Investor AB: The Swedish Berkshire Hathaway

“Esse non videri – To be, rather than to seem.“

– Motto of the Wallenberg dynasty

Dynasties.

They carry a certain mystique.

Think of names like Rockefeller, Vanderbilts or Rothschild — families whose wealth and influence not only shaped industries but also left marks on politics, economies, and entire nations. They amassed fortunes during their active times and, perhaps even more impressively, passed them along to the next generation. No small feat — because if history teaches us anything, it’s that succession is the hardest part of building a dynasty.

Do you still remember the Achaemenid Empire under Cyrus the Great? Or the story of the Han Dynasty? Both rank among the most powerful dynasties the world has ever seen. And yet, like all empires, they faced the same challenge: continuity.

Speaking of dynasties: fancy getting lost in one? Our Book Club offers a selection.

Unlike those fallen empires, a few dynasties have mastered the art of reinvention — carrying their legacy forward generation after generation. In Sweden, there’s one such dynasty that has quietly shaped the country itself. Now in its fifth generation, with the sixth preparing to take over, this family dynasty is alive and well.

The family? The Wallenbergs.

The nickname for their business empire?

The Swedish Berkshire Hathaway.

The name of the company?

Investor AB.

Chart 1: The Wallenberg Family: From Swedish Banking to Global Industrial Dominance

Every country has its dynasties.

In Sweden? It’s the Wallenbergs.

For over 160 years, this family has quietly shaped the nation’s destiny. Their influence runs so deep that Swedes jokingly say: “Wallenbergare äta först” — “the Wallenbergs eat first.”

And yet, you will rarely see them in the spotlight.

No flashy yachts, no tabloid scandals, no media circus. Instead, they operate in the background - pulling the strings of industry, politics and philanthropy with a steady hand at Villa Täcka udden on Djurgarden (see today's cover). At one point, it was estimated the Wallenberg sphere controlled nearly one-third of Sweden’s GDP through their network of companies.

How?

At the heart of it all sits Investor AB, founded in 1916 to consolidate the family’s holdings. Often called the Swedish Berkshire Hathaway, it is today the country’s largest investment company with a market cap nearing $100bn.

Through Investor AB, the Wallenbergs haven’t just invested in companies — they’ve built national champions and ensured Sweden’s rise as a global industrial power.

The scale?

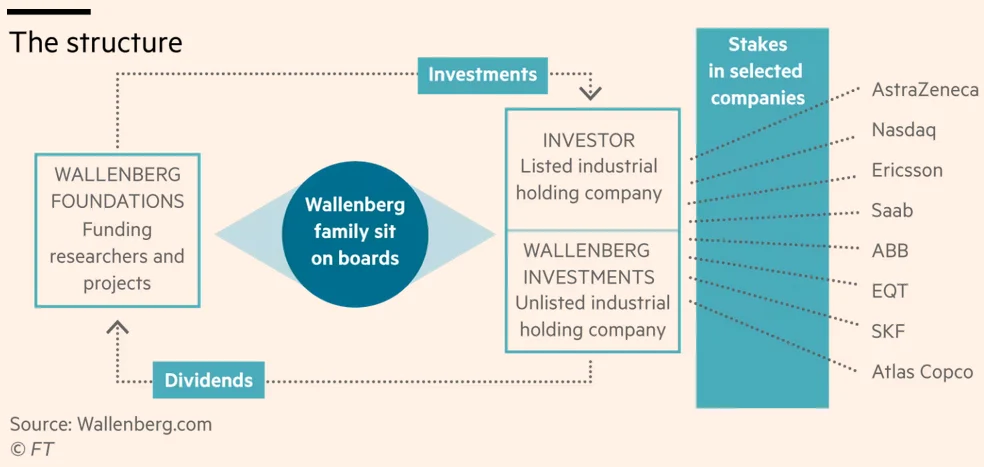

The twist: the Wallenbergs themselves own nothing directly.

All is tied up in foundations.

They see themselves as stewards, not owners — a structure that has prevented dynastic infighting and ensured continuity for six generations. More importantly, it institutionalized giving: profits are not only reinvested, but also funneled back into science, research, and innovation.

The Wallenbergs aren’t just industrial architects. They are, in a very real sense, nation-builders.

The Wallenberg Model (chart 2):

And that leads us to their real secret.

Not just what they own.

But how they own it.

Chart 2: The Structure of the Wallenberg Model

So, what’s the recipe behind this dynasty’s success?

Investor AB doesn’t chase trends or trade quarterly headlines. Their model rests on three timeless pillars: sound businesses, patient ownership, and low debt (chart 3).

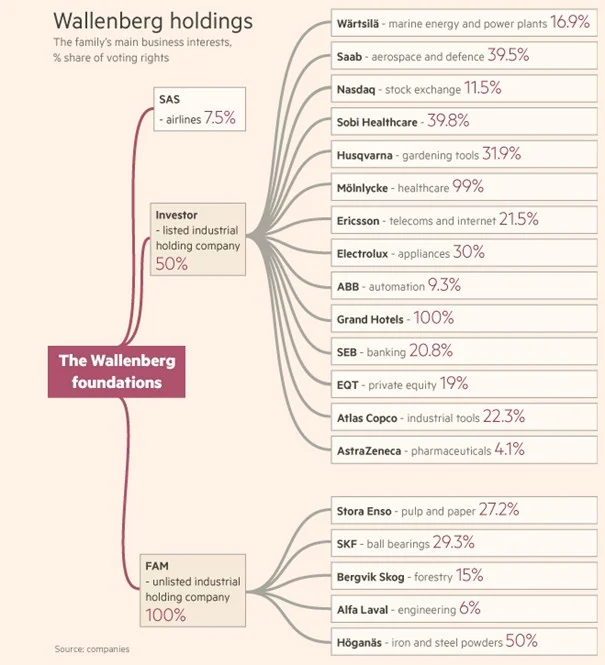

Take Atlas Copco.

When Investor backed it a century ago, it was a struggling industrial with a future no one could fully see. Today, it’s one of Sweden’s largest companies at an $80bn market cap.

Or look at Ericsson.

The company was on the verge of collapse after the Kreuger crash in 1932 — a massive fraud that shook global finance. The Wallenbergs stepped in, restructured the balance sheet, and transformed Ericsson into a telecom world leader.

More recently, they incubated EQT inside Investor AB in 1994 — now a $45bn global private equity powerhouse, still partly owned by Investor AB.

Then we have SEB, the family bank that started it all, with Investor AB still holding 21% today. And not to forget, the 14.4% stake in Swiss Swedish ABB, another global giant.

The pattern is clear: they don’t just provide capital. They provide stability, governance, and talent.

In their world, the CEO is the Most Valuable Player. They place them carefully, guide them quietly, and let them perform.

For us at arvy, this is “Good Story & Good Chart” in practice — albeit with a more activist hand than we would (or can ;-)) take. They back fundamentally strong companies with a story that lasts decades (“Good Story”). And over time, the market honors that discipline with rising prices (“Good Chart”).

Investor AB’s philosophy in a nutshell:

Or as Jacob Wallenberg (Chairman of Investor AB) puts it: “The long term also consists of many short terms. You have to perform in every one of them.”

The lesson?

Investor AB isn’t just an investor. They’re an architect of industries. And that leads us to the natural next question.

What has this philosophy delivered in numbers?

Chart 3: Wallenberg Holdings 2015 (today, divested of SAS)

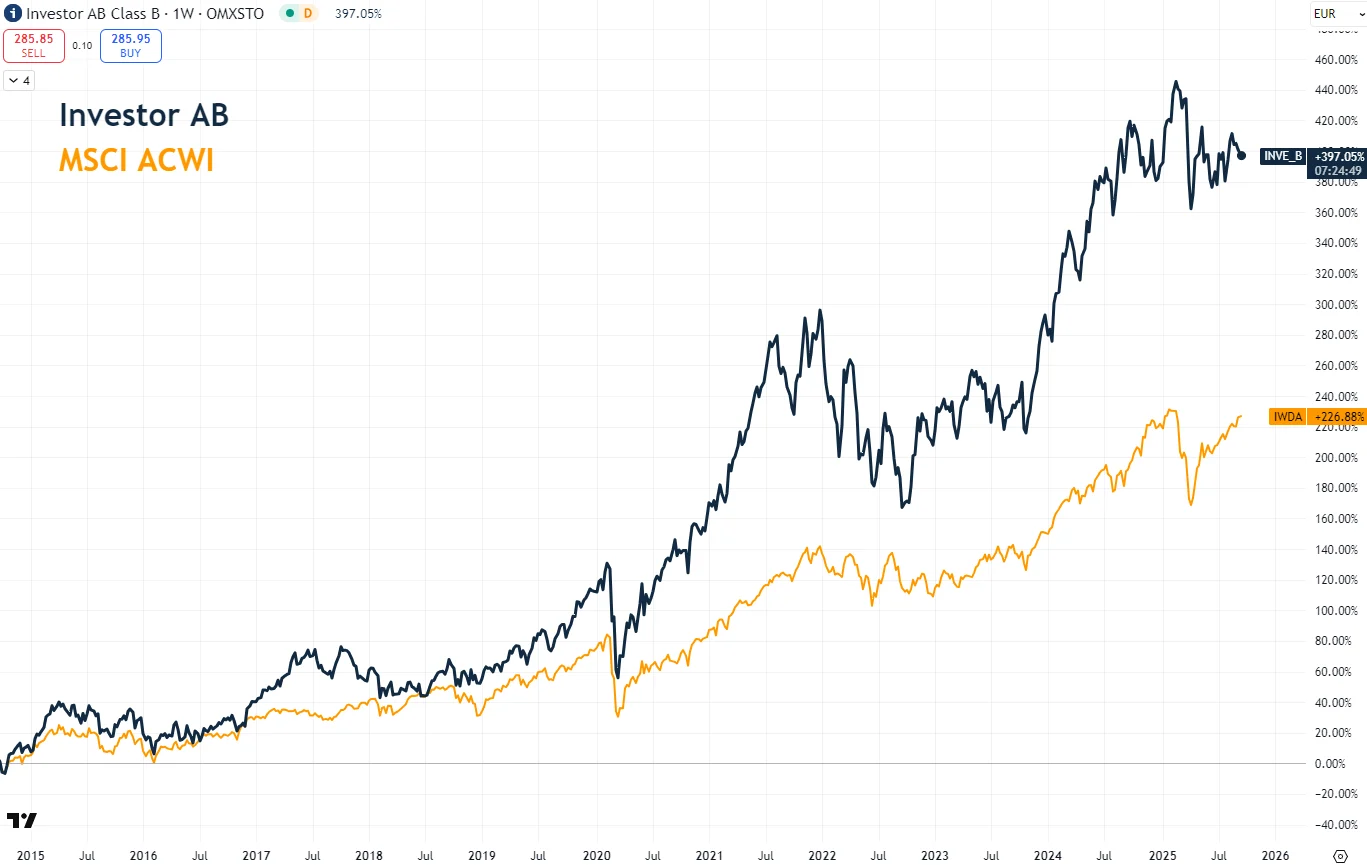

If you want proof that patience pays, look no further than Investor AB.

Since its IPO in 1919, the company has delivered a staggering 160,000x return — an annualized ~13% CAGR for more than a century, through wars, crises, bubbles and pandemics.

The secret?

Long-Term Horizon Arbitrage.

Investor AB doesn’t trade quarters — it thinks like an owner. You don’t buy a stock; you buy into a business. With that mindset, patience becomes a competitive edge, compounding does the heavy lifting, and benchmarks are irrelevant. Instead of chasing indices, Investor AB focuses on businesses and their long-term potential — because in the end, stock prices follow strong fundamentals.

That owner thinking also explains how Investor AB treats cycles.

Its exposure to industrials, engineering and tech means it feels the booms and busts harder — but it embraces that volatility. Low leverage, active stewardship and patient reinvestment turn downturns into opportunity: buy, fix, wait, compound. Over time, what looks like risk to the short-term trader becomes tailwind to the long-term owner.

This isn’t just history on a page — it’s a playbook.

And it shapes arvy too.

We try to invest the same way: think long-term, act like owners, avoid leverage, back fundamentally sound businesses, and let compounding work for us. That’s our translation of the Wallenberg lesson into everyday portfolio decisions.

With the sixth generation stepping up at Investor AB, the dynasty shows no sign of slowing.

So, what do you get when you blend a dynasty mindset with market discipline and an owner’s horizon?

A story still being written — and a chart that keeps climbing.

Chart 4: Investor AB over the last ten years, in EUR