Heico: Family-Led Aerospace Compounder

„The stock has turned a lot of ordinary Heiconians, especially early staffers, into millionaires. No, that’s incorrect, multimillionaires.”

– Laurans Mendelson, the late former CEO of Heico

Aerospace.

Next to the beauty market, it’s my other favorite sector.

Why? Because the two share far more similarities than you’d think.

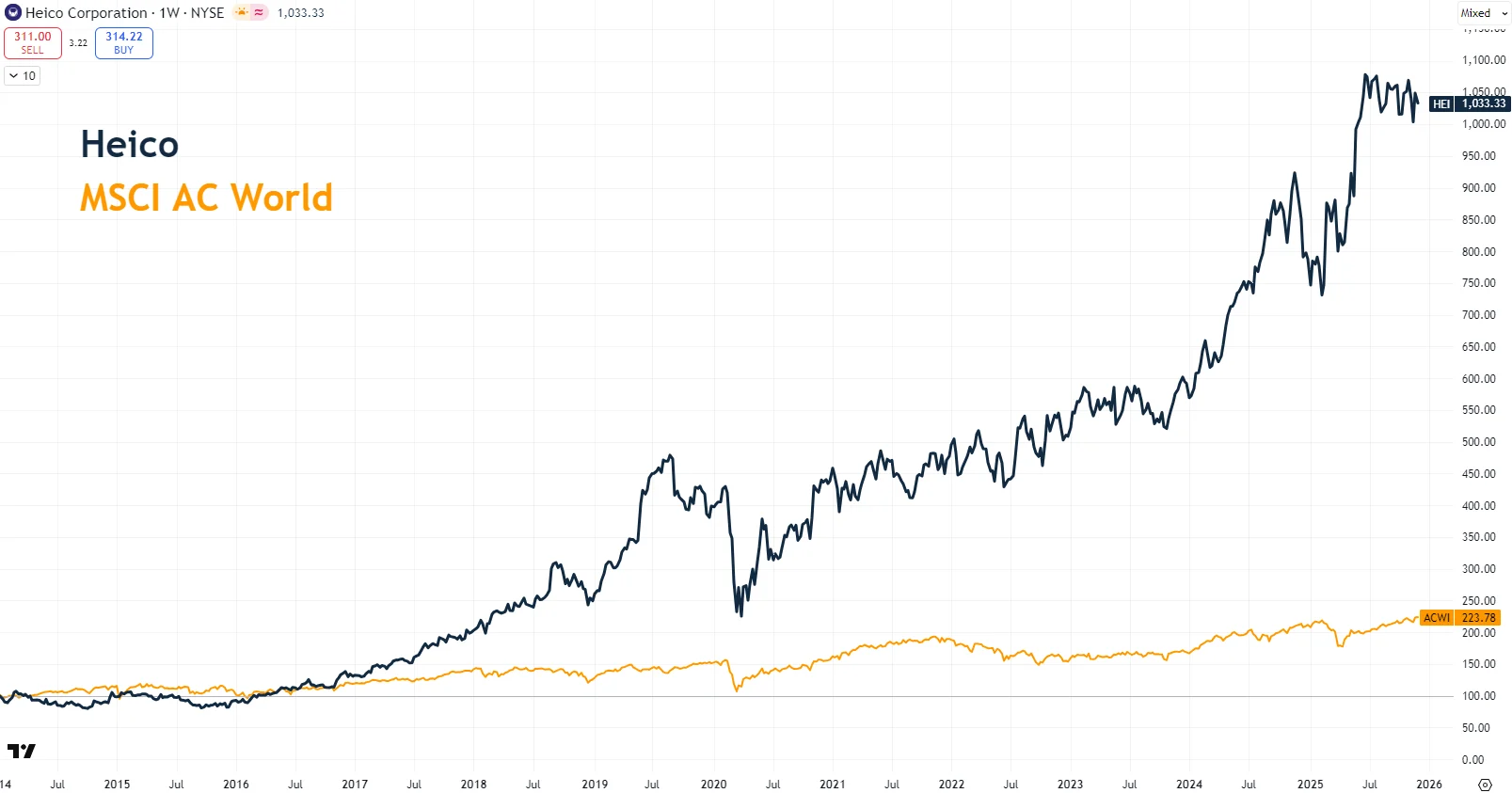

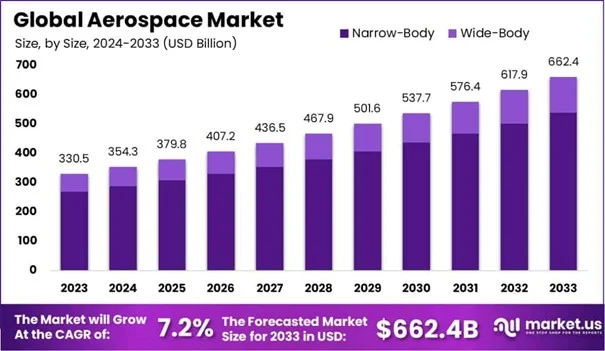

Like beauty, aerospace grows attractively on an organic basis — around 7% (beauty grows ~6%) — placing it among the top-growth industries globally (chart 1). Over time, the market has become increasingly oligopolistic as brands and businesses cemented their domains of expertise. Thanks to extremely demanding certification requirements, market positions have strengthened dramatically over decades.

That’s how Airbus and Boeing ended up sharing a duopoly in commercial aircraft. Safran and GE Aerospace dominate jet engines, forming an oligopoly alongside Rolls-Royce, MTU Aero Engines, and Pratt & Whitney (part of RTX).

It’s not unlike Estée Lauder in premium beauty, L’Oréal in mass-market beauty or Galderma as Europe’s only pure-play dermatology giant — each owning entire ecosystems of sub-brands.

And the similarities don’t stop there.

Just as consumers periodically replace beauty products, the aerospace industry operates with recurring replacement cycles. Parts wear out, maintenance intervals come due, and fleets need constant upkeep. This creates a powerful, built-in demand engine.

And this is where a niche market leader shines. A company that keeps planes and spacecraft in the sky by providing the essential replacement parts they rely on.

Every time you step onto a plane, you’ve likely encountered their products.

One of the most reliable businesses on the planet.

Heico.

Chart 1: The Global Aerospace Market size is expected to grow at a CAGR of 7.2%

At any given moment, roughly 10,000 planes are soaring through the sky.

Now consider that an Airbus A320 contains around 340,000 individual parts, and a Boeing 747 (the iconic Jumbo) can have up to 6 million parts.

That’s a lot of components flying around at once.

And you know how robust these parts must be — the stress, cold, heat, wind, and even heavy turbulence they’re exposed to.

This is exactly where Heico enters the story.

Heico is a rapidly growing aviation, aerospace, defense, and electronics company focused on niche markets and highly engineered, ultra-reliable products (chart 2).

Since 1990, the company has been run by the Mendelson family, who still own 16.6% of the business.

So yes — it’s a family-led company, the kind we love to own at arvy.

Why?

Because family-run businesses think in decades, not quarters. They build for long-term value creation.

Heico’s product line includes around 50,000 (!) parts, from engine components to cooling system parts to brake pads.

And here’s the astonishing part: since its founding, Heico has sold over 87 million parts to the aerospace industry. They’ve delivered so reliably over the years that Forbes named them one of the “100 Most Trustworthy Companies in America.”

Heico operates in two main segments:

But there’s more.

Heico currently owns 98 subsidiaries operating across niche segments of aviation, defense, space, medical, telecommunications, and electronics.

That makes Heico a serial acquirer.

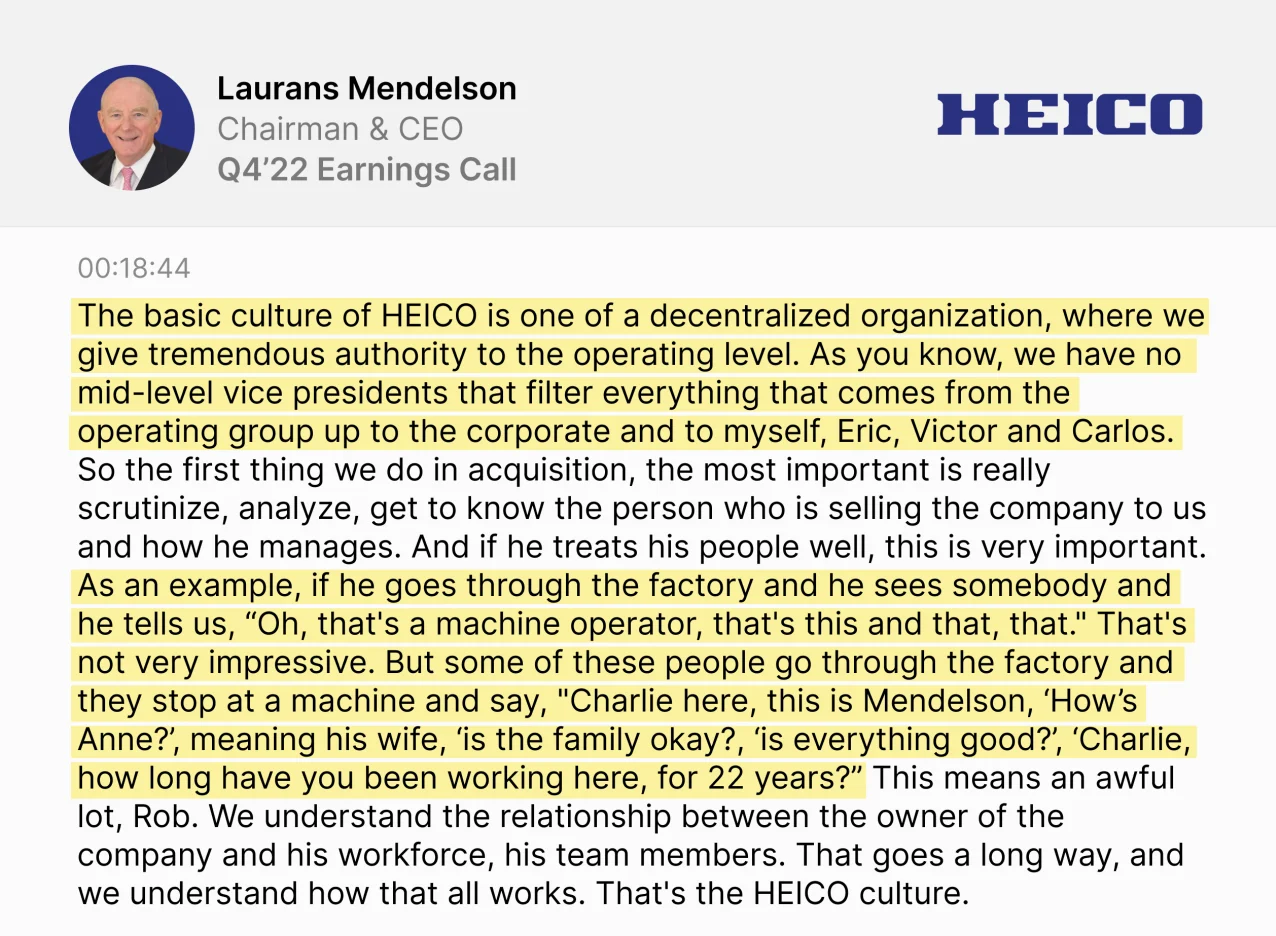

And here’s what sets them apart: the Mendelson family deeply understands the power of founder-led and owner-led businesses. So, when they acquire a company, they typically buy only 80%, leaving 20% with the original owners to preserve that entrepreneurial mindset.

Marvelous, isn’t it?

And that’s not all.

Chart 2: About Heico, a rapidly growing aviation, aerospace, defense and electronics company

The Mendelson family’s way of doing business should, in my view, be studied in every university classroom and every business school on the planet.

It is the epitome of long-termism.

Here are my Top 5 takeaways from studying their thinking, their vision, and how they walk the talk by analyzing investor presentations and conference call transcripts:

This long-term mindset is why Heico is now harvesting the fruits of decisions planted a decade, two decades, even three decades ago.

Two examples stand out:

Mr. Market, of course, is fully aware of this “Good Story.”

Heico trades at a premium valuation of 52x forward earnings, compared to a 10-year average of 46x. Free cash flow yield is at 2.1%, vs. a long-term average of 2.4%.

Yes - quality comes at a price. But normally, you only cry once when you buy quality.

Let’s see what the “Good Chart” says.

Chart 3: Laurans Mendelson on corporate culture as the backbone of any successful organization

Because Heico has such a highly fragmented product offering, no single product truly moves the needle on its revenues. Or as Laurans Mendelson, the late former CEO, puts it: “If one HEICO product failed, nobody would even notice.”

On top of that, as we all know, stock prices eventually follow business fundamentals. And in Heico’s case, this consistency is reflected beautifully in the chart: steady growth, diversified income streams, and a long, reliable uptrend pointing north.

Of course, there was a little damper along the way. COVID hit the aerospace sector harder than almost any other.

But as miles flown and passenger numbers have returned to trend — and the pandemic has become dry ink in the history books — Heico has regained its usual strength.

Yes, 2020 and 2021 were choppy due to elevated uncertainty. And market participants dislike nothing more than uncertainty.

But now things are simple again — which is always best.

So, let’s end with a good old stock market saying.

The trend is your friend. Until the end.

When it bends.

Chart 4: Heico over the last ten years