Ryanair: The Airline That Broke the Rules — and Won

"I don't like airlines, lousy unions"

– Gordon Gekko in the movie Wall Street (1987)

Airlines.

Lousy unions.

And even lousier investments.

That’s what Gordon Gekko — the ruthless corporate raider in my favorite finance movie, Wall Street (1987) — told Bud Fox when he pitched the idea of buying Bluestar Airlines.

Growing up in an airline family, I got to know the industry inside and out — its economics, but also its beauty. From Air France and Swissair to Pan Am, I’ve seen firsthand how it works — and why Gekko didn’t want to touch it. Too many competitors. Highly cyclical. Weather disruptions. Massive capital tied up in aircraft. Seasonality. No moats. To say the least — it’s a brutal business.

Yet, one airline has mastered it.

It’s charted an extraordinary growth path, crushing its competitors and becoming the rare exception in an industry notorious for destroying shareholder value.

The secret?

A ruthless commitment to low-cost operations, discipline in execution, and strategic route expansion — a combination that’s turned it into Europe’s dominant airline powerhouse.

Let’s dig into what has allowed this airline to deliver substantial returns in one of the toughest industries out there.

The airline?

Ryanair.

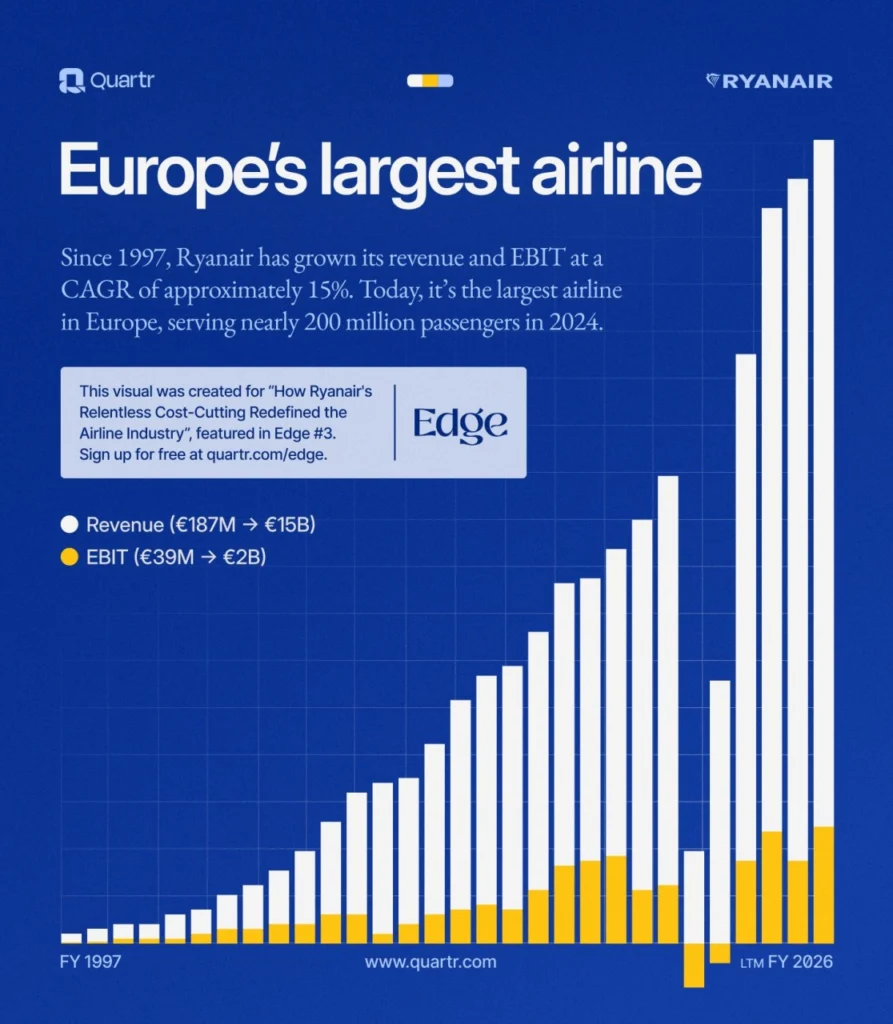

Chart 1: Ryanair's revenue growth since 1997 to become the largest airline in Europe

4% in 2004. 8% in 2008. 16% in 2023.

That’s Ryanair’s market share in Europe — and counting.

CEO Michael O’Leary loves making money. And he loves competing even more. Today, Ryanair is Europe’s largest budget airline, serving nearly 200 million passengers in 2024 (chart 1).

Founded in 1984 in Ireland by the Ryan family — with Tony Ryan at the helm — Ryanair started with a single small turboprop plane. Its mission was simple yet bold: break the duopoly of British Airways and Aer Lingus on London–Ireland flights by offering a lower-cost alternative.

After years of early struggles, one turning point changed everything.

In the early 1990s, then-CFO Michael O’Leary took a trip to the United States. There, he met Herb Kelleher, co-founder of Southwest Airlines — the pioneer of the low-cost model. O’Leary returned to Ireland with a revelation: “We can revolutionize European air travel.”

The Southwest model?

So simple.

So easy.

Yet revolutionary:

The result?

O’Leary transformed Ryanair from a small, struggling carrier into Europe’s lowest-cost, highest-margin airline — a powerhouse that keeps widening its cost advantage. It has the by far lowest cost per passenger (ex-fuel, chart 2).

Ryanair operates with a gross margin of 28.9% and a net income margin of 14.1%. For context: Lufthansa sits at 18.6% / 4.6%, Air France at 20.3% / 3.2%, and easyJet at 33.7% / 4.3%.

So yes, a single “stealing of the idea” moment reshaped not just Ryanair, but arguably the entire European airline industry.

Today, Ryanair operates 636 planes (199 Boeing 737-8200 “Gamechangers,” 411 Boeing 737 Next Gens, and 26 Airbus A320s). By 2034, it will receive another 300 Boeing 737-Max 10s — each carrying 21% more passengers, burning 20% less fuel, and flying 50% quieter than previous generations.

That’s 3’600 daily flights, across 240 airports in 40 countries.

Thinking of catching a cheap Ryanair flight from Zurich?

Bad news — you’ll have to drive to Basel/Mulhouse.

After all, Switzerland remains a “Hochpreisinsel” 😉.

But relentless cost discipline isn’t Ryanair’s only edge. There’s another, even smarter idea built into its business model.

One of the best of modern investing.

Chart 2: Ryanair with Europe’s Lowest Costs Gap Widens (vs. Wizz Air, easyJet, Southwest, British Airways, Lufthansa, AirFrance/KLM)

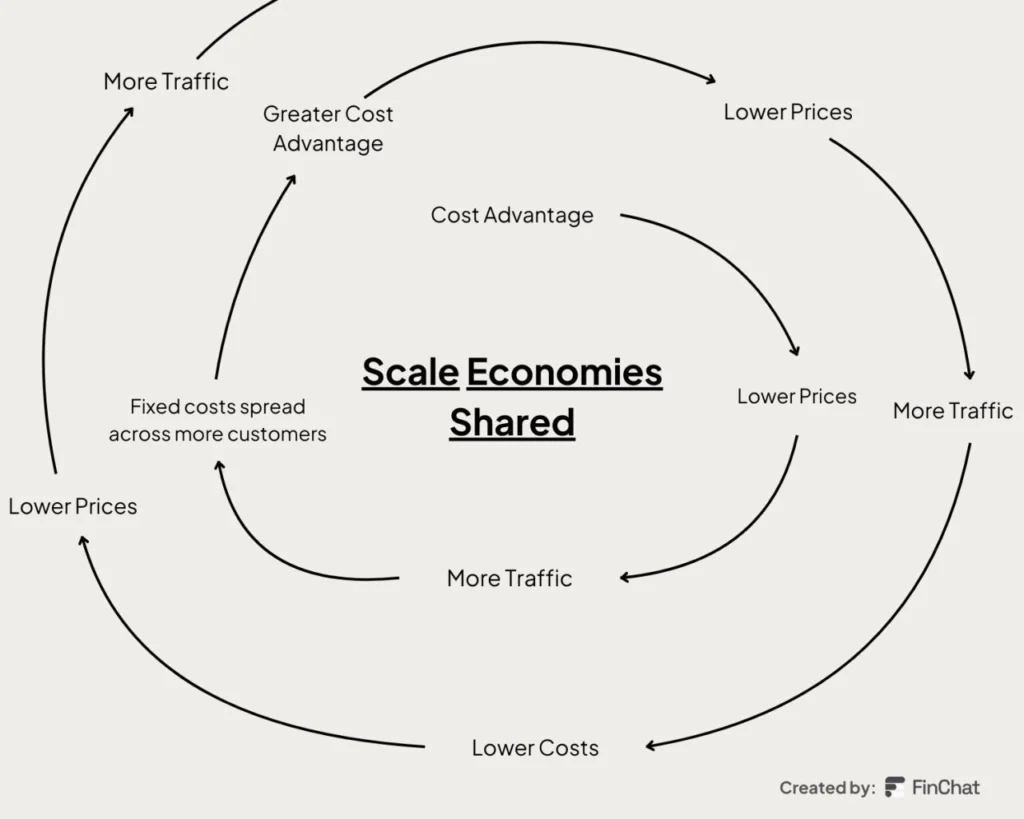

Some companies succeed by giving more than they take.

By reinvesting their scale advantages, they turn efficiency into loyalty — fueling compounding growth and an enduring competitive edge.

That’s exactly what Ryanair does.

The foundation of Ryanair’s spectacular rise is its position as the lowest-cost provider — by a wide margin — in an industry infamous for inefficiency and razor-thin margins.

This cost leadership forces competitors to charge roughly double Ryanair’s fares, which is why the airline keeps capturing market share across Europe.

Ryanair’s low-cost strategy is built on extreme operational efficiency — its biggest cost edge coming from airport landing fees, followed by the use of a single aircraft type.

And here’s the genius: Those savings aren’t hoarded. They’re shared.

Cheaper fares drive more passengers. More passengers spread fixed costs. Lower unit costs lead to even cheaper fares. Round and round it goes.

Or, in investing terms: Scale Economies Shared (chart 3).

It’s one of the greatest ideas in modern business — and one NZZ The Market through companies like Amazon, Costco, and MercadoLibre, all masters of this principle.

Ryanair has consistently rethought the airline playbook and pursued cost cuts with near-religious intensity. Many of its moves are controversial — yet its rivals often follow to capture the same savings.

Example?

Charging for food and drinks, luggage fees, airport check-in charges, skipping frequent-flyer programs, and avoiding air bridges altogether.

These bold (and often mocked) moves not only allow Ryanair to offer ultra-low fares — they also generate massive publicity. Much of it negative, sure, but it’s still free marketing.

And Ryanair owns that narrative. Its social media team roasts customers, trolls competitors, and laughs along with the internet — memes, fake rumors about paid toilets, even jokes about standing seats.

If you’re up for a good laugh, check out their accounts. You won’t be disappointed.

So yes — the “Good Story” of Ryanair is a compelling one, especially in a notoriously brutal industry.

But the question remains: Would we ever touch this at arvy?

Let’s see what the “Good Chart” says.

Chart 3: The Concept of Scale Economies Shared done by Ryanair

We touched on it in the beginning — it’s a brutal business.

Too many competitors. Highly cyclical. Weather disruptions. Massive capital tied up in aircraft. Seasonality. No moats.

And all of that is clearly reflected in Ryanair’s stock price.

As an owner of the business — and its stock — you need to stomach a lot of volatility.

We’re talking big drawdowns:

That’s a lot of stamina. A lot of conviction. And a lot of turbulence for one position in a portfolio.

So, while over the last decade Ryanair has performed roughly in line with global markets (chart 4), its linearity — meaning return per unit of volatility — is dramatically worse.

To make this arvy’s Weekly short and clear, let’s end with the wisdom of a real investor, not a Wall Street raider.

As Warren Buffett once said: “The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money… think airlines.”

That's why we at arvy say thanks - but no thanks.

Turbulence yes, but only in flight, please.

Not in the portfolio.

Chart 4: Ryanair over the last ten years, in USD, ADR