Novartis: Dividend-Paying, Cash-Generating Pharma Giant

"Go long when stocks reach a new high. Sell short when they reach a new low."

– Jesse Livermore, Trading Legend

“Musch ha.”

You know the expression.

In Switzerland, it refers to the handful of companies that are considered mandatory holdings — the names you just must own because it’s bon ton.

Three are always mentioned. At arvy, we call them the three big elephants.

Two of them are our beloved consumer supertanker Nestlé, which has run into a bit of a storm over recent quarters, and the diagnostics-plus-oncology powerhouse Roche.

And while writing this, I would even add a fourth: Lindt & Sprüngli — the company that continues to enchant the world with chocolate. And as a Swiss investor, of course we aim for the Namensaktie. Yes, it costs a bit more at CHF 120’000 per share, but who would ever want to give up the legendary 3kg Schoggi-Koffer handed out every year at the Annual General Meeting in the Kongresshaus in Zurich?

Yet, the one major name I skipped is, naturally, the other Swiss pharma bellwether. No more generics, no more eye-care — those were spun off as Sandoz and Alcon, respectively.

Today the company is a focused innovator, centered on cardiovascular, immunology and neuroscience breakthrough medicines.

Like Roche, its headquarters are in Basel.

The third big elephant in the SMI.

Novartis.

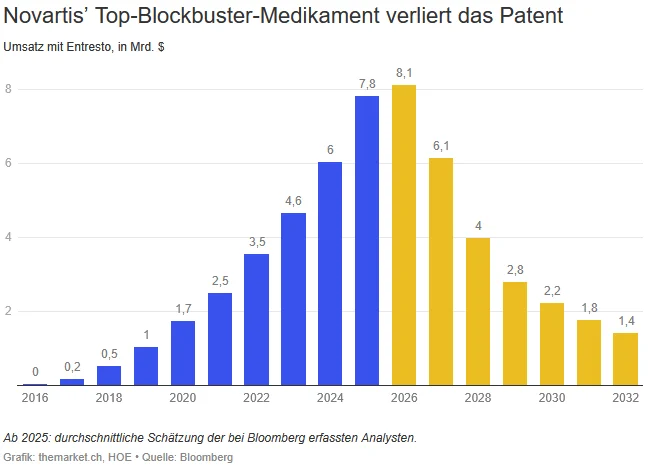

Chart 1: Novartis and Big Pharma businesses always must fight the patent cliff

Novartis is one of the global heavyweights in branded pharmaceuticals.

“Branded drugs” is simply the industry’s elegant way of saying: the original innovator — the one that discovers, designs, and owns the drug.

Every branded drug comes with a patent, typically lasting 20 years from the moment the application is filed. But those 20 years are not 20 years of sales.

The first 5–15 years are spent in:

Only the remainder — the precious 5 to 15 years — are the golden era where Big Pharma can charge premium prices before generics enter the arena.

And charge they do.

It’s no coincidence that branded drug pricing was once a major pillar of President Trump’s political agenda. With Novartis generating roughly one-third of its revenue in the US, it was often a poster child in that debate.

Interestingly, this has now been pushed into the background.

Why?

Because with the new 15% tariff deal, Switzerland secured an exemption for Novartis and Roche — in return for a combined $73bn investment over five years to manufacture all key drugs for US patients on US soil.

“The Art of the Deal,” as Donald Trump would undoubtedly put it.

But back to patents.

Patents create exactly the kind of economic moat Warren Buffett loves: a castle, surrounded by a wide moat filled with sharks and crocodiles, where the company can safely harvest profits.

But the moat has an expiry date.

Eventually, the patent expires — and the cash cow becomes a cash ghost almost overnight.

This is the infamous patent cliff.

Novartis is no exception.

Its top blockbuster heart medicine Entresto ($7.8bn in revenue, ~15% of the company total; chart 1) is approaching this cliff. And it’s not alone. Cancer drugs Promacta ($2.2bn) and Tasigna ($1.7bn) follow.

All three face patent expirations in the coming years.

And before I forget. A “blockbuster drug” is the pharmaceutical version of a Hollywood smash hit. Anything generating more than $1bn in revenue.

But just like movies, blockbusters fade.

And new ones must follow.

Novartis must act the same way. Every blockbuster eventually expires. Every blockbuster must be replaced.

History offers painful examples for companies that failed to refill the pipeline. Novo Nordisk and Pfizer both fell more than 60% from their respective peaks when their blockbuster cycles turned against them.

So, this begs the obvious question.

Will Novartis face the same destiny?

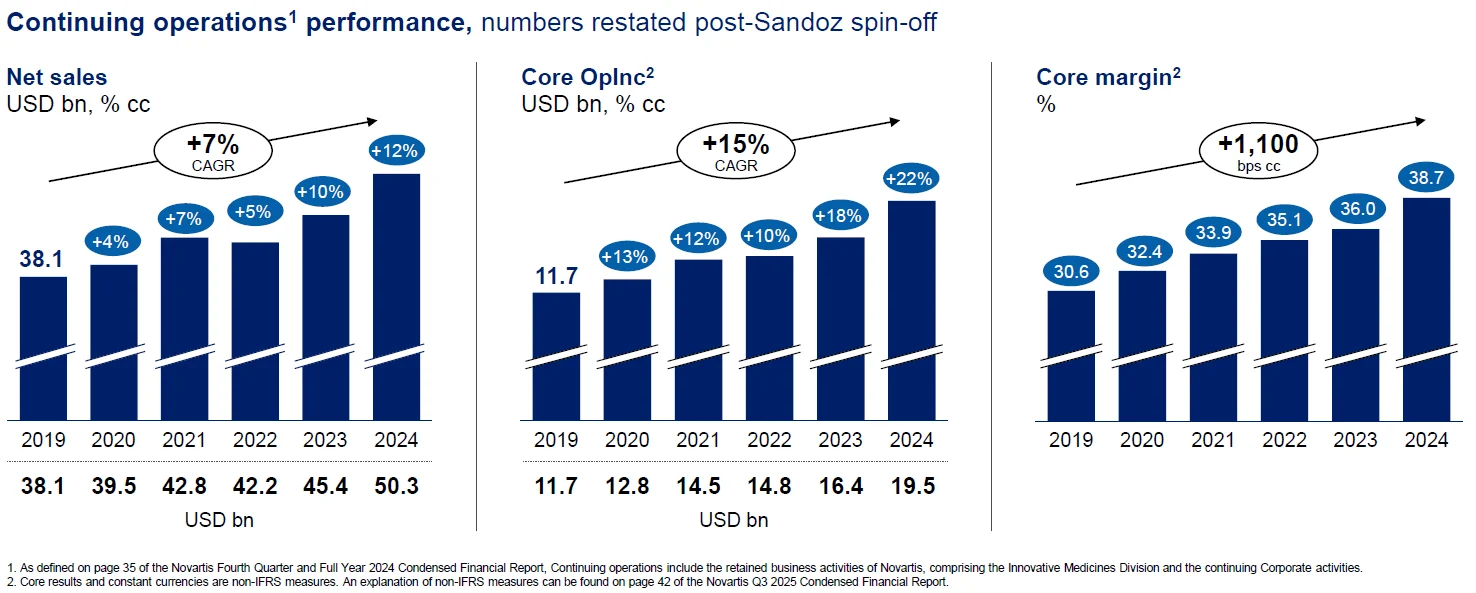

Chart 2: Novartis’ strong multi-year track record of sales growth, operating income growth, and margin expansion

Historically, Novartis has been exceptionally well positioned to deliver — year after year — across its diversified portfolio of therapies. Whether we look at new drug approvals, net sales, operating income, or margins (chart 2), everything reflects a business that executes with Swiss-made precision.

Currently, Novartis has 14 in-market blockbusters, of which 8 carry a $3bn+ peak sales potential, complemented by 6+ ongoing launches.

Like a Swiss clockwork, I would say 😉.

But is this enough?

Looking forward, the same pattern of consistency continues. Novartis holds 30+ potential high-value pipeline assets, giving the business depth and long-term visibility.

On top of that comes a higher-risk but often highly effective strategy: acquisitions — buying future pipelines rather than building all of them internally.

Just this past October 2025, Novartis acquired Avidity Biosciences for $12bn. This deal significantly strengthens its neuromuscular portfolio, bringing in promising assets such as del-desiran and del-brax, both projected to have multibillion-dollar peak revenue potential.

This “pipeline-buying” approach is typical for Big Pharma, which generates massive cash flows from established branded drugs.

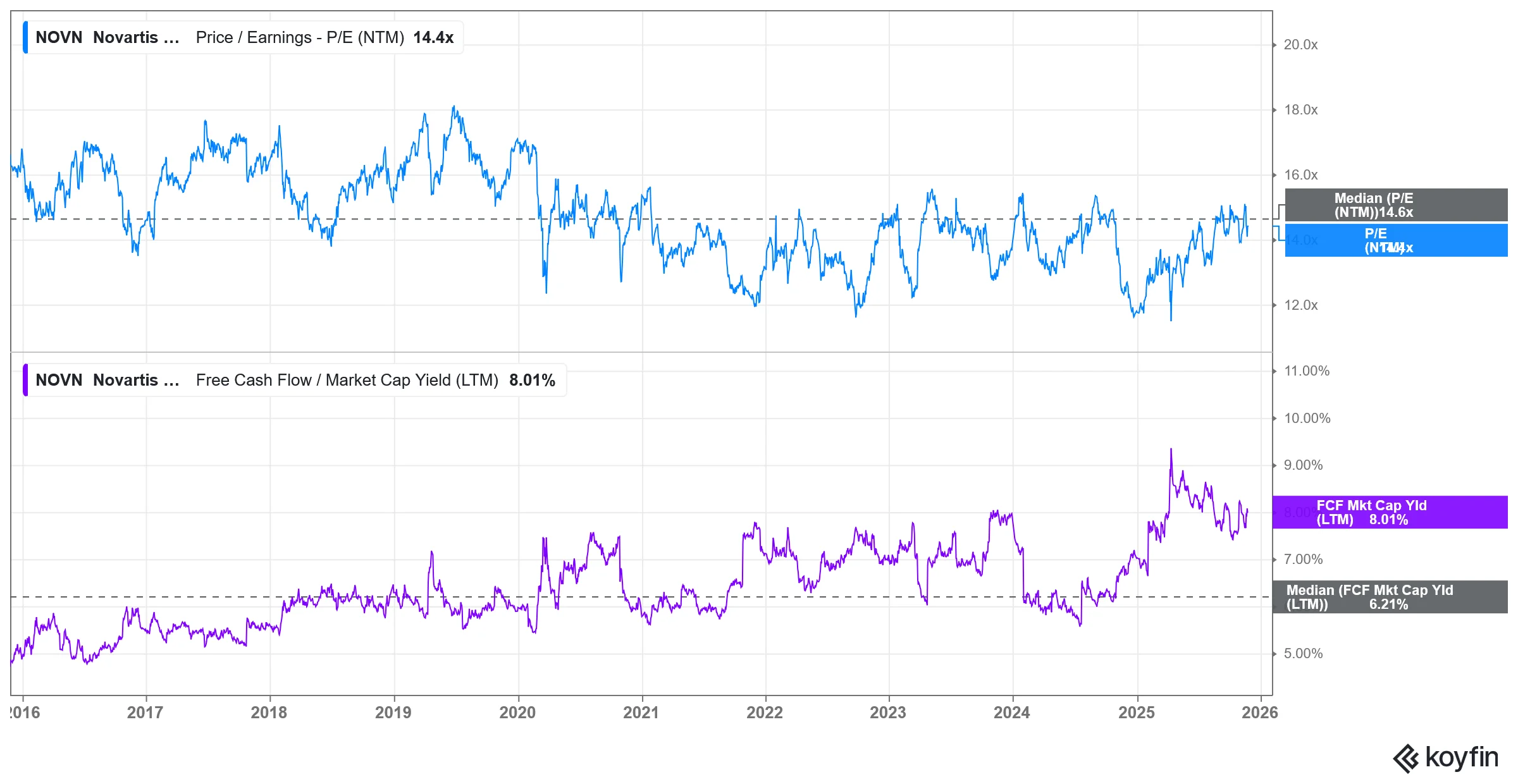

And that shows up in Novartis’s financial profile: a strong free cash flow yield of ~8.0% combined with a low P/E of ~14.6 — a valuation discount driven by the never-ending fear of patent cliffs (chart 3).

Oh, and for the dividend hunters — it even pays a lofty 3.4%.

Can a Friday morning get any better?

Putting the pieces together, the “Good Story” is straightforward.

With Novartis — one of arvy’s four “Musch Ha” in Switzerland — we have a business that is strongly positioned across multiple therapeutic areas, capable of generating stable long-term cash flows with both top- and bottom-line growth. It is backed by a deep pipeline that can weather the patent cliff, trades at an undemanding valuation both historically and versus peers, and carries the bonus of our home currency, the strong Swiss franc.

The story is clear.

Now let’s see what the “Good Chart” is saying.

Spoiler: it cannot be more bullish.

Chart 3: Novartis valuation is in its historical ranges

Let’s look at Novartis’ stock price — the “Good Chart” (chart 4).

It’s sitting at all-time highs.

Why care?

Because stocks making new highs come with a powerful psychological advantage.

And psychology — more than models, forecasts, or spreadsheets — drives investing. It accounts for well over half of long-term results. Arguably even more.

Why is owning stocks at new highs such an advantage?

It comes down to a simple but profound concept: the “line of least resistance.”

When a stock is pushing into new 52-week highs, or better, all-time highs, the line of least resistance is upward.

And more importantly, every investor holding the stock is:

Think about yourself.

When a stock in your portfolio makes a new high, you’re not stressed. You’re not checking the price every hour. You’re not second-guessing your decision. The level of uncertainty is low — and as investors, we dislike uncertainty more than anything.

This collective investor psychology creates a reinforcing loop: happy holders → no selling pressure → easier path upward → new highs → even happier holders.

And that’s why a new all-time high is the single most bullish signal in technical analysis.

Not because of magic or a complex formula.

But because of human behavior.

Chart 4: Novartis over the last 20 years, dividends reinvested (total return)