Santa Rally? Nice. Compounding? Better.

„Investing is truly the gift that keeps on giving - compound interest, returns, and dividends”

– Phil Town, investor and author

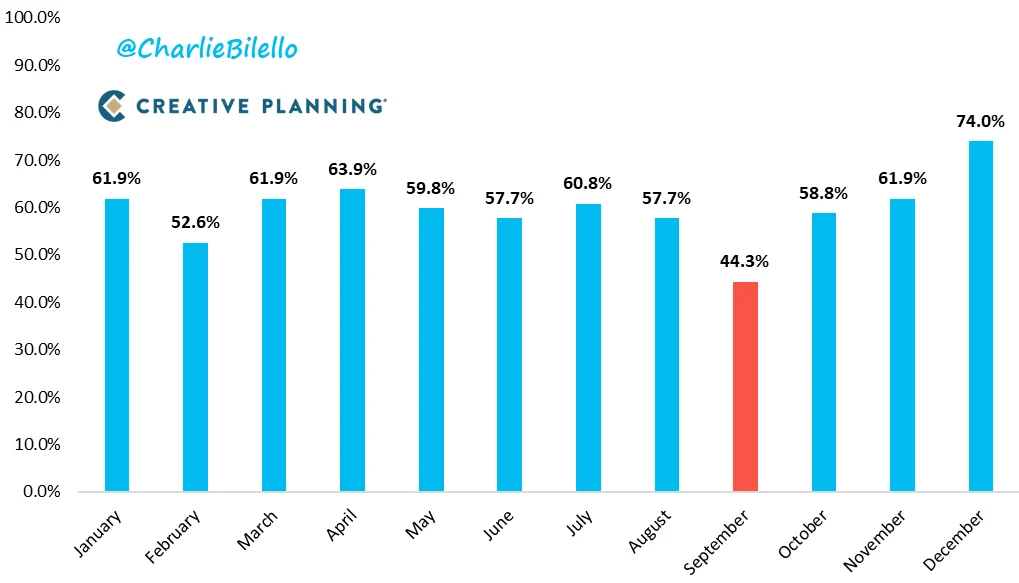

74%.

That’s how often the stock market finished December in the green over the last century.

In other words: nearly three out of every four Decembers delivered positive returns. No other month even comes close to this level of consistency (chart 1).

But here’s the twist: despite its stellar hit rate, December isn’t the strongest month in terms of performance. Its average return of 1.4% puts it only in third place — behind April (1.5%), lifted by Easter optimism, and November (1.7%), boosted by Thanksgiving and the kickoff to holiday spending.

Notice a pattern?

All three of these months are anchored by major festivities. And these holidays reliably bring a mix of consumer spending, optimism, bonus season liquidity, and general year-end cheer. The result: a well-documented seasonal anomaly of stronger markets.

So, it’s no coincidence that we’re highlighting the most magical of them just as we reach mid-December.

It’s the one investors watch for, talk about — and hope for — every year.

The Santa Claus Rally.

Chart 1: S&P 500: % Positive Monthly Return (1928 – 2024)

The “Santa Claus Rally” is one of the most talked-about anomalies in markets — so widely known that many investors assume it means stocks simply do well throughout December.

But that’s not entirely true. Which raises the obvious question:

When does Santa actually come to town?

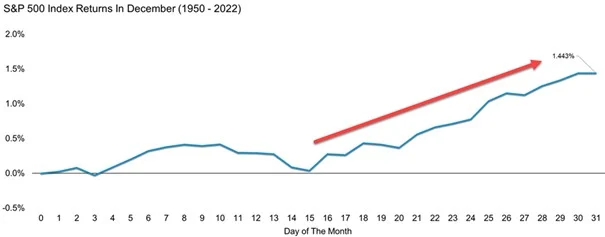

Historically, most of December’s strength is concentrated in the second half of the month (chart 2).

Even more striking: the last five trading days of the year and the first two trading days of the new year. Those seven sessions — the classic “Santa Claus period” — have produced positive returns 79.2% of the time for the S&P 500.

As for why this happens, most explanations revolve around the U.S. market — which makes sense, given that the U.S. accounts for roughly 70% of global equity market activity.

Theories include:

But while the Santa Claus Rally can provide a festive tailwind, investors shouldn’t rely on it for anything more than what it is: a short-term seasonal pattern. Magic is fun — but it’s not a strategy.

Real, lasting wealth comes from identifying companies that can compound value over decades, not days.

And at arvy, that has been the mission from day one.

We call it “Good Story & Good Chart.”

Chart 2: Remember, Santa Tends to Come Later in December

This December 15th marks the two-year anniversary of the relaunch of the arvy equity strategy (seven years in total). What began with $5 million in assets under management has grown to nearly $60 million – we’re this close 😉 – thanks to your trust and support.

Regarding our other mission to make investing accessible and tangible, our weekly readership has grown from 143 readers in the very first edition in June 2023 to over 11,000 today, with this edition being number 128 – delivered every single Friday without missing a beat.

Not to mention the nearly 1,000 clients on the arvy app and the completion of a major project that will soon make us tradable across Germany through platforms like Comdirect, Sparkassen, and Volksbanken – juhui.

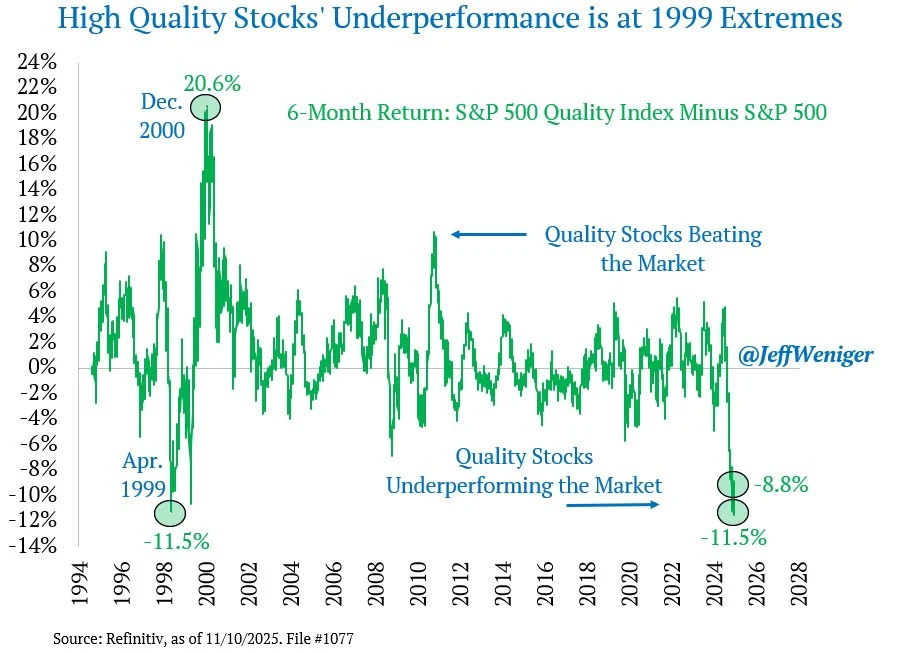

It has been a challenging year for our “boring is good” investment philosophy. Many of our high-quality holdings were left in the shade by Mr. Market. And of course, the relentless punishment of software businesses supposedly “threatened” by Artificial Intelligence – even though the businesses continue performing just fine while the stock prices… did not.

We highlighted the poster child Adobe: the company is still growing at 14%, yet Mr. Market believes Adobe is going extinct and pushes it to a 13x forward P/E vs. a historical 30x.

Result?

The stock is down 60% from its highs. (You’ll find our “AI eats Software” piece here – a must-read for every investor, in our humble view.)

As you know, due to the relentless punishment and being heavily exposed to this theme over the past seven years, we reduced our software allocation from nearly 30% to below 10% for 2025.

All in all, rotations out of “compounders” do happen occasionally – but rarely as violently as this year (chart 3).

While market conditions haven’t been kind, we’ve worked diligently to keep improving the quality of the portfolio. Today, arvy’s portfolio consists of 33 companies of superior quality and stronger long-term prospects compared to the global market, which remains heavily concentrated in a handful of mega-caps (over 50% of the S&P 500 is essentially one story: AI + CAPEX).

On top of that, our portfolio offers a more attractive valuation profile on a free-cash-flow yield basis.

If you are interested in the portfolio, reply to this email.

We now own a rock-solid portfolio of businesses capable of compounding at mid-teen rates – and Mr. Market is offering them at compelling prices.

So, in our view, Santa came early this year, and all three founders added a meaningful amount on top of our monthly savings plan through the app.

After all, when a gift keeps on giving… you pick it up.

Speaking of gifts…

Chart 3: High-quality equities suffer a 1999-level rotation in the 2025 stock market year

Investing is not only about making money. It’s about compound interest.

In our view, it’s a gift that keeps giving.

It’s a multi-faceted world: while we wrestle with low interest rates and inflation eating away at hard-earned cash, investing also gives us fascinating intersections with people, businesses, ideas, and innovations.

We never stand still — we’re always learning.

That is our joy: not only turning over every stone to find wonderful businesses that compound capital at high rates, but also compounding everything else in life.

That’s how we built arvy — a free newsletter that makes investing approachable to everyone, that shares what keeps our minds sharp through our book club (please have a look at our epic Christmas Reading List, chart 4), and that helps us build long-term relationships.

Because compounding applies to everything in life, not just money.

We want to take this moment to thank all our investors, friends, family, business partners, and the 11,000 readers of arvy’s Weekly who have supported us on this journey. As young entrepreneurs, your encouragement and belief in our mission to build something enduring in the financial world mean the world to us.

Thank you for being part of our journey!

Merry Christmas!

Chart 4: Team arvy wishes you a blessed Christmas Season with your family and friends