The first pillar: understanding AHV

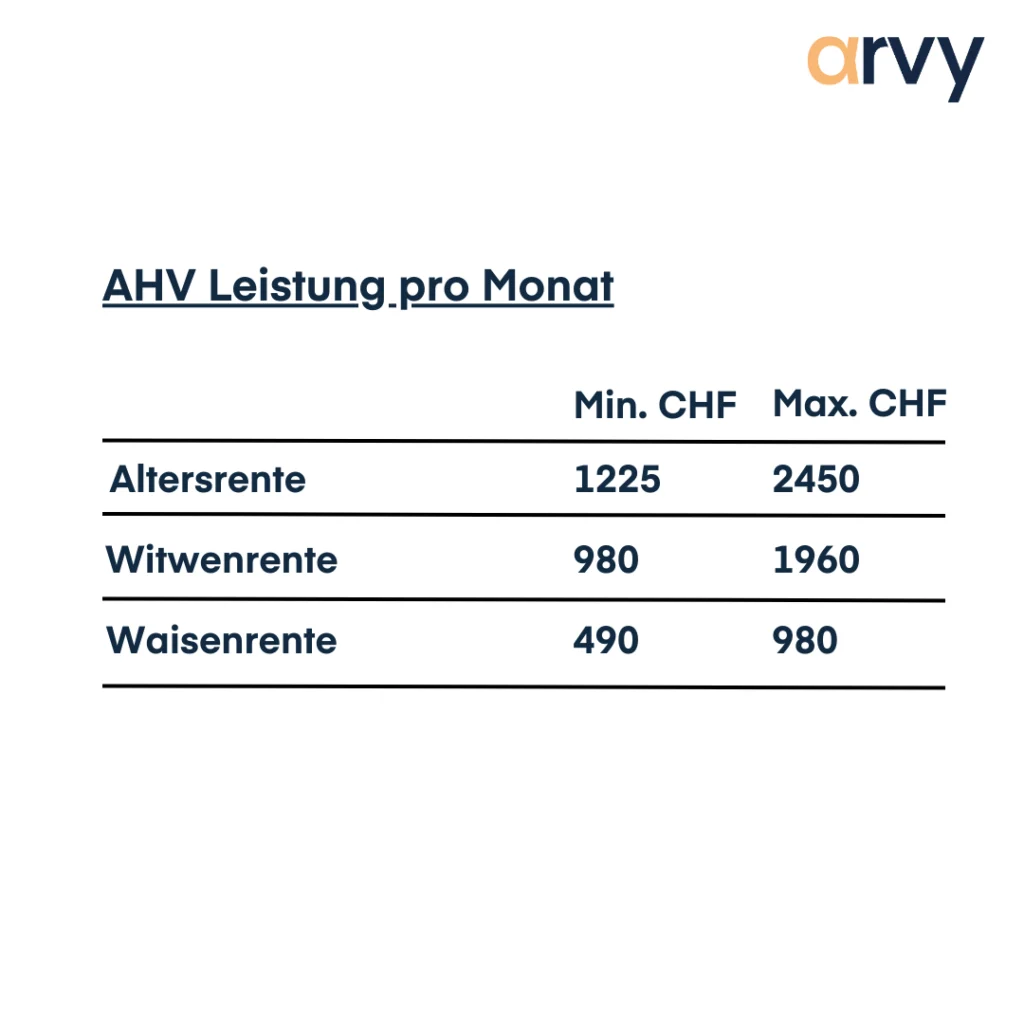

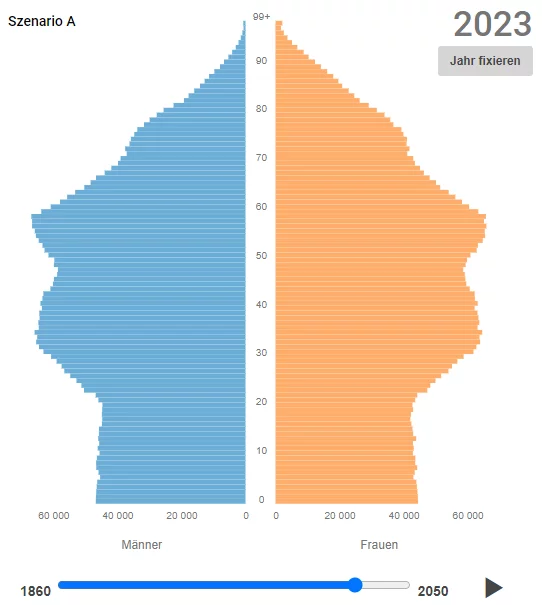

The state old-age and survivors' insurance (AHV) is the first pillar. The AHV ensures the basic needs. This is understood to mean more than just the minimum for survival, but rather "a simple dignified life in old age. The 1st pillar is obligatory, which means that in principle all persons are insured who live or work in Switzerland and are older than 17 years. The AHV can be drawn from the normal retirement age (currently: men from 65, women from 64). The retirement age has been heavily debated in recent years, as an aging population (ratio of retirees to working people) is expected to lead to financial bottlenecks for the AHV. For this reason, there was a vote in September 2022. Simply put, the current imbalance can be corrected by a) working people paying in more b) reducing the pension or c) raising the retirement age. An AHV pension is between CHF 1225 and 2450 per month (single) or a maximum of CHF 3675 for a married couple. Important, the maximum AHV pension is only paid if you have a high enough income (>88'200/year) and enough contribution years (>44).

The purpose of the AHV

The AHV provides a basic (quasi minimum) pension for retirees as well as financial support for survivors and people in need of assistance. Currently, the AHV pension is approximately CHF 1225 per month minimum for a person and CHF 3675 maximum for a couple. If the pension income is not sufficient to ensure subsistence, supplementary benefits (EL) also help to cover the necessary living requirements.

Financing of the AHV:

The state pension system is based on the pay-as-you-go principle. The money that the AHV collects from the active insured flows directly to the retirees. In other words, current employees finance current pensioners. Various factors play a role here.

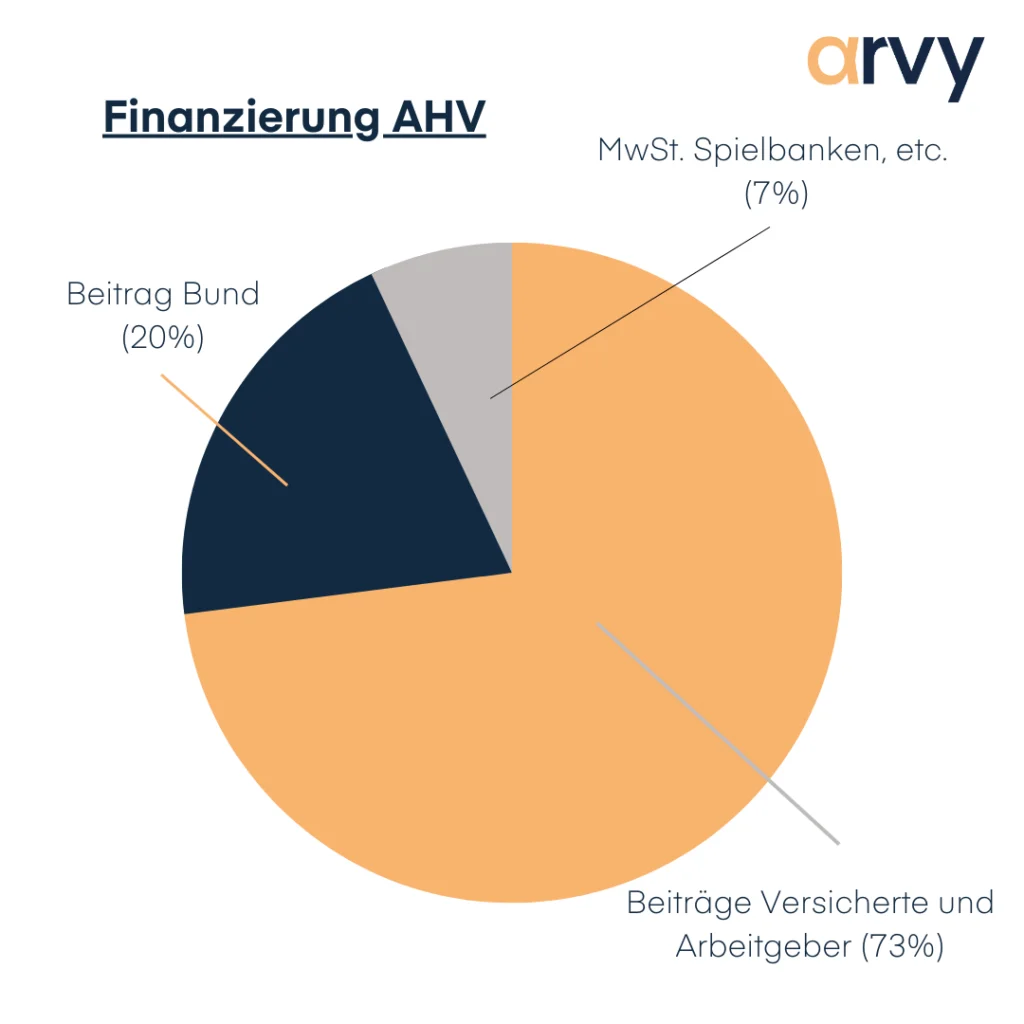

The AHV is financed by 75% as a levy from your salary (the deductions on your salary statement). The remaining 25% is financed by the federal government (tobacco & alcohol tax), VAT (1% of VAT), and casino tax. In principle, every person over 17 years of age who is employed is required to pay contributions. The contributions are currently 8.7% and are paid in equal parts by employers and employees, but amount to at least CHF 514 (<21'150 income/year) and a maximum of CHF 25'700 (>127'500/year) per year.

What you need to know:

To make sure you have enough money in retirement, it's important to consider AHV in conjunction with the second pillar of occupational benefits and also the third pillar. It is also possible to supplement your AHV pension with additional savings and investments. Basically:

The AHV pension is usually barely enough to finance life. It is therefore worthwhile to save an additional, private cushion for the future.