Porsche: Engineering Dreams, Investor Nightmares

“I couldn’t find the sports car of my dreams, so I built it myself.”

– Ferdinand Porsche

arvy's teaser: Porsche dazzles on the road but stumbles on the stock market. Once chasing Ferrari’s margins, it chased volume instead — and lost balance. Luxury is scarce. Porsche stock, sadly, is not.

911.

Brum, brum.

You know exactly what I’m talking about.

When it comes to high-performance sports cars, the name Porsche 911 echoes instantly in the minds of automotive enthusiasts around the world.

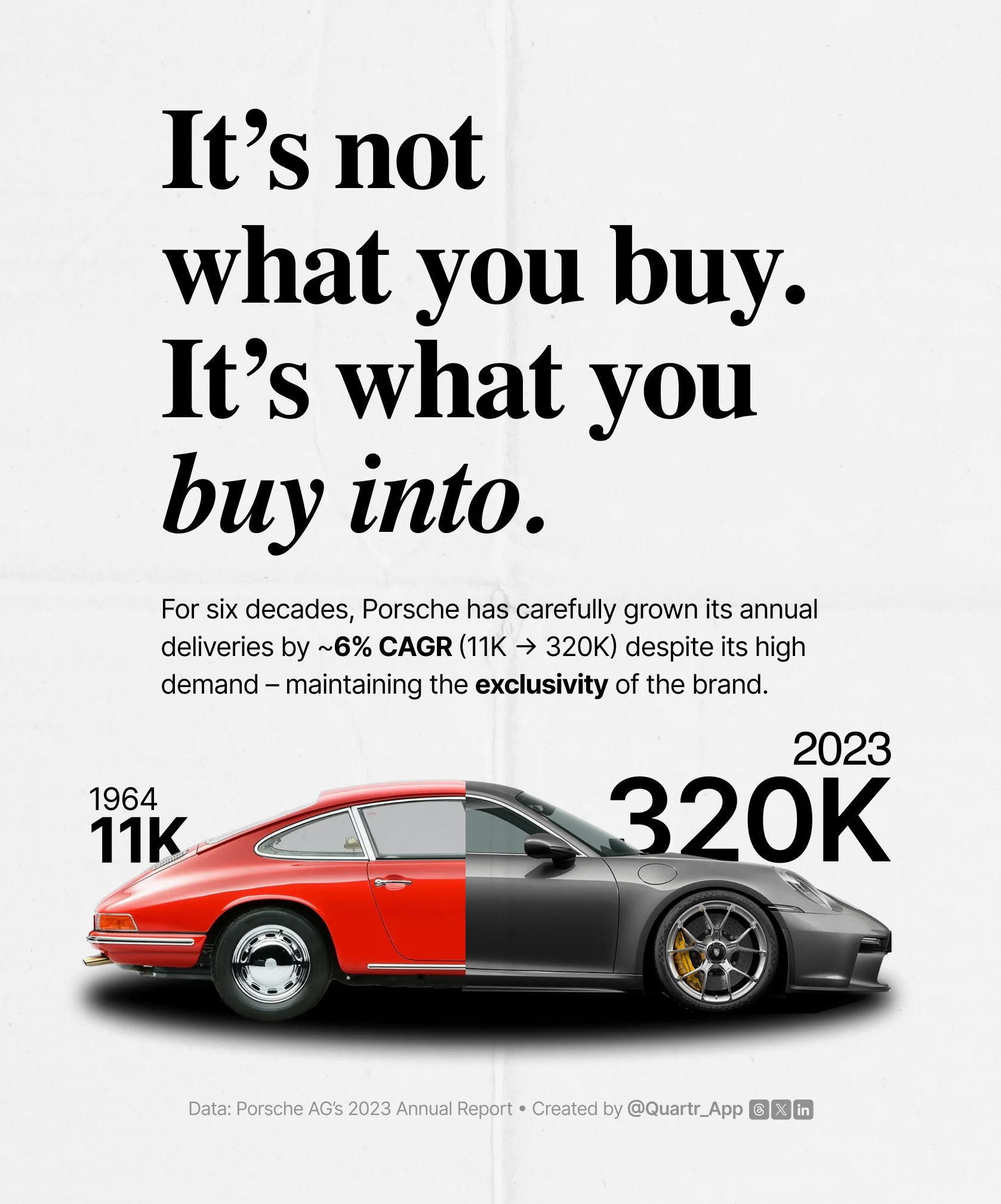

Since its introduction in 1963, the 911 has been universally admired for its timeless design. Even though it has undergone numerous updates and improvements over the decades, its unmistakable shape and style have always kept it immensely popular. Remarkably, over a million Porsche 911s have been manufactured since launch, evolving through eight significant “generations.” Each generational shift improved performance, comfort, and technology — yet all stayed true to the original ethos (chart 1).

The car is the flagship of a remarkable success story, family legacy, and German engineering art. But its stock? It feels more like hitting potholes on a bumpy road.

We are, of course, talking about a company that carries the same name as its masterpiece.

And the founding family.

Porsche.

Source: Quartr

First things first — grab a coffee, because this one needs your Friday brain switched on.

Porsche’s roots trace back to Ferdinand Porsche — the man behind the legendary Volkswagen Beetle, the “people’s car,” which went on to become one of the world’s best-selling vehicles.

To this day, the Porsche/Piëch family maintains control, with the torch of ownership carefully passed across generations. The bond was sealed when Ferdinand’s daughter, Louise, married Anton Piëch — intertwining two dynasties that still steer the empire.

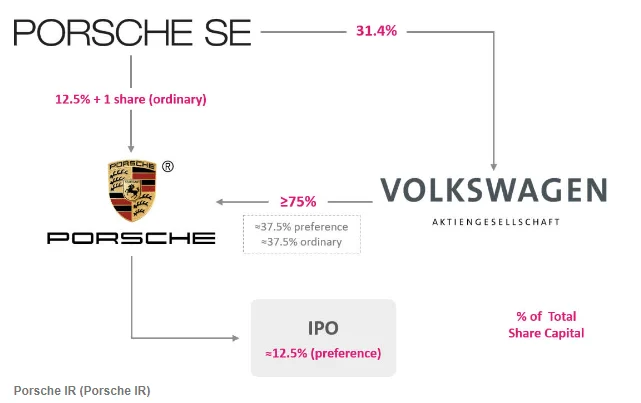

Now, let’s talk chart 2. If you really want to untangle who owns what, take a good look here. With one glance, you’ll always know who pulls the strings.

Here’s the short version: the family controls Porsche SE (Ticker: PAH3), the holding company. Through Porsche SE, they own 31.4% of Volkswagen’s equity but control 53.3% of its voting rights — giving them effective control over the €51 billion car giant. Volkswagen, in turn, owns over 75% of Porsche AG (Ticker: P911), while Porsche SE itself directly holds 12.5% of Porsche AG — spun off in the high-profile IPO of 2022.

Messy?

Absolutely.

Worth a Hollywood script?

Definitely - Don’t forget the infamous Volkswagen short squeeze — when, for two days, VW became the most valuable company in the world. This is one story among many others.

But let’s keep focus here: Porsche AG.

The company sells more than ten times as many cars as peers like Ferrari, Bentley, or Lamborghini — and around 65% of its cars sold cost over €100,000. Over the past five years, Porsche has grown volumes by 25%, driven mainly by strong demand from China.

And that’s where the plot twist comes in.

What was once Porsche’s growth engine has now turned into its biggest headache. Demand in China is expected to fall by more than 50% in 2025 compared to the previous peak.

Porsche needs to pivot.

Dramatically.

Source: Seeking Alpha, Patrick Kroneman

For Porsche, everything comes down to balance — balancing exclusivity with volume growth to protect its most precious asset: the brand.

In 2024, Porsche sold 311,000 vehicles at an average selling price of €129,000.

But is that truly exclusive?

Let’s put it in context.

Now, as an investor, never forget two truths:

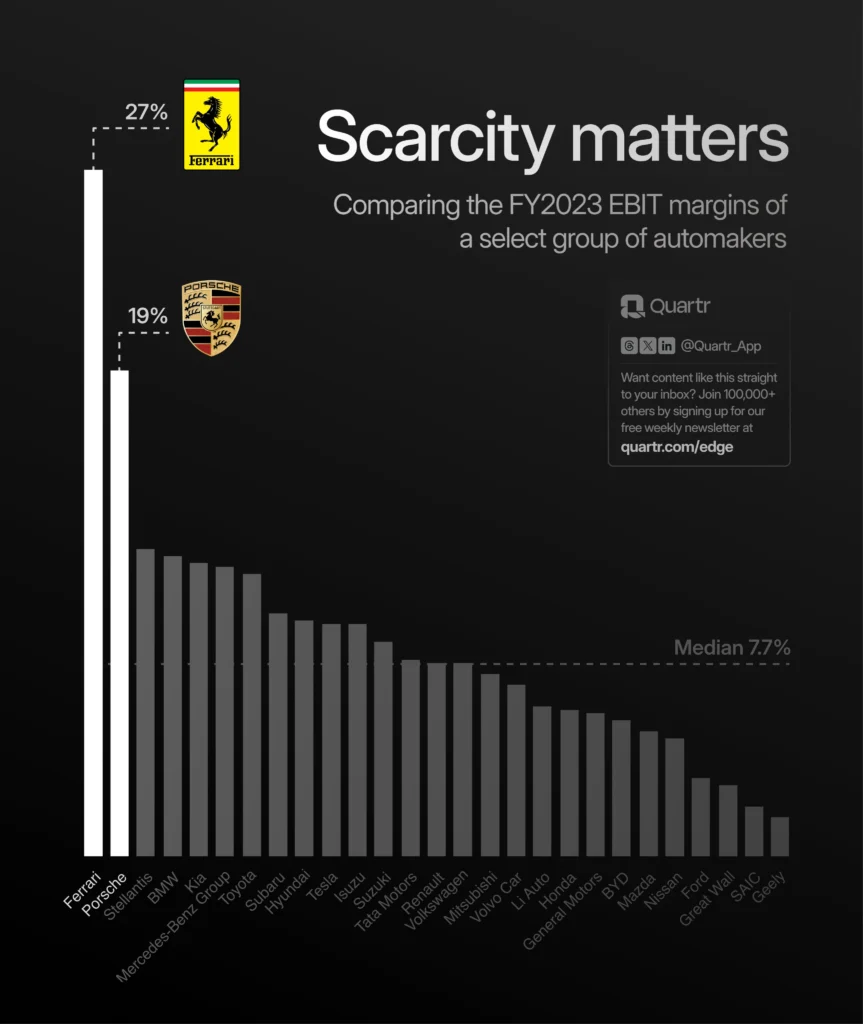

And while substitution isn’t the threat in autos (we all still need cars), competition is relentless. That’s why the median EBIT margin of a carmaker is only 7.7% (see chart 3). Thin margins, brutal cycles, and hardly a “Good Story.”

That’s why at arvy, we usually steer clear of automakers as investments. But the exception to the rule sits in Maranello: Ferrari.

“Il Cavallino Rampante” plays in the luxury arena, not the auto pit. Its 29% EBIT margins rival Hermès (41%) and LVMH (21%), fueled by the ultimate luxury ingredient: scarcity.

Porsche, however, has drifted.

Once boasting EBIT margins of 19% (see again chart 3), Porsche chased volume — growing sales by 25% in five years and overstretching demand. Add to that a -50% demand slump in China and heavy bets on electric vehicles (with targets of 50% of sales by 2025 and 80% by 2030, built on the Taycan and the EV-only Macan) that have not lived up to expectations. The result? Porsche missed the turn and margins dropped to 10%.

And while these challenges pile up, rumors now swirl that CEO Oliver Blume — wearing the dual hat of Volkswagen and Porsche since 2022 — may step down from Porsche. Another layer of uncertainty.

The strategic pivot investors are waiting for? It hasn’t materialized yet.

And the market? It didn’t blink. It punished the stock.

The “Good Chart” took its toll.

Chart 3: Scarcity matters, EBIT Margins of a select group of automakers

Source: Quartr

IPO Base

Now let’s focus on the stock price.

Porsche was spun off and IPO’d in 2022.

And at arvy, whenever there’s an IPO or a spin-off — listen! There might be a big winner around the corner. Think Ferrari from Fiat Chrysler Automobiles (today Stellantis), PayPal from eBay, or more recently our Swiss darling Accelleron Industries from ABB.

But what we never do is blindly jump in.

We wait.

We let Mr. Market confirm if the “Good Story” is indeed a good story. That means watching for a multi-week (if not multi-month) consolidation. Only when the “Good Chart” confirms the “Good Story” do we act.

At Porsche?

There was a brief period of euphoria post-IPO, followed by a multi-week consolidation — its first since being listed (see chart 4). That “IPO base” gave us a potential first buy point, the breakout a confirmation.

But the follow-up price action?

South.

Down.

The trend — including the 200-day moving average — is still pointing lower.

Right now, Porsche stock is bottom-fishing territory, or worse, a hope-for-turnaround trade. And hope is not a strategy at arvy.

At the moment, our conclusion is simple.

We wouldn’t pass on the 911.

But we pass on the stock.

Chart 4: Porsche AG since its Spin-Off and initial public offering in 2022

Source: TradingView