Quality Stocks on Sale

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

– Warren Buffett

Sale season.

It happens occasionally.

Particularly on those high-quality clothes you love.

Nothing quite sparks that little joy inside like spotting a SALE sign, wandering through the racks, and finding something you’ve long wanted — now at a discount.

It’s pure psychology. Discounts make us want to buy. Yet, strangely, when it comes to investing, the very same human instinct flips. Falling prices don’t excite most investors — they scare them.

But every so often, Mr. Market behaves just like a seasonal sale.

He marks down prices, not only across the board, but sometimes even on the finest quality items — the wonderful companies. Of course, that doesn’t happen often. Quality rarely goes on sale (Hermès, for instance — a business we own — never does – whether in price nor on its clothes).

But right now, as the market’s attention is absorbed elsewhere — chasing the next big thing — the high-quality compounders are quietly sitting on the shelf, overlooked and underpriced. Their fundamentals keep delivering, just as they always have.

Only this time, they come with a tag we investors love to see.

They’re on sale.

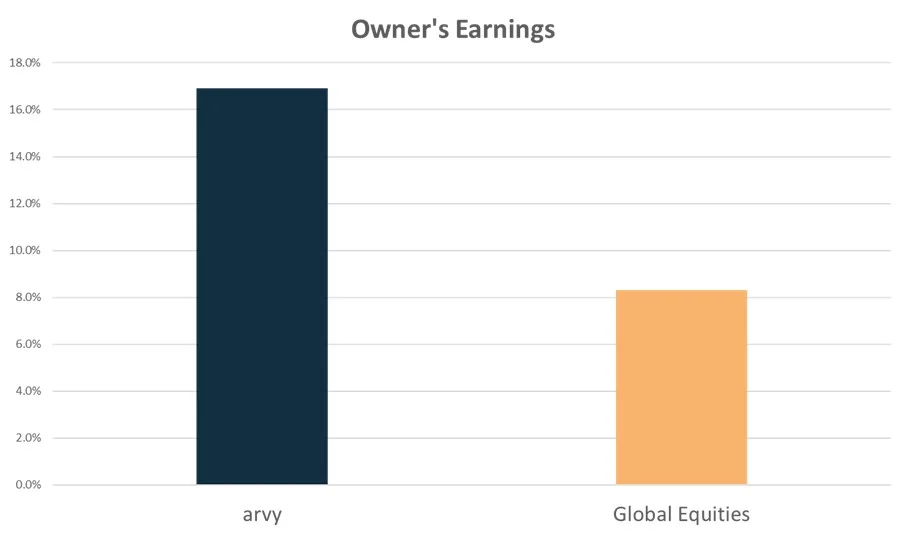

Chart 1: arvy’s high quality portfolio characteristics (if it would be one stock)

At arvy, we buy good businesses.

What are good businesses?

They’re compounders — companies with a wide moat, protecting their economic castle from competition. They show high gross and net margins, reflecting pricing power and the ability to weather inflation. They generate strong free cash flow, leaving cash not to plug debt holes or pay dividends, but to reinvest at high returns — the ultimate mark of a quality compounder (ROIC/ROCE).

And above all, they’re led by prudent, honest management with skin in the game — equity stakes aligned with shareholders, growing top and bottom lines in structurally attractive end markets.

The goal: looking for compounders that steadily can grow 12-15% per year, net in $.

How does such a portfolio look like?

One that is qualitatively 1.5–2x stronger than the global market (chart 1). We presented five candidates on The Market NZZ this week.

Warren Buffett would call these “wonderful companies.”

We call them businesses with a “Good Story.”

The catch?

Everyone knows they’re high quality — and quality rarely comes cheap. They seldom go “on sale,” much like your favourite premium brand that never seems to hit the discount rack.

Yet now? They are.

Why?

Because the market’s attention has drifted elsewhere.

Markets are always driven by narratives. Whether it was stagflation in the ’70s pushing energy stocks, Japan-mania in the ’80s, the dotcom bubble of companies with clicks but no cash, or China’s rise post-GFC — each era had its obsession.

And today’s?

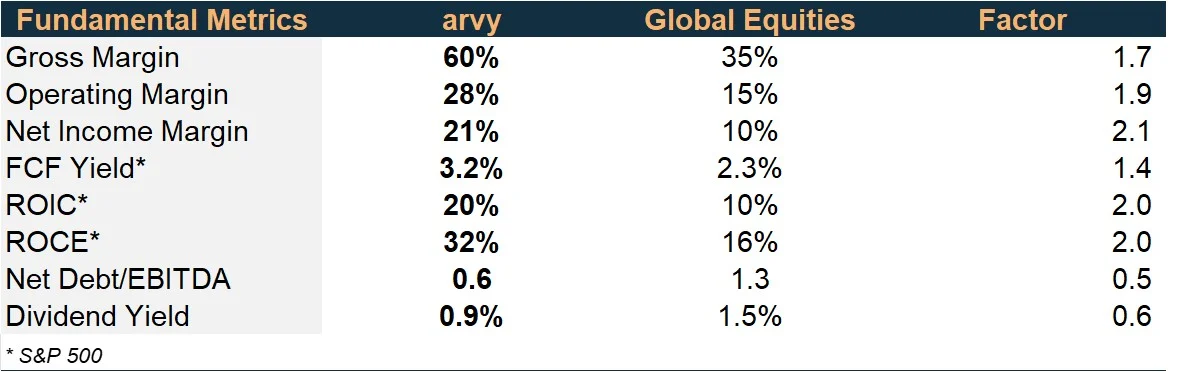

Artificial Intelligence – and a mix of related topics such as nuclear energy, quantum computing, infrastructure, and rare earth elements. The result: a deeply divided market—a wide dispersion between the themes and the companies that belong to them or not (chart 2).

Example?

Unprofitable companies have been among the year’s best performers. Even more striking, companies with no revenue (such as nuclear companies or quantum computing) have outperformed every group by at least 2×.

It’s all about AI — or fluff.

And while AI has a seat in our portfolio (though not the biggest one), the fluff does not.

So how do we think about this?

Chart 2: A divided market: Tech companies with no revenues or profits are flying. The rest are left in the shade

Good businesses keep on being good — their fundamentals don’t suddenly crumble.

But when Mr. Market shifts his focus from fundamentals to narratives, as we’ve seen with the surge in “no-revenue” companies, something interesting happens: great businesses quietly get cheaper.

Stock prices start to lag business performance.

To our annoyance of being invested in compounders, these steady, highly visible names often get sold — not because anything broke, but because investors need to fund the next “big idea.”

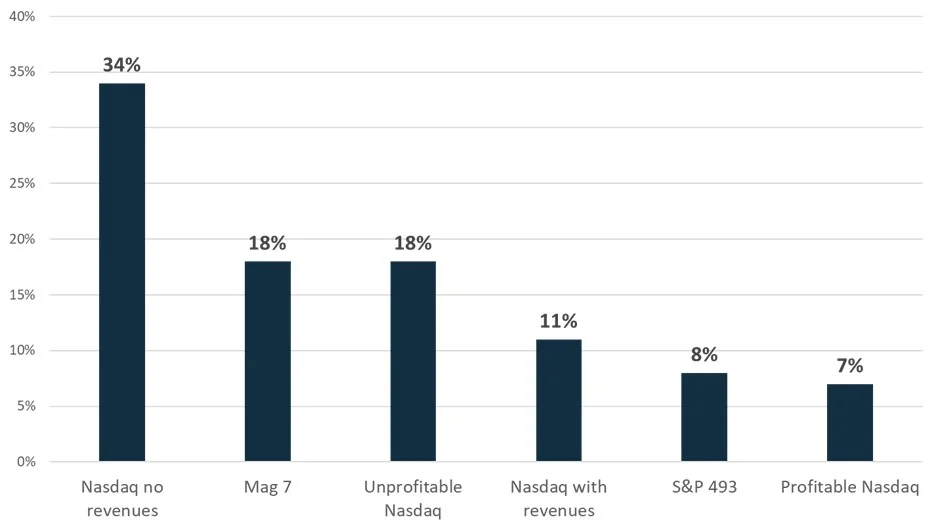

Market commentators call this a rotation. It leaves quality names underperforming (chart 3).

But the story remains the same.

The wonderful company, still executing as ever, becomes undervalued simply because it’s not en vogue — or ironically, because it keeps doing exactly what it always has: delivering.

The result?

We get exactly what Warren Buffett meant: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Right now, wonderful businesses are available at more than fair prices — a rare market anomaly that tends to appear only once every decade or so (see again chart 3: Dot-com and post-2008).

Historical data shows that quality businesses, underpinned by strong fundamentals, eventually see prices catch up with them.

As these businesses keep delivering, their compounding power shines through, and over the long run, they outperform.

That’s the essence of the quality anomaly.

Of course, the long run requires patience.

To the frustration of our investing style, we’re in one of those periods where “boring is good” moves sideways quietly — no fireworks, no headlines.

So, while it might feel challenging in the short term, at Arvy we continue to dollar-cost average into our portfolio — and apply our other two DCA strategies (check out our most-read blog) — to keep benefiting from these rare dislocations. Here lies the opportunity! The best time to buy a great company is not when everyone agrees it’s great and it’s priced for perfection, but when it’s fallen out of favour — perhaps even trading at a historical discount.

Because history always rhymes: Mr. Market’s chase for the hottest narrative cuts both ways — sharply up, and sharply down.

We prefer to stick to our plan — long-term compounding in good businesses with an attractive risk/reward profile.

After all, investing other people’s money is a privilege. We don’t chase “the next big thing.” We don’t invest in unprofitable companies — and certainly not in those with no revenues.

So yes, Mr. Market is leaving high-quality names in the dust right now.

But what does that mean for the long run?

How does it look in real life?

Are we worried?

Spoiler: No.

Chart 3: High Quality Stocks Underperformance is at 1999 Extremes

The good businesses we own all share the same DNA: high earnings stability and visibility — the hallmark of true compounders, alongside high returns on invested capital.

You can see this reflected not only in their steady financials but also in their resilience during drawdowns and lower volatility.

In fact, our portfolio shows a maximum drawdown of less than 70% of the global market’s and only two-thirds of its volatility — while still delivering similarly strong returns.

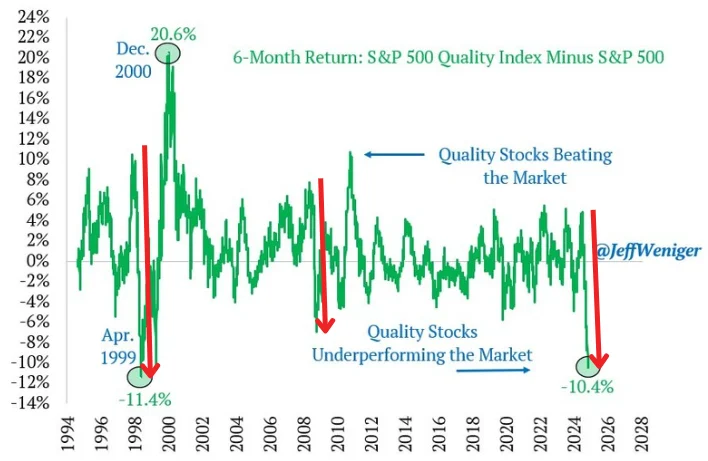

Now, let’s bring in a concept popularized by Warren Buffett (yes, him again): Owner’s Earnings.

It tells you how much a company really earns for you as a shareholder.

Why are they important?

Because over the long term, stock prices always follow a company’s owner’s earnings.

Focusing on this cuts through the noise of the manic-depressive Mr. Market — from euphoric manias chasing the next big thing to the inevitable panics and crashes.

How to calculate them?

Simple: Earnings per share growth + Dividend yield.

Take arvy’s portfolio as an example (chart 4): 16.0% (3-year EPS CAGR) + 0.9% dividend yield = 16.9% owner’s earnings. Compared to the common 7-10% of global markets.

Considering valuations of our 30 holdings are roughly in line with historical averages — while major indices like the S&P 500 or Nasdaq trade at their most expensive levels in decades — that sounds like a pretty good deal, if you ask me.

As we scale further through DCA into our portfolio at these attractive valuations, we remind ourselves of one last timeless piece of wisdom — this time from the architect of Berkshire Hathaway himself.

Then successful investing is like the great Charlie Munger said.

The big money is not in the buying and selling.

But in the waiting.

Chart 4: arvy’s long-term return expectations (estimates)