Our Four Lessons from Warren Buffett and Charlie Munger

"There is only three ways a smart person can go broke: liquor, ladies and leverage"

– Charlie Munger, the architect of Berkshire Hathaway

arvy's teaser: Last Sunday, we received the 2023 annual report from Warren Buffett and Berkshire Hathaway, which is a must-read. Always full of wisdom, knowledge and modesty. I highlight the four most important lessons that we at arvy have learnt from reading these annual reports over the past few years and have integrated into our professional and personal lives.

Nothing beats having a great partner.

That is lesson #1 from Warren and Charlie (chart 1) when it comes to building something to last.

It is simple. When you find the right thing to do when you find the right people to work with, invest deeply. Sticking with it for decades is how you make the big returns in your relationships and in your money (Warren knew Charlie since 1959).

Pick an industry where you can play long term games with long term people. All returns in life, whether in wealth, relationships, or knowledge, come from compound interest.

That is the idea of arvy and our mission: we want to solve the problem of barriers to investing, make it simple and accessible. And create the most modern investment experience we wish we had enjoyed years ago – all while giving you updates along the way and, most importantly, with a decent return.

Founded by Florian, Thierry and myself, who have been friends for fifteen years.

And we have been working together for six years.

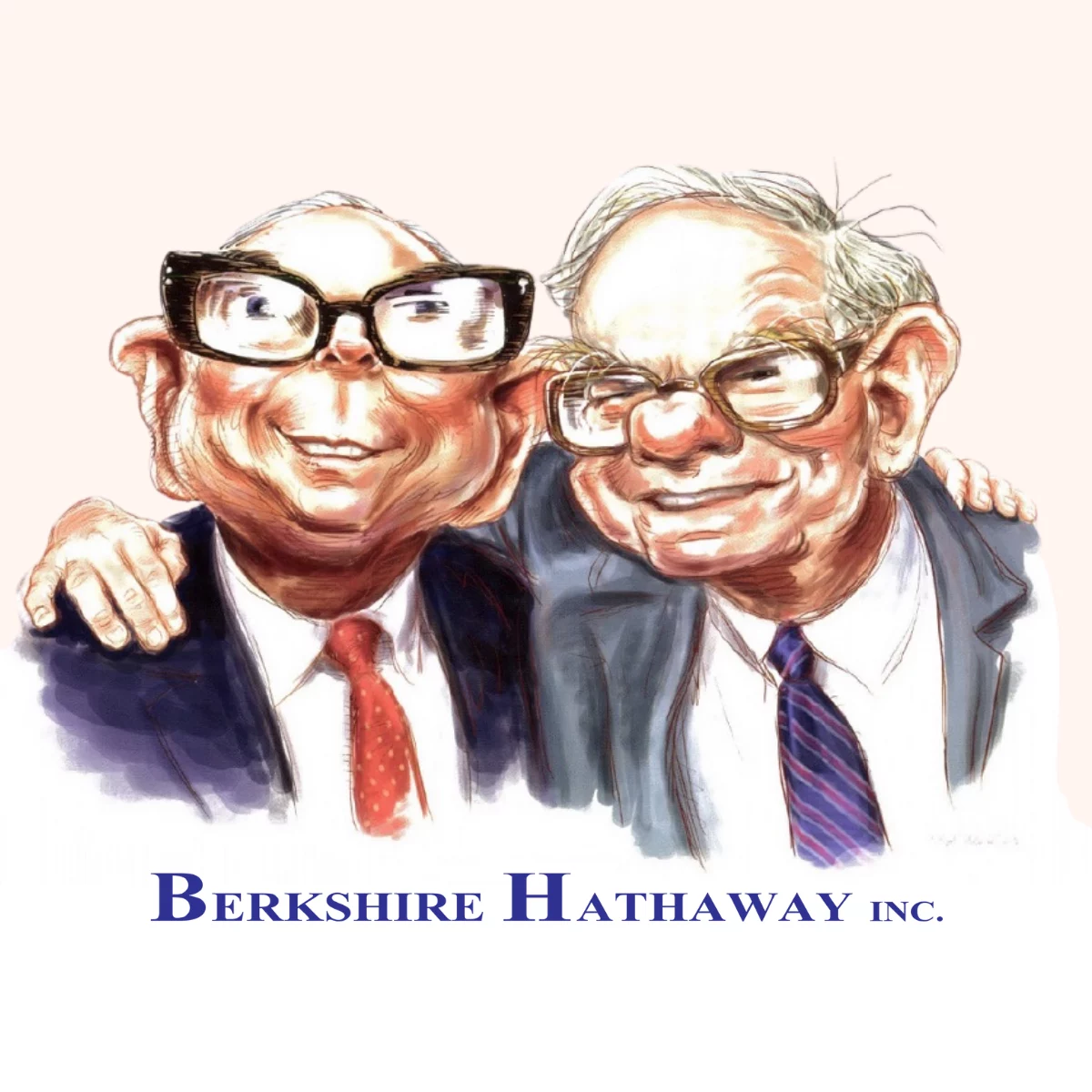

The key metric for a quality business

1979.

That year, Buffett mentioned in his annual report that the most important financial metric was return on capital. It reflects how efficiently the management deploys its capital.

A business I want to own must have these three characteristics:

If you find businesses that fulfil all three of these criteria, you will find winners that keep winning. Industries that exhibit these characteristics can be found in chart 2.

McKinsey analyzed the ROIC histories of about 7’000 publicly listed nonfinancial US companies from 1963 to 2004. The blue bar in the following chart shows the median annual ROIC for 1963 to 2004 and the orange bar shows the ROIC from 1995 – 2004.

Something catches your eye?

No sector exists that leads from one end to the other. It is persistent. That explains why we have been heavily exposed to sectors such as healthcare, consumer staples and technology over the years. There you will find many quality companies that can reinvest their capital at high returns.

We wrote about it in The Market NZZ this week: The Perfect Company Does Not Pay Dividends

This is lesson #2.

Chart 1: The return on capital is consistent for industries

Read, read, read

“In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time – none, zero.”

Friends said about Charlie that he is a book with legs sticking out. He assigns most of his success to reading, which is reflected in the above quote.

This is lesson #3 and is echoed in our company culture: every day you can pick a book or article from our office library and sit down for 15 minutes to let your mind wander.

Many of our best ideas stem from this exercise.

Most of the wisdom, most of the knowledge is already written down somewhere in a book. And for us, reading is to the mind what exercise is to the body. You just need to have the curiosity to pick up a book and read it.

Looking for some book inspiration? The middle part of the first paragraph is from one of my all-time favorite books: "The Almanack of Naval Ravikant" by Eric Jorgenson (chart 3).

If you need any more, just check out our arvy's book club.

And please, we are always open to recommendations!

Chart 2: arvy’s Book Club – The Almanack of Naval Ravikant

Source: arvy’s Book Club

The root of all evil

Listening to both was always characterized by wit and wisdom.

A well-known message from them is today's quote from Charlie Munger, whom Warren honored as the architect of Berkshire Hathaway in his annual letter this Sunday after he passed away last year at the age of 99.

A lesser-known part of this quote was once uttered by Warren and has always stuck with me: "My partner Charlie says there are only three ways a smart person can go broke: Liquor, ladies and leverage," he said. "Well, the truth is - he only added the first two because they start with L - it's leverage."

So, lesson #4 is a simple one.

We do not want to own companies that are highly leveraged. We do not want companies that rely on leverage to make money.

The root of all evil is leverage.

Period.

To summarize and expand a little, the attributes Warren and Charlie look for are a wide economic moat, management integrity, low capital intensity and high returns on invested capital, good capital allocation, high profitability, attractive historical growth, low debt levels and strong secular tailwinds.

If you manage to acquire companies with these characteristics at a reasonable valuation and hold them for a long time, you will achieve great results.

Simple – and this is what we aim for at arvy.

Chart 4: Berkshire Hathaway A Shares since inception

Source: TradingView