AutoZone: Recession? Inflation? No problem for this company!

„Pay attention to the cannibals“

– Charlie Munger

Cars.

By no means the usual, top-notch investment.

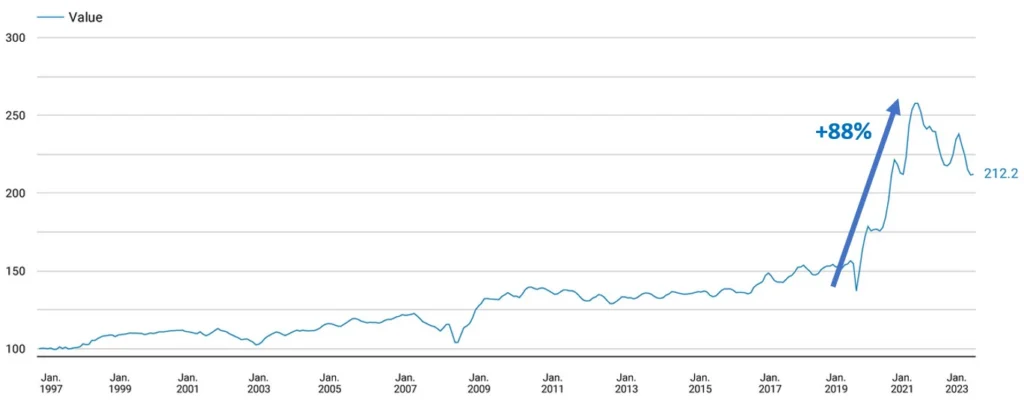

In particular, when you think of ordinary used cars. Yet, in the US, they performed virtually the same as the S&P 500 from the Covid lows in March 2020 to the peak.

Return?

88% for used cars versus 90% for the main US market.

Yes, you read that correctly. You literally enjoyed an 88% increase in value on your Toyota Prius due to a crazy set of circumstances.

Several factors played into your hands. In general, car ownership in America is on the rise - 92% of households have at least one vehicle. When the world came to a halt during Covid, car production collapsed due to a shortage of chips. As a reminder, a normal car has about 1,000 chips. A Tesla has more than 3,000. Those shortages are finally unraveling but now rising inflation has led to higher interest rates and thus higher lease rates. This means that the demand outlook is unclear and car producers remain cautious to increase production.

No supply of new cars meets significantly rising prices for used cars. So for now, you keep your car as long as possible.

This is where a very interesting sector comes into play.

Auto parts retailers.

Chart 1: Manheim Used Vehicle Value Index

Recession and inflation proof

Sleepy business.

This is how you could explain the auto parts retailers market.

It involves the sale of automotive spare parts, tools and accessories to professionals and do-it-yourself customers.

It grows by 7% every year. Come rain or shine.

The business model is simple. In the US, which is a car-loving country, there is an ever-growing middle class buying cars. On top, public transportation in the US is almost non-existent and hardly used. More people mean more cars, which means more miles driven, which means more repair potential, which in turn means more business for auto parts retailers.

And the icing on the cake?

The sector is recession and inflation proof.

Why?

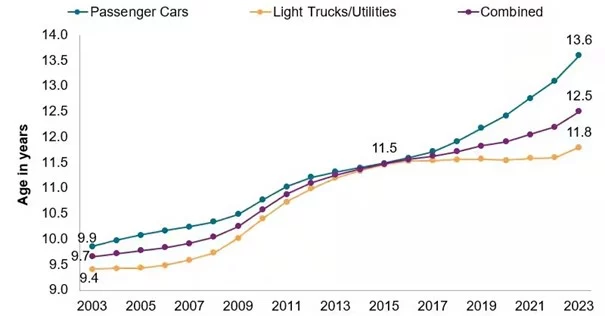

Chart 2: Average age by vehicle type

The King of Do-It-Yourself

A car is the second-largest purchase for an individual after the decision of buying a house.

Inflation means people have less money to spend on new cars, while vehicle prices skyrocket. And with an uncertain economic outlook, people are generally more willing to repair their cars than replace them.

That is exactly what people are facing now. Higher inflation and rising lease rates coupled with fears of a recession.

So, it is better to keep your old car and repair it, if necessary, right? This is reflected in the rising average age of cars, which are getting older by the day.

Here is where the king of do-it-yourself steps in.

AutoZone.

The leader in DIY auto parts retail and a trusted source for vehicle components. Many rely on its knowledgeable sales staff for advice on complex automotive parts. They enhance this support by providing free tool loans, repair guides, how-to videos, and diagnostics at their stores.

As this week's results show, business is running on all cylinders. In addition, customers are not very price sensitive since their car needs to be repaired anyway. You can pass higher prices (inflation) on to them.

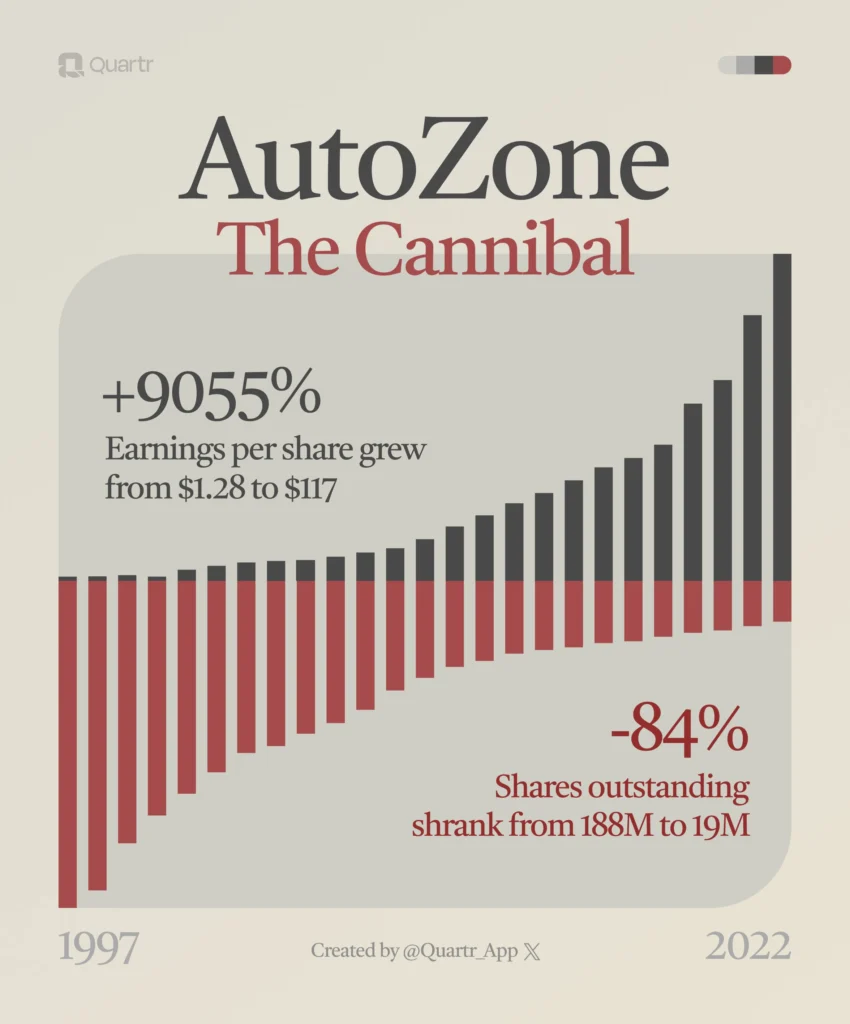

AutoZone prints money and does something special with it.

It eats itself.

Chart 3: AutoZone, the cannibal

The cannibal

Scorpions are not the only ones known for cannibalism.

It is also a notorious act in the stock market world. It is a word popularized by Charlie Munger, Warren Buffett's best friend, decades ago. In short, it involves companies buying back their own stock.

A prime example of a cannibal is AutoZone. The company has been buying back its own stock on a massive scale over a very long period.

Extremely successful.

Think of a company's shares as slices of a pie. When the company decides to buy back its own shares, it is like they are taking a slice of that pie away, but the pie remains the same overall size. Now, with fewer slices (or shares) available, each remaining slice represents a larger portion of the pie. So, if you are an investor holding onto a slice, your piece of the pie just got bigger in terms of ownership percentage. As a result, the value of your slice (or share) in the company increases. In Switzerland, this process is tax-free compared to dividends.

In AutoZone's case, this happens while the company is making huge profits.

Sleepy business no longer sounds so bad, does it?

Chart 4: AutoZone since 2007

arvy's takeaway: In the world of investing, sometimes it is the unexpected heroes that shine the brightest. Auto parts retailers have quietly thrived amidst economic uncertainties, proving their mettle in both recession and inflation. Their steady growth, combined with the unique 'cannibal' approach of buying back shares, exemplifies the resilience of AutoZone. So, remember, when everyone else is looking elsewhere, sometimes the road less traveled can lead to surprising success.