Waste Management: Unglamorous Sector

"Funding clean technology is the way to avoid climate disaster"

– Bill Gates

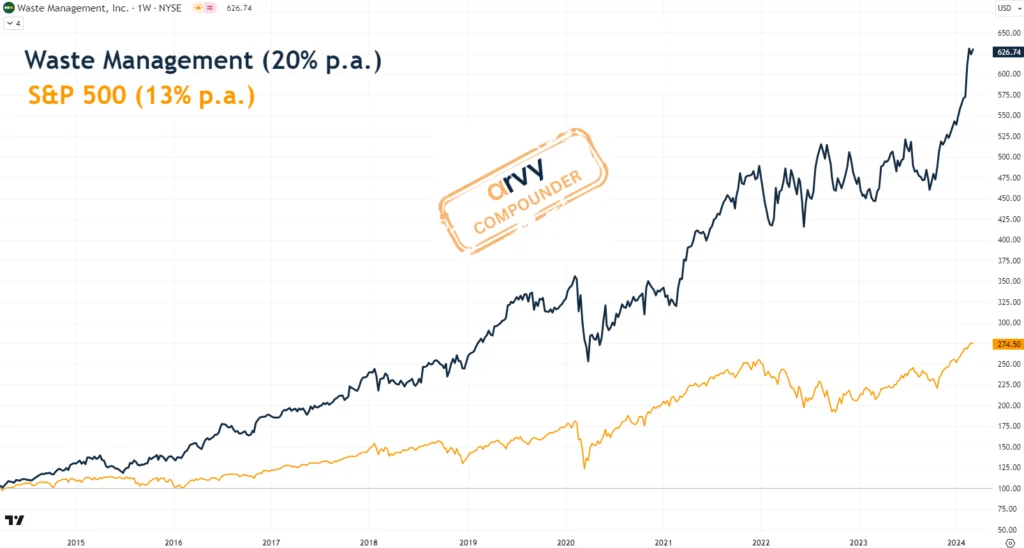

arvy's teaser: Waste collection. This unglamorous sector is a haven for investors, boasting structural growth, recession resilience, and robust revenue stability. With its integrated business model and oligopolistic market dominance, Waste Management (WM) stands out as a compelling compounder candidate.

Waste collection.

It is an unglamorous sector. Neither exciting nor thrilling.

And yet it is a structural growth market par excellence and a highly profitable industry. The math is simple: the more people living on planet Earth, supported by a general upward trend in GDP growth, the more litter is generated. And all the garbage from households, construction projects, your Zalando parcels or festivals like the Street Parade needs to be collected and recycled, ideally to be reused.

We all agree that it would be a shame to destroy our wonderful Mother Nature with trash lying around. But not to worry, this is where our green hero comes in.

The market leader in waste collection has a name that speaks for itself.

Waste Management.

Chart 1: Waste Management’s Smart Truck® - Natural Gas Powered Trucks

Source: Waste Management

All-In-One Business

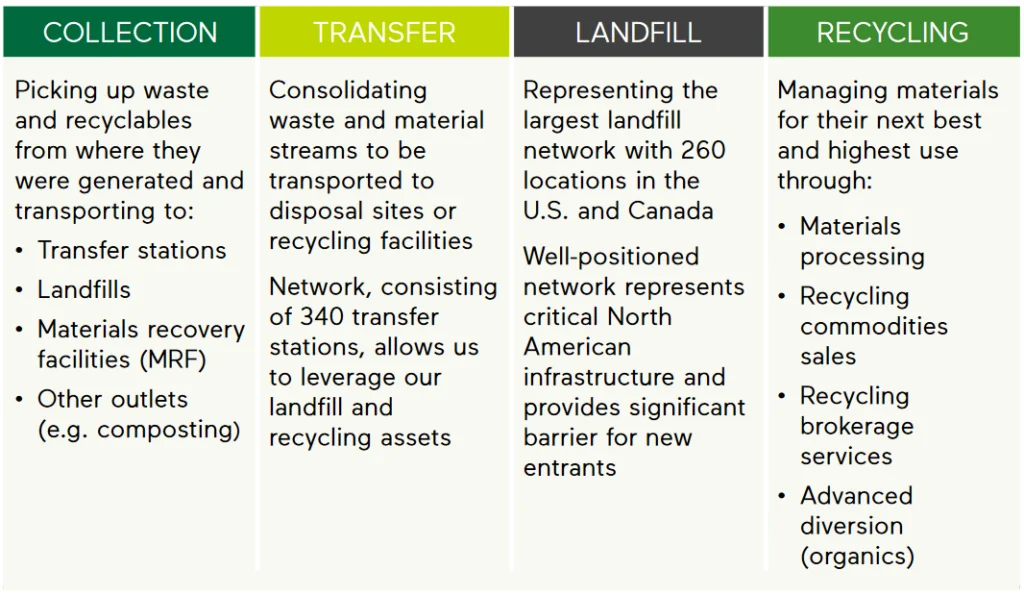

WM is a fully integrated waste-hauler – an all-in-one business.

The company uses its extensive network of collection routes and transfer stations, which gives it significant control over the waste stream, to channel waste from numerous end users (commercial, industrial and residential) into its highly valuable landfill facilities where it is all recycled (chart 2).

As if this were not enough of attractive features, I will give you a few more that focus on inflation and recession resilience:

Sounds like a solid compounder candidate, doesn't it?

And that is not all.

Chart 2: All-In-One Business, Fully Integrated Asset Base Drives Core Business

Source: Waste Management, Annual Report 2022

Three Moats in an Oligopoly

WM commands a market share of 24%, followed by Republic Services (15%) and Waste Connections (8%).

This gives the market leader three moats, according to Morningstar:

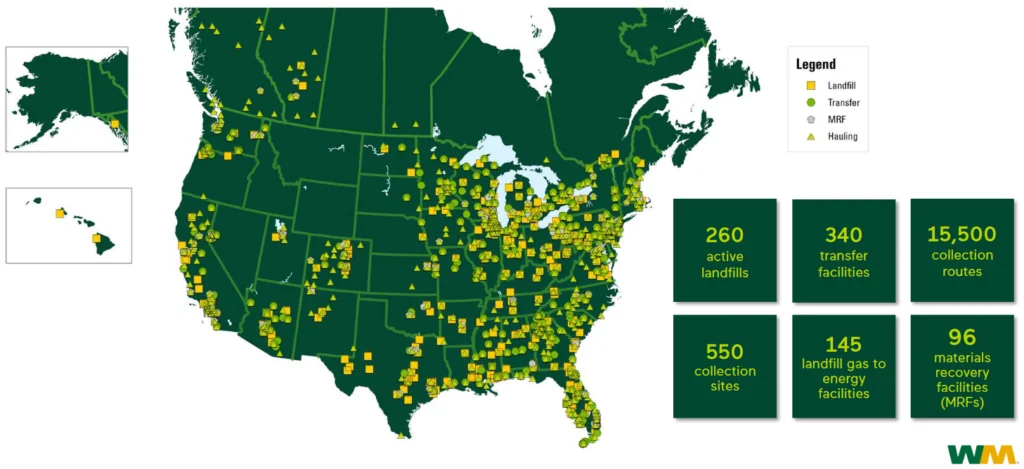

WM is by far the best positioned waste facility network with unmatched size and scale in the US (chart 3).

Eventually, companies with such enduring competitive advantages often form natural monopolies, duopolies or oligopolies (as in the case of the waste market in the US).

How does this happen?

Companies cannot always beat every competitor, which prompts WM to target weaker competitors and avoid stronger ones. The company repeatedly takes over shares from weaker competitors or even buys them up and integrates them into its own organization. With great success, as the best-in-class return on invested capital demonstrates.

Do not fight with the big waste collectors!

Chart 3: Best positioned asset network with unmatched size and scale

Source: Waste Management, Annual Report 2022

Clean Technology

It may come as a surprise that waste management companies score quite well in terms of environmental, social and governance risks.

But they do the dirty work, don't they, you might say?

Federal and state regulations and not-in-my-backyard activism have made operating in this industry extremely difficult and strictly regulated. For this reason, the number of landfills has decreased from about 10,000 in 1980 to only about 1,500 today. Small landfill operators could not afford to comply with environmental regulations and were gobbled up by their larger competitors - think oligopoly characteristics.

Of course, WM faces environmental risks related to greenhouse gas emissions from its landfills and its large fleet of vehicles. However, they continue to invest in clean technologies to capture landfill gas and convert it into electricity and renewable natural gas. These investments are an important part of combating environmental issues, which Bill Gates, who owns 17.5% of WM through his holding companies, explains in his book "How to avoid a climate disaster".

For example, WM has replaced vehicles with internal combustion engines with those that run on electricity and compressed natural gas. WM's Smart Truck in chart 1 is one such vehicle.

They are making great strides on the technological front.

And that is good for Mother Nature.

Chart 4: Waste Management over 10 years

Source: TradingView