The Best Idea in Modern Investing: Scale Economies Shared

Some companies succeed by giving more than they take. By reinvesting scale, they convert efficiency into loyalty, compounding growth, and enduring competitive advantage. Let’s examine three notable examples.

Cutting prices to make more money: At first glance, it sounds like a business blunder, not a masterstroke.

Most companies scale up and use their power to fatten their margins or pad executive paychecks. But a rare breed of companies flips the script. As they grow more efficient, they don’t hoard the benefits – they pass them back to customers. Instead of raising prices to boost profits, they cut them to cement loyalty.

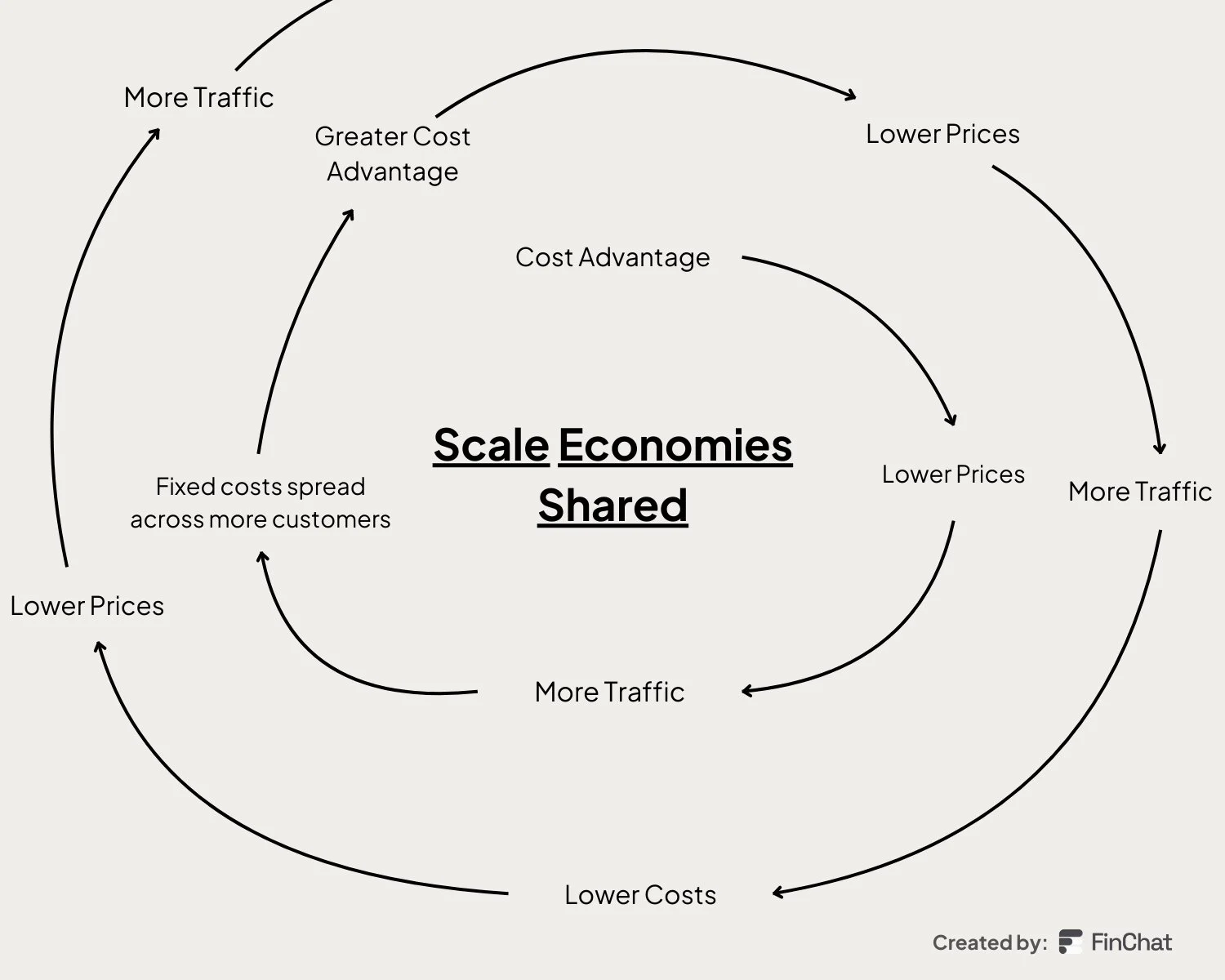

This creates a powerful flywheel effect:

•Lower prices keep customers coming back

•Higher volumes drive more efficiency

•Efficiency deepens the moat

The longer you held these businesses, the better they got. Not by accident – but by strategy. Every spare dollar was plowed back into faster delivery, sharper prices, stronger infrastructure (see chart 1). Earnings looked lean in the short run, but dominance was built in the long run.

For investors, the bet wasn’t just on a good company. It was on a system – a flywheel fueled by customer goodwill and compounding efficiency.

History has given us two shining examples of this playbook. And at arvy, we own a company at the very beginning of this journey. The company is in its early innings of a playbook we know well.

The idea behind it?

Scale Economies Shared.

Chart 1: Scale Economies Shared