S&P 500’s Best Week: Thanksgiving (Holiday Effect)

"Investing is not the study of finance. It is the study of how people behave with money”

– Morgan Housel, Author of Psychology of Money

Psychology.

One of the most powerful forces in the stock market — especially in the short term.

It’s why we attach so many acronyms and labels to our emotional tendencies as investors.

You’ve likely encountered them all:

And of course, the emotions at the extremes. The euphoria that fuels melt-ups and manias, or the fear that turns into panics and crashes.

Yet one psychological influence is often overlooked despite being well-known and long-studied: The Holiday Effect.

Seasonal bursts of optimism and calmer trading behavior that translate into surprisingly consistent market strength. The most famous? The Santa Rally.

But next week brings the strongest of them all.

Thanksgiving.

Chart 1: S&P 500 seasonal trends over the last 20 years (Easter, Thanksgiving & Santa Rally)

Thanksgiving is deeply rooted in American culture — for many, it’s the most important holiday of the year.

Yes, even more important than Christmas.

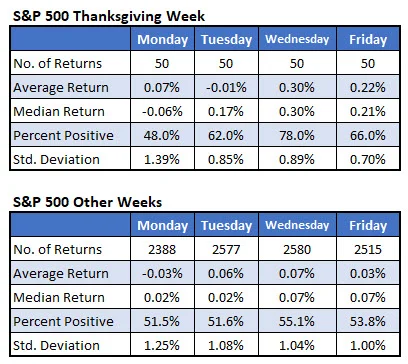

It always falls on the fourth Thursday of November, which means it’s right around the corner. Here’s what Thanksgiving week typically looks like:

This tradition — and especially the shopping frenzy — has long since spilled over into Switzerland.

Here it’s not just Black Friday, but Black Week. Consumers go bargain hunting for days, and enthusiasm is massive. Digitec Galaxus, the largest Swiss online retailer, once reported 100x more website visitors than on a typical day.

Back to the US.

Americans spend several days with family, enjoy downtime, feast on turkey and leftovers… and do a whole lot of shopping.

And that’s where the Holiday Effect comes into play in the stock market.

Thierry, you are telling me happy people = rising stock prices?

Yep, you're absolutely right.

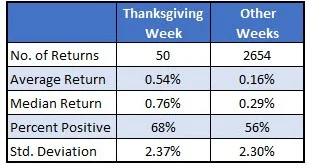

Chart 2: S&P 500 over the last 50 years

Thanksgiving week tends to be bullish.

In fact — it is the best week of the entire year.

Wait… so no one is working, everyone is eating turkey, families are gathering, the market is barely open…

and that week posts the strongest returns?

Yes. Exactly that.

Over the last 50 years (Charts 2 & 3):

So, what explains this holiday market anomaly?

Americans notoriously get very little vacation — roughly two weeks per year. Thanksgiving week is sacred: time with family, rest, comfort food, gratitude. Happy people tend to take fewer risks. Happy people also tend to buy. Happy people create quiet upward drift in markets.

Trading volumes drop sharply. Desks are half empty. Most investors prefer not to take risks going into a long weekend. So they simply stay put, keeping markets stable — and stability often drifts upward.

Remember: Consumer spending makes up 70% of US GDP. Thanksgiving kicks off the holiday shopping season, and Black Friday and Cyber Monday provide an early read on the health of the American consumer.

Adobe — yes, Adobe — publishes highly watched real-time data on sales, spending, and volumes.

Thanksgiving week is therefore part sentiment, part psychology, part economics.

And part good old retail therapy…

Chart 3: S&P 500 returns during Thanksgiving Week

The explanations for why the stock market is so strong during this period remain just that — theories.

But the evidence?

That is indisputable.

The holiday effect — whether it’s Easter, Thanksgiving or the Santa Rally — has shown up consistently across decades. Markets simply tend to behave favorably during these festive windows.

A fun anecdote: Why is it called “Black Friday”?

Is it because businesses finally move out of the red and “into the black” on this day?

Or because shopkeepers literally ended up with blackened fingers from counting so many bills late into the night after a sales frenzy?

The truth is lost somewhere between folklore and finance.

And that’s precisely the point: We don’t need to over-analyze the “why” behind every seasonal uptrend.

Not every market move can be reduced to a spreadsheet cell, a regression model, or a macro thesis.

Sometimes, it’s okay to simply accept the effect and not fight it.

Markets are built on numbers, but they are also built on narratives, behavior, rhythm, and — occasionally — a little magic.

So, for once, let the holiday effect be the holiday effect.

Happy Thanksgiving to all!

Team arvy

Chart 4: Stock bulls enjoy their Thanksgiving turkey this year - the bear is left behind