EssilorLuxottica & Meta Platforms: AI Meets Glasses

“AI Glasses will replace phones and anyone without them will fall behind.“

– Mark Zuckerberg, Founder of Meta Platforms (formerly Facebook)

Oakley.

Ray-Ban.

Chanel, Prada, Versace, Bulgari, Ferrari, Burberry, Valentino, Dolce & Gabbana.

Do you wear any of these brands — as sunglasses or even just your daily pair of glasses?

Guess what? They all belong to, or sit under license agreements with, the same company.

The story began in 2018, when two separate entities joined forces: a French lens manufacturer and an Italian eyewear designer. The merger was a pivotal moment — creating the world’s largest eyewear company.

It brought together a powerhouse portfolio of brands and retail reach with cutting-edge expertise in lens manufacturing. A new standard was set for the industry. Their ability to integrate and scale acquisitions has since been crucial in cementing their position as the global leader in eyewear — defining quality, innovation, and customer reach.

The French lens manufacturer was Essilor.

The Italian designer, Luxottica.

Together, they became:

EssilorLuxottica.

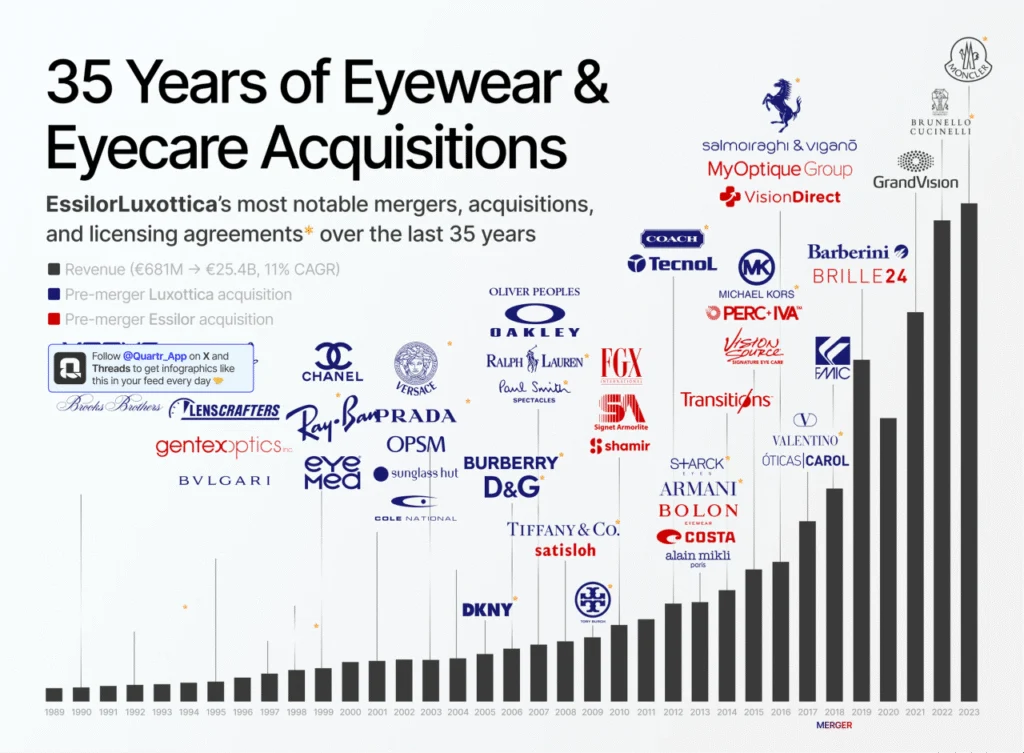

Chart 1: EssilorLuxottica's most notable mergers, acquisitions, and licensing agreements over the last 35 years

EssilorLuxottica’s journey of mergers and acquisitions reflects a clear strategic vision: market leadership and relentless innovation in eyewear.

Over the past 15 years, the company has grown revenue at a 15% CAGR and free cash flow at 11% CAGR. Its ability to integrate and scale acquisitions (chart 1) has been key in cementing its role as the global leader in eyewear — setting new standards in quality, innovation, and customer reach.

A standout move was the 2021 acquisition of GrandVision, a global optical retail giant. That deal massively expanded EssilorLuxottica’s retail footprint. Today, the group boasts nearly 18,000 retail locations — compared to just 450–500 for the biggest luxury brands. On the lenses side, Essilor serves some 400,000 independent eyecare professionals worldwide (with small shops accounting for more than half of the industry’s global sales).

The bigger picture: EssilorLuxottica operates in a structurally growing industry, driven by macro trends like

Innovation is another driver:

The result?

EssilorLuxottica is the undisputed leader in a fragmented industry, more than twice the size of its next competitor. Scale matters here — enabling efficiencies others can’t match.

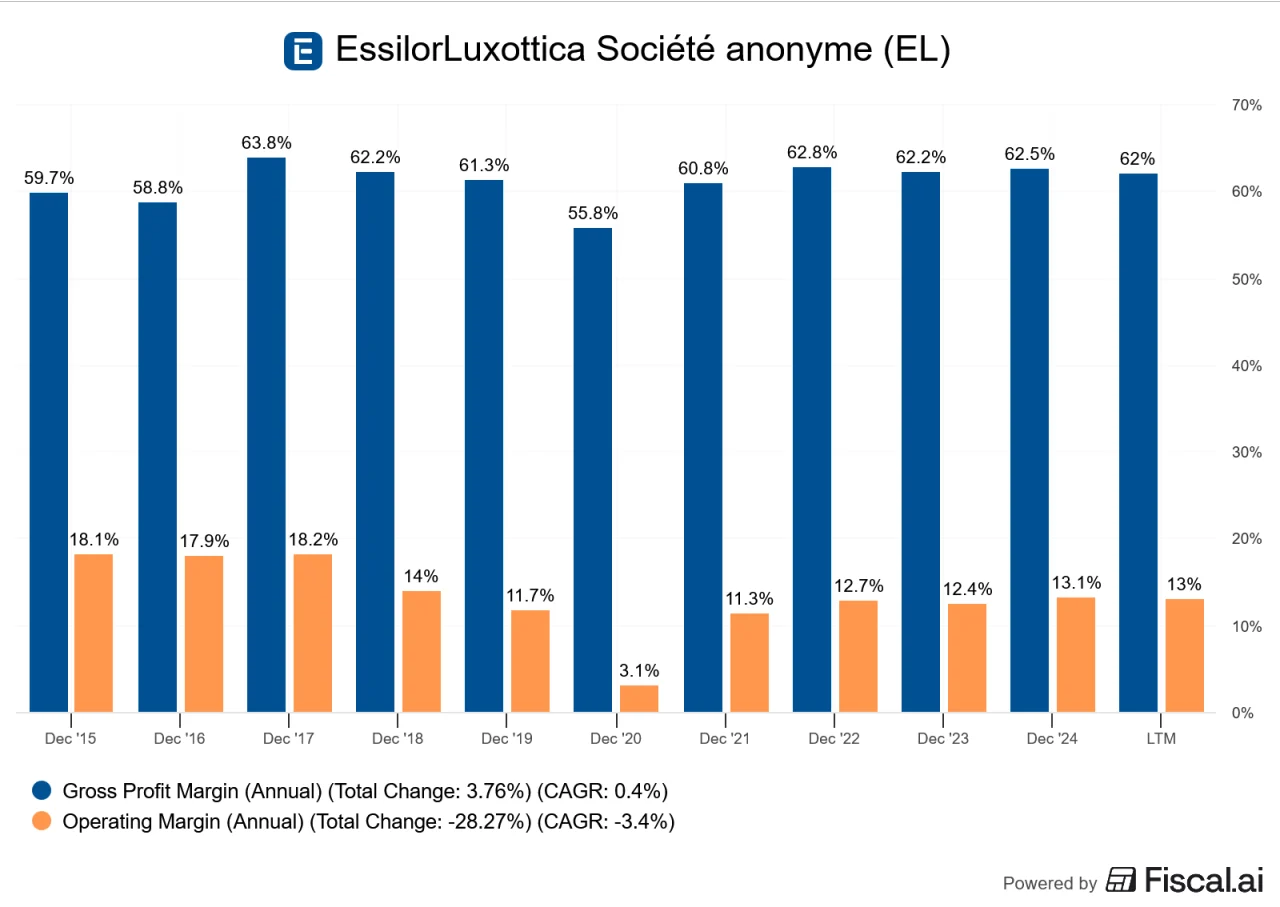

Even more powerful: the company’s vertical integration. EssilorLuxottica does it all — from design to manufacturing to distribution. That control translates into serious pricing power, reflected in 63% gross margins and management’s target of 19–20% operating margins by 2026 (chart 2).

Already, this looks like a “Good Story” with plenty to like.

And then came Meta Platforms.

Chart 2: Gross margins and operating margins of EssilorLuxottica over the least ten years

Meta Platforms?

Yes — the same Meta behind Facebook, Instagram, WhatsApp and the metaverse bets. In July 2025, they snapped up a 3% stake in EssilorLuxottica — a move worth around €3 billion.

What is Zuck trying to do here?

This isn’t just a financial play — it’s strategic.

Meta wants in on AI-powered wearable eyewear. By owning part of the world’s largest eyewear company, Meta gains a front row seat in the hardware + fashion + optical world. It’s a lever into owning the interface that lives on your face.

Why take a stake rather than just partner?

What’s the vision?

Meta seems to see smart glasses evolving from novelty to everyday utility – see today’s quote. And don’t forget: around 50% of the world — and up to 70% in developed markets — already wear prescription glasses.

That’s a massive built-in user base.

Imagine glasses that:

Case in point: Meta’s newest rollout — Meta Ray-Ban Display (price tag $799, end of September 2025). It’s the first to embed a display directly into the lens — not just sensors or cameras. Think notifications, maps, translations, previews — all in a subtle form factor.

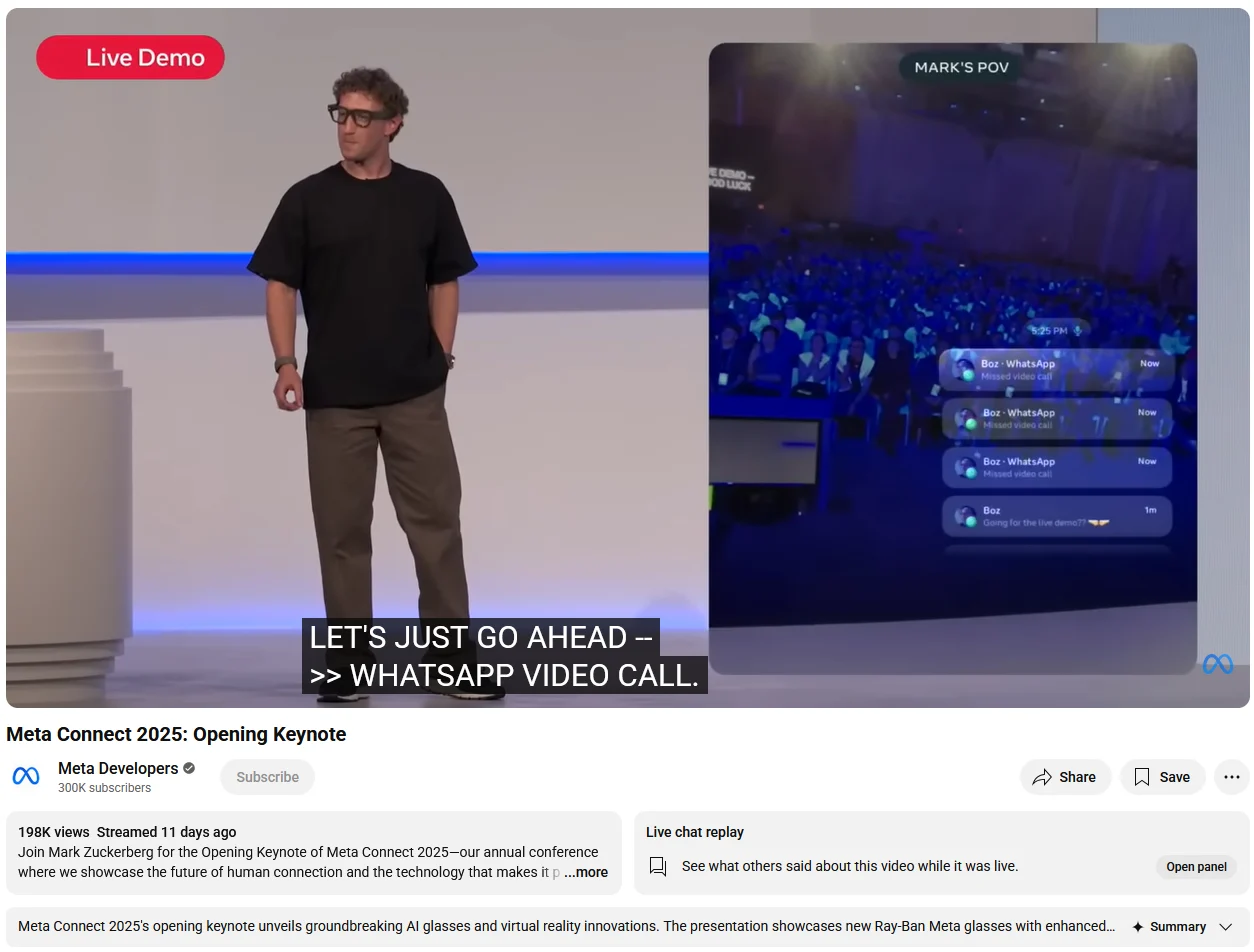

If you’re curious about the nuts and bolts, watch how Zuck unveiled these glasses — along with Meta’s virtual reality innovations — at Meta Connect 2025 (chart 3, check it out here). It’s packed with demos, concepts, and hints at where this could all go.

Sure, some demos flopped live on stage (classic). But in true Silicon Valley startup fashion, Meta’s approach is clear: Build. Break. Gather feedback. Improve. Fix.

Then repeat. On loop.

That’s the Meta playbook.

But enough about vision and demos. Let’s see what really counts.

What does Mr. Market have to say?

Time to check the “Good Chart”.

Chart 3: Meta Connect 2025, Keynote, Zuck’s Live Demo

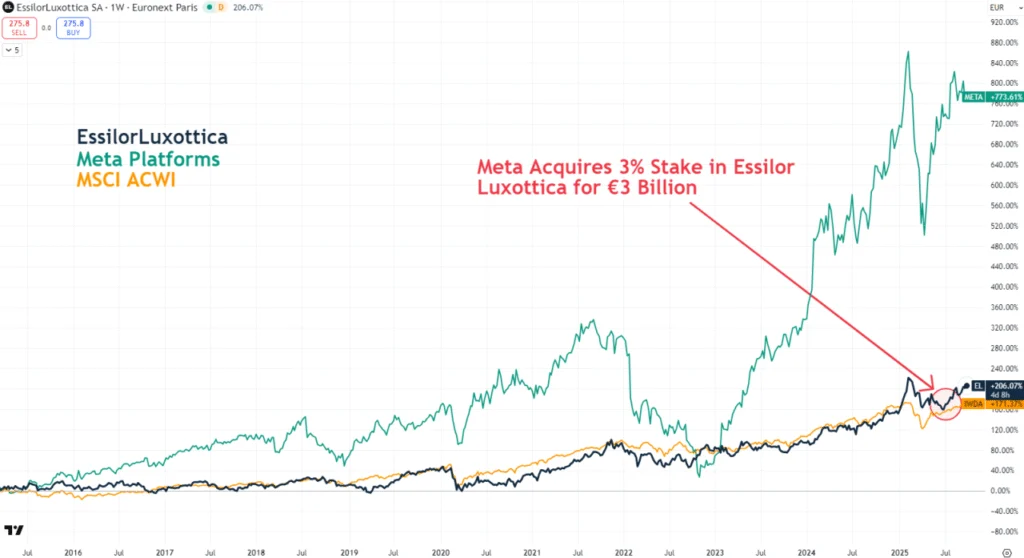

The two “Good Charts” of EssilorLuxottica and Meta Platforms couldn’t be more different.

Meta plays in the Big Tech league — asset-light, powered by network effects, and platforms that scale at lightning speed. EssilorLuxottica, in contrast, deals in physical products, physical stores, and the slower grind of convincing customers to buy rather than just download an app.

That difference shows up in the price action as well.

It's highly cyclical, and we should never forget that.

Advertising is the first expense companies cut when the economy weakens. Layer on top Meta’s habit of betting billions on capital-intensive moonshots (see our Weekly on Meta), and you get a business with much higher uncertainty — and much higher potential upside.

For investors, the comparison feels like the proverbial fable of the hare and the tortoise (chart 4).

Meta, the hare, sprints, stops, and leaps forward much more unpredictably. EssilorLuxottica, the tortoise, moves steadily, predictably, and smoother (chart 4). Although this time, the hare may have too much of a head start thanks to its foundation.

But taking all into consideration, as investors, we know what to expect from owning each.

Because a tortoise remains a tortoise.

And a hare remains a hare.

Chart 4: EssilorLuxottica & Meta Platforms over the last ten years, in EUR