BlackRock: The best of both worlds

"If you want to have a better performance than the crowd, you must do things differently from the crowd"

– Sir John Templeton

arvy's Teaser: BlackRock, the asset management giant, masters the balancing act between active and passive investments. With assets under management of USD 9.1 trillion, its diverse strategies and solid corporate culture cement its supremacy. The mastermind and innovative CEO Larry Fink reinforces its "best in class" status.

Active vs. passive.

In investing, this is an endless debate.

At arvy, we are advocates of active management, even though we are experiencing the worst decade for active fund managers. It is not surprising to us considering the many reasons we have given in the past (what keeps me awake at night) and that the average equity fund manager buys far too many stocks and essentially follows the index. As a result, you get the index minus the manager's fees and trading costs. This structure makes underperformance against the index inevitable.

According to Sir John Templeton and today's chosen quote, the only way to succeed in investing is to break out of the crowd. In a positive way, of course.

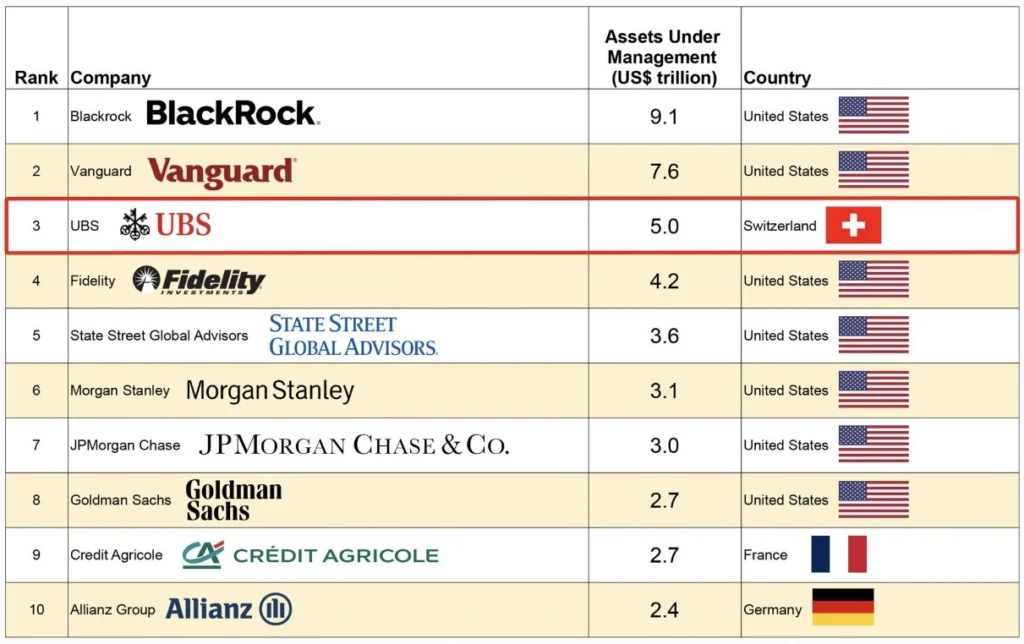

Speaking of breaking out of the crowd: Unlike most of its competitors, there is one asset manager who took on the debate by doing things differently from the masses (chart 1).

It positioned itself by focusing on the best of both worlds.

BlackRock.

Chart 1: World largest Asset Managers, by Assets Under Management (AuM)

Source: Advratings, March 2023

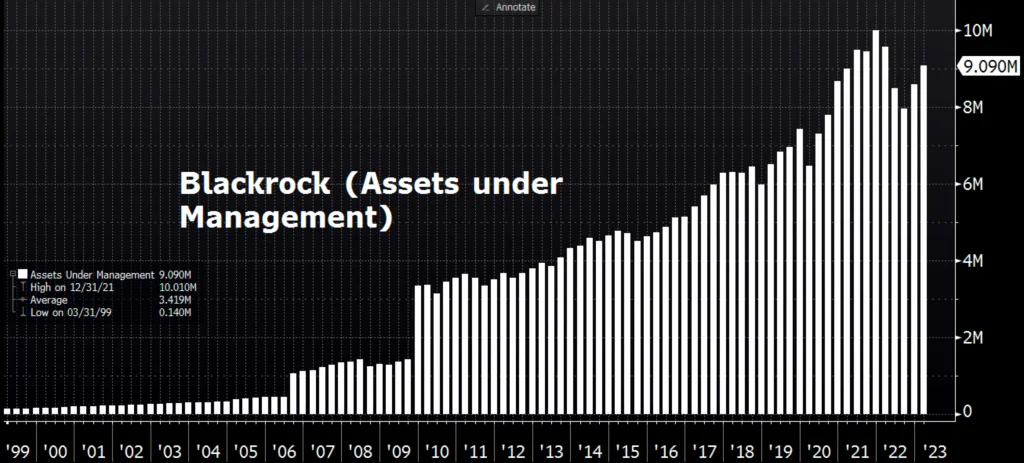

9,100,000,000,000

BlackRock has become the world's largest asset manager with total assets of USD 9.1 trillion (chart 2).

Read the number in the title. And yes, I also googled it as a precaution, because a zero can easily go under.

Better safe than sorry.

The US company has positioned itself well by focusing on being a passive investment business at its core, while also offering active strategies with investment managers who have established names, solid long-term performance and reasonable fees. In addition, Blackrock has built a strong brand identity with iShares in the ETF space and Aladdin, a data analytics tool for the institutional world.

The company's product mix is quite diverse with 2/3 passive and 1/3 active strategies (source: Morningstar):

Always in tune with the zeitgeist, Blackrock plans to get approval for the first ever Spot-Bitcoin ETF.

It gives you access to Bitcoin without having to own it.

Chart 2: BlackRock Assets Under Management

Source: Bloomberg

Mastermind Larry Fink

A good company should be backed by management with integrity and "skin in the game". Not only for me as a co-investor in my own strategy, but also for the companies I buy into, I want people to have fire in the eyes - for their company, their product and their vision.

Having integrity and "skin in the game" is very powerful.

What does that look like at BlackRock?

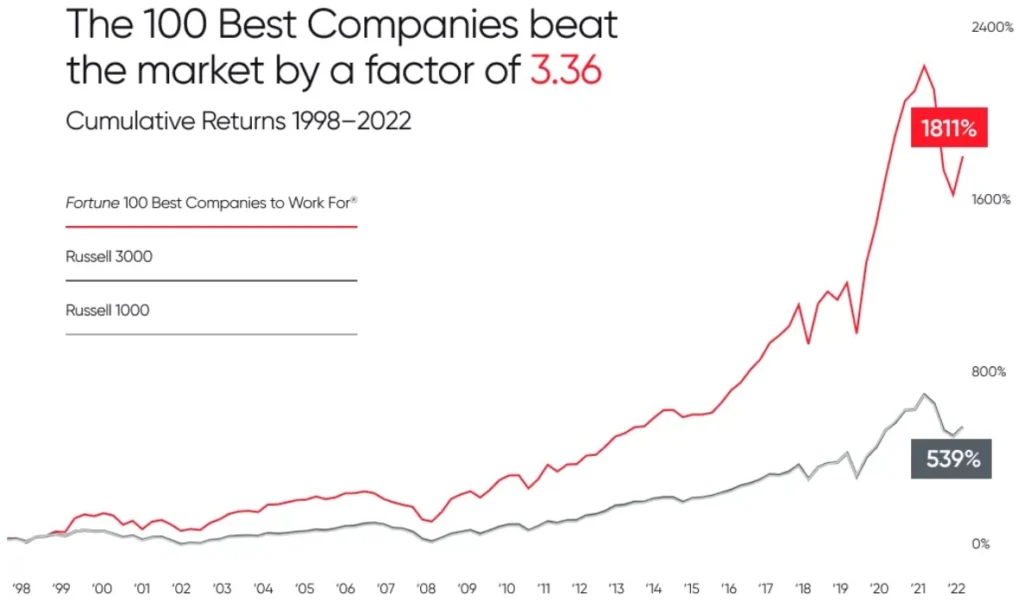

I believe that CEO Larry Fink's (with the company since 1988) insistence on a shared culture, centered on a common vision and operating on a common platform has also given the company an edge over its competitors.

Larry's interests are aligned with the interests of you, the shareholder. This includes incentives, honest feedback and communication, the way he deals with and addresses mistakes, the words and actions that follow, etc. This is also reflected in an 84% CEO-approval-rating on Glassdoor - an anonymous company review website.

In short, a great place to work (77% would recommend it to others according to Glassdoor) and thus the company culture is the cornerstone of any successful organization (chart 3).

Period.

Chart 3: Fortune 100 Best Companies to Work For Outperform

Source: Great Place To Work

A sector-specific fate

A major disadvantage of companies in the financial sector is their strong dependence on global markets and market sentiment.

You cannot influence them. Nor does anyone know where they will go.

This is a fate you must accept. After all, 80% of revenue comes from assets under management, which are exposed to dramatic market movements or changes in fund flows. The other 20% comes from fast-growing services such as Aladdin.

We will have more information in today's earnings release.

But it is already clear that the company has an advantage over its competitors due to its size and scale, brand recognition, diversity of assets under management, distribution channels and geographic reach. The icing on the cake is the distinctive corporate culture.

One thing will remain very clear for us in any case.

BlackRock remains best in class.

Chart 4: BlackRock over 10 years

Source: TradingView