Uber’s Dominant Ride-Hailing Network

“If your enemy is superior, evade him. If angry, irritate him. If equally matched, fight.”

– Sun Tzu, The Art of War

arvy's teaser: Uber transformed urban mobility, creating a global ride-hailing empire without owning a single car. Now, it dominates markets, drives massive profits, and faces its next battle - autonomous vehicles.

Digital disruption.

In 2015, an observation made the rounds that has always stuck in my mind.

The point was this: “Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. Netflix, the fastest growing television network lays no cables. Instagram, the most valuable photo company sells no cameras. And Airbnb, the world’s largest accommodation provider, owns no real estate.”

But one company and digital disruptor is still missing. It's the world's largest taxi company that doesn't own any vehicles.

And something interesting is happening there.

Uber Technologies.

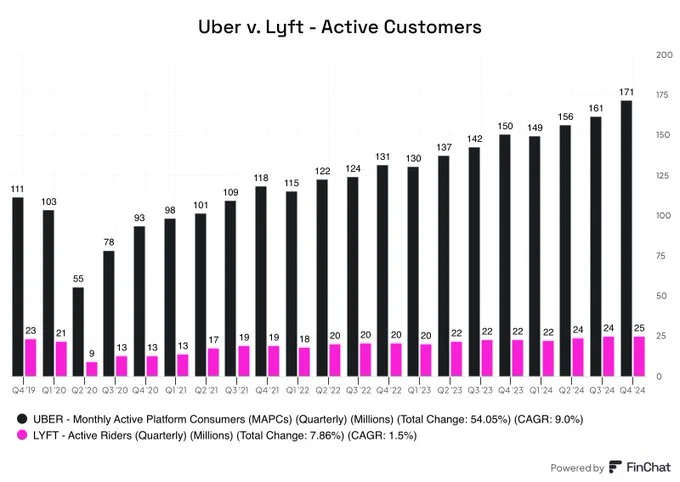

Chart 1: Uber vs Lyft – Active Customers

Source: Finchat

Duopoly Industry Structure & Uber’s Flywheel

To say that Uber has a turbulent history is an understatement. Uber has suffered from unpredictable management and legal disputes.

Since its founding in 2009, there have been repeated doubts about the legitimacy of the business model and whether it would ever be profitable. Added to this was the uncertainty of whether the management team was able to put investors' capital to good use, while founder and former CEO Travis Kalanick (unsuccessfully) wasted billions of dollars on developing autonomous vehicle technology.

But things have changed.

Dramatically.

First, the ride-hailing market evolved into a duopoly structure with one dominant major player. In the case of Uber, the company now holds a dominant number one position in 90% of the markets in which it operates. In other words, Uber has (by far) the most drivers using its platform. In numbers, this means that Uber has 8 million drivers in 15,000 cities in 70 countries and 171 million users. Every second, 400 rides or food orders are booked via the app. An example is the globally oriented Uber compared to its competitor in the US, Lyft (chart 1).

And as you know, I love duopolies as they are very attractive investments.

Second, Uber has created a flywheel that benefits from the “network effects” moat (chart 2). A network with the largest pool of drivers is attractive to passengers because it allows for the shortest wait times, the highest reliability and the lowest prices. Conversely, it is also the most attractive for drivers, as they then encounter the most customers on the app and the number of trips per working hour is maximized, resulting in higher earnings.

And when the flywheel is spinning at full speed, it keeps accelerating and getting stronger.

All these processes not only make me curious, but they also now have my attention.

Because Uber is cementing its leading market position.

In a way that has already worked well for others.

Chart 2: Uber's flywheel strengthens its moat “network effects”

Source: arvy

Shameless Copycat

I love studying past winners and history. We can learn a lot from it. And Uber has done the same.

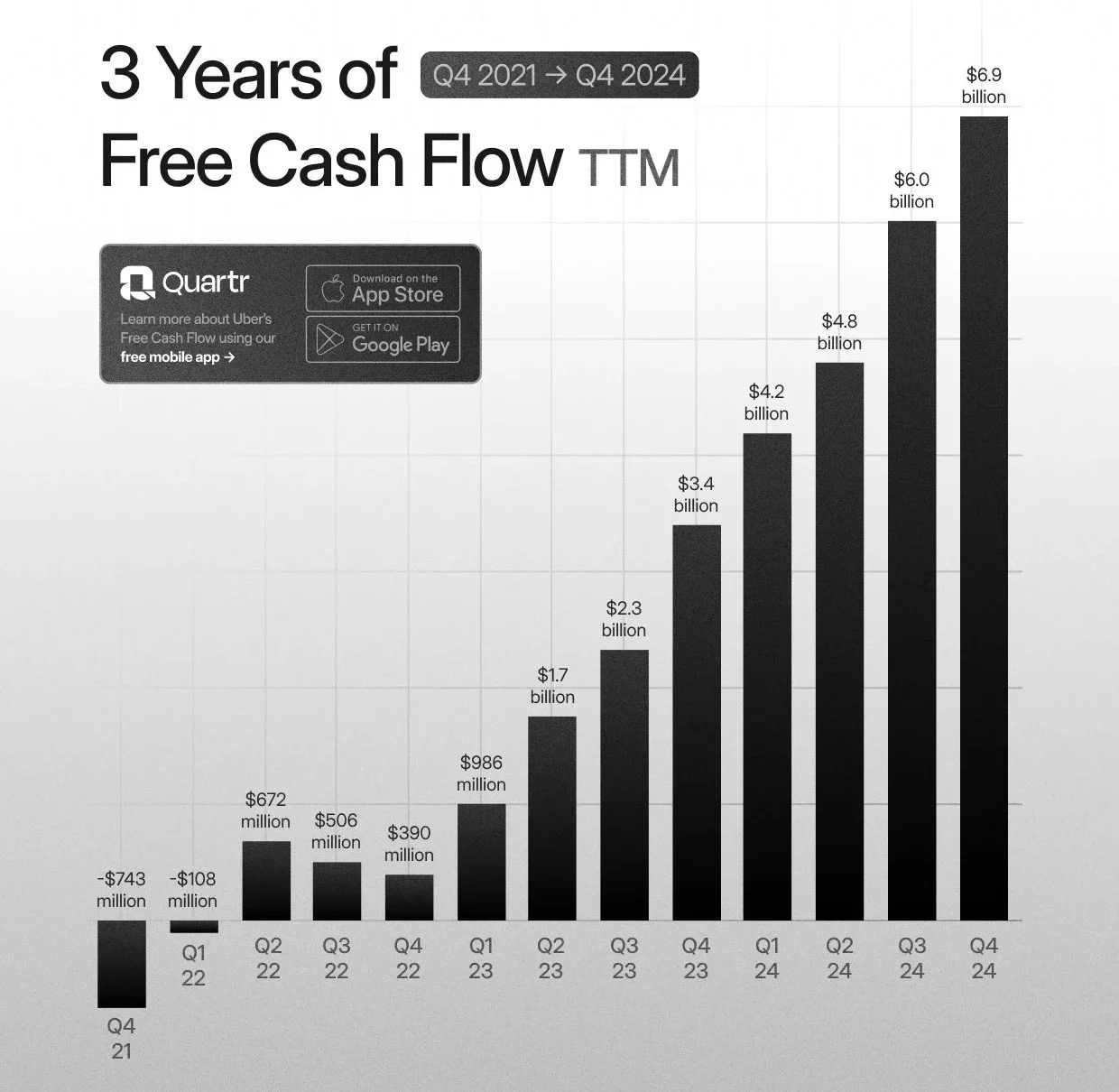

Since Dara Khosrowshahi, the new CEO, joined the company in 2017, he has done an excellent job of turning the company into a highly profitable and cash-generative growth machine (chart 3).

How did he manage to transform a highly loss-making company?

He studied what works and was a shameless copycat.

On the one hand, he studied Sun Tzu, and on the other, he studied Amazon and Costco's customer loyalty program.

Think about today's quote. That was his first strategic point.

Wherever they already had a strong market position, they doubled on it. For example, they have increased their market share in the US from 69% to 75% in the last three years alone. Wherever Uber was not dominant and faced a superior competitor, the company gave up, e.g. in Singapore by merging its local operations with Grab, the dominant provider of ride services in Southeast Asia. Uber owns 13% of Grab.

As for Amazon and Costco, Uber copied their playbook in 2019 and launched its loyalty program “Uber One”. Uber One is a program that gives you access to benefits and discounts on orders and arranged rides for a set monthly amount.

From its beginnings to today, it has grown to 30 million members. I love loyalty programs like those successfully used by Amazon and Costco to engage customers and increase adoption of their product offerings over time.

On average, members spend twice as much as non-members, and the high retention rates, such as 90% at Costco, lead to repeat purchases. Member retention and growth in spending at the individual member level have helped these dominant companies to cement and expand their market position.

At Uber, members already account for 40% of bookings, despite making up less than 20% of monthly active users. This is crucial and solidifies Uber's “Good Story” as it adds visibility.

But every good story has a villain.

Chart 3: Uber’s transformation into a free cash flow machine

Source: Quartr

Autonomous Driving

It's about the long-term risk for Uber from autonomous vehicles (AV).

The market is attaching so much importance to this that Uber is trading at the lowest free cash flow valuation since IPO (4.6% vs. an average of 1.9%) and the lowest P/E ratio (22 vs. an average of 33), even though the company is firing on all cylinders.

What's all the fuss about?

That Waymo's (Alphabet, Google's parent company) and Tesla's efforts in autonomous driving will make Uber obsolete (chart 4), as concerns have shown by the end of 2024. Why would you need a cab or someone to drive you from A to B when you have a self-driving, autonomous car to do it?

Even if widespread introduction is unlikely in the next few years, Uber is positioning itself as a potential partner. This is because every city has different regulations, cost structures or consumer behavior. So, Uber already has 14 AV partners in mobility, delivery and freight and even Waymo is one of them because Uber has such a strong value proposition with its significant network around the world.

But the uncertainty remains, and in a fast-growing market with many opportunities, where a large-scale adoption of AV would arguably grow the overall rideshare market significantly, this leads to a “Good Chart” with a lot of volatility.

Here we can conclude with another quote from Sun Tzu.

Opportunities multiply as they are seized.

Chart 4: Uber since IPO, 2019

Source: TradingView