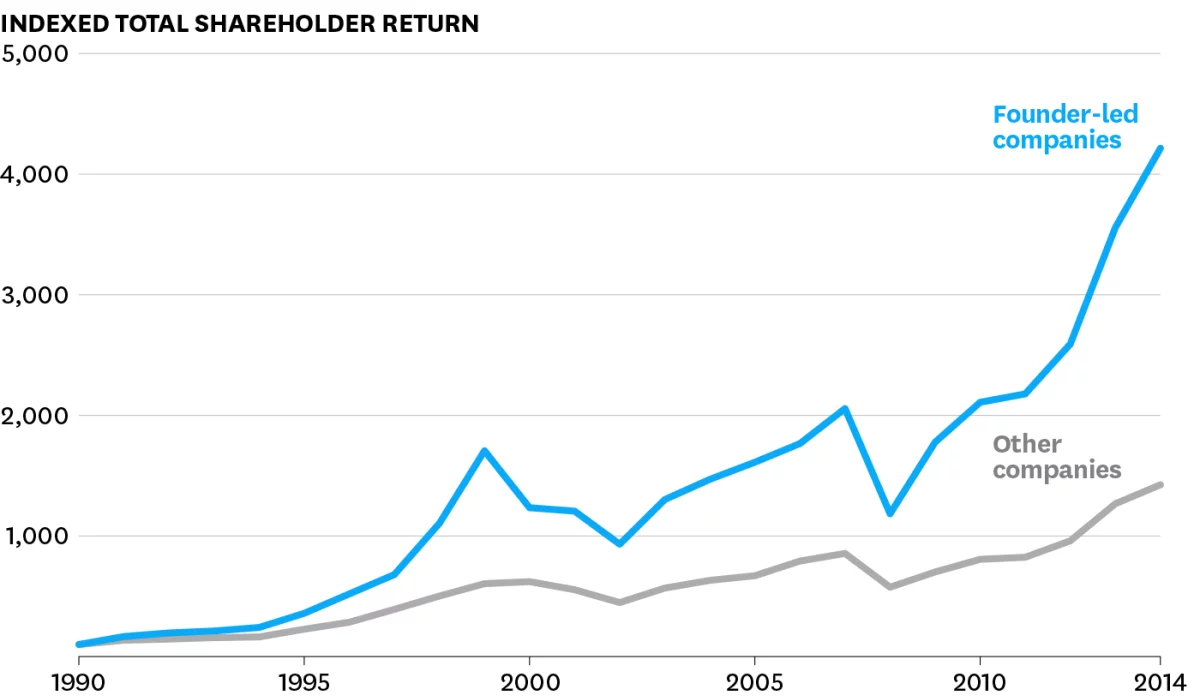

History shows that businesses still shaped by their founders (or families) tend to outperform (chart 3). The “Good Chart” confirms what the “Good Story” suggests: leadership that is personally invested — not just financially, but emotionally — drives long-term value creation.

Why?

Because founders don’t think in quarters — they think in decades.

They carry the scars of the early days, the late nights, and the near-bankruptcies. That experience creates a culture where product, purpose, and persistence take center stage.

Contrast that with a professional manager parachuted in to “optimize operations.” The incentives differ. For many, it’s about this year’s bonus (DOLF; Day Of Long Faces), not the next 20 years of compounding.

The PayPal Mafia is proof in real life.

Elon Musk didn’t just build Tesla and SpaceX; he bet his entire fortune on them.

Today’s quote highlights his significant investment in his ambitious ventures and the financial difficulties he faced even after the PayPal sale.

Reid Hoffman grew LinkedIn into the world’s professional network. The YouTube founders turned grainy clips into a platform used by billions. Peter Thiel helped shape Palantir into a data powerhouse. These aren’t stories of incremental improvement — they’re stories of vision, risk, and relentless ownership.

As the saying goes, culture eats strategy for breakfast. And no one imprints culture as deeply as a founder.

But let’s be clear: founder-led isn’t a free pass. Blind faith in a visionary can be just as dangerous as ignoring one. Founder DNA is powerful — but it’s only one piece of the puzzle.

A piece of the mosaic.

Chart 3: Founder-Led Companies Outperform the Rest (based on S&P 500)

Source: Quartr

A Piece of the Mosaic — Alongside Moats, Margins, and Growth

Because in the end, owning great businesses isn’t about chasing a single trait.

It’s about stacking the odds.

History shows that winners consistently exhibit a combination of. We call this a “Good Story”:

A visionary founder may light the fire, but it takes a robust business model to keep it burning. Pricing power that holds in downturns, returns on invested capital that compound like clockwork, and a moat that deters copycats — these are the gears that make a business durable.

Cash is king. Strong free cash flow, combined with a reasonable valuation, ensures the story is not just pretty on paper but bankable in reality.

Growth matters — both top line and bottom line. Companies that can scale revenue without watching margins collapse are rare, and markets reward them accordingly.

Tailwinds matter too. Invisible forces — demographic shifts, digital adoption, decarbonization, rising disposable incomes — quietly push businesses forward over decades.

Finally, debt discipline is non-negotiable. The best businesses don’t just survive tough cycles — they emerge stronger because they weren’t strangled by leverage.

So yes, a founder’s vision sparks greatness. But lasting greatness comes when vision meets structure, discipline, and tailwinds.

That’s the mosaic we seek.

Chart 4: List of the most prominent companies founded, co-founded or backed by members of the PayPal Mafia that are listed on a public stock exchange (Telsa, Palantir, Meta Platforms, Affirm, Yelp)

Source: TradingView