Swiss Equities: 7.7 % p.a. Return (in CHF) over 99 years!

“Unus pro Omnibus, Omnes pro Uno”

– Switzerland's unofficial motto meaning “One for all, all for one”

arvy's teaser: Welcome to the Swiss Equity Special! They are the silent compounders of global markets. No hype, no headlines — just nearly a century of relentless compounding. Built on stability, modesty, and precision. This is long-term wealth, the Swiss way.

1291.

1st of August.

Happiest 734th birthday, my beloved Switzerland.

This iconic date traces back to the Federal Charter of 1291 — the Pacte du Rütli — when three Alpine cantons (Schwyz, Uri, and Unterwalden) swore an oath of confederation (chart 1). That simple act of unity later came to be seen as the birth of Switzerland.

Fast forward a few centuries.

In 1926, Switzerland’s stock market quietly joined the party — and since then, it’s been compounding like Swiss clockwork: steady, precise, relentless. Next year, it hits a major milestone with 100 years of market history.

So, what’s the score?

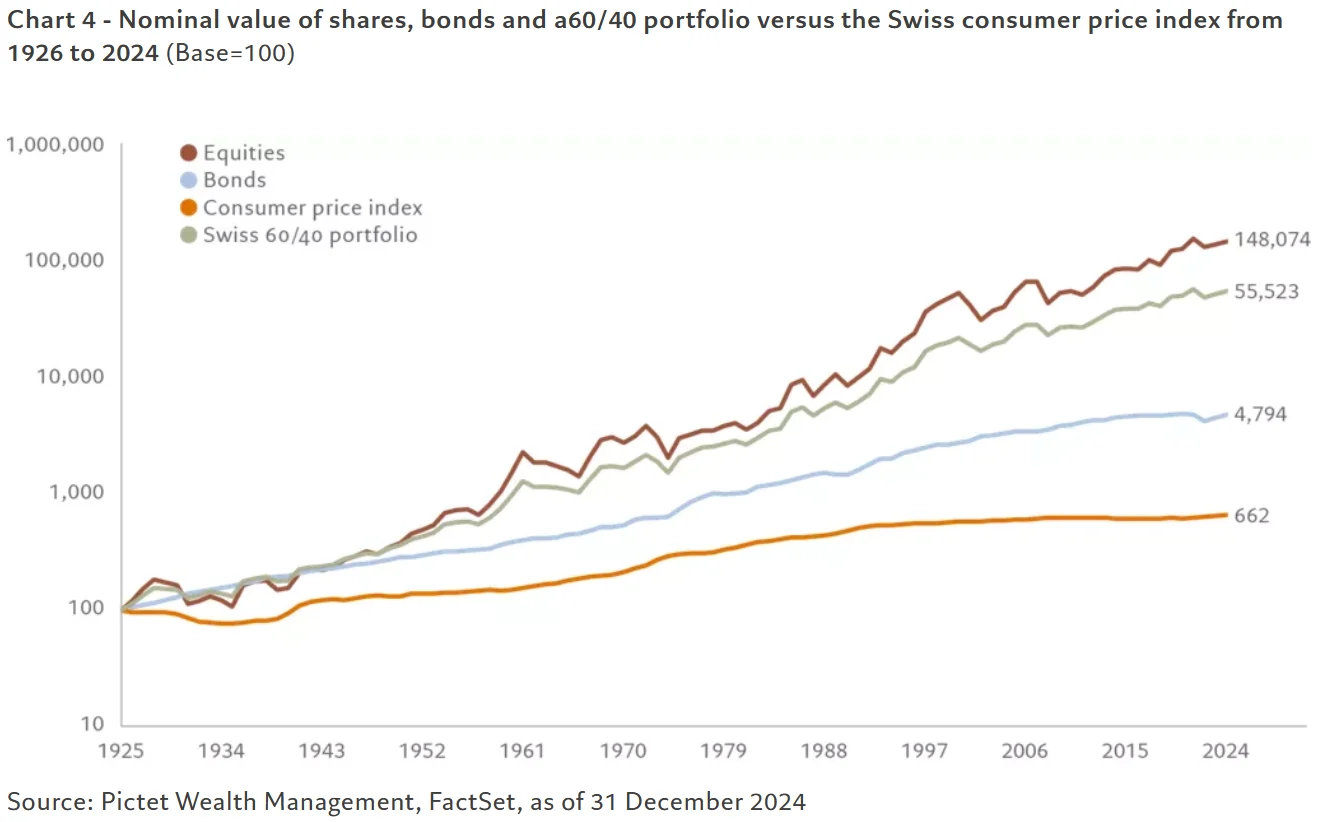

According to a long-term study by Pictet — which we gratefully borrow (and of course source 😉) for today’s birthday special — Swiss investors have enjoyed: 4.0% average annual return in bonds. 7.7% nominal return in equities (in CHF). Over nearly a century. Now that’s some serious clockwork.

How do those numbers stack up globally? And what does it mean in the language we love most — compound interest?

Let’s zoom in on the impressive track record of our home market and how to classify it.

Swiss equities, the stage is yours to show “Wo dä Bartli dä Most holt”!

Chart 1: Rütli pier with the three Alpine cantons swearing the oath of confederation

Source: Thierry’s drone, 1st of August 2019

Solid Returns from Swiss Equities

CHF 1’480’740.

That’s how much you’d have today if you had invested CHF 1’000 in the Swiss equity market 99 years ago (chart 2).

That's the magic of compound interest — or more precisely, the power of a 7.7% average annual return. And yes, taking inflation into account, it is 5.6%. Still solid.

Now, for those seeking less volatility: A balanced Swiss portfolio (60% equities / 40% bonds) has returned 6.6% per year on average since 1926 — and there has never been a 10-year period with negative returns.

“Do hauts mer jo de Nuggi use!”, the Swiss would say.

It proves what every investor learns (and re-learns): Time in the market beats timing the market.

And here’s the thing — Swiss equities don’t just perform. They’re backed by something deeper: a rock-solid foundation.

That’s the kind of structural resilience that supports long-term returns. It’s not just performance — it’s Swissness.That’s exactly where arvy comes in.

With "vy" — our voyage — we want to make this long-term mindset accessible, practical, and emotionally sustainable. Because let’s be honest: it’s easier said than done.

But of course, there are also headwinds. Especially when it comes to bonds in a low-interest rate environment.

At the moment, bonds are unattractive, and the good old Swiss saying puts it bluntly: “Chasch nöd immer de Füfer und sWeggli ha”.

So, let's keep our eyes on what is successful for now - and on the Swiss equity engine that has been quietly amassing wealth for almost a century.

Swissness. Stability. Stock market serenity.

Let’s dive deeper.

Chart 2: Nominal value of shares, bonds and a 60/40 portfolio versus the Swiss consumer price index from 1926 to 2024 (Base=100)

Source: Pictet Wealth Management, FactSet, as of 31 December 2024

Swiss Equities: The Long-Term Value of Patience and Perseverance

As mentioned, — easier said than done.

A drawdown in equities is always stressful. But zoom out, and time becomes your greatest ally. When viewed across nearly a century, bear markets fade into the background.

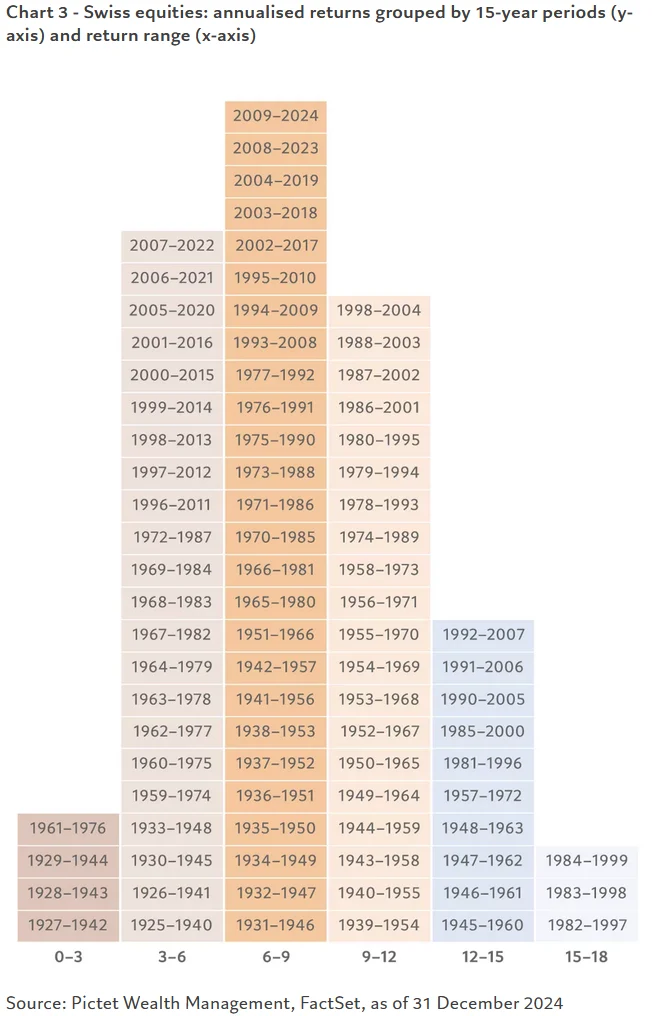

According to Pictet’s stunning analysis, from 1926 to 2024, Swiss equity investors with a five-year horizon experienced a negative return just 14 times. Unsurprisingly, most of those dips trace back to the big three market corrections:

So yes, a little bad luck is part of the journey.

But here’s the kicker: No one who held Swiss equities for 14 years or more ever lost money (see chart 3 for 15-year rolling returns — it’s a beauty).

Even if you invested at the worst possible moment — at a peak, before a war, or during a crash — you'd still come out ahead after 14 years.

Let that sink in.

I repeat.

Never a negative return over any 14-year holding period. Despite world wars, financial crises, oil shocks, pandemics, and political turmoil.

The point? In investing, playing the long game immediately puts you ahead of most.

You just must sit and wait.

And that’s exactly where arvy comes in again:

And worried about bad timing when you start investing? There are smart ways to reduce that risk:

And how has Switzerland managed such consistent, long-term success?

With a “Good Story & Good Chart,” of course. As the Swatch Group once beautifully summed it up in their Swiss German annual report, it's about: Modesty. Quality. Intelligence. Diversity. Simplicity. Reliability.

That’s the Swiss way.

Turns out, you don’t need Big Tech or moonshots to build wealth.

Just a good compass, a long horizon, and a clear mind.

Let’s check the numbers.

Chart 3: Swiss equities: annualized returns grouped by 15-year periods (y-axis) and return range (x-axis)

Source: Pictet Wealth Management, FactSet, as of 31 December 2024

Swiss Performance Index = S&P 500 — At Least Return-Wise

No Big Tech? No Moonshots? No Problem.

Let’s talk numbers.

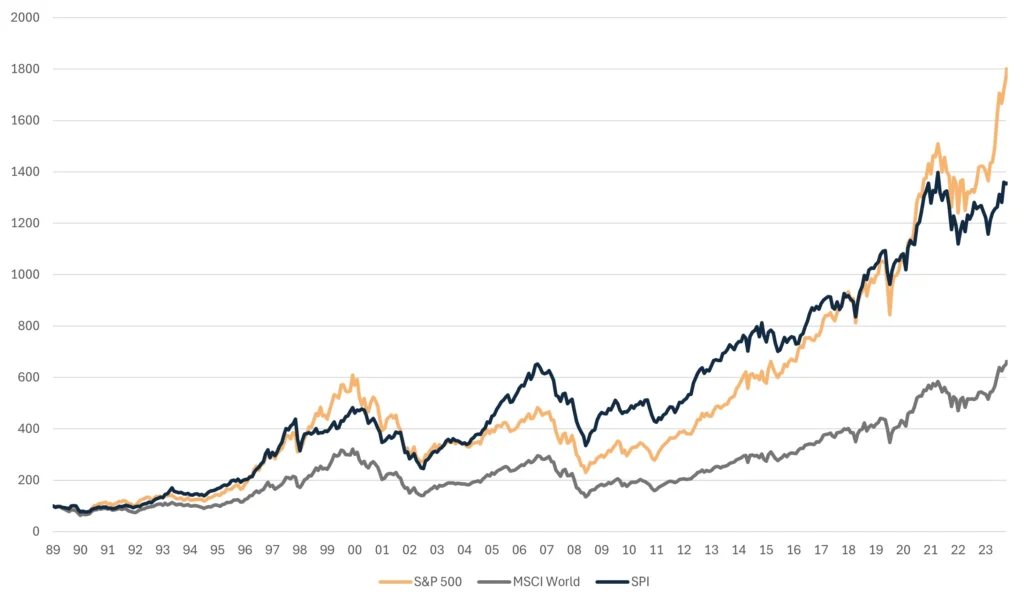

Swiss equities haven’t just held their ground over the long run — they’ve quietly matched some of the loudest markets out there. Yes, even the S&P 500 (chart 4), filled with names like Nvidia, Meta, Microsoft, Alphabet, Apple, Amazon, Tesla, Netflix, Palantir and Co.

How is that possible?

The S&P 500 returned ~10% p.a. in USD over the last century.

Swiss equities delivered 7.7% p.a. in CHF.

Now factor in currency. The USD lost ~2–3% annually to the CHF over decades.

Do the math, and it turns out: US and Swiss equities delivered almost identical returns when viewed in CHF. Or vice versa in USD.

Moral of the story?

Always compare apples to apples. Returns mean little without context.

Of course, both indices now have their flaws:

So, what’s the takeaway?

As we celebrate Switzerland’s birthday and nearly a century of Swiss equity compounding, we believe today’s setup is a gift — not just for our beloved country, but for thoughtful long-term investors and stock pickers.

And that’s why we established arvy. Built on the same values that shaped Switzerland: Modesty, Quality, Intelligence, Diversity, Simplicity, Reliability.

Built for the long run. Built to last. Built for you.

Happy Birthday, Switzerland!

Love, team arvy.

Chart 4: Swiss Performance Index vs MSCI World & S&P 500 since 1989, in CHF, Total Return

Source: Bloomberg